St. Croix Realtors Joe & Julie San Martin

January2026

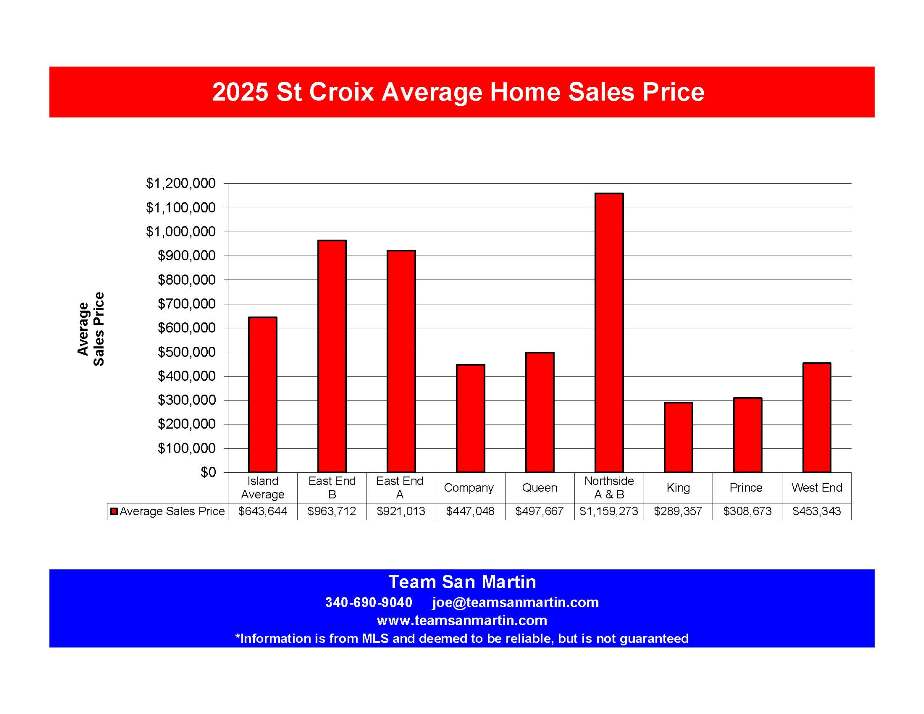

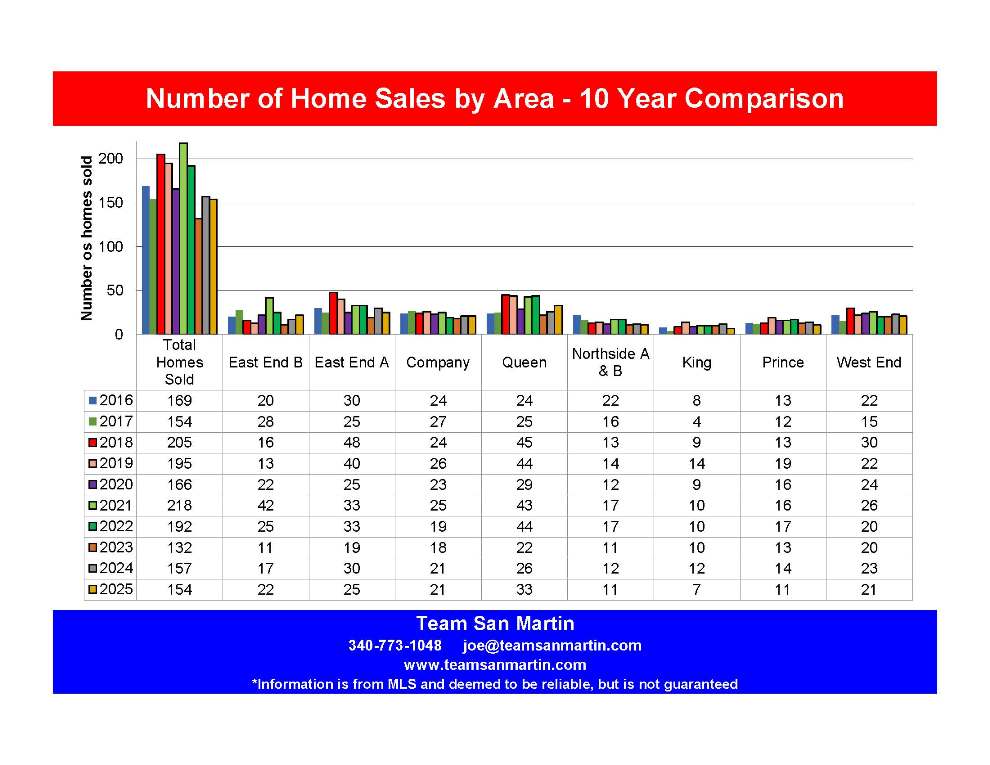

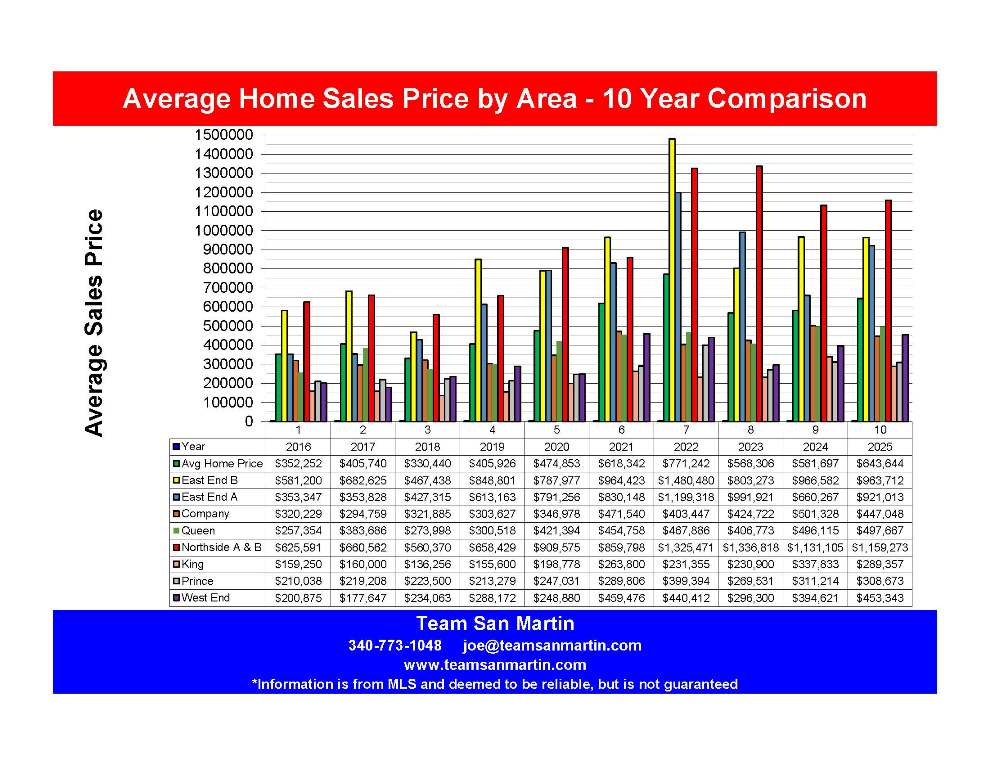

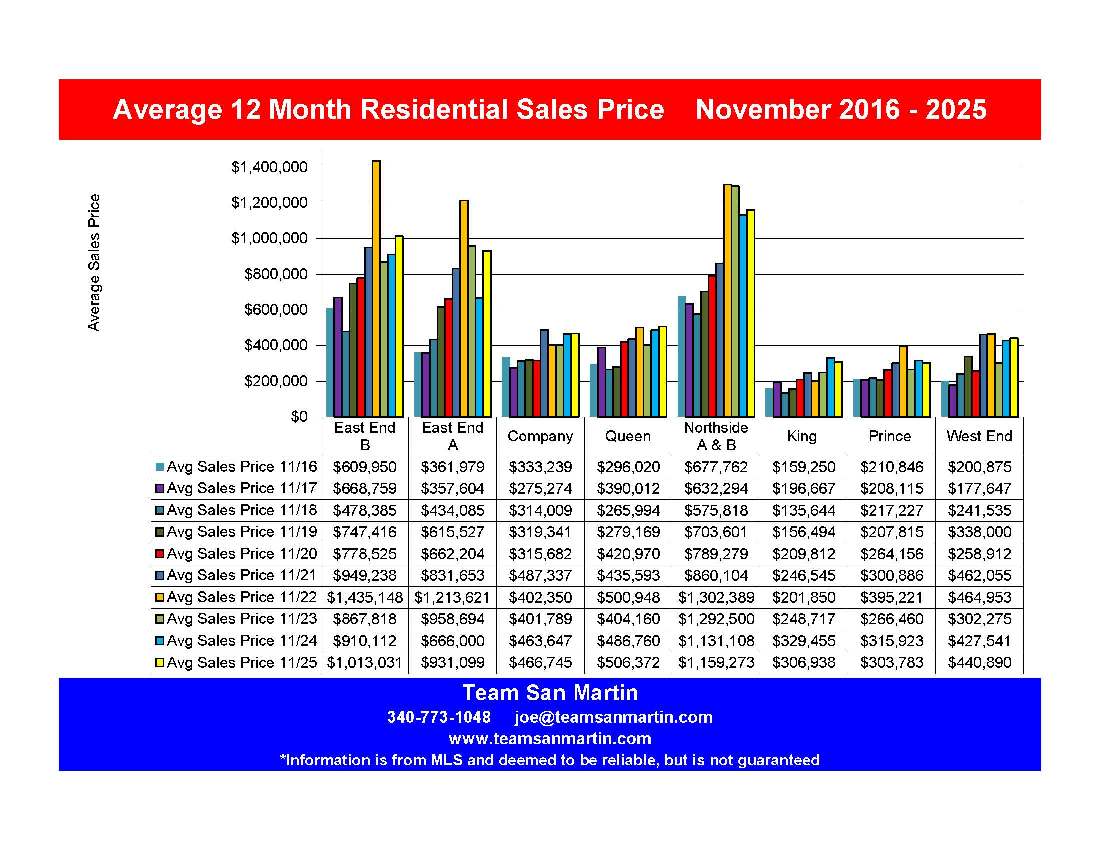

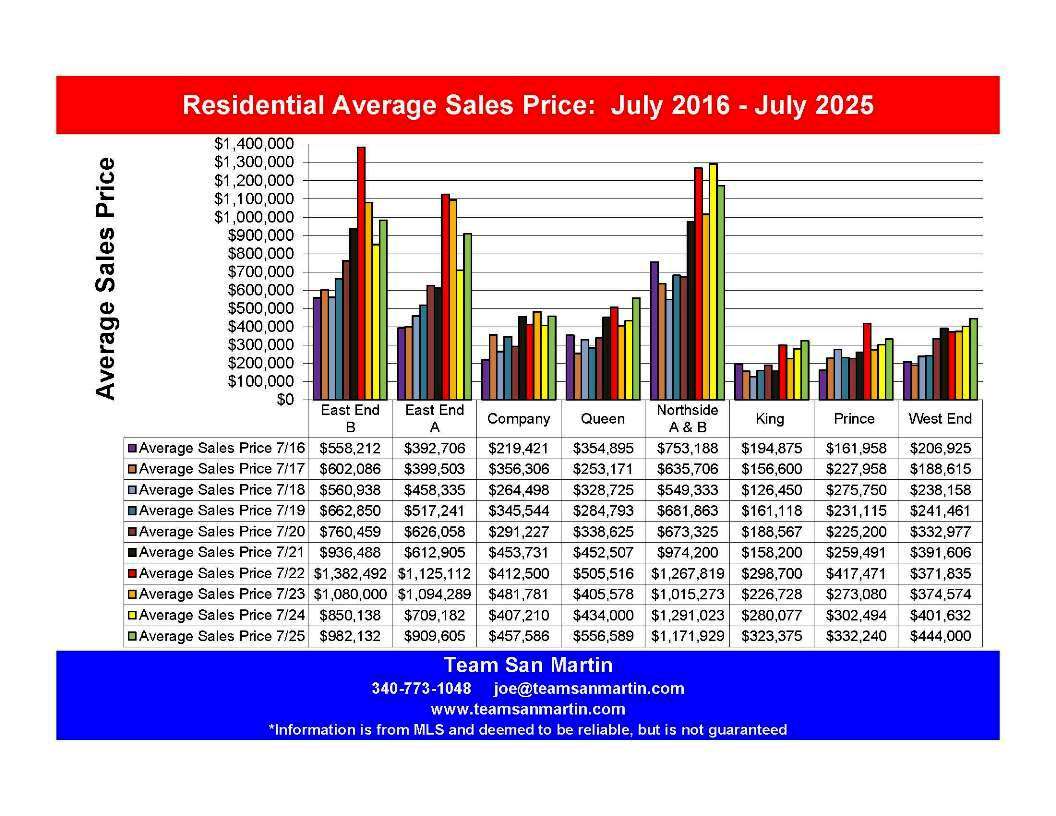

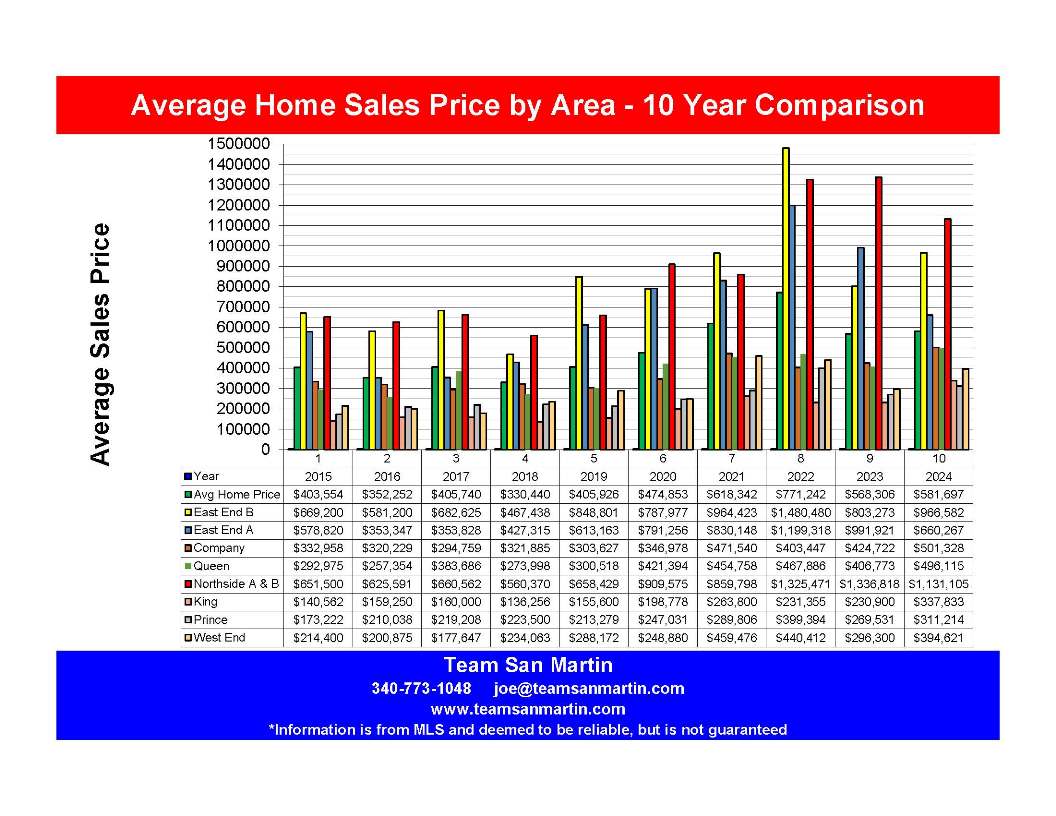

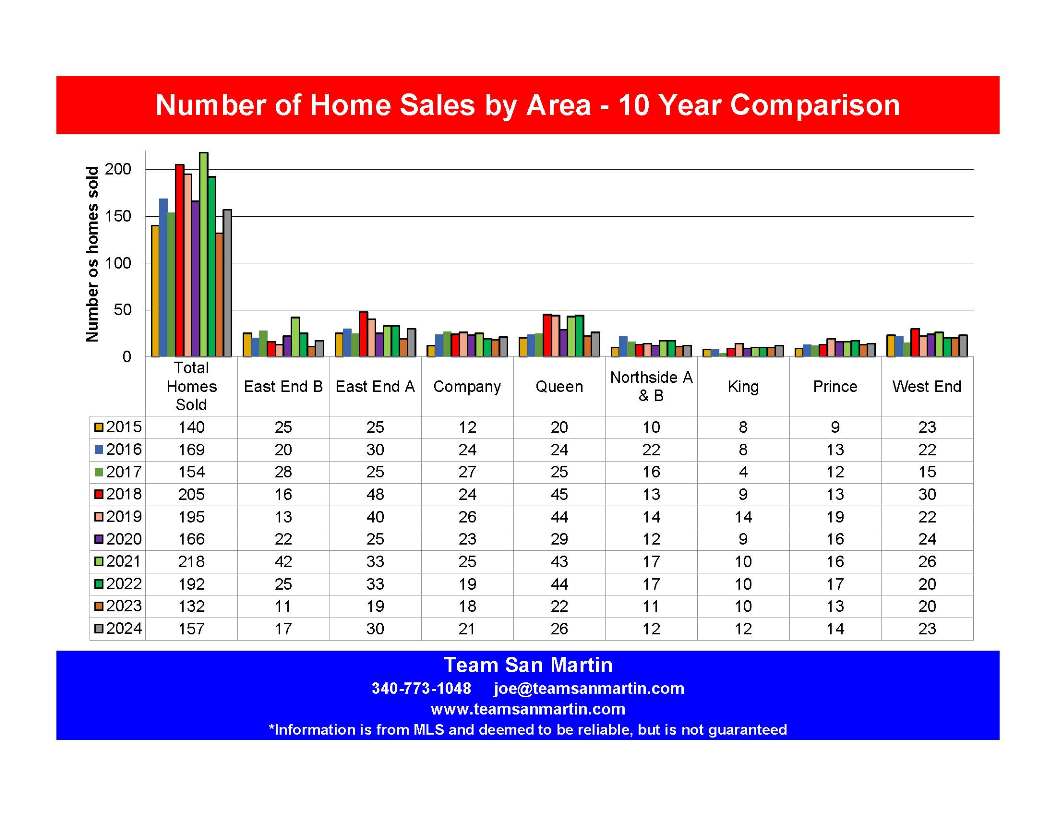

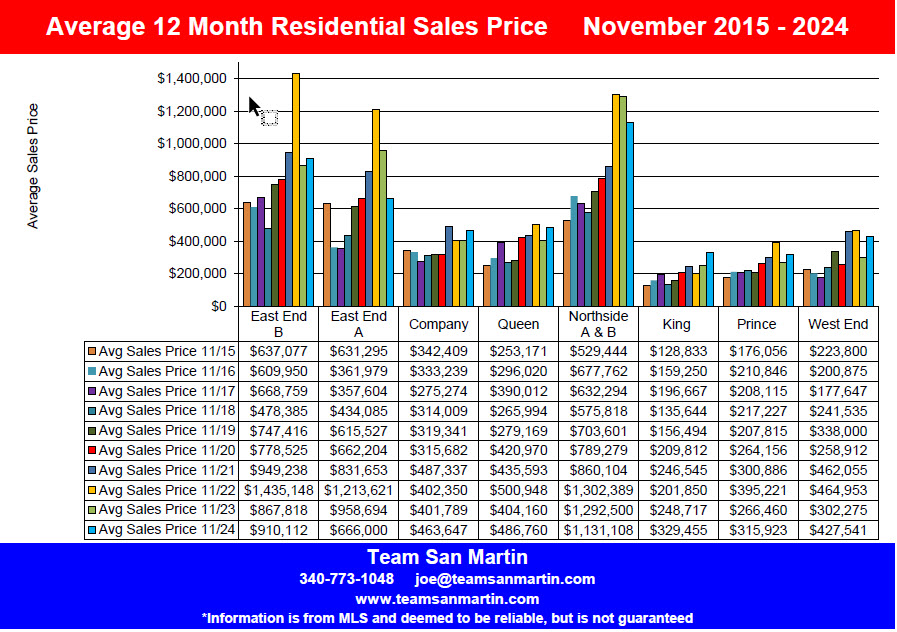

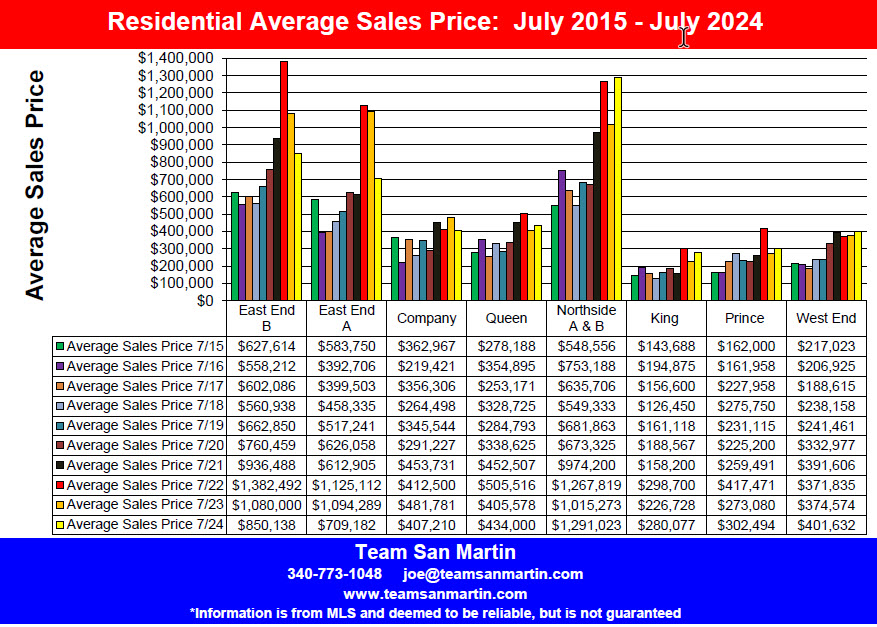

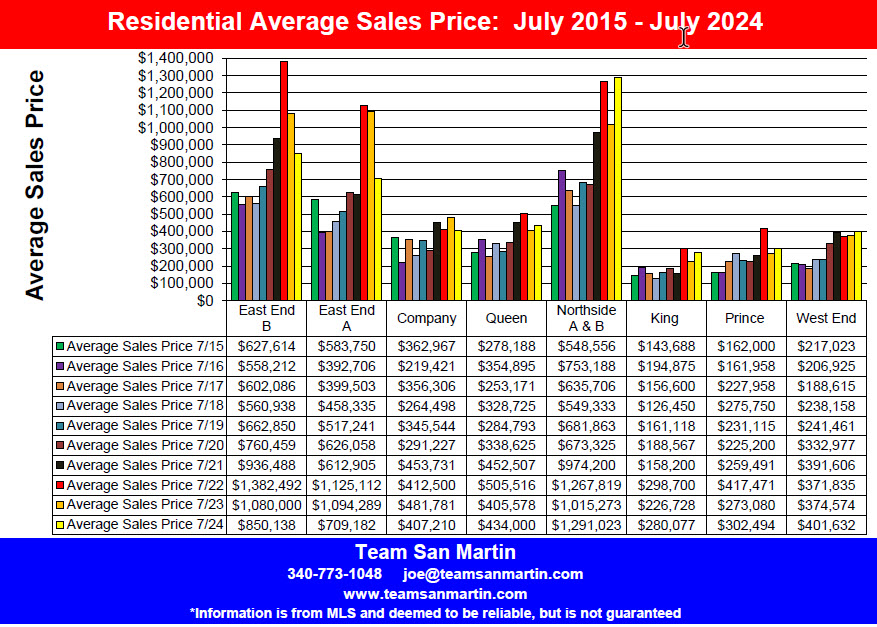

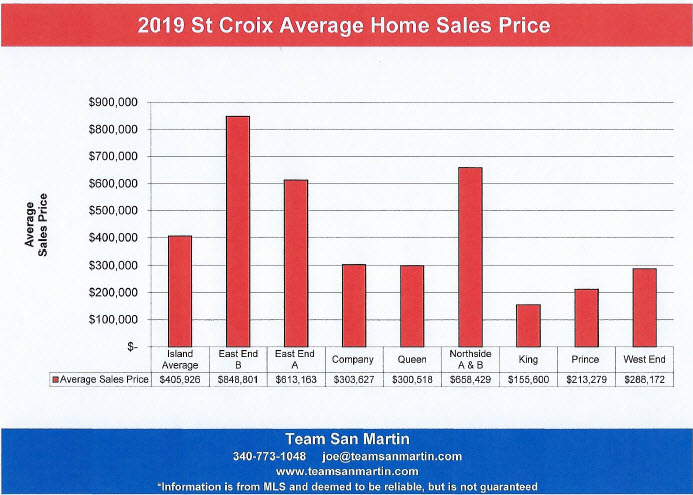

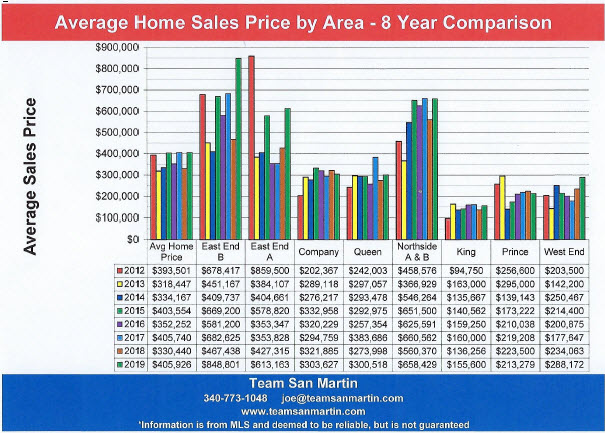

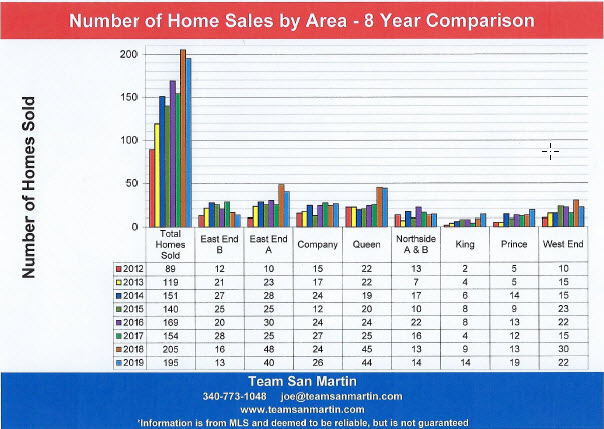

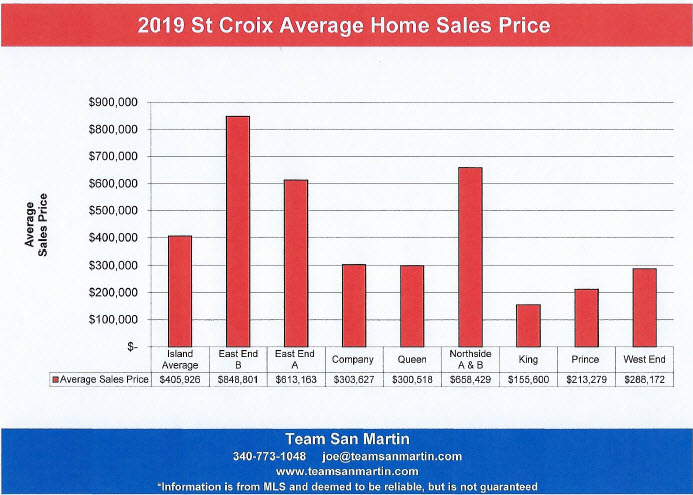

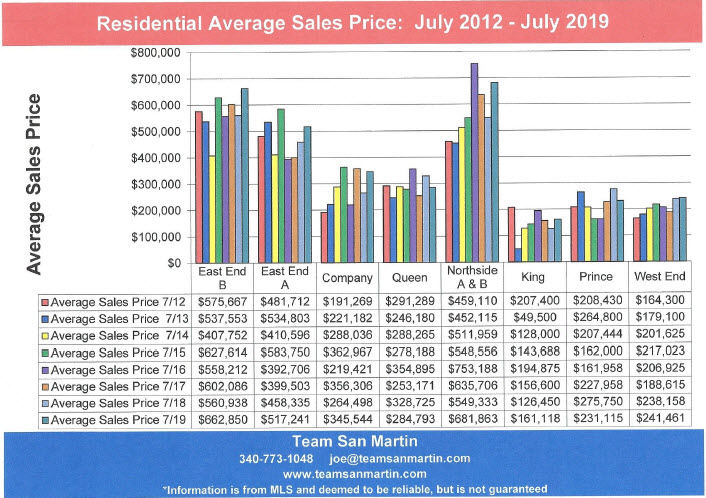

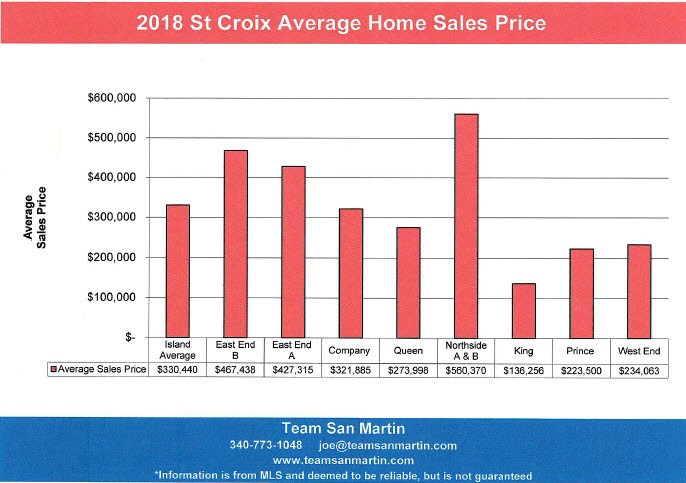

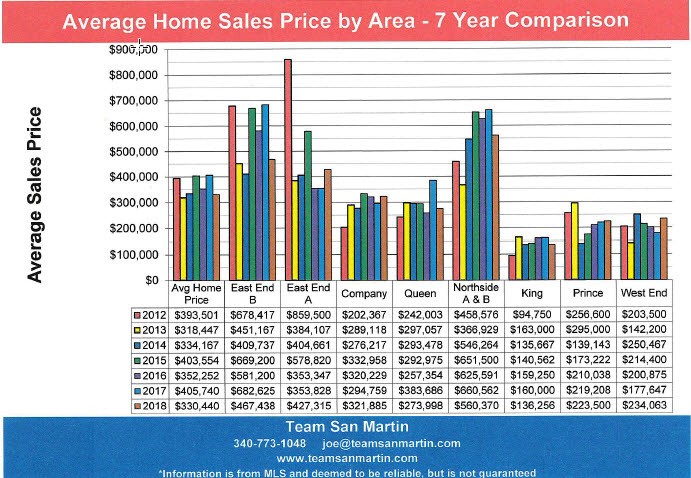

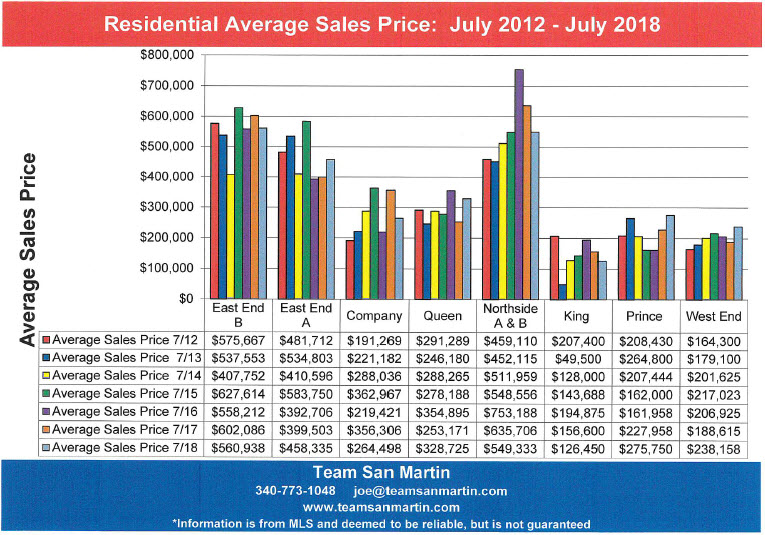

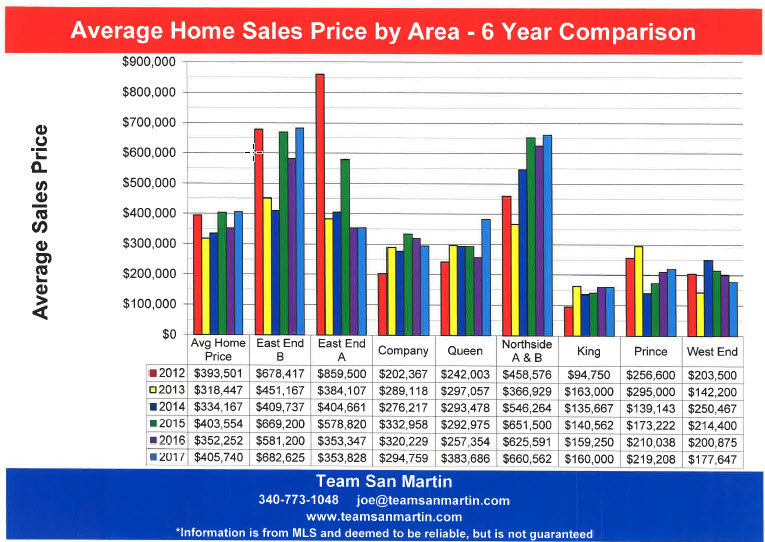

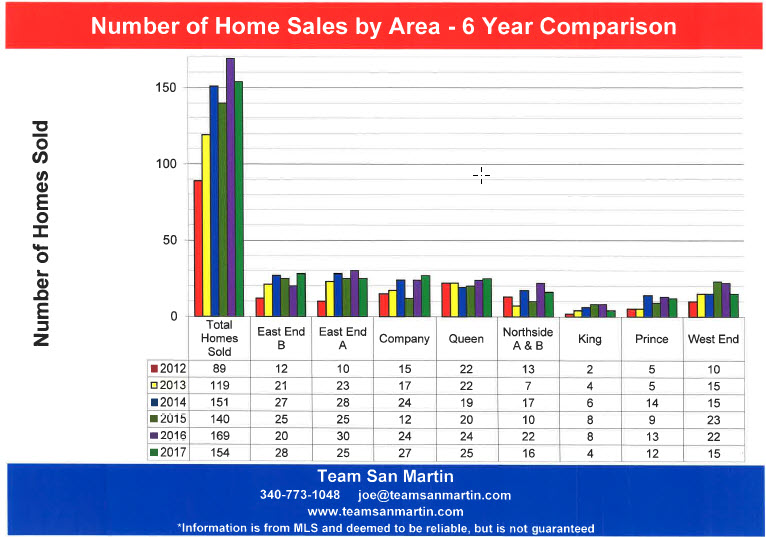

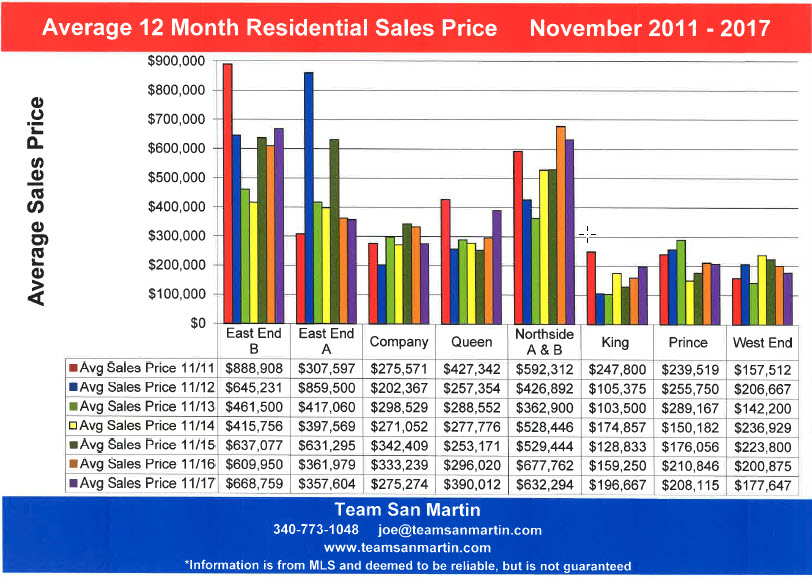

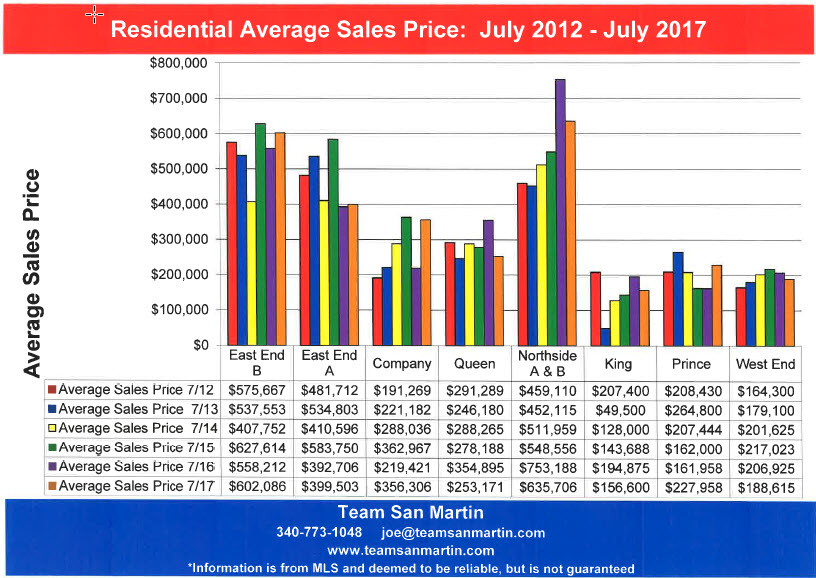

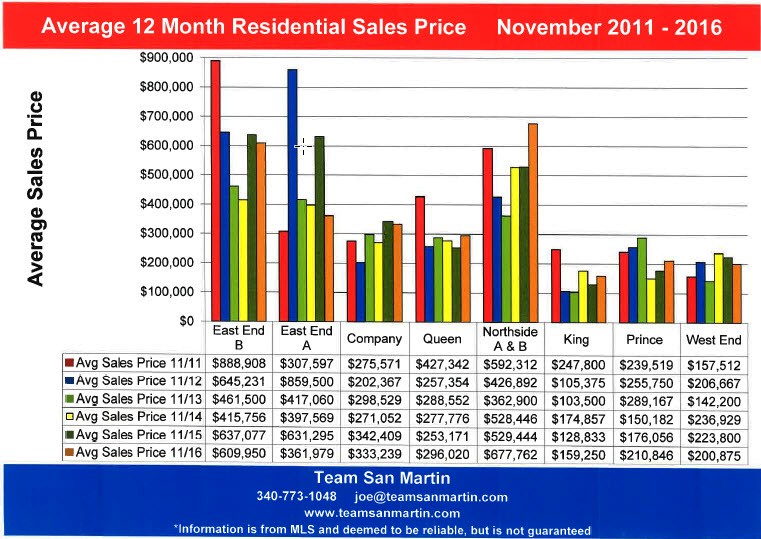

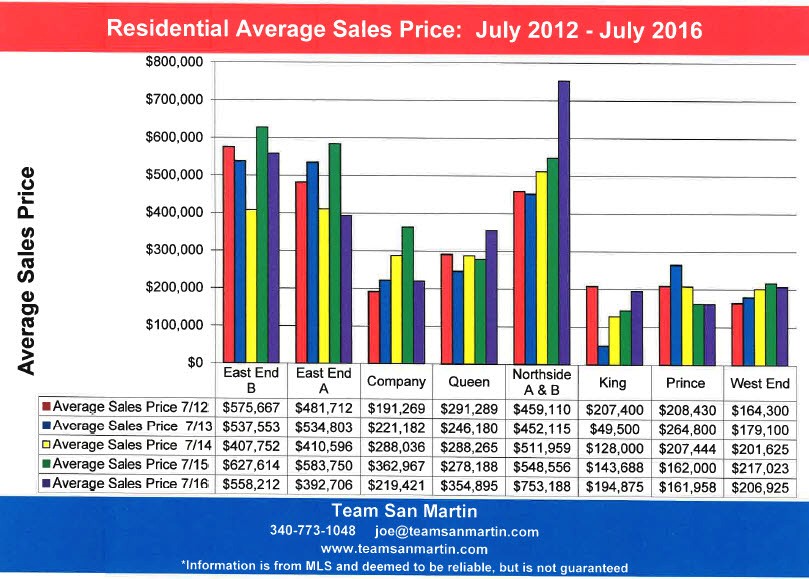

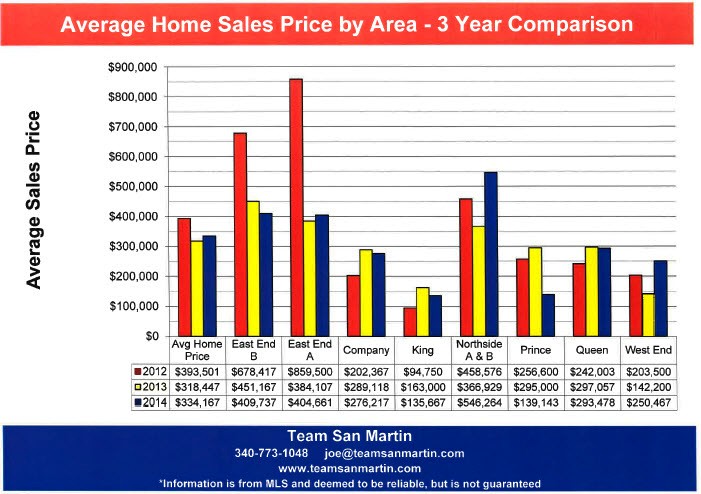

10 Year St Croix Home Sales Price Trends

The average sales price of a home on St Croix increased $291,392 over the

10-year period; this is a 83% increase.

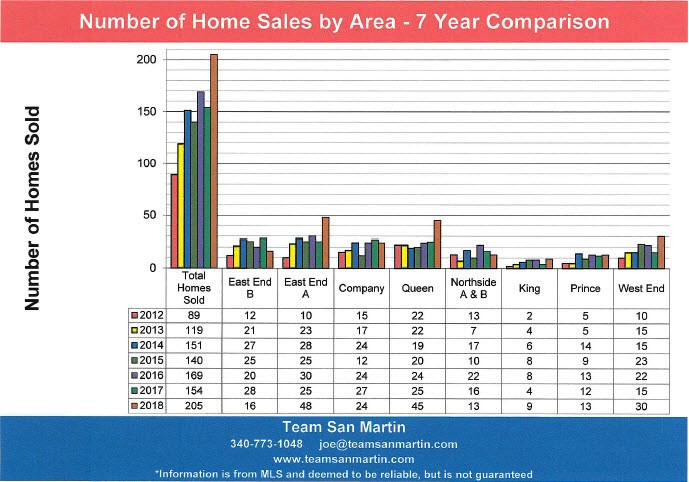

Total number of homes sold annually decreased 9% (15 homes) since 2016.

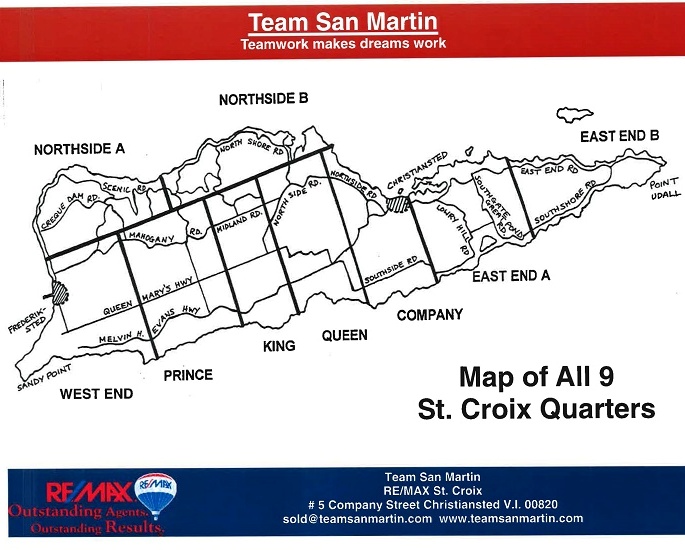

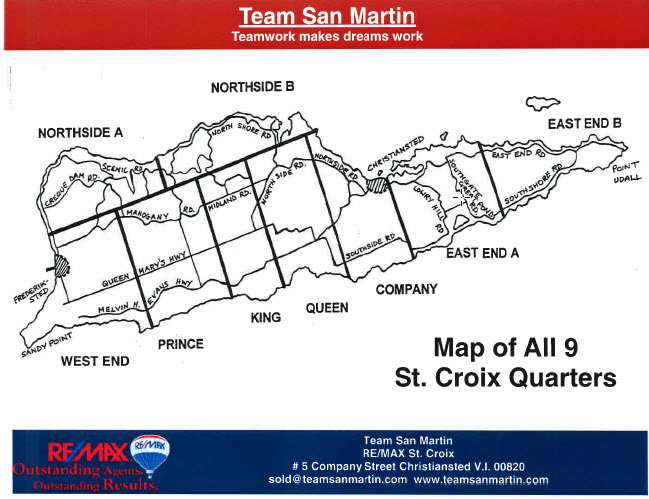

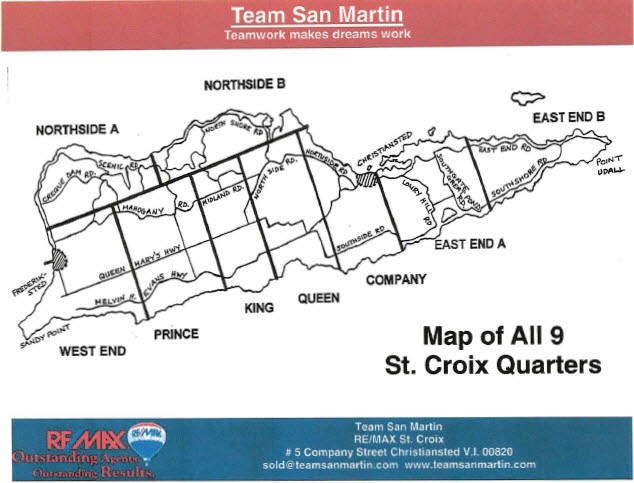

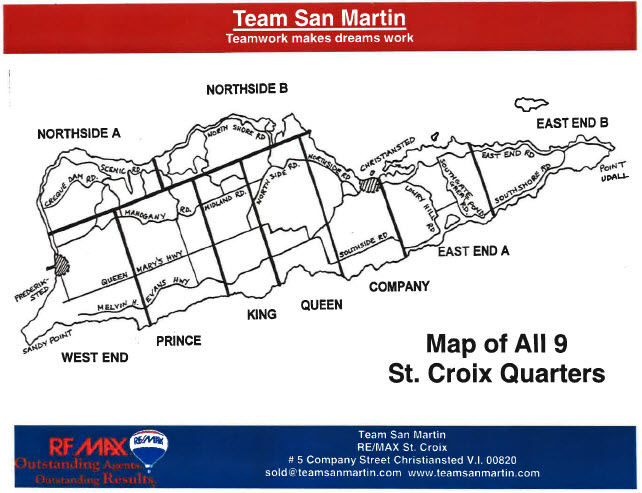

All areas of the island did not perform the same.

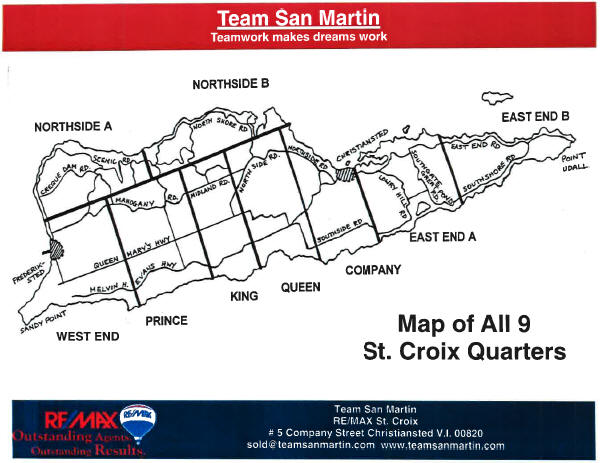

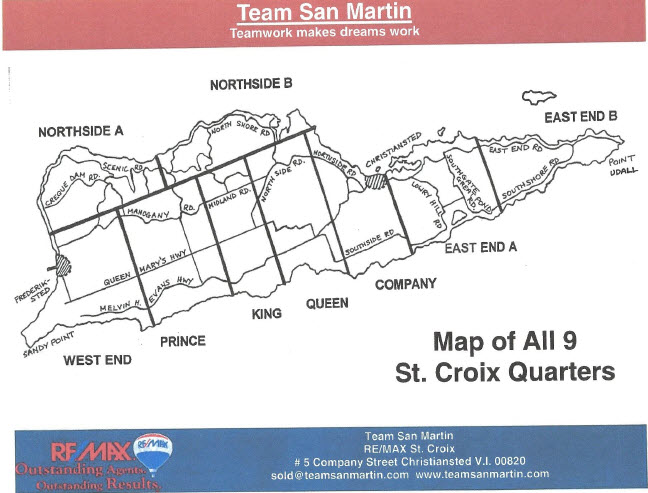

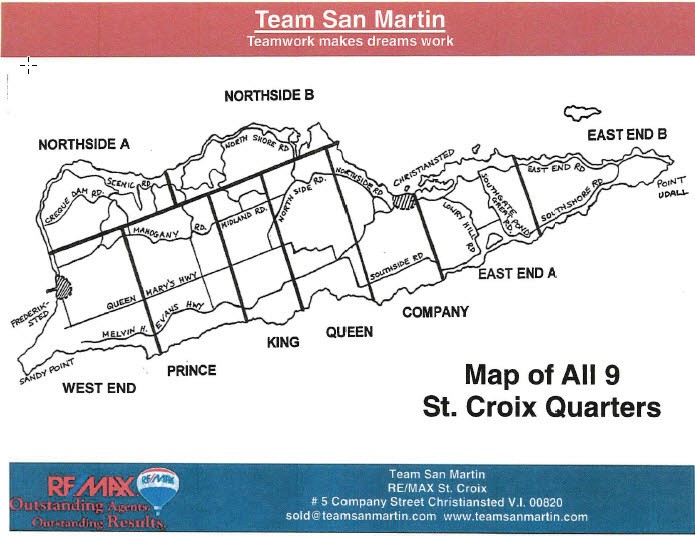

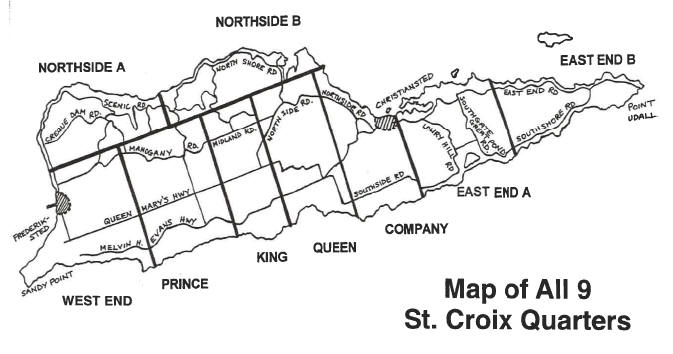

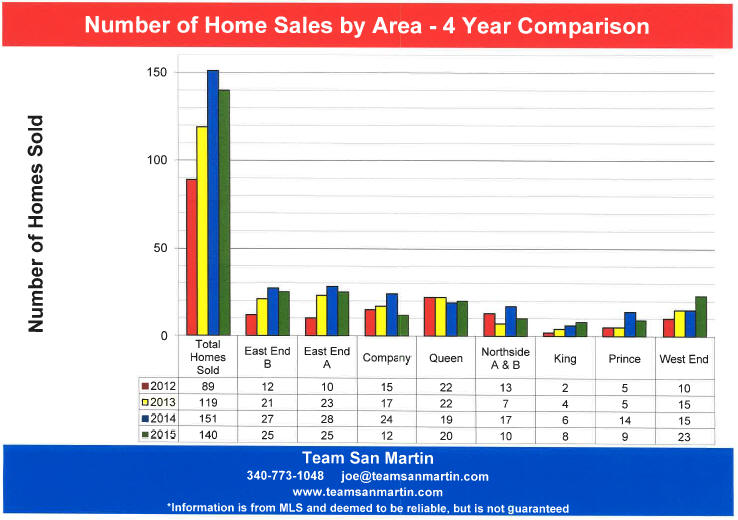

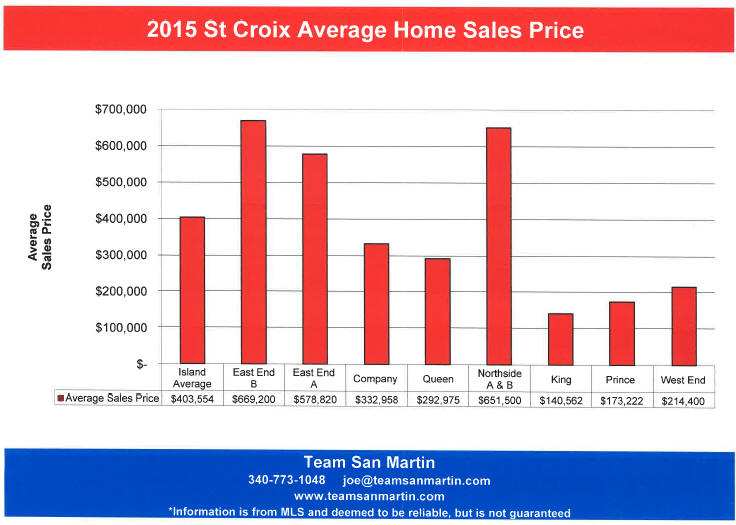

East End B

Far East End

Compared to 9 years ago, the average sales price of a home increased 66% ($382,512 increase).

The number of homes sold in a year increased by 2 homes, compared to 9 years ago.

20homes sold in 2016, 22homes sold in 2025.

East End A

Christiansted East to Coakley Bay

Compared to 9 years ago, the average sales price of a home increased 161%

($567,666increase).

The number of homes sold in a year decreased by 5 homes, compared to 9 years ago;

30 homes sold in 2016, 25 homes sold in 2025

Company

Christiansted West to the East Side of Judiths Fancy

Compared to 9 years ago, the average sales price of a home increased 40% ($126,819 increase).

The number of homes sold in a year decreased by 3 homes

, compared to 9 years ago,from 24home sales in 2016 to 21 home sales in 2025.

Queen

Constitution Hill West to La Reine, includes southwest

Judiths Fancy

Compared to 9 years ago, the average sales price of a home increased 93%

($240,313 increase).

The number of homes sold in a year increased by 9 homes, compared to 9 years ago, from 24homes sold in 2016 to 33 home sales in 2025.

Northside A & B

North Shore from North Judiths Fancy to Hamms Bluff

Compared to 9 years ago, the average sales price of a home increased 85% ($533,682increase).

The number of homes sold in a year decreased by 11 homes (50%), compared to 9 years ago.

22homesalesclosed in 2016, 11 home sales closed in 2025.

King

South Shore from La Reine West to UVI

Compared to 9 years ago, the average sales price of a home increased 82%

($130,107 increase).

The number of homes sold in a year decreased by 1 home, compared to 9 years ago, from 8 homes sold in 2016 to 7 home sales in 2025.

Prince

South Shore from UVI West to Williams Delight

Compared to 9 years ago, the average sales price of a home increased 47%

($98,635increase).

The number of homes sold in a year decreased by 2 homes,compared to 9 years ago, from 13 homes sold in 2016 to 11 home sales in 2025.

West End

South Shore, South from Mahogany Road,

East to Williams Delight

Compared to 9 years ago, the average sales price of a home increased 126%

($252,468increase).

The number of homes sold in a year decreased by 1 home, compared to 9 years ago, with 22 homes sales in 2016and 21 homes sales in 2025.

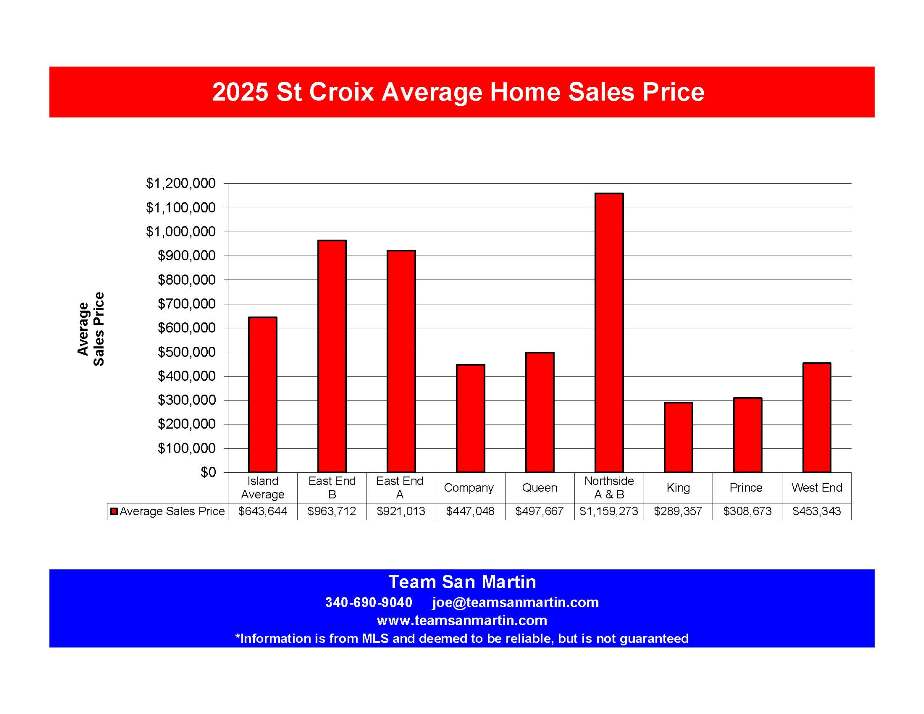

Observations

Average home sales prices in three areas of the island consistently exceed the

island wide "average" home sales price:

Average home sales prices are consistently much lower than the island wide "average" home sales price:

Fewer homes sold in all quarters during 2025, when compared to 2016 except for:

Compared to 2024, the island wide average home sale price increased 11%.

All quarters experienced increased average sales prices except for:

Information is from MLS and deemed to be reliable but is not guaranteed.

Prepared by:

Julie San Martin

Team Manager

December2025

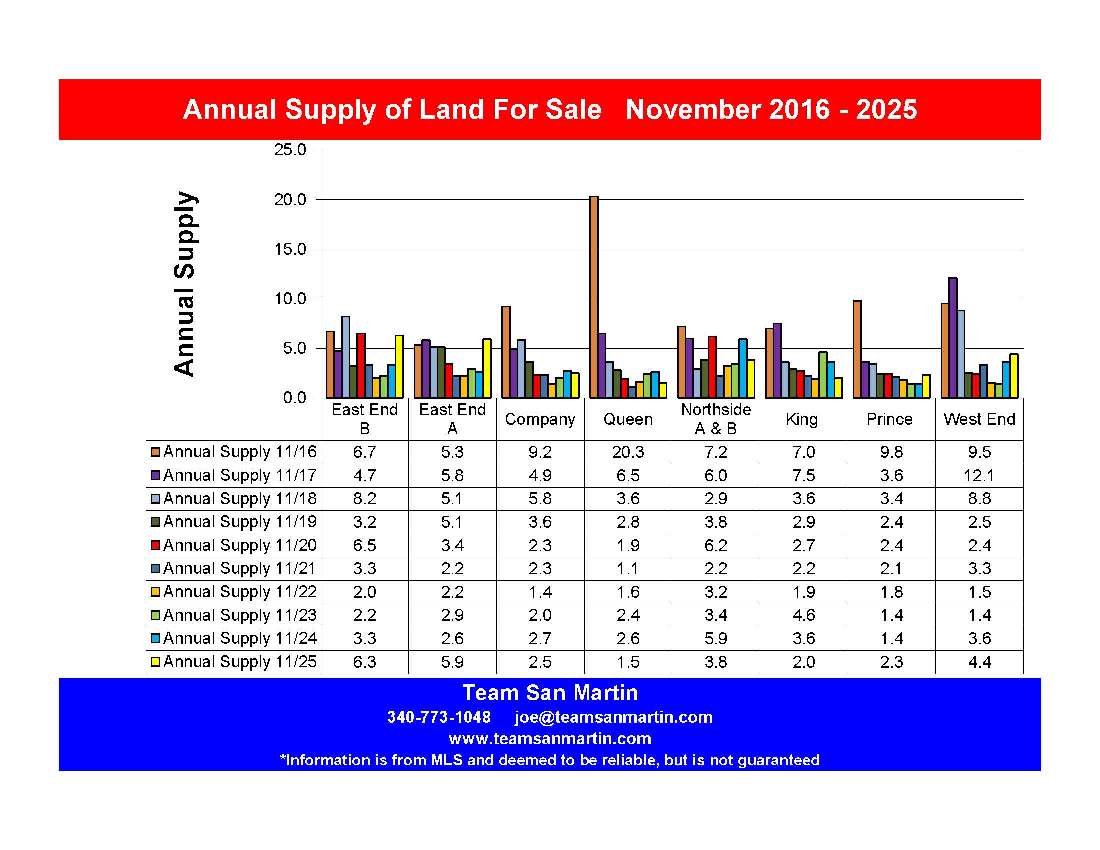

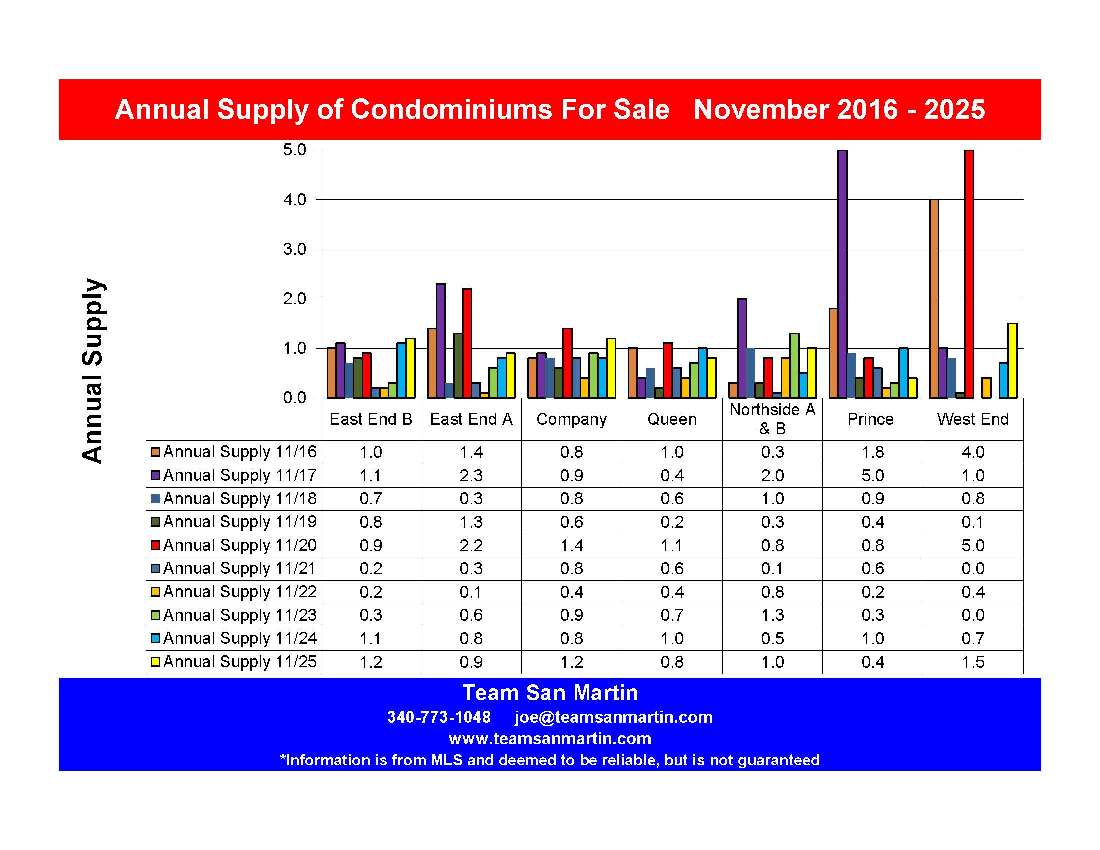

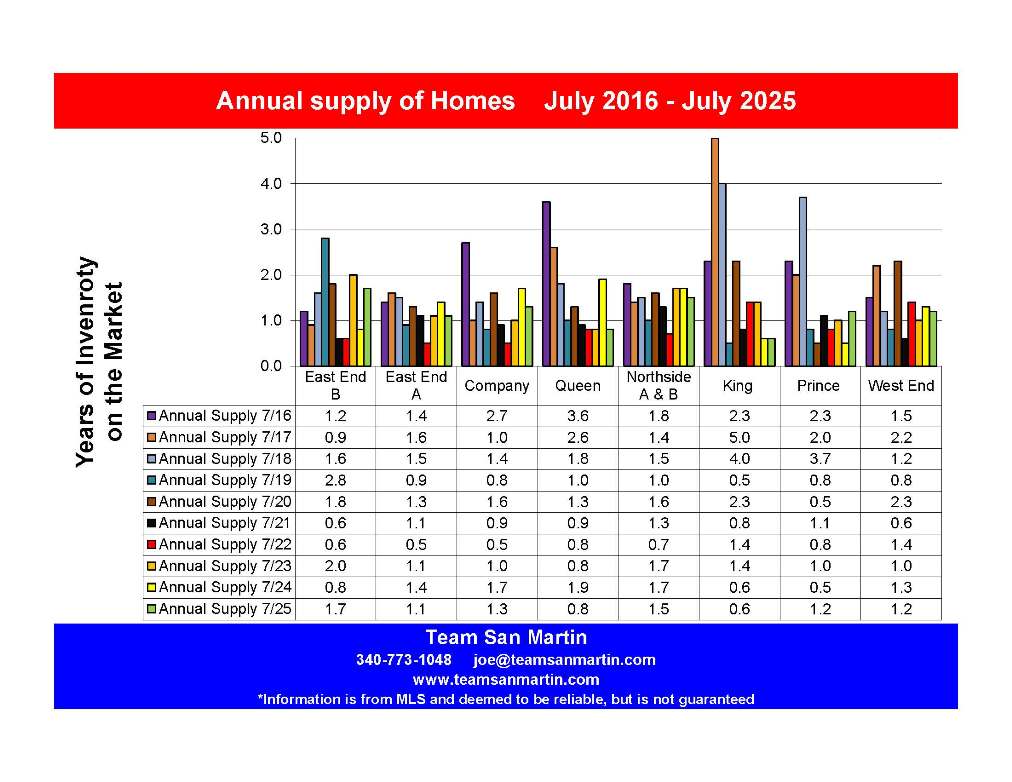

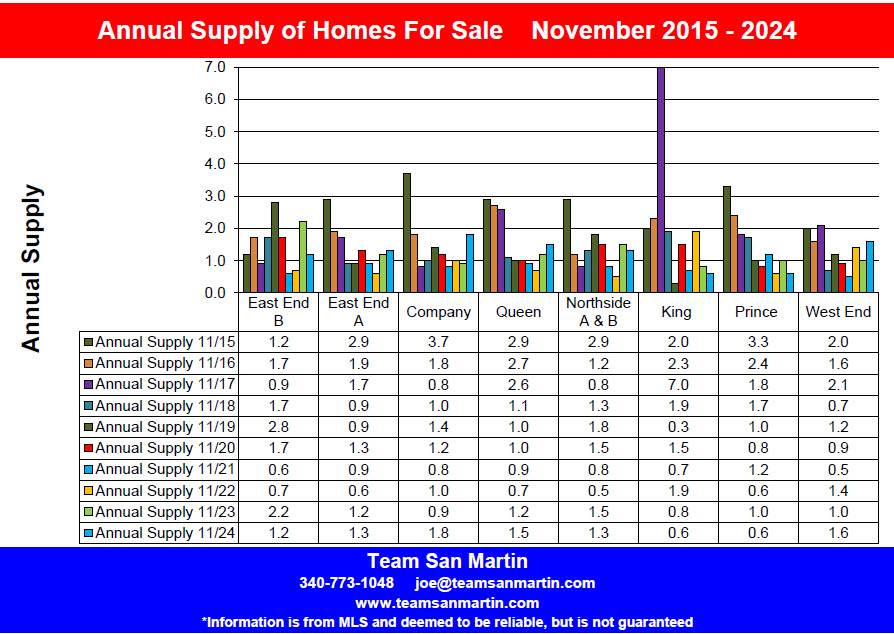

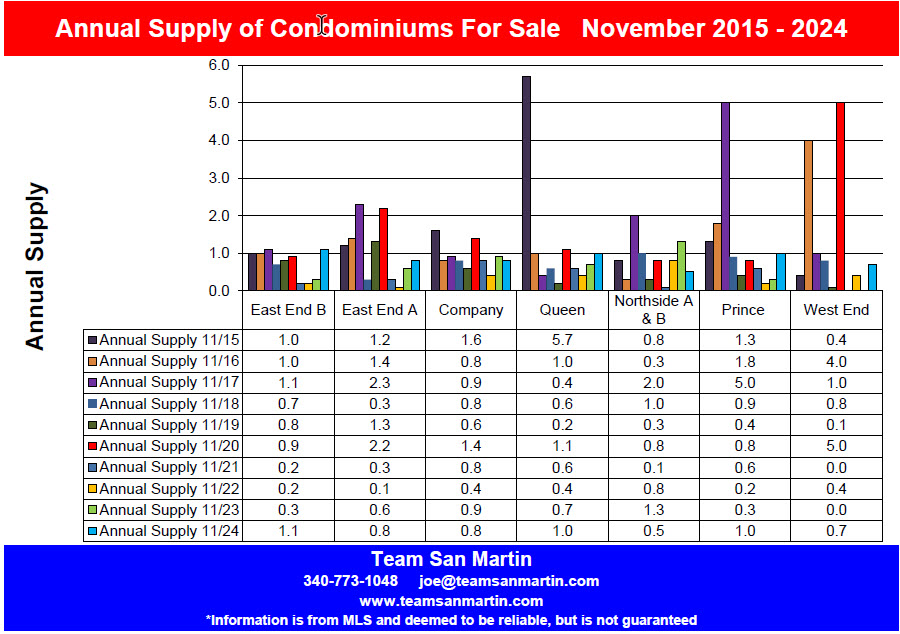

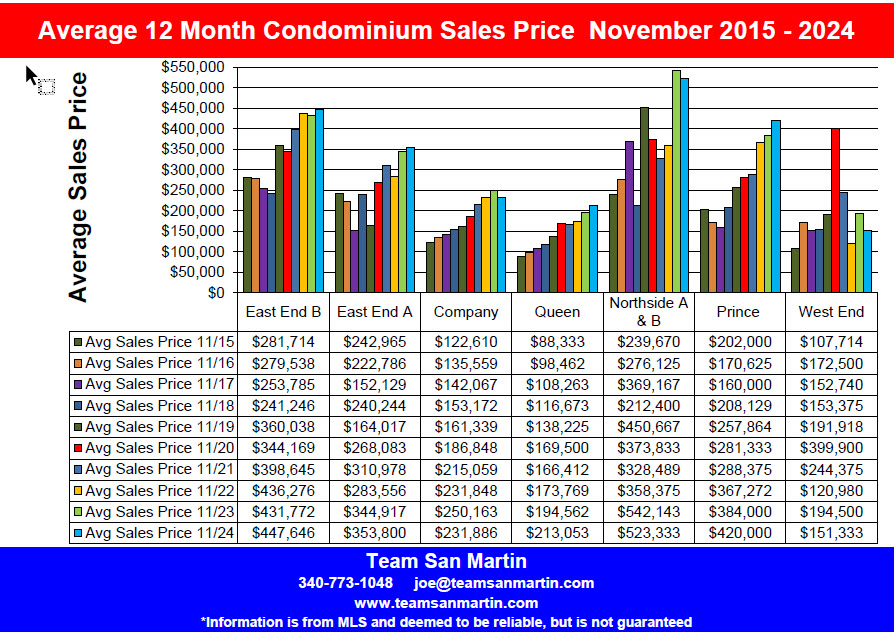

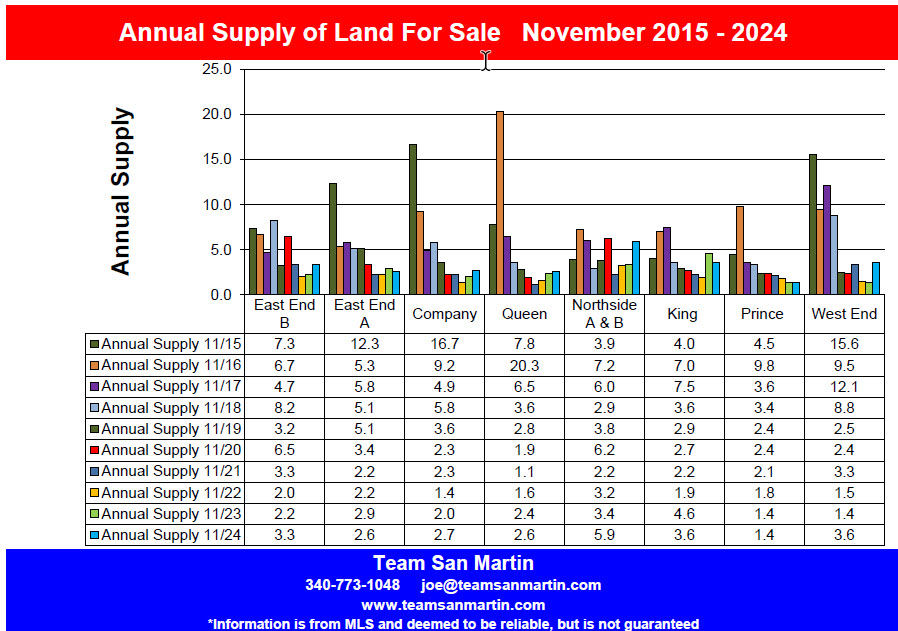

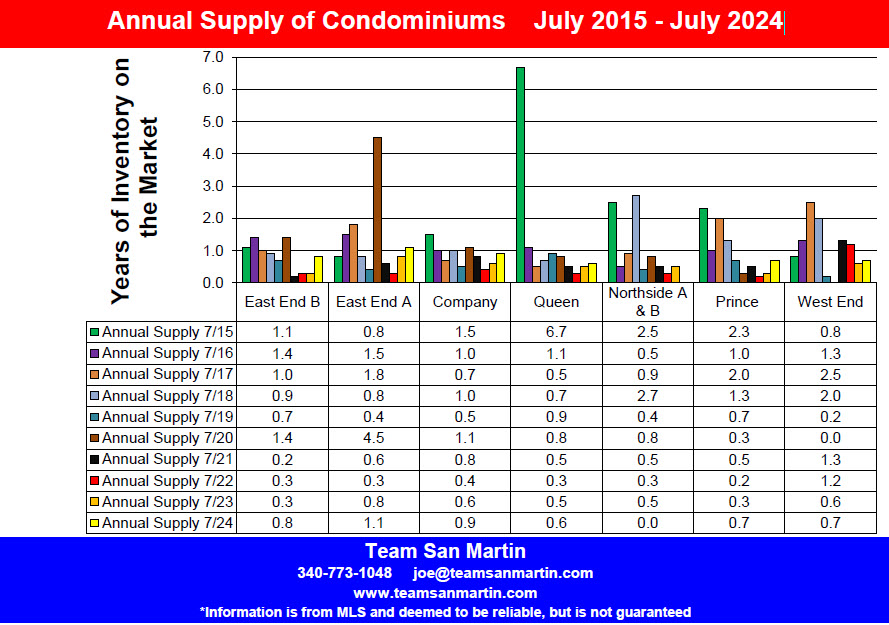

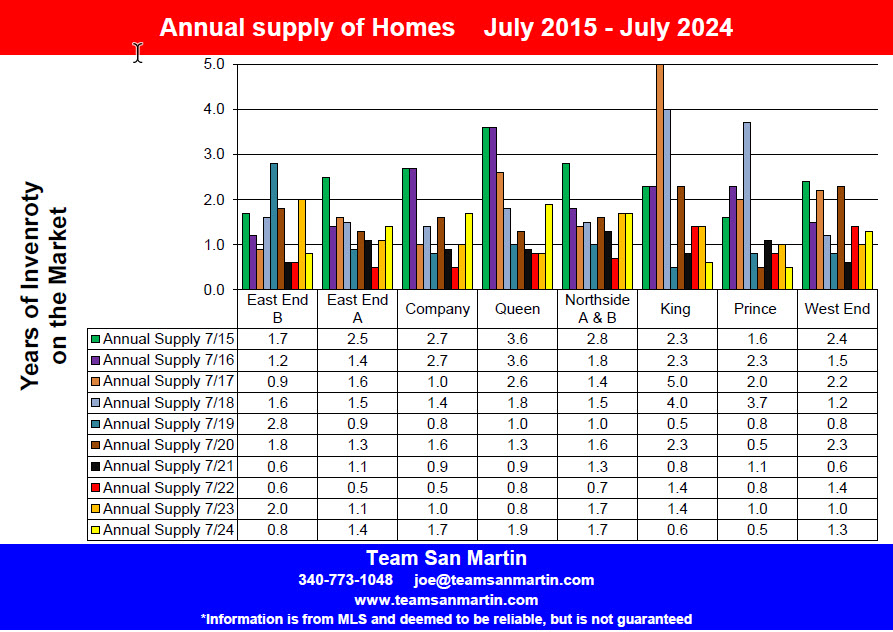

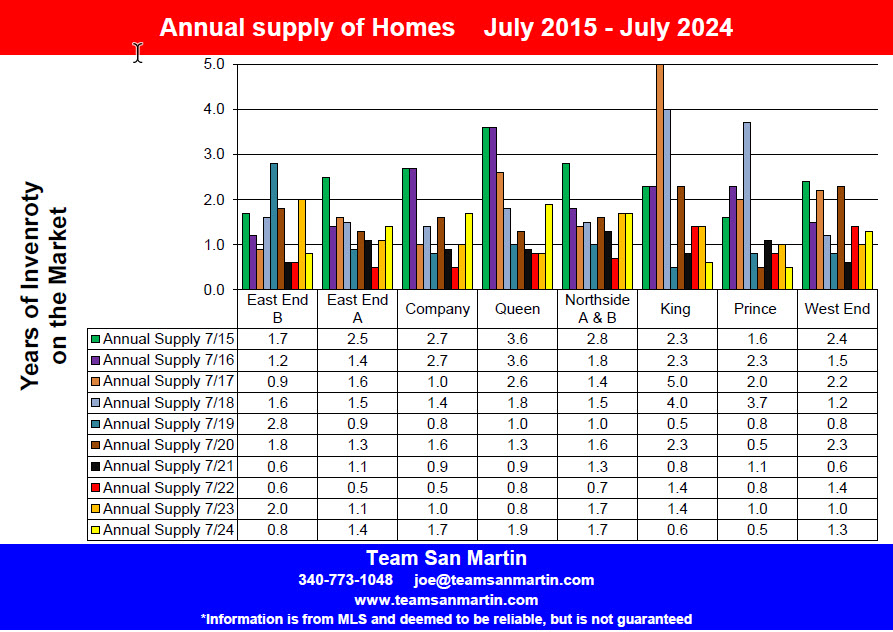

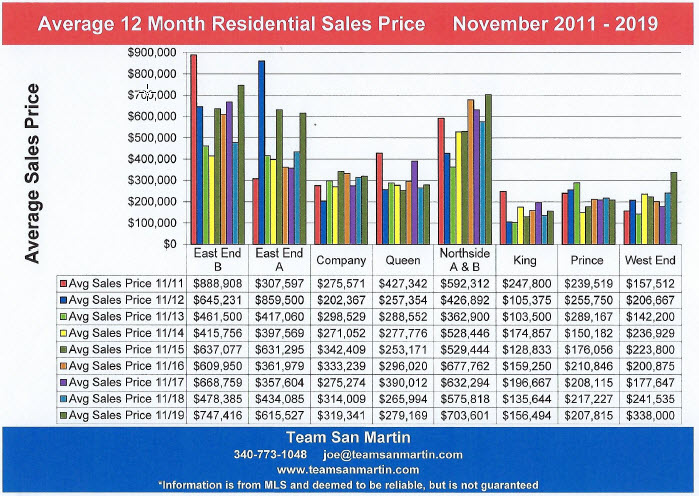

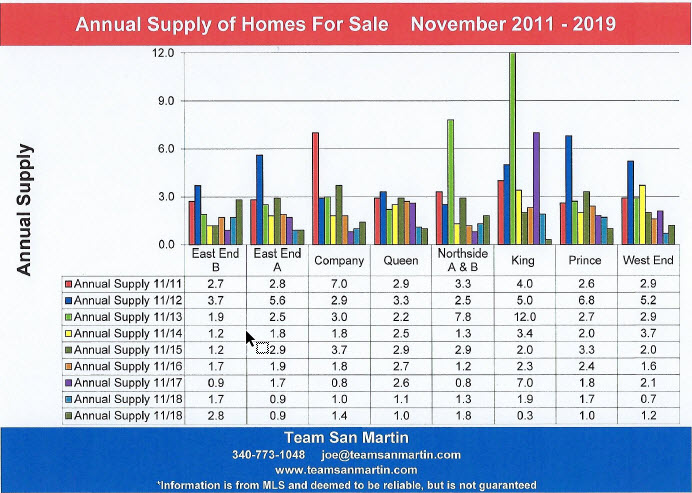

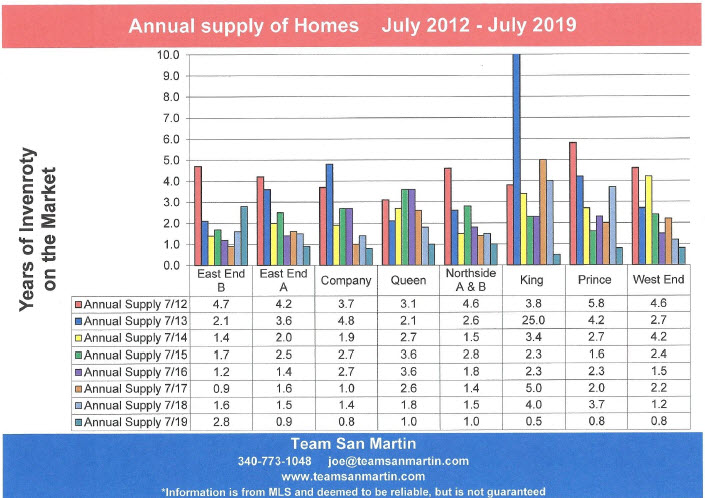

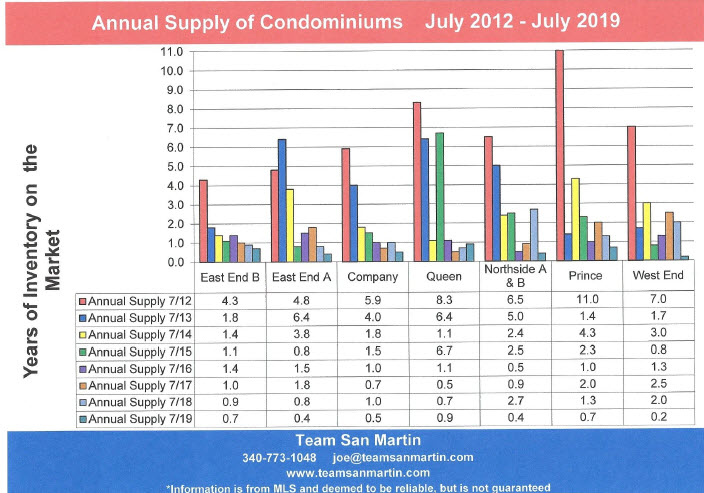

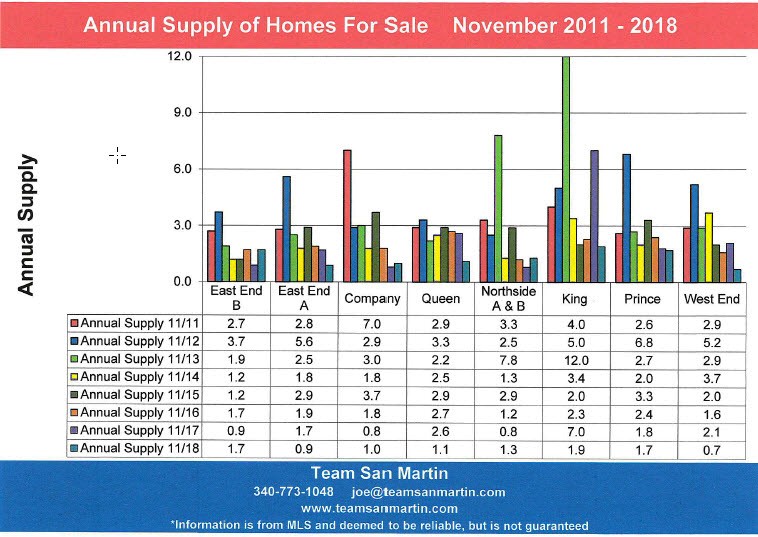

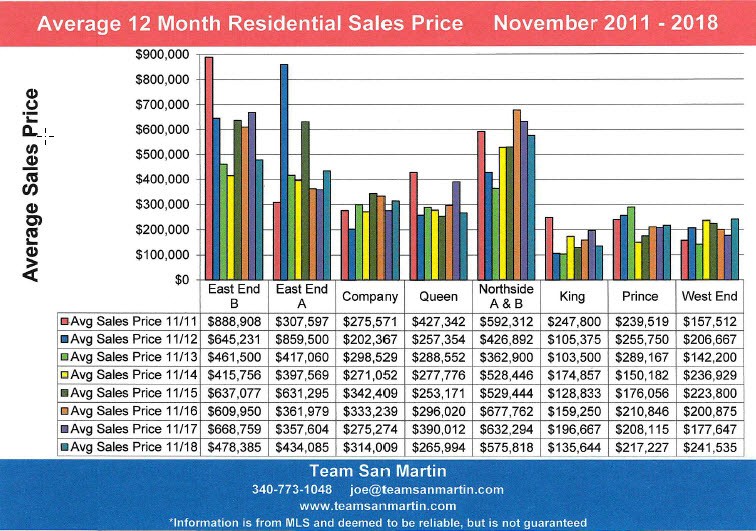

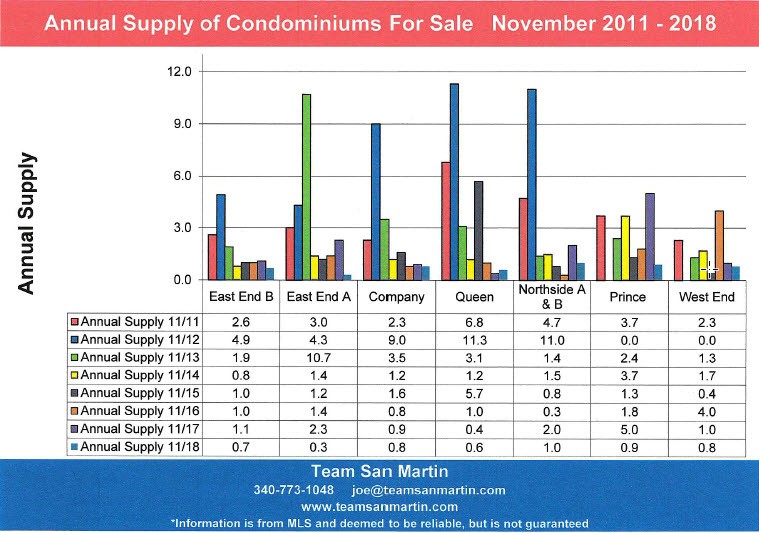

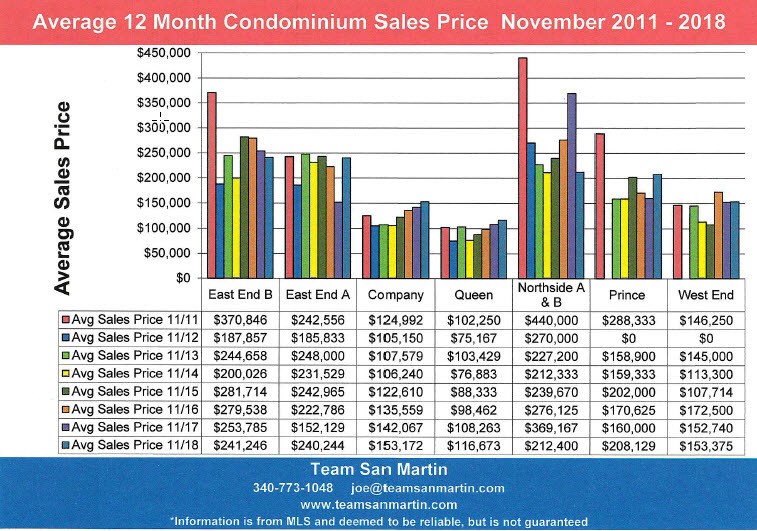

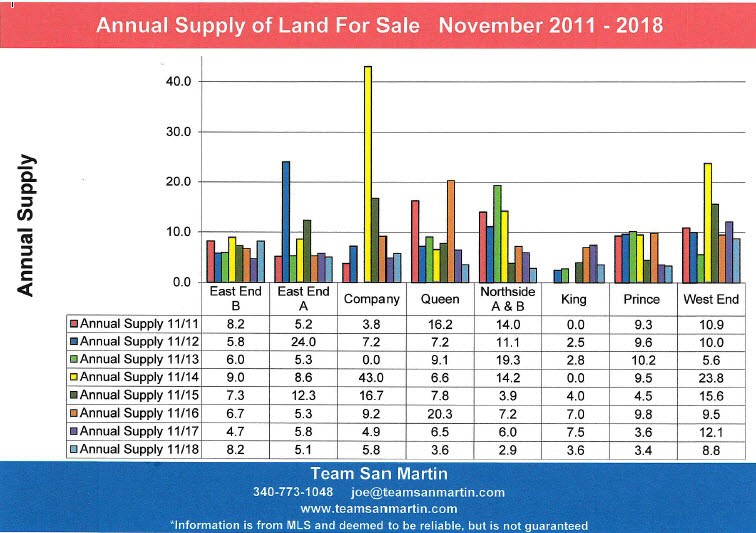

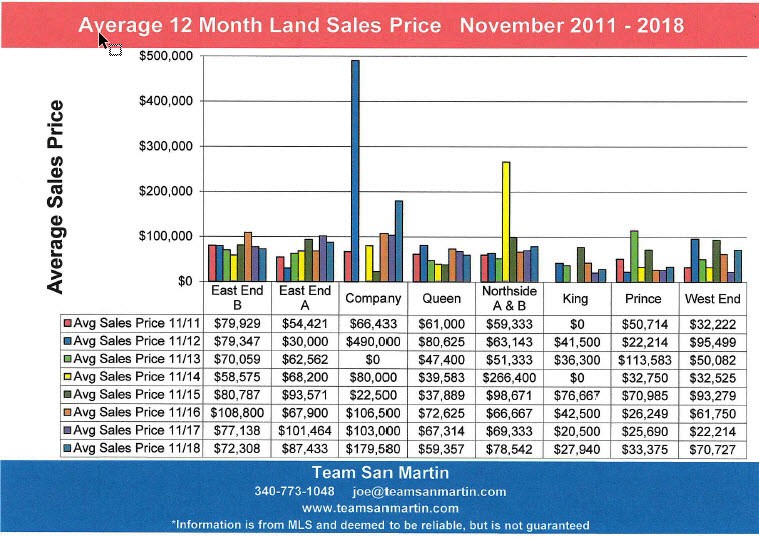

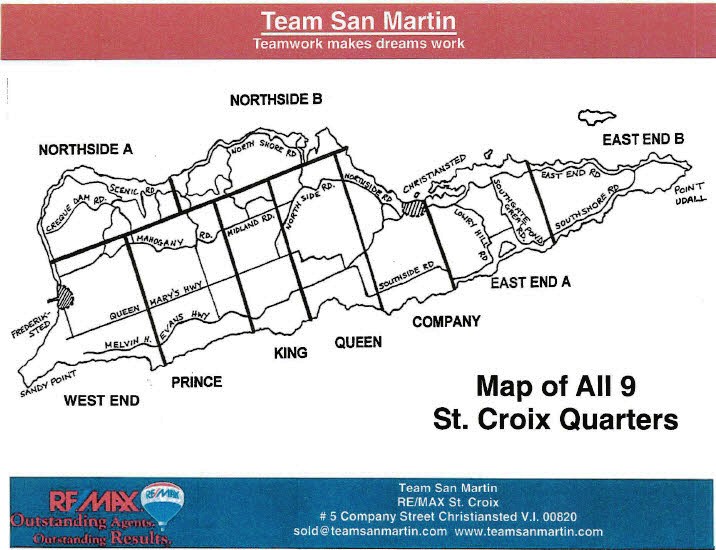

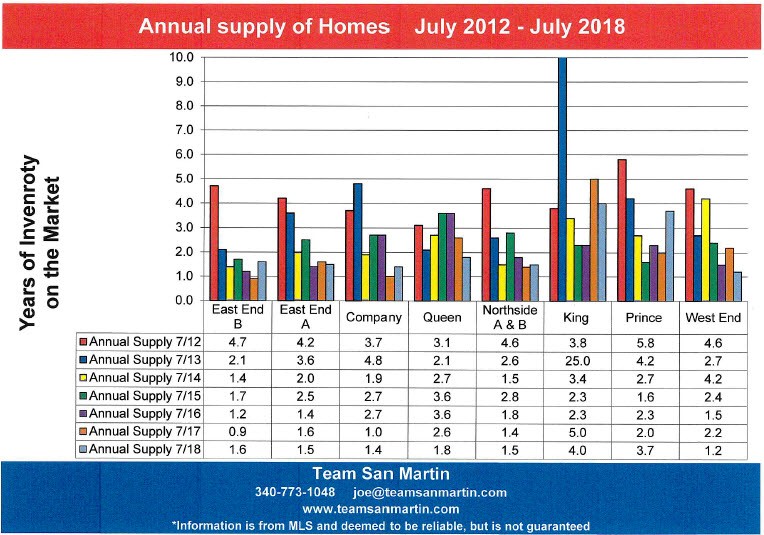

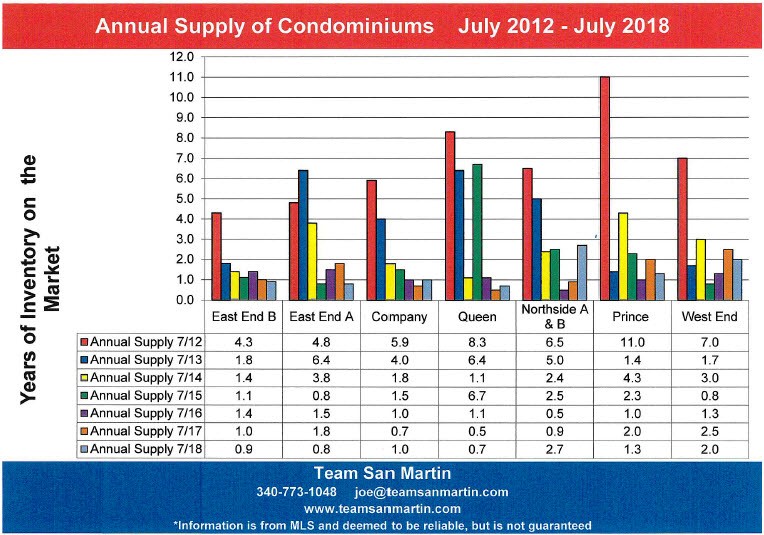

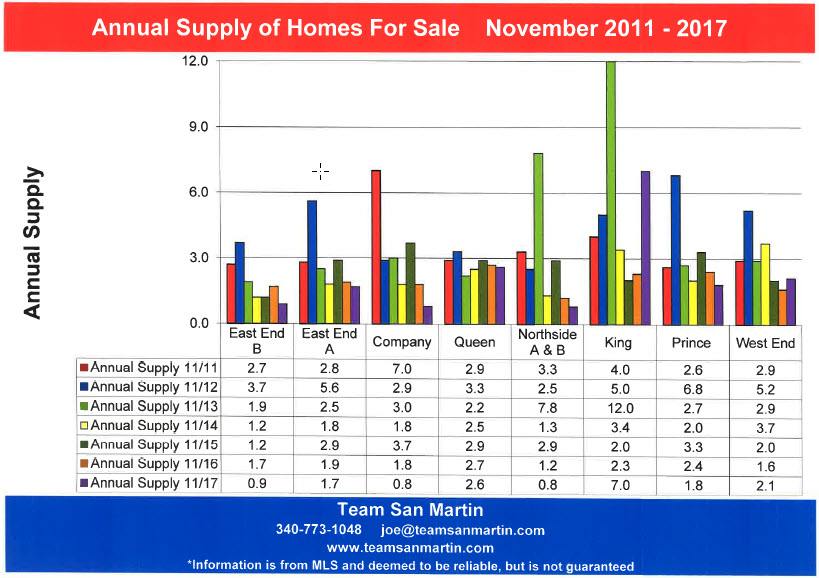

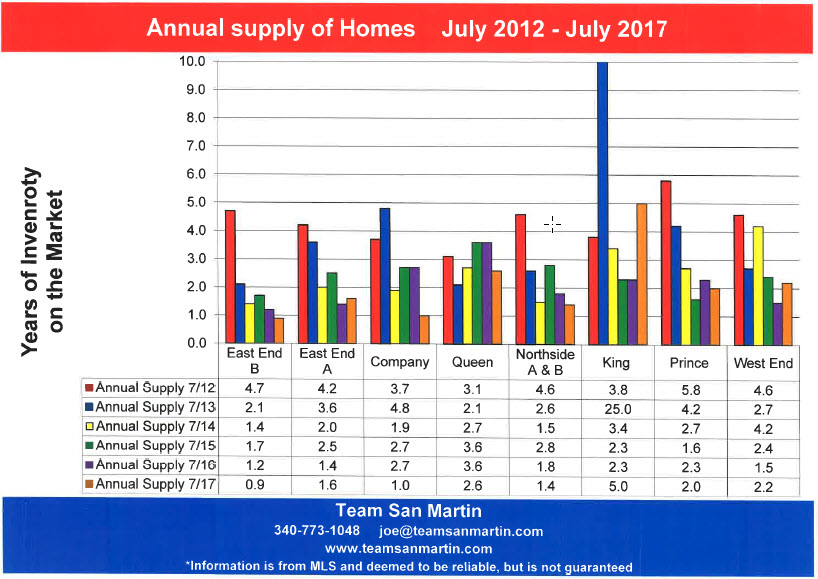

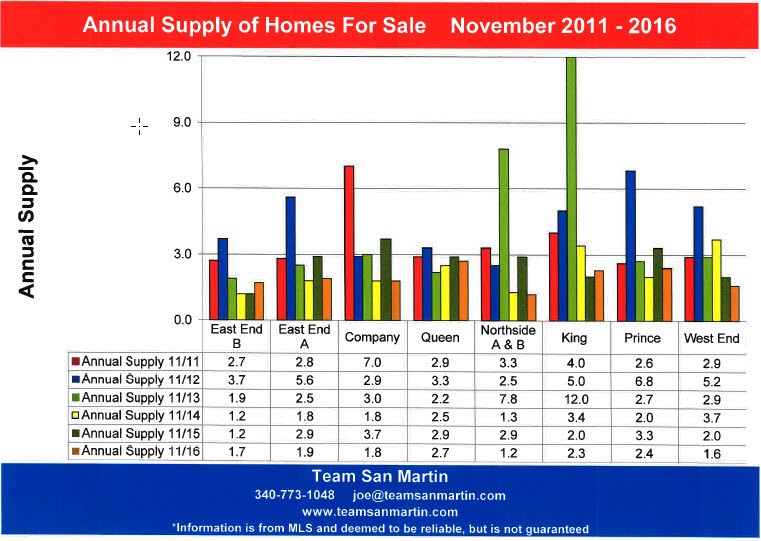

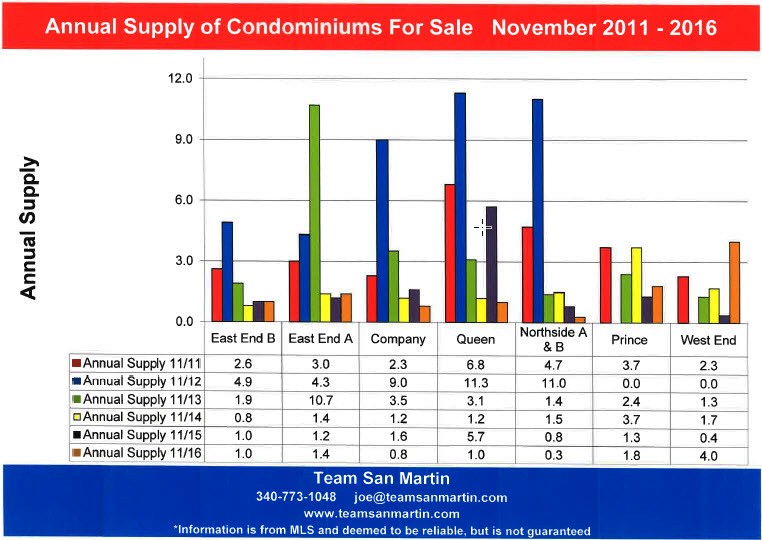

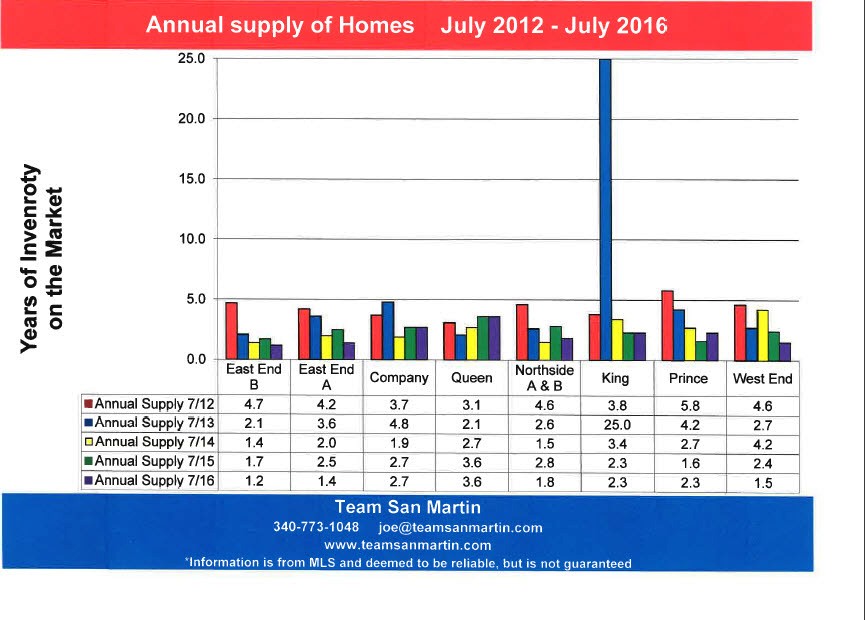

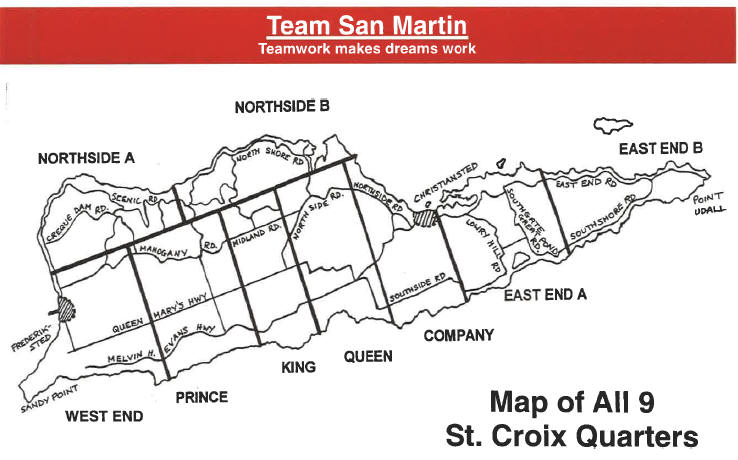

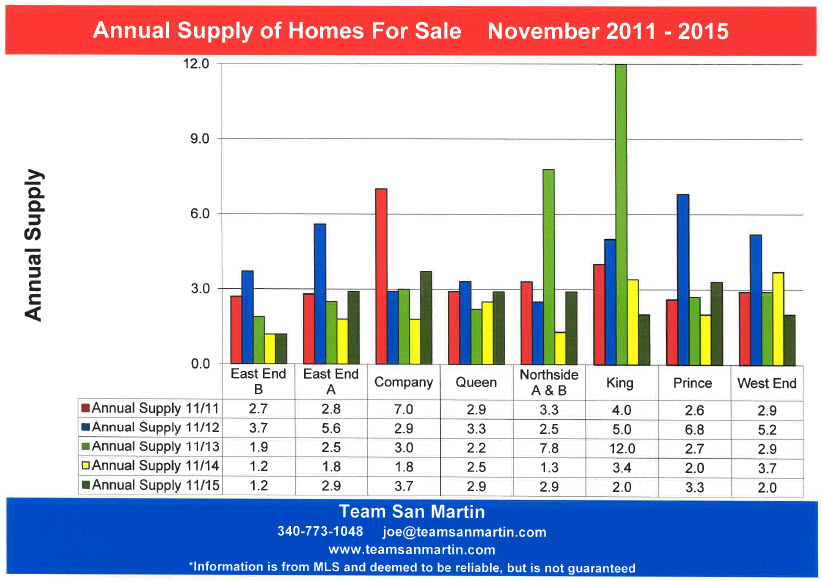

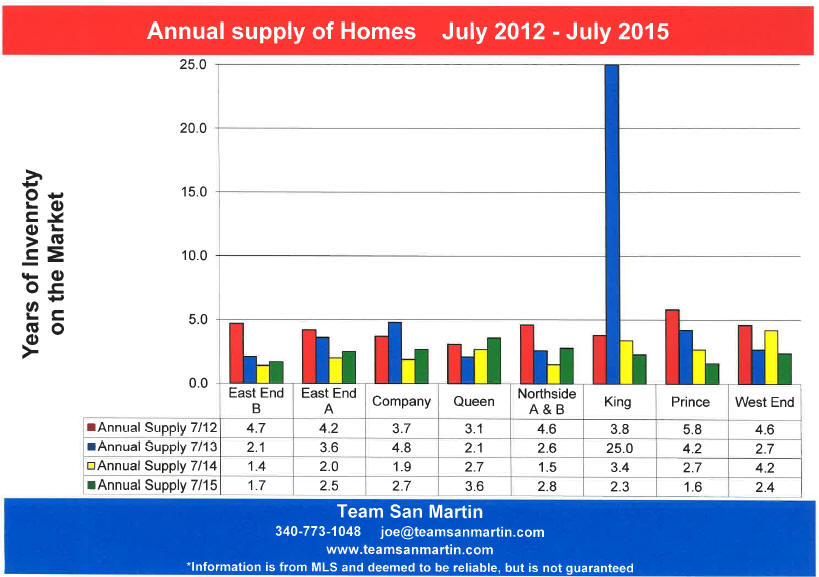

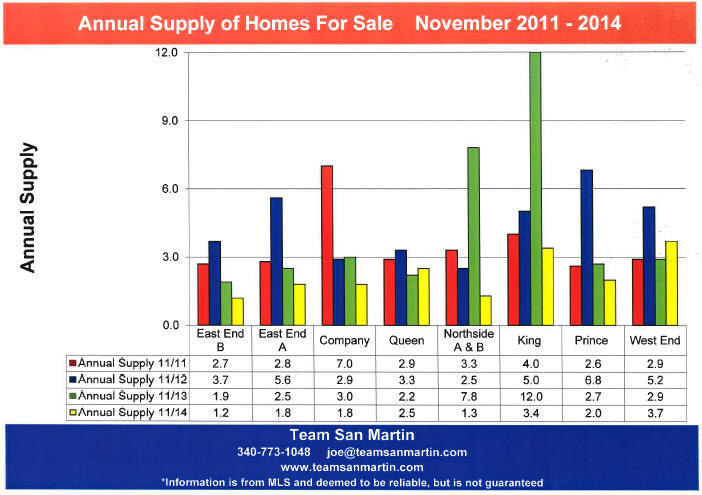

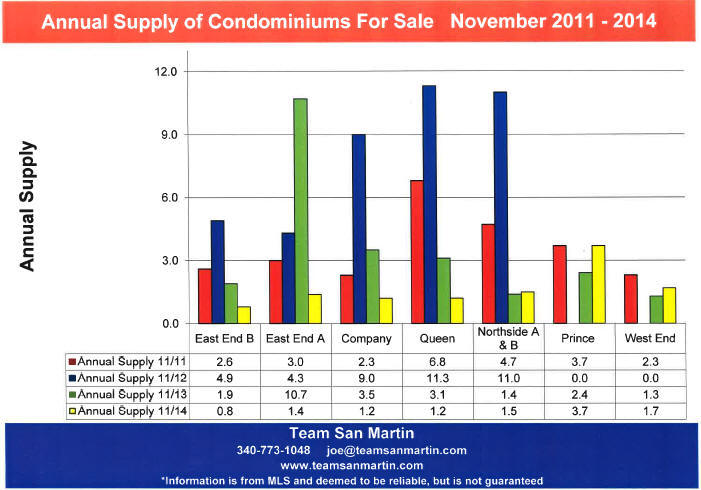

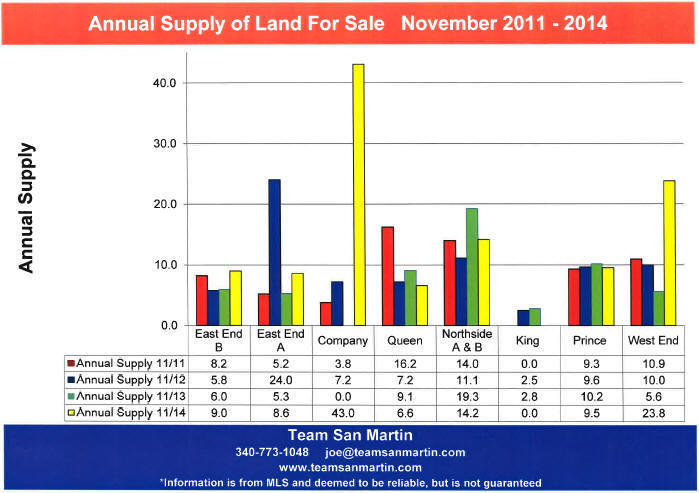

Ten Year Inventory Level Trends

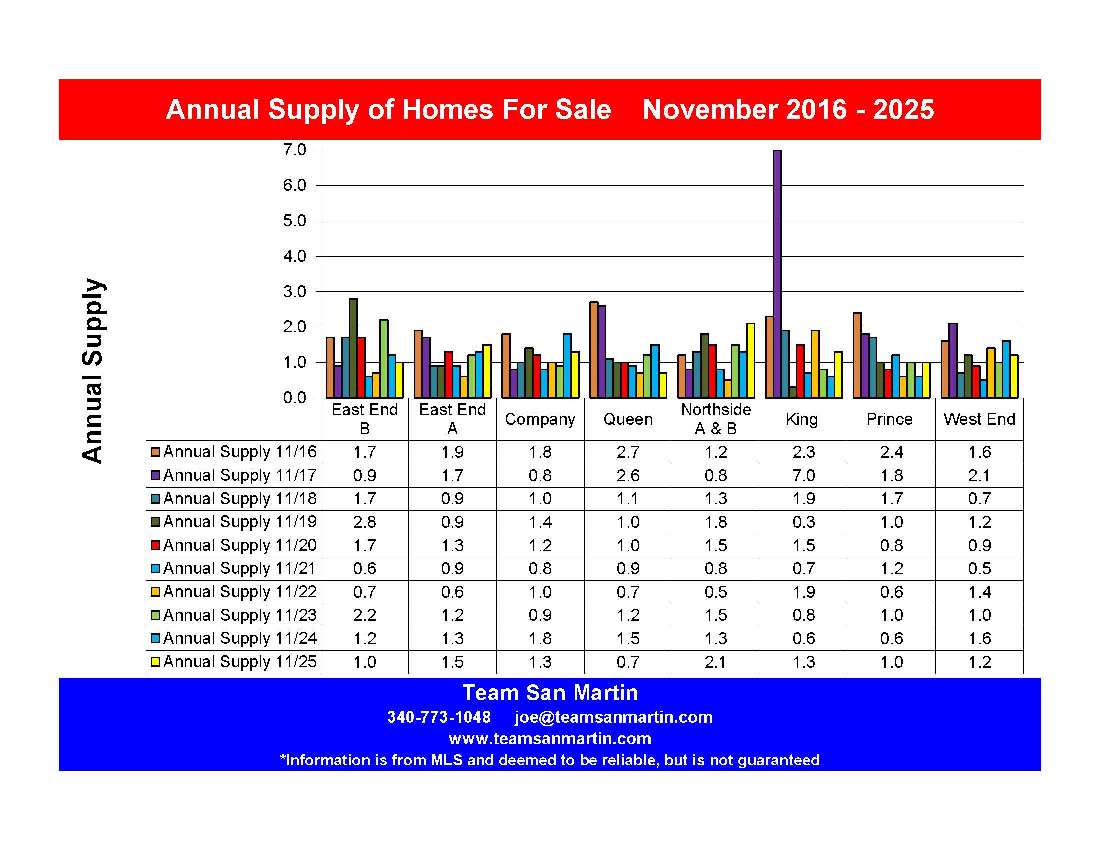

Current Annual supply represents the number of years it will take at the current rate of sales to sell all the properties listed in a specific area (Quarter) of St Croix.

[Active Listings + Pending Listings] /

Number of Listings Sold During the Previous 12 Months

For example:

In November 2025, there were 21 active and 2 pending home sales in East End B, with 22 home sales in the previous 12 months, for a 1.0-year supply of homes for sale

[21 + 2] / 22 = 1.0 Years

East End B

Far East End

Residential

Compared to 9 years ago, home inventory has decreased by 8 months;average sales price increased 66%; from $609,950to $

1,013,031.Compared to last year, average time on the market decreased by 2 months.

average sales price increased 11% (from $910,112 to $1,013,031)

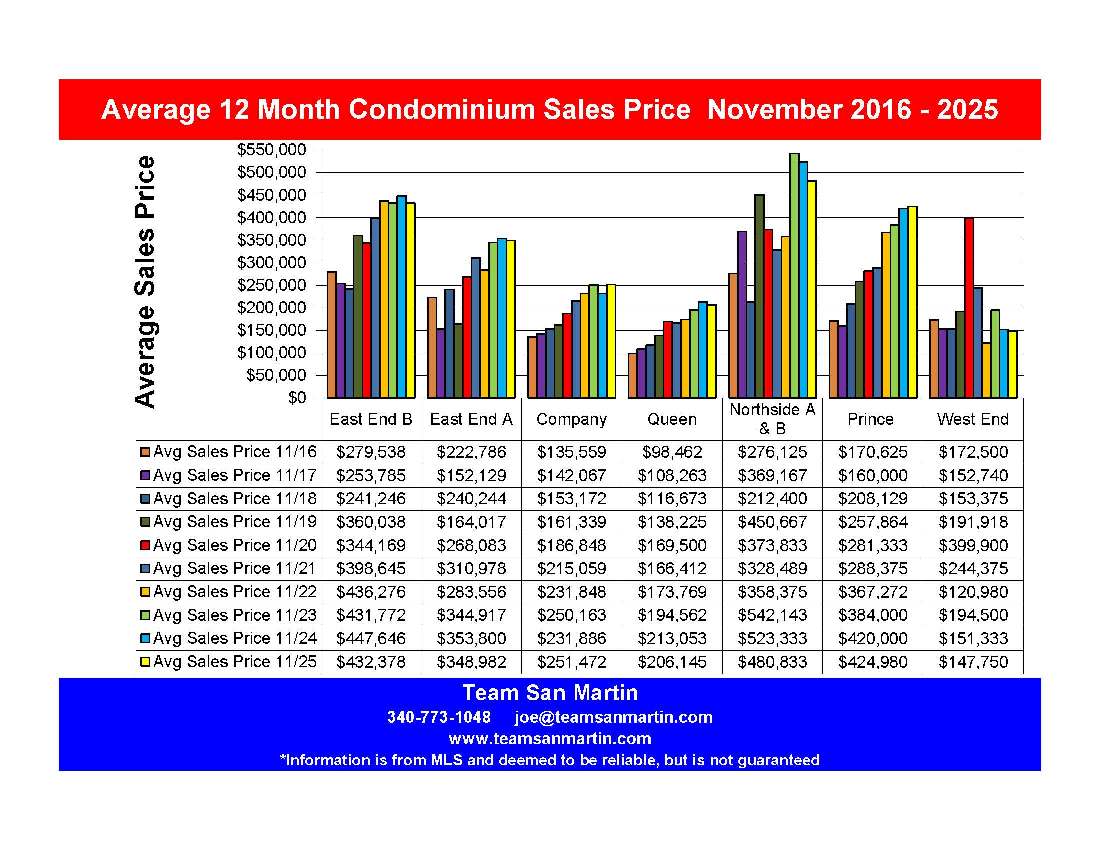

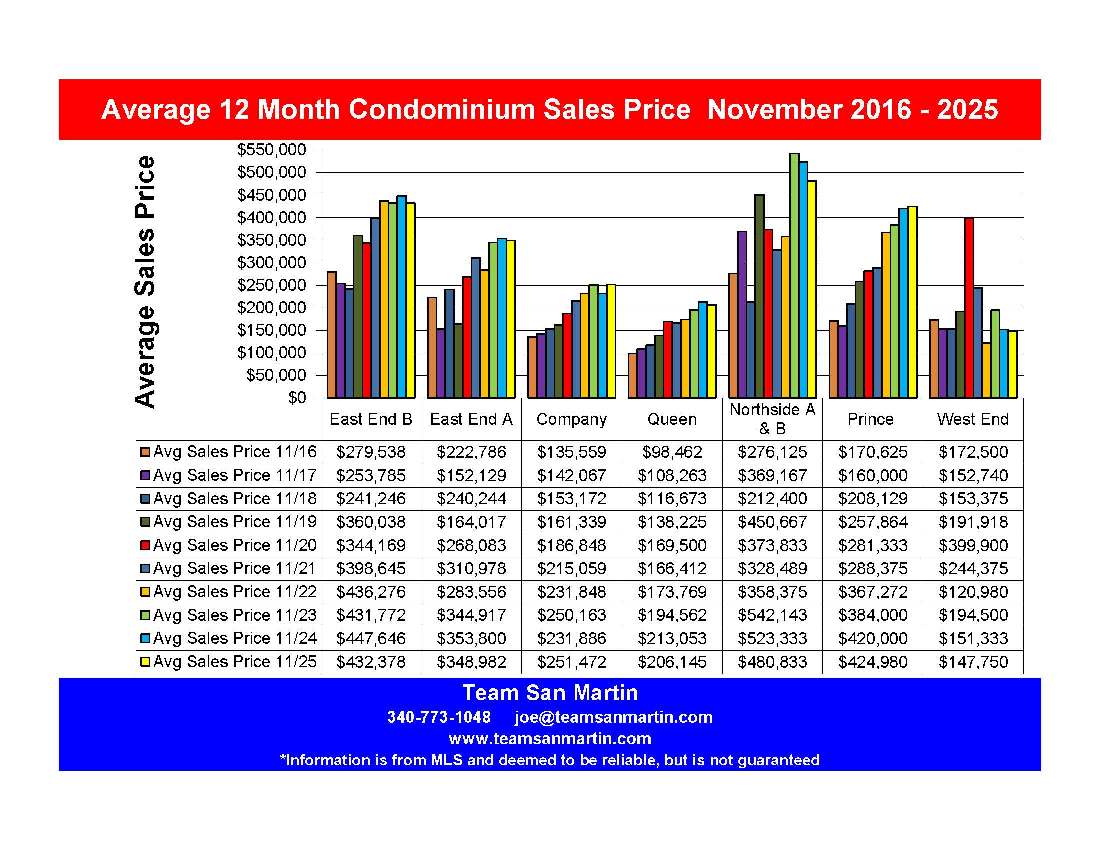

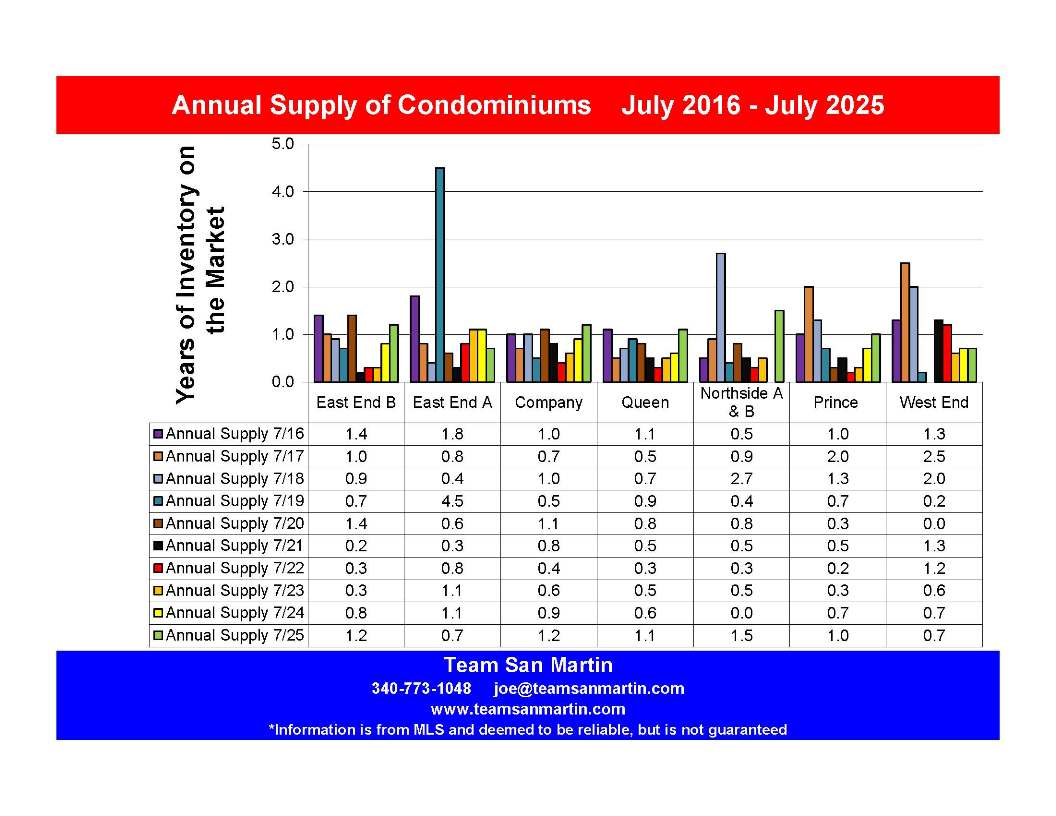

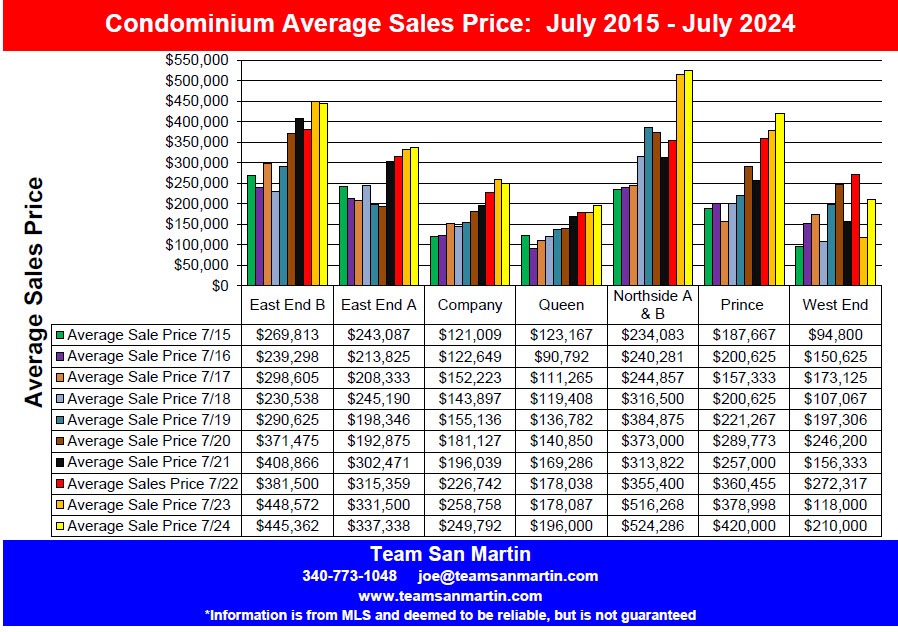

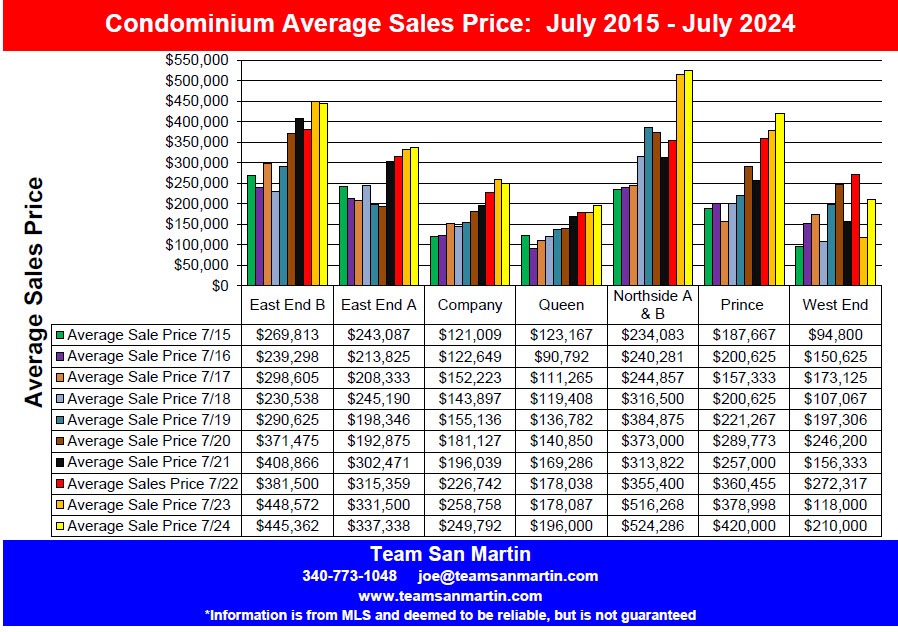

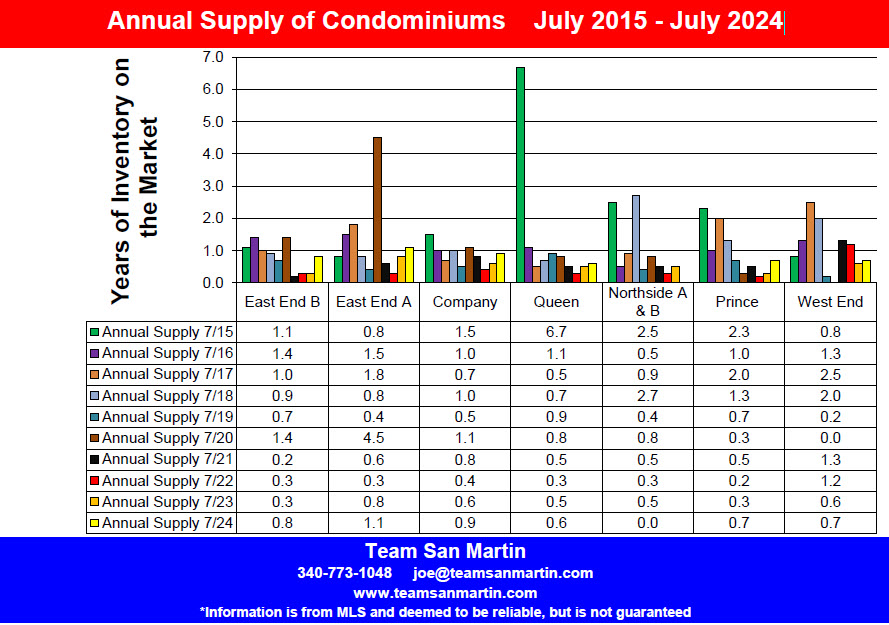

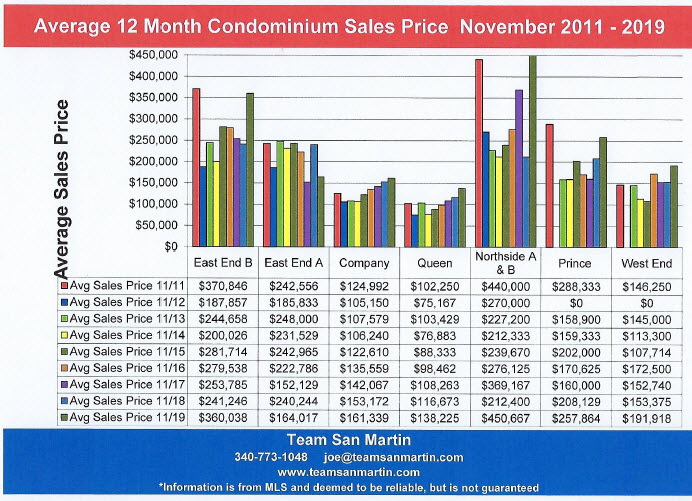

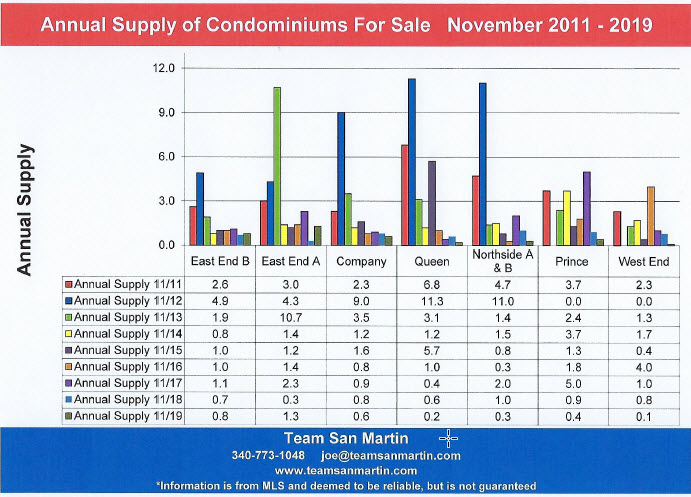

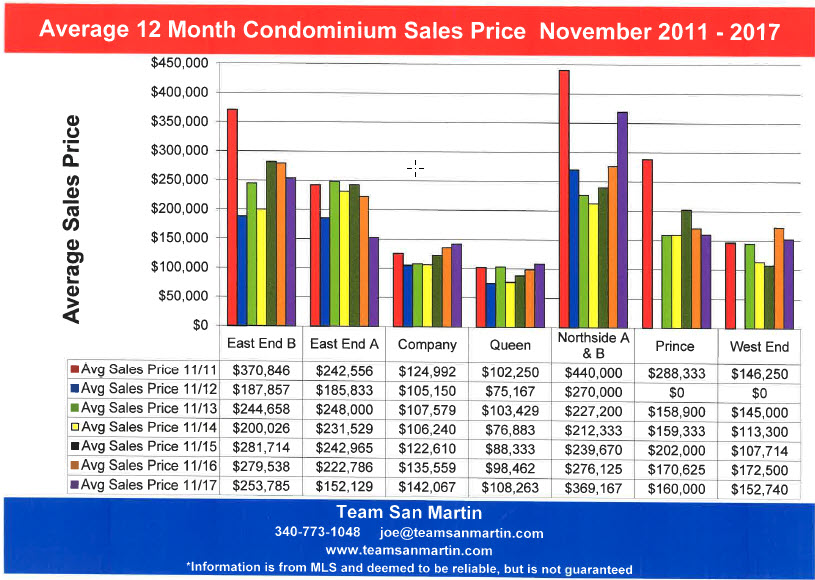

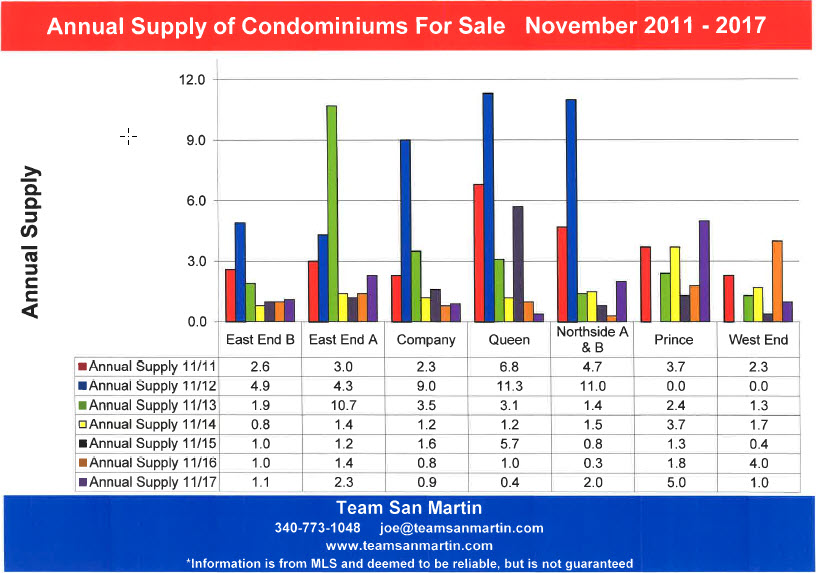

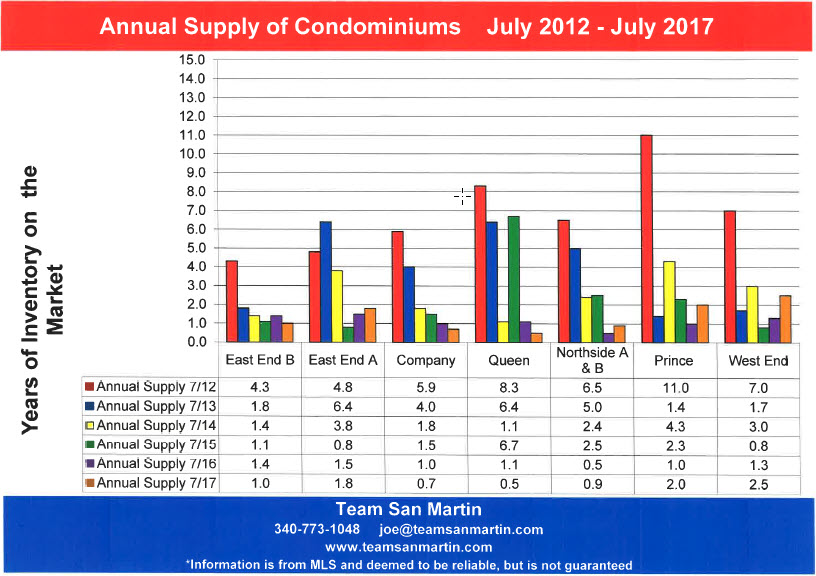

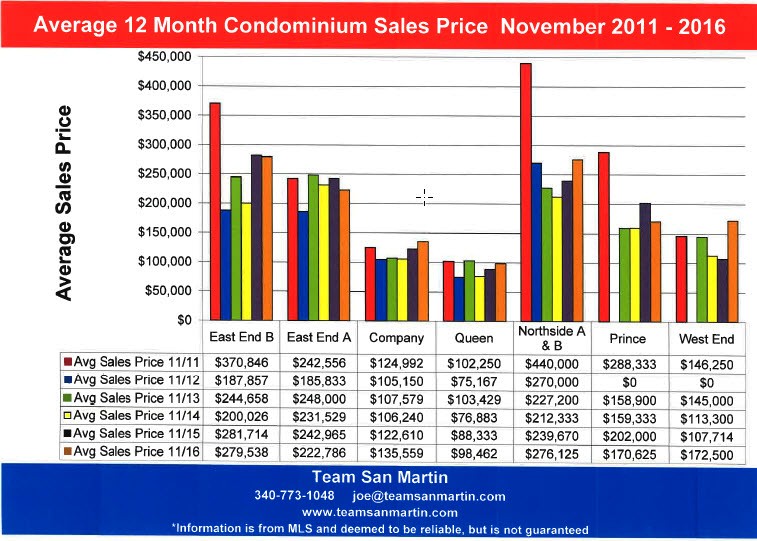

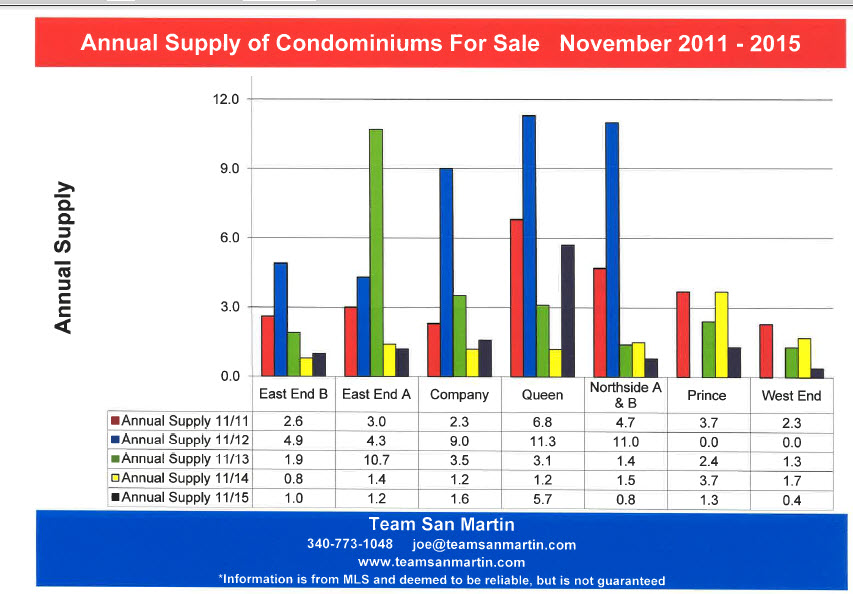

Condominium

Compared to 9 years ago, condominium inventory increased by 2 months; average sales price increased 55%, from $279,538to $432,378.

Compared to last year,average time on the market increased by 1 month.

average sales price decreased 3%(from $447,646 to $432,378)

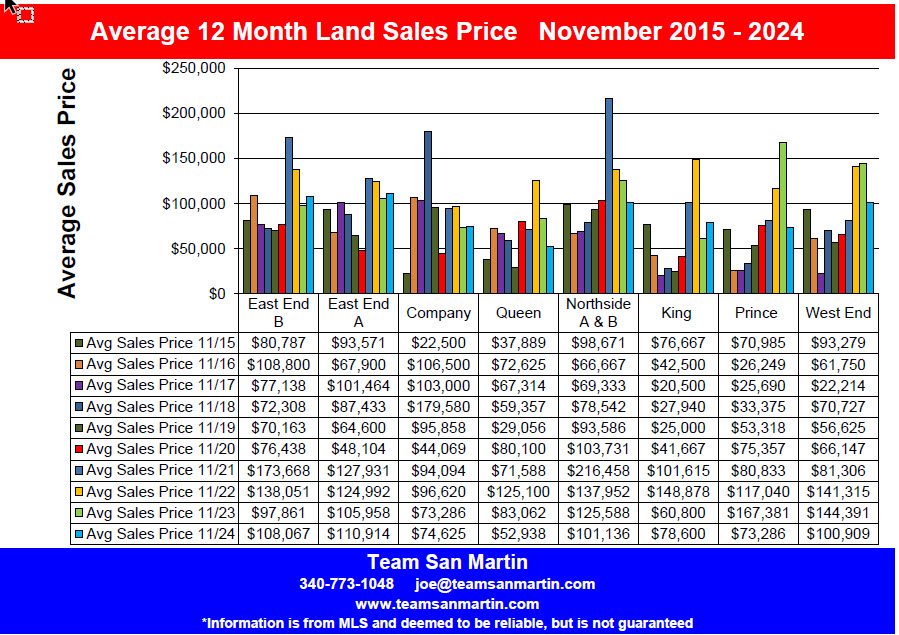

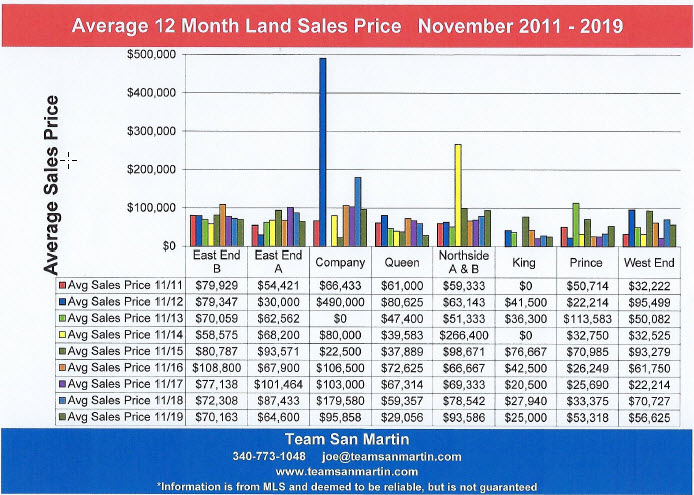

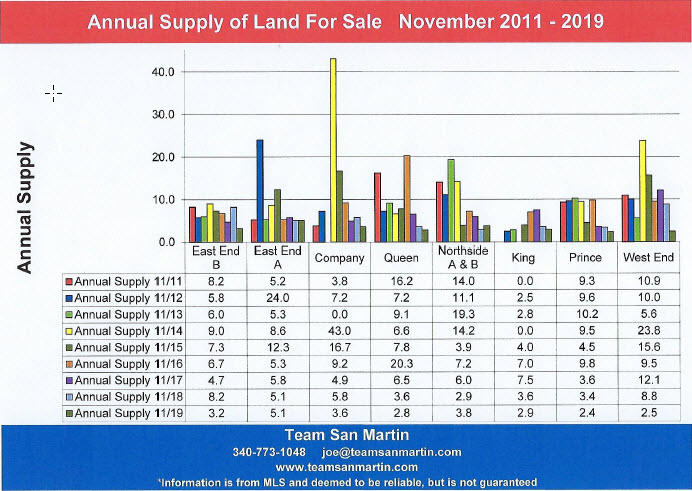

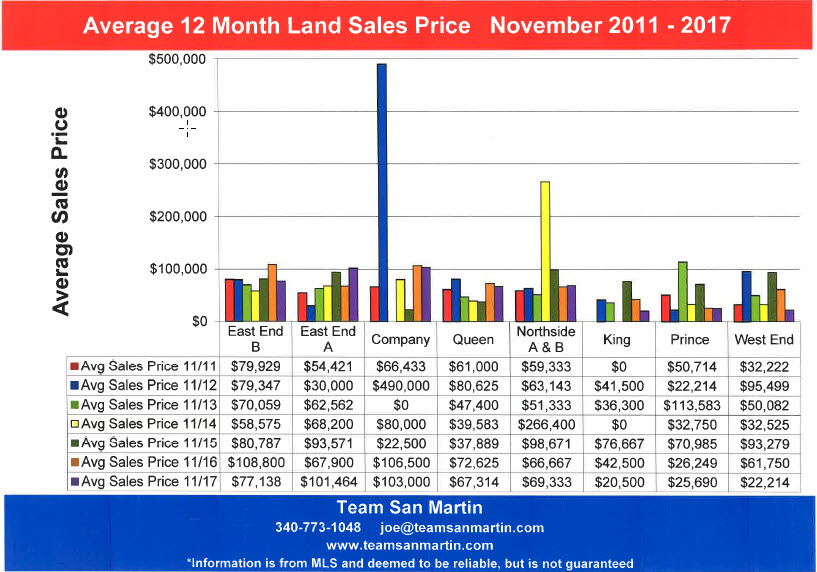

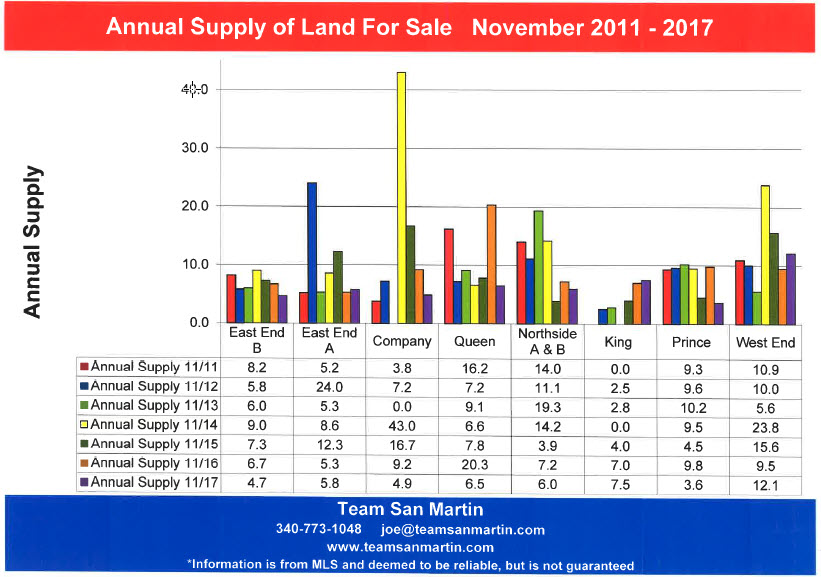

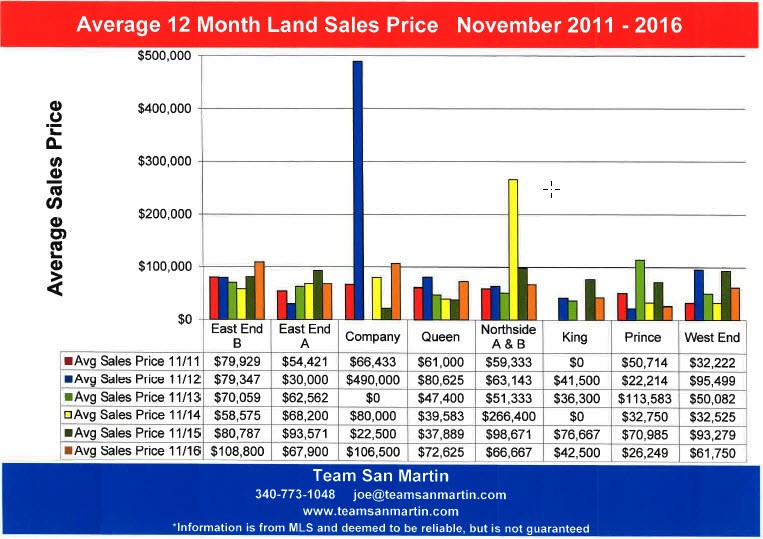

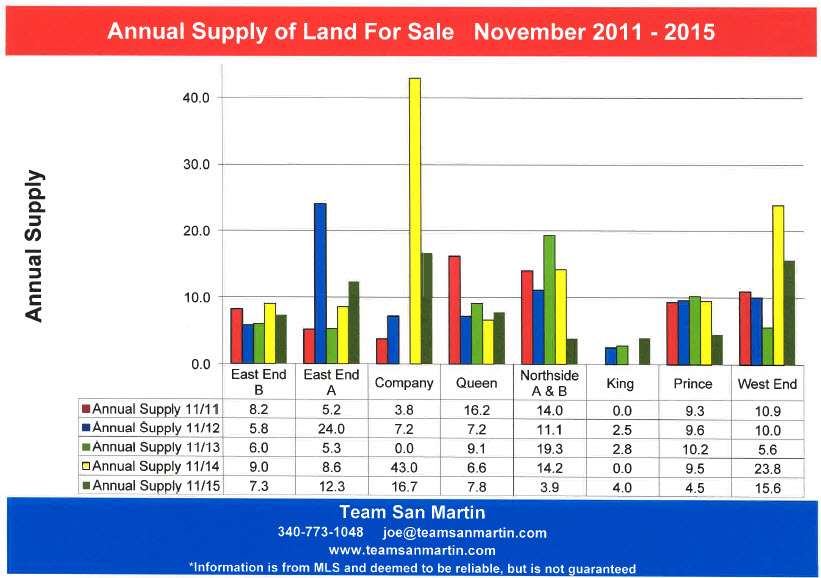

Vacant Land

Compared to 9 years ago, land inventory decreased by 5 months.

average sales price increased 16%(from $108,800to $126,075)

Compared to last year, land inventory increased by 3 years, from 3.3 to 6.3 years.

average sales price increased 170% (from $108,067 to $126,075)

East End A

Christiansted East to Coakley Bay

Residential

Compared to 9 years ago, home inventory decreased by 5 months.

average home sale price increased 157%,from $361,979to $931,099.

Compared to last year, residential inventory increased by about 2months.

average sales price increased 40%(from $666,000 to $931,099)

Condominium

Compared to 9 years ago, condominium inventorydecreased by 6months.

average condominium sales price increased57%(from $222,786to $348,982)

Compared to last year, condominium inventory increased by 1month.

average sales price decreased 3%(from $353,800 to $348,982)

Vacant Land

Compared to 9 years ago, land inventory increased by 7months.

average lot sales price increased 39%, from $67,900to $94,423)

Compared to last year, land inventory increased by 3.3 years, from 2.6 to 5.9 years;

average lot sales price decreased 15% (from $110,914 to $94,423)

Company

Christiansted West to the East Side of Judiths Fancy

Residential

Compared to 9 years ago, residential inventory decreasedby 6 months.

average home sales priceincreased 40% (from $333,239 to $466,745)

Compared to last year, residential inventory decreased by 6months.

average home sales price increased 1% (from$463,647 to $466,745)

Condominium

Compared to 9 years ago, condominium inventory increased by 5months.

average sales price increased 86% (from $135,559to $251,472)

Compared to last year, condominium inventory increased by 5months.

average condo sales price increased8% (from $231,886 to $251,472)

Vacant Land

Compared to 9 years ago, lot inventory decreased by 6.7 years, from 9.2 to 2.5years.

average lot sales price decreased 34%, from $106,500 to $69,886.

Compared to last year, land inventory decreased by 13 months.

average sales pricedecreased 3%,from $74,625 to $69,886.

Queen

Constitution Hill West to La Reine, includes southwest

Judiths Fancy

Residential

Compared to 9 years ago, residential inventory decreased by 2years.

average sales priced increased 71% (from $296,020to $506,372)

Compared to last year, residential inventory decreased by 10months.

average sales price increased 4% (from $486,760 to $506,372)

Condominium

Compared to 9 years ago, condominium inventory decreased by 2 months.

average condominium sales price increased109% (from $98,462to $206,145)

Compared to last year, condominium inventory decreased by 2months.

average sales price decreased 3% (from $213,053 to $206,145)

Vacant Land

Compared to 9 years ago, land inventory decreased by 18.8 years,

from 20.3 years to1.5 years);

average lot sales price increased 8%, from $72,625to $78,477.

Compared to last year, land inventory decreased by 13months.

average lot sales price increased 48%,from $52,938 to $78,477.

Northside A & B

North Shore from North Judiths Fancy to Hamms Bluff

Residential

Compared to 9 years ago, residential inventory increased by 11 months.

average home sales price increased71%(from $677,762to $1,159,273)

Compared to last year, residential inventory increased by 10months.

average home sales price increased 2%(from $1,131,108 to $1,159,273)

Condominium

Compared to 9 years ago, condominium inventory increased by 8months.

average sales price increased 74% (from $276,125to $480,833)

Compared to last year, condominium inventory increased by 6months.

average condo sales price decreased 8%,from $523,333 to $480,833.

Vacant Land

Compared to 9 years ago, land inventory decreased by 3.4 years,

from 7.2 years to3.8years.

average lot sales price increased 1388%,from $66,667to $991,900*

* $17.5 Million sale to VI Government has skewed statistics.

Compared to last year, land inventory decreased by 2.1years.

average lot sales price increased 881%,from $101,136 to $991,900.*

King

South Shore from La Reine West to UVI

Residential

Compared to 9 years ago, residential inventory decreased by 1year.

average home sales price increased93% (from $159,250to $306,938)

Compared to last year, residential inventory increased by 8months.

average residential sales price decreased 7% (from $329,455 to $306,938)

Condominium

There are no condominium complexes in King Quarter

Vacant Land

Compared to 9 years ago, land inventory decreased by 5 years,

from 7 years to 2years.

average lot sales price increased 436%, from $42,500 to $227,800)

Compared to last year, land inventory decreased by 1.6years.

average lot sales price increased 190%,from $78,600 to $227,800.

Prince

South Shore from UVI West to Williams Delight

Residential

Compared to 9 years ago, residential inventory decreased by 1.7years.

average residential sales price increased 44% (from $210,846to $303,783)

Compared to last year, residential inventory increased by 5months.

average residential sales price decreased 4% (from $315,923 to $303,783)

Condominium

Compared to 9 years ago, condominium inventory decreased by 1.4 years.

Average condominium sales price increased 149% (from $170,625 to $424,980).

Compared to last year, condominium inventory decreased by 7 months.

average condominium sale price increased 19% (from $420,000 to $424,980)

Vacant Land

Compared to 9 years ago, land inventory decreased by

7.5 years, from 9.8 years to2.3years.

average lot sales price increased 210%, from $26,249to $81,467)

Compared to last year, land inventory increased by 11 months.

average lot sales price increased 11%,from $73,286 to $81,467.

West End

South Shore, South from Mahogany Road,

East to Williams Delight

Residential

Compared to 9 years ago, residential inventory decreased by 5 months.

average home sale price increased 119%, from $200,875to $440,890.

Compared to last year, residential inventory decreased by 5months.

average home sale price increased 3% (from $427,541 to $440,890)

Condominium

Compared to 9 years ago, condominium inventory decreased by 2.5 years.

average condominium sales price decreased 14% (from $172,500 to $147,750)

Compared to last year, condominium inventory increased by 10 months.

average condominium sales price decreased 2%, from $151,333 to $147,750.

Vacant Land

Compared to 9 years ago, land inventory decreased by 5.1 years,

from 9.5 years to4.4years.

average lot sales price increased 53%, from $61,750to $94,750.

Compared to last year, land inventory increased by10 months.

average lot sales price decreased 6%, from $100,909 to $94,750.

Information is from MLS and deemed to be reliable but is not guaranteed.

Prepared by:

Julie San Martin

Team Manager

November 2025

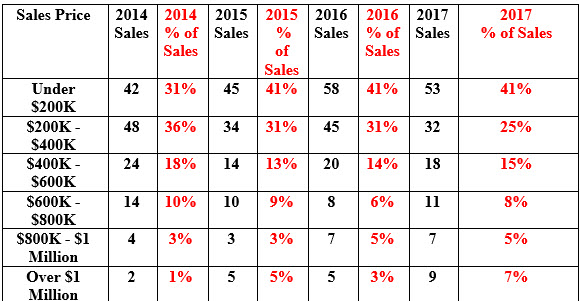

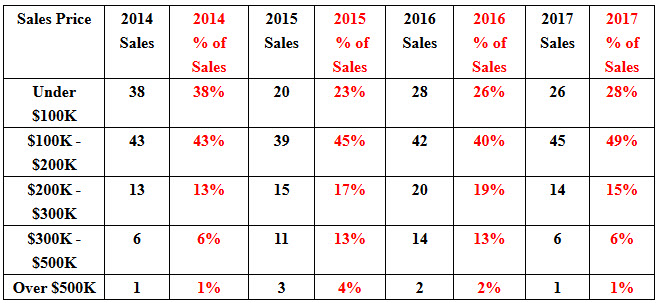

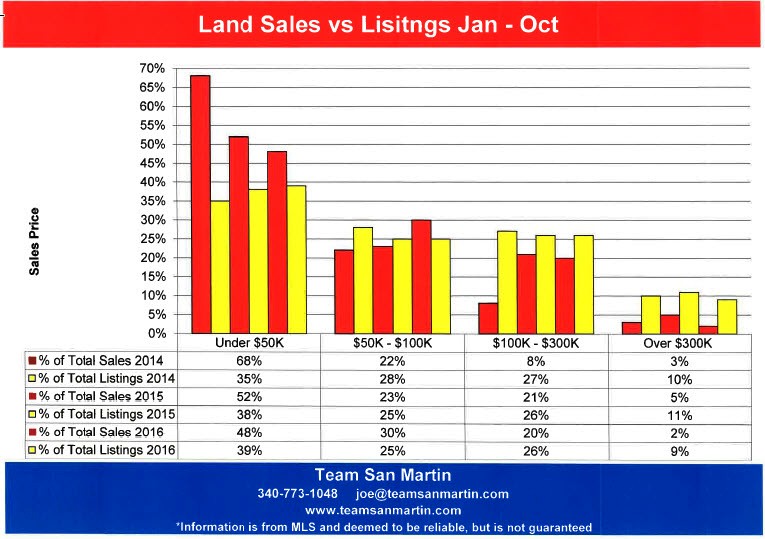

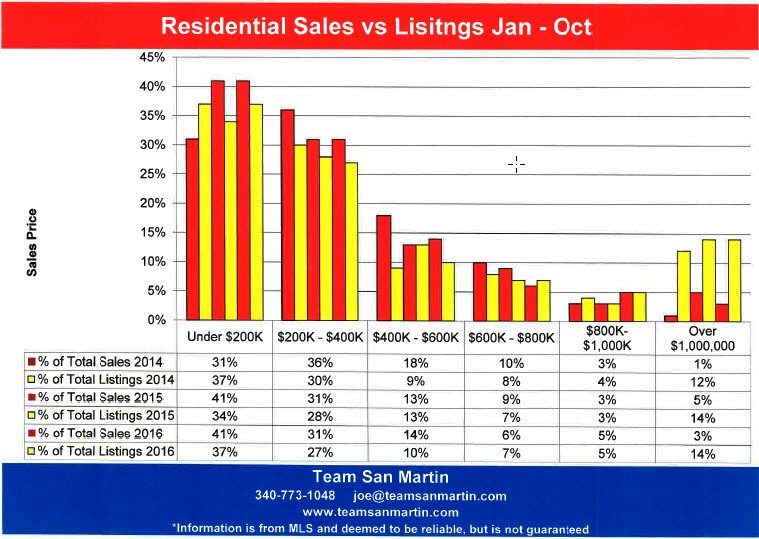

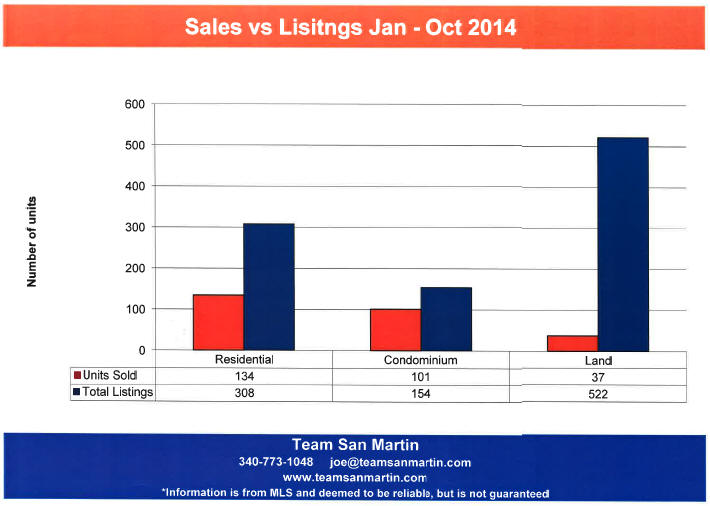

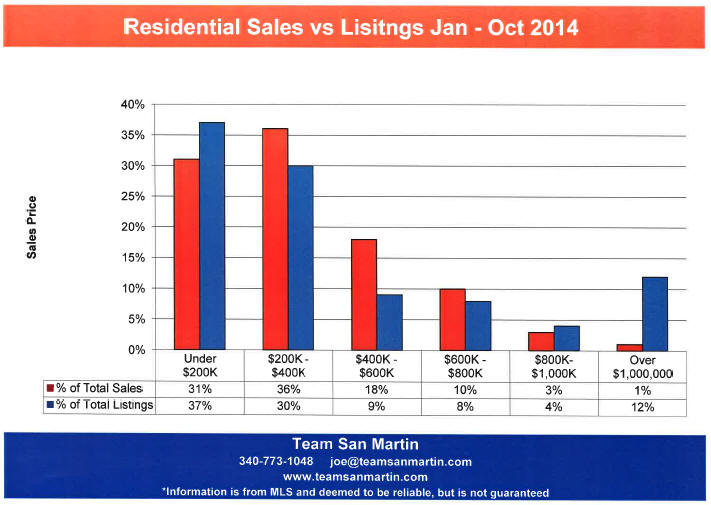

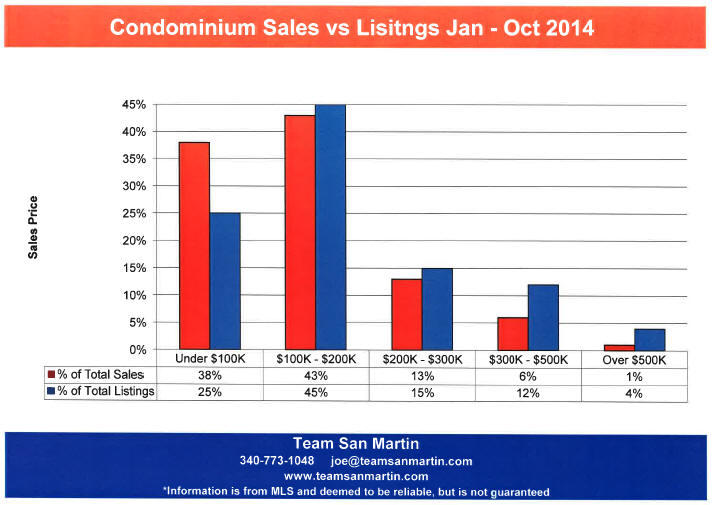

Which St Croix Price Ranges are Selling?

First 10 months of 2021 through 2025

Residential

2021

183 home sales closed January through October; there were 90 homes for sale

2.03 buyers for every seller

2022

157 home sales closed January through October; there were 96 homes for sale

1.64 buyers for every seller

114 home sales closed January through October; there were 123 homes for sale

0.93 buyers for every seller

2024

127 home sales closed January through October; there were 135 homes for sale

0.94 buyers for every seller

2025

132 home sales closed January through October; there were 154 homes for sale

0.86 buyers for every seller

Condominium

2021

131 condominium sales closed January - October; there were 26 condos for sale

5.04 buyers for every seller

2022

127 condominium sales closed January - October; there were 30 condos for sale

4.23 buyers for every seller

2023

82 condominium sales closed January - October; there were 49 condos for sale

1.67 buyers for every seller

2024

84 condominium sales closed January - October; there were 76 condos for sale

1.11 buyers for every seller

2025

95 condominium sales closed January - October; there were 99 condos for sale

0.96 buyers for every seller

Vacant Land

2021

158 land sales closed January through October; there were 373 lots for sale

0.42 buyers for every seller

2022

175 land sales closed January through October; there were 336 lots for sale

0.52 buyers for every seller

132 land sales closed January through October; there were 332 lots for sale

0.40 buyers for every seller

2024

111 land sales closed January through October; there were 315 lots for sale

0.35 buyers for every seller

2024

103 land sales closed January through October; there were 366 lots for sale

0.28 buyers for every seller

SALES BY PRICE RANGE

Residential

|

2025 % of Sales |

2025 Sales |

2024 % of Sales |

2024 Sales |

2023 % of Sales |

2023 Sales |

2022 % of Sales |

2022 Sales |

2021 % of Sales |

2021 Sales |

Sales Price |

|

%17 |

22 |

%14 |

18 |

%19 |

22 |

%11 |

18 |

%16 |

30 |

Under $200K |

|

%30 |

40 |

%31 |

39 |

%34 |

39 |

%25 |

33 |

%25 |

45 |

$200K - $400K |

|

%13 |

17 |

%17 |

21 |

%14 |

16 |

%21 |

33 |

%17 |

31 |

$400K - $600K |

|

%12

|

16 |

%10 |

13 |

%11 |

13 |

%10 |

16 |

%19 |

34 |

$600K - $800K |

|

%11 |

14 |

%11 |

14 |

%11 |

12 |

%8 |

13 |

%11 |

21 |

$800K - $1 Million |

|

%17 |

23 |

%17 |

22 |

%11 |

12 |

%28 |

44 |

%12 |

22 |

Over $1 Million |

Condominium

|

2025 % of Sales |

2025 Sales |

2024 % of Sales |

2024 Sales |

2023 % of Sales |

2023 Sales |

2022 % of Sales |

2022 Sales |

2021 % of Sales |

2021 Sales |

Sales Price |

|

%5 |

5 |

%10 |

8 |

%2 |

2 |

%6 |

8 |

%2 |

2 |

Under $100K |

|

%25 |

24 |

%15 |

13 |

%28 |

23 |

%23 |

29 |

%27 |

36 |

$100K - $200K |

|

%20 |

19 |

%27 |

23 |

%29 |

24 |

%31 |

40 |

%33 |

43 |

$200K - $300K |

|

%37 |

35 |

%38 |

32 |

%32 |

26 |

%35 |

45 |

%31 |

41 |

$300K - $500K |

|

%13 |

12 |

%10 |

8 |

%9 |

7 |

%4 |

5 |

%7 |

9 |

Over $500K |

Vacant Land

|

2025 % of Sales |

2025 Sales |

2024 % of Sales |

2024 Sales |

2023 % of Sales |

2023 Sales |

2022 % of Sales |

2022 Sales |

2021 % of Sales |

2021 Sales |

Sales Price |

|

%44 |

45 |

%35 |

39 |

%43 |

57 |

%39 |

68 |

%41 |

65 |

Under $50K |

|

%33 |

34 |

%36 |

40 |

%31 |

41 |

%30 |

53 |

%32 |

50 |

$50K - $100K |

|

%18 |

19 |

%23 |

25 |

%22 |

29 |

%23 |

41 |

%23 |

36 |

$100K - $300K |

|

%5 |

5 |

%6 |

7 |

%4 |

5 |

%7 |

13 |

%4 |

7 |

Over $300K |

Information is from MLS and deemed to be reliable but is not guaranteed.

Prepared by:

Julie San Martin

Team Manager

October 2025

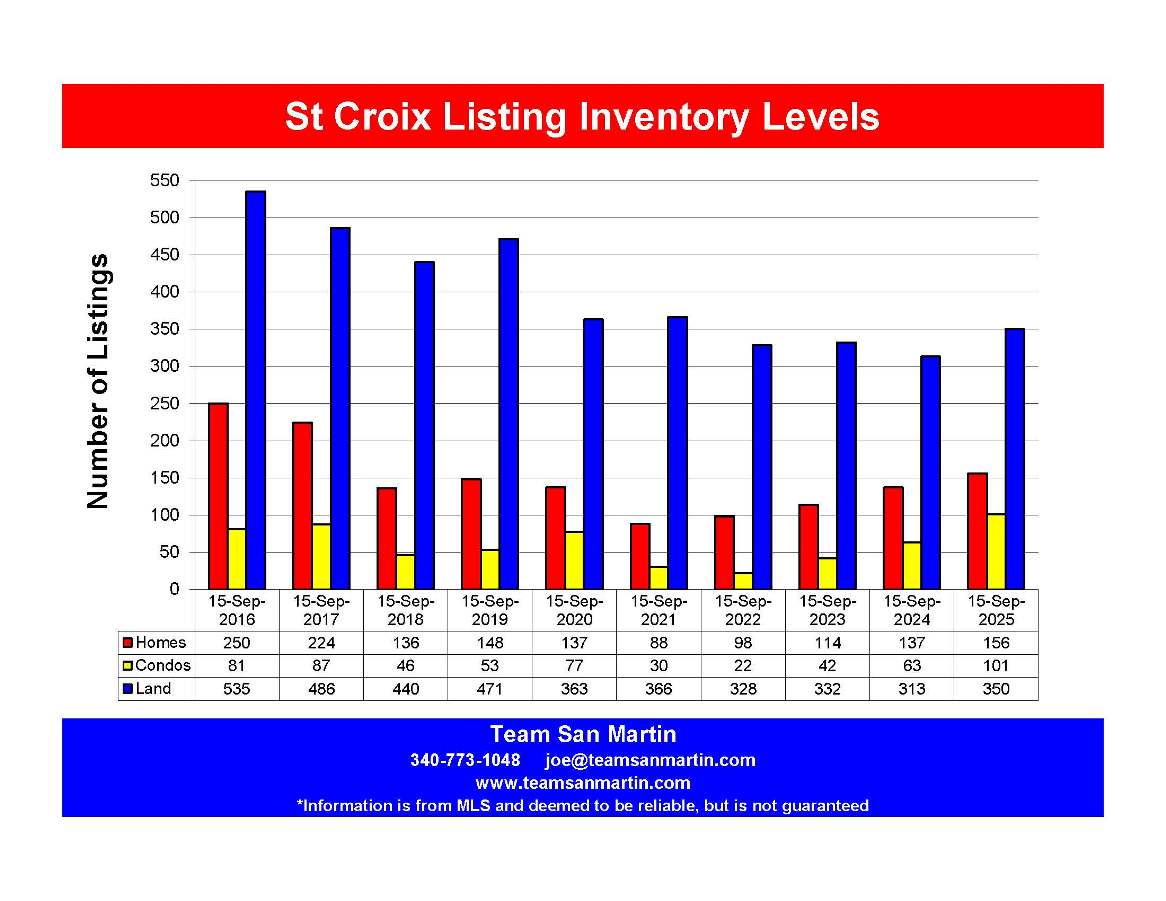

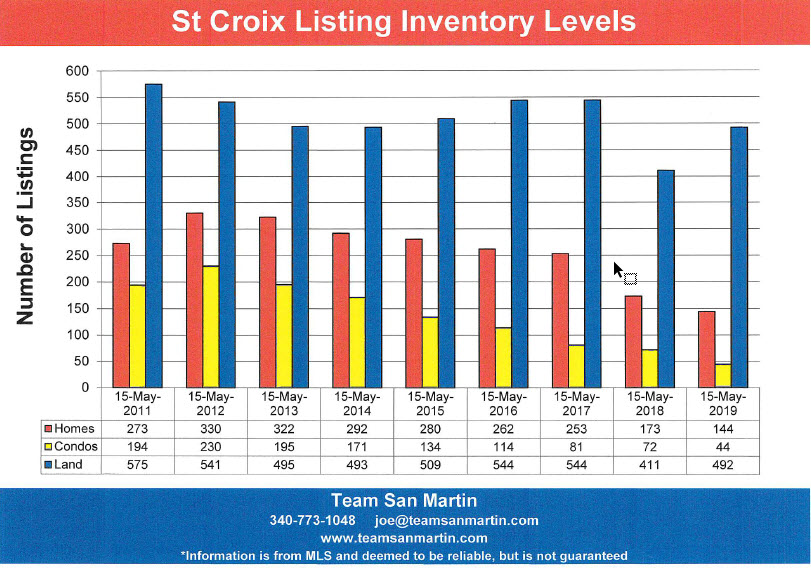

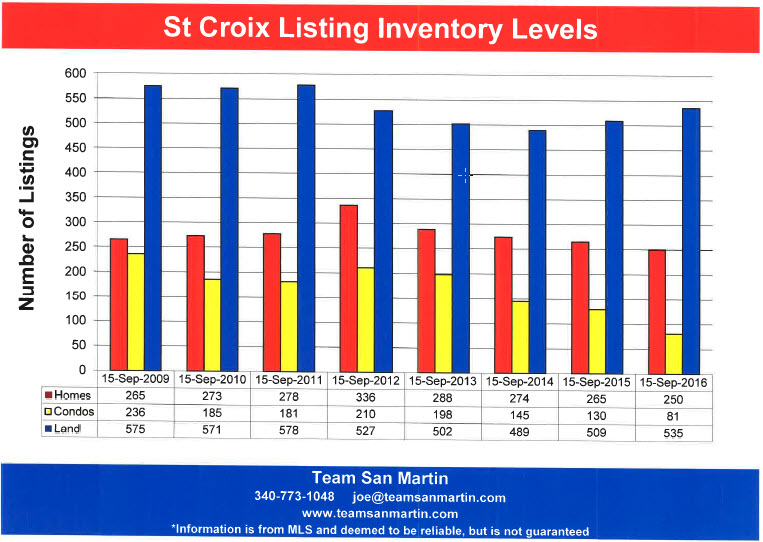

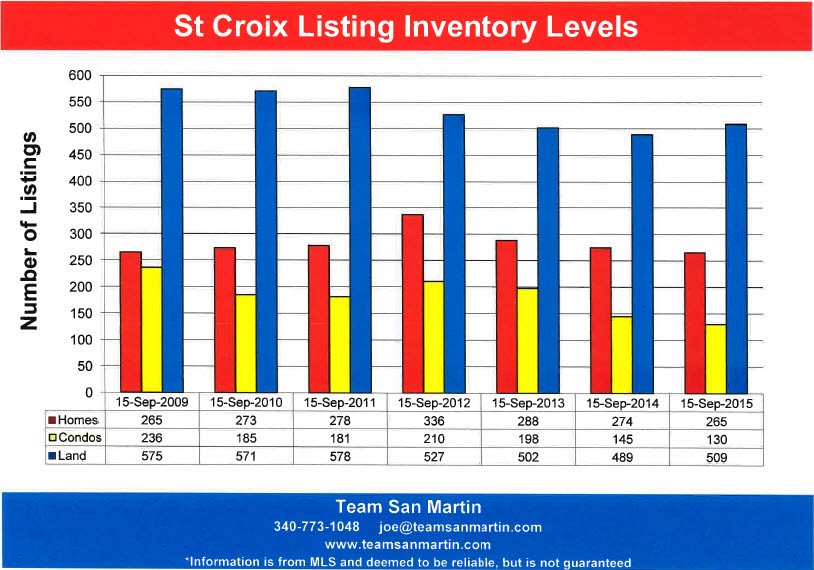

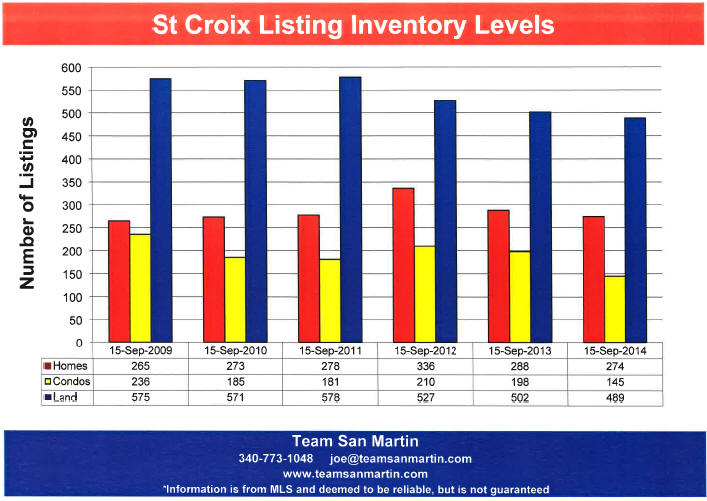

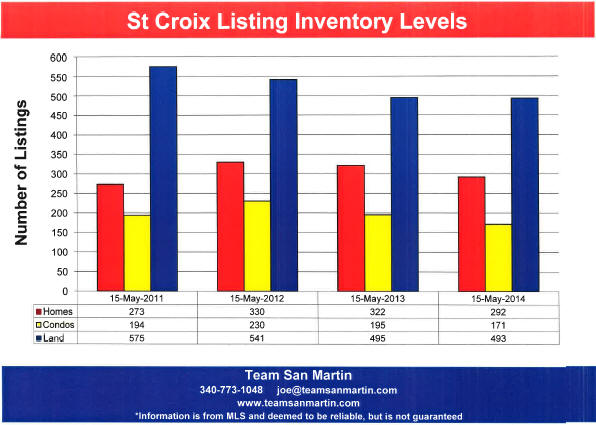

Ten Year Comparison

St Croix Real Estate Inventory Levels

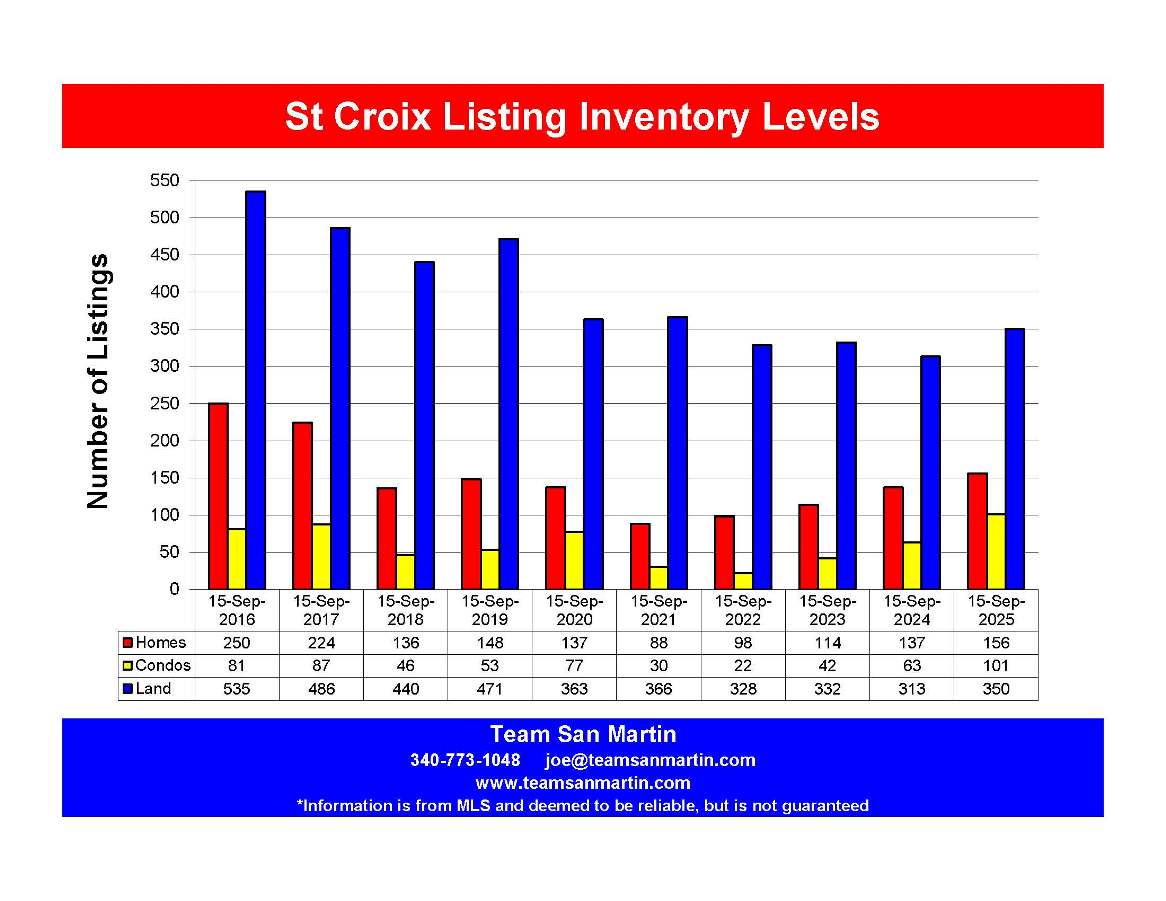

TOTAL INVENTORY

Residential

38% fewer homes (94) than ten years ago.

The highest inventory during this period was 9/15/16 with 250 homes on the market.

Lowest inventory during this period was 9/15/21 with only

88 homes for sale.

Condominium

25% more condominiums (20) than ten years ago.

The highest inventory during this period was 9/15/25, with 101 condominiums for sale.

The lowest inventory during this period was 9/15/22 with only 22 condos for sale.

Vacant Land

40% fewer lots (186) than ten years ago.

The highest inventory during this period was 9/15/16 with 535 lots on the market.

9/15/2024 is the lowest inventory of the ten-year period with only.

313 lots for sale.

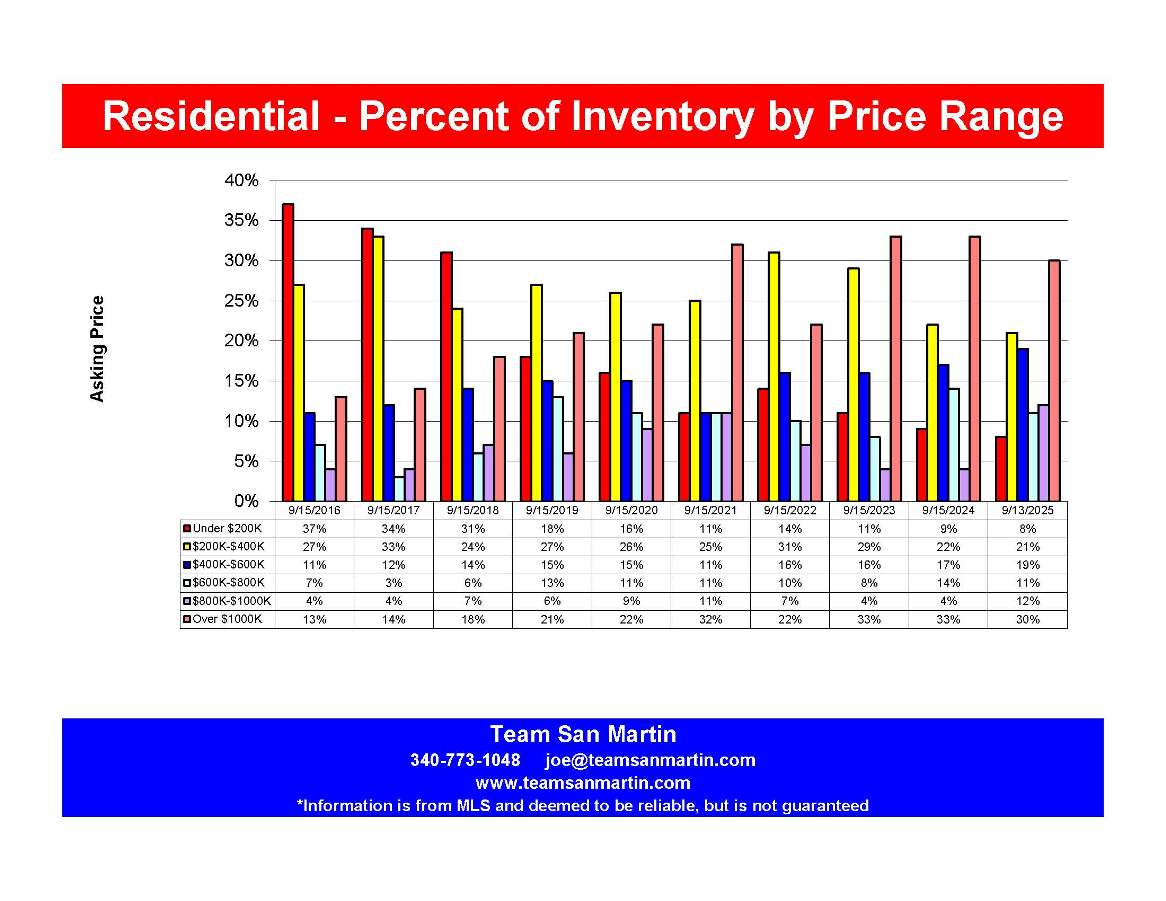

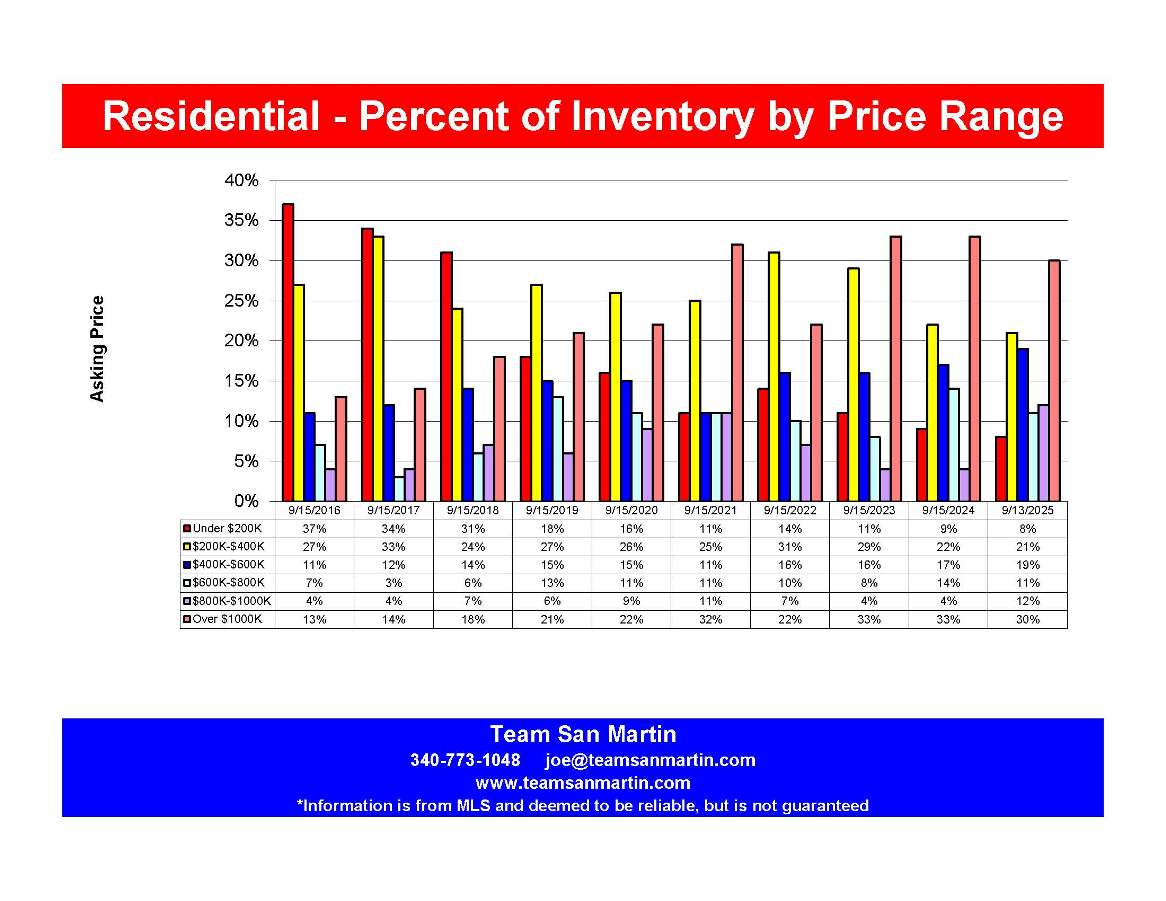

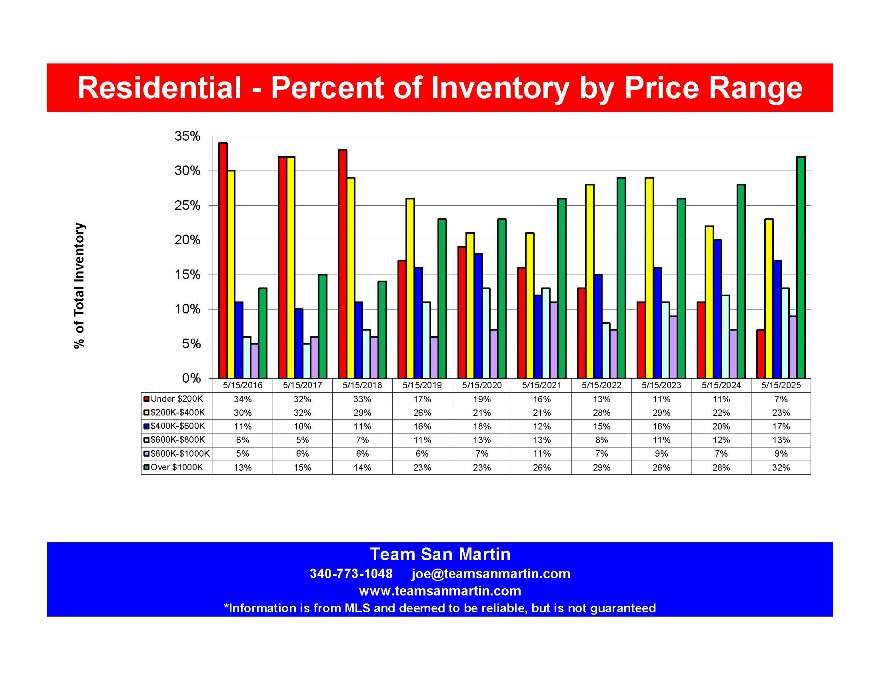

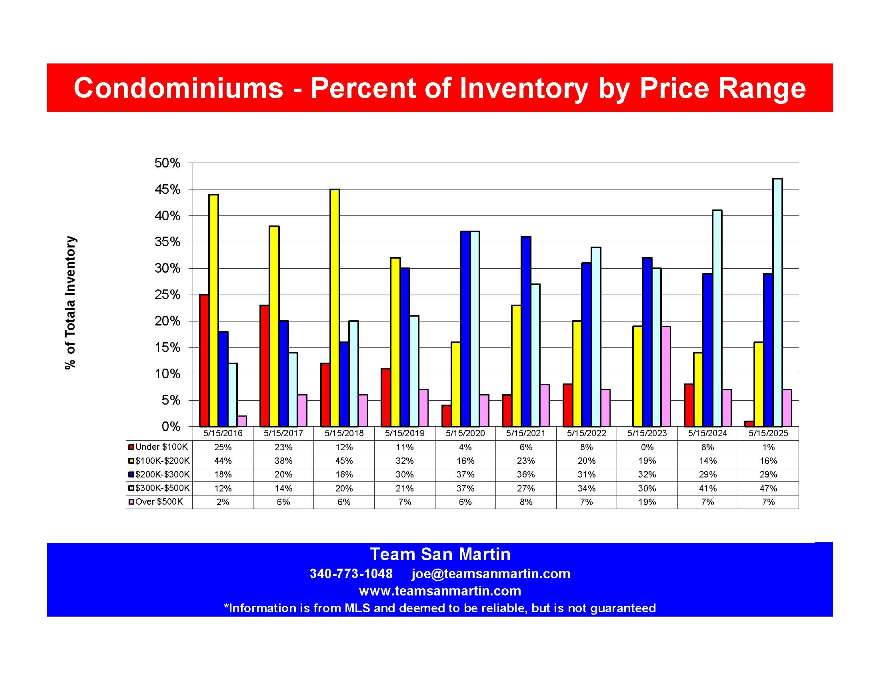

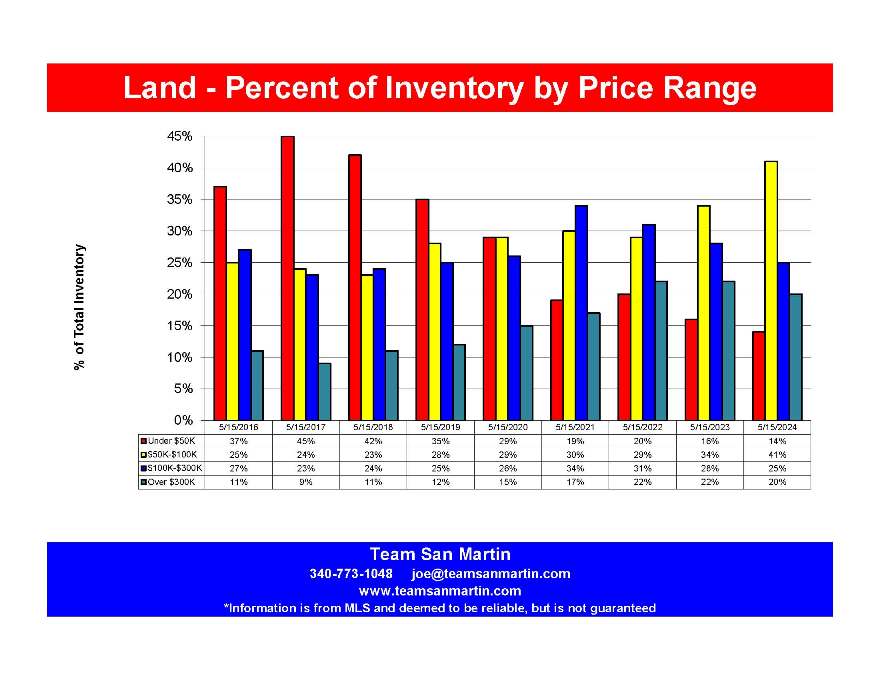

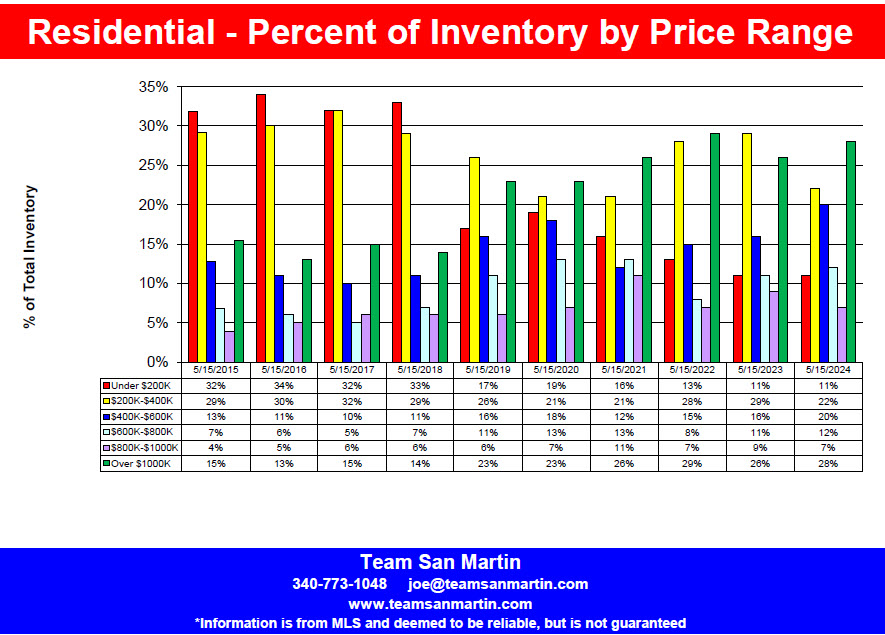

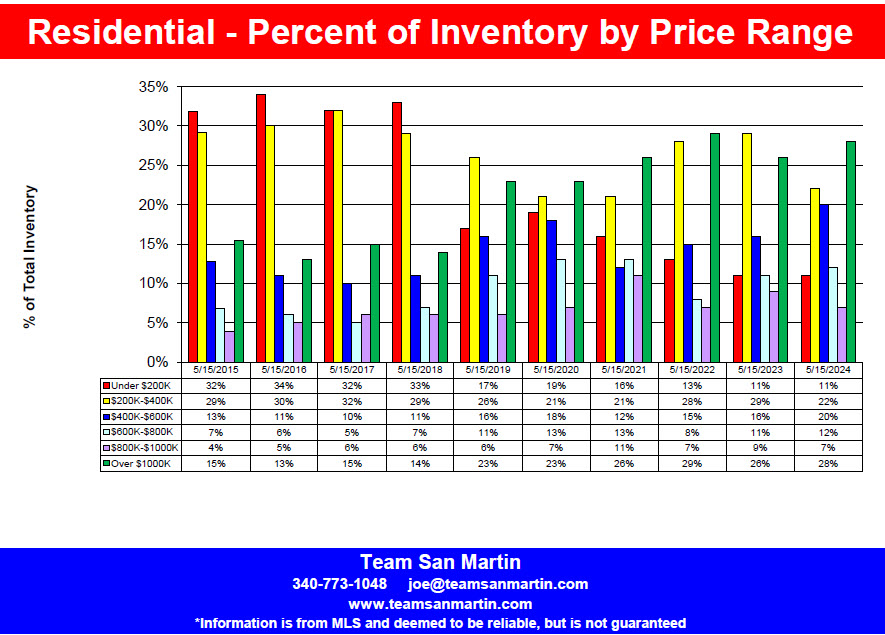

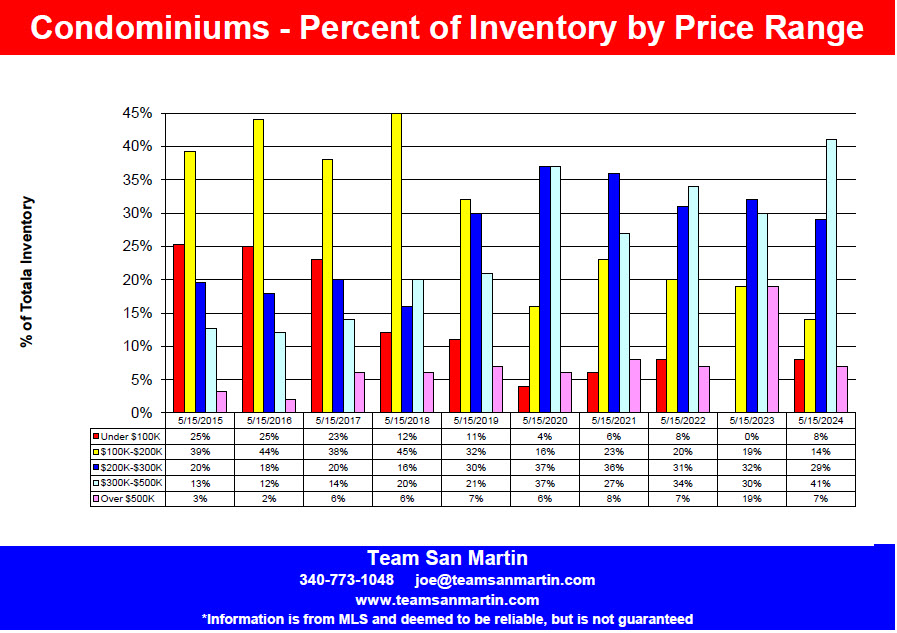

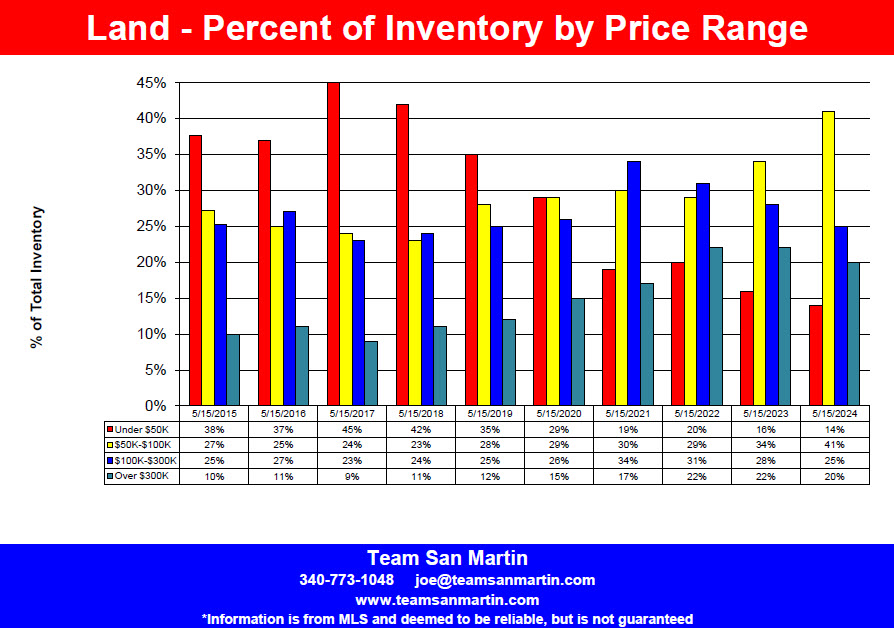

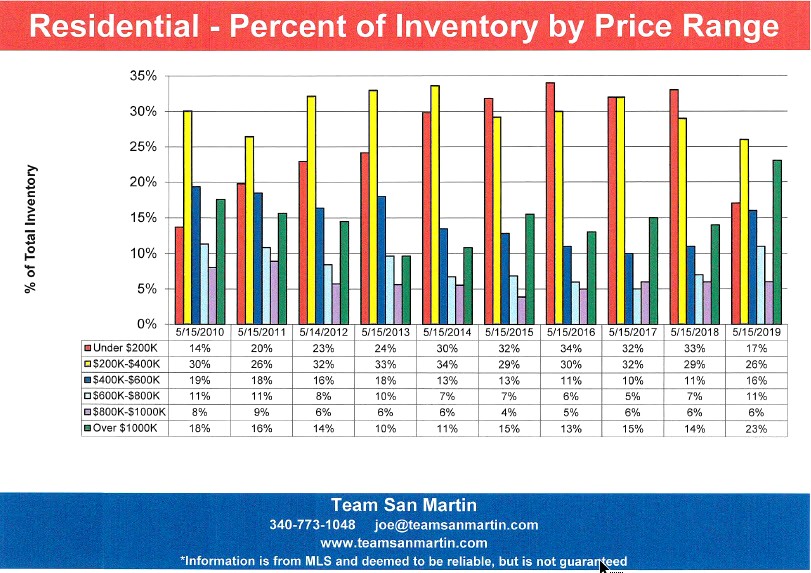

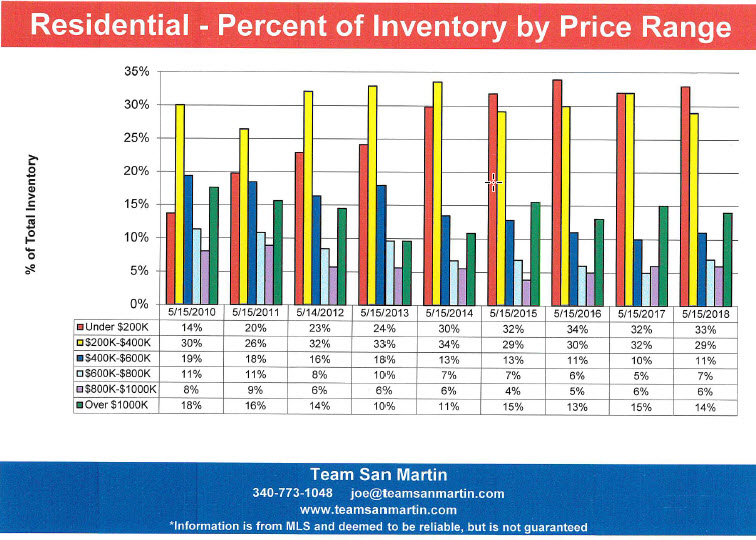

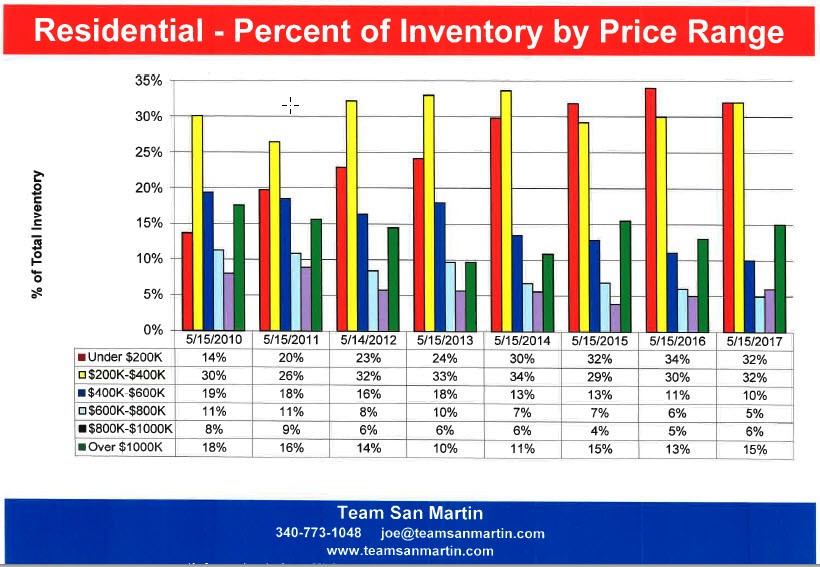

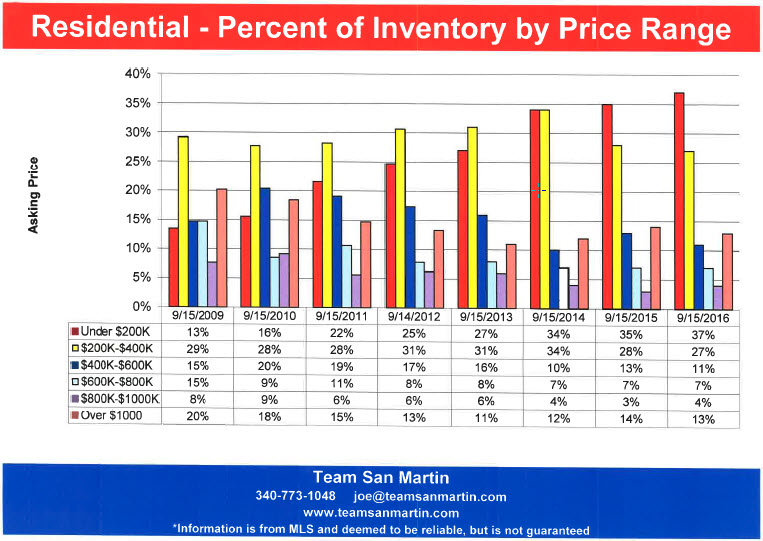

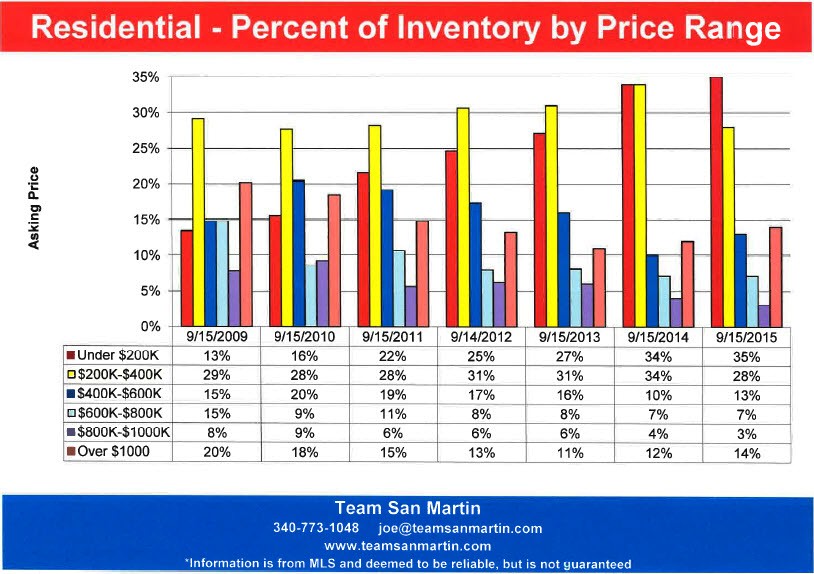

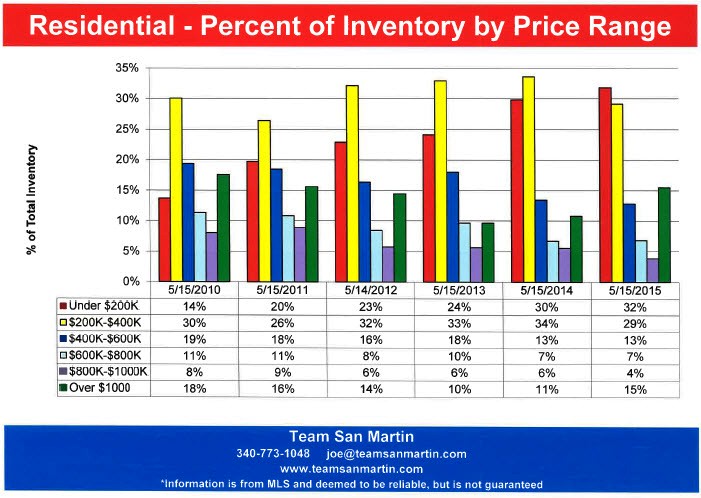

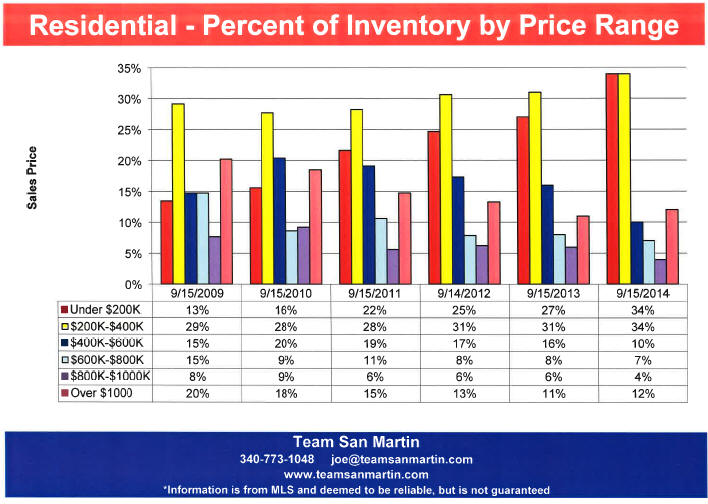

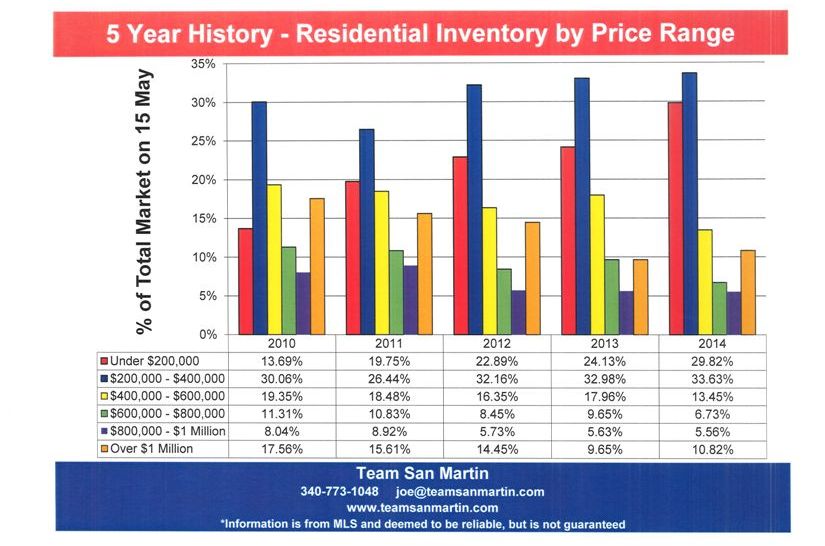

INVENTORY BY PRICE RANGE

Residential

Under $200,000 listings (8%) are 29% lower than ten years ago as percentage of total inventory. Compared to last year, this segment decreased by 1%.

$200,000 to $400,000 listings (21%) have remained relatively constant over the 10-year period, varying from 33% of inventory (9/15/17) to 21% of inventory (9/15/25).

$400,000 to $600 listings (19%) are 8% higher compared to 10 years ago and the highest for this price range. Lowest was 11% (9/15/16 & 9/15/21).

$600,000 to $800,000 listings (11%) are 4% higher than ten years ago (11%). The highest for this price range was 14% (9/15/24), the lowest was 3% (9/15/17).

$800,000 to $1,000,000 listings (12%) are triple the number of ten years ago (4%). The highest percentage of the 10-year period was 12% (9/15/25), the lowest 4% (4 of the 10 years).

Listings over $1,000,000 (30%) have more than doubled over the 10-year period. The lowest level was 9/15/16, at just 13% of total inventory, highest was 33% (9/15/23 & 9/15/24).

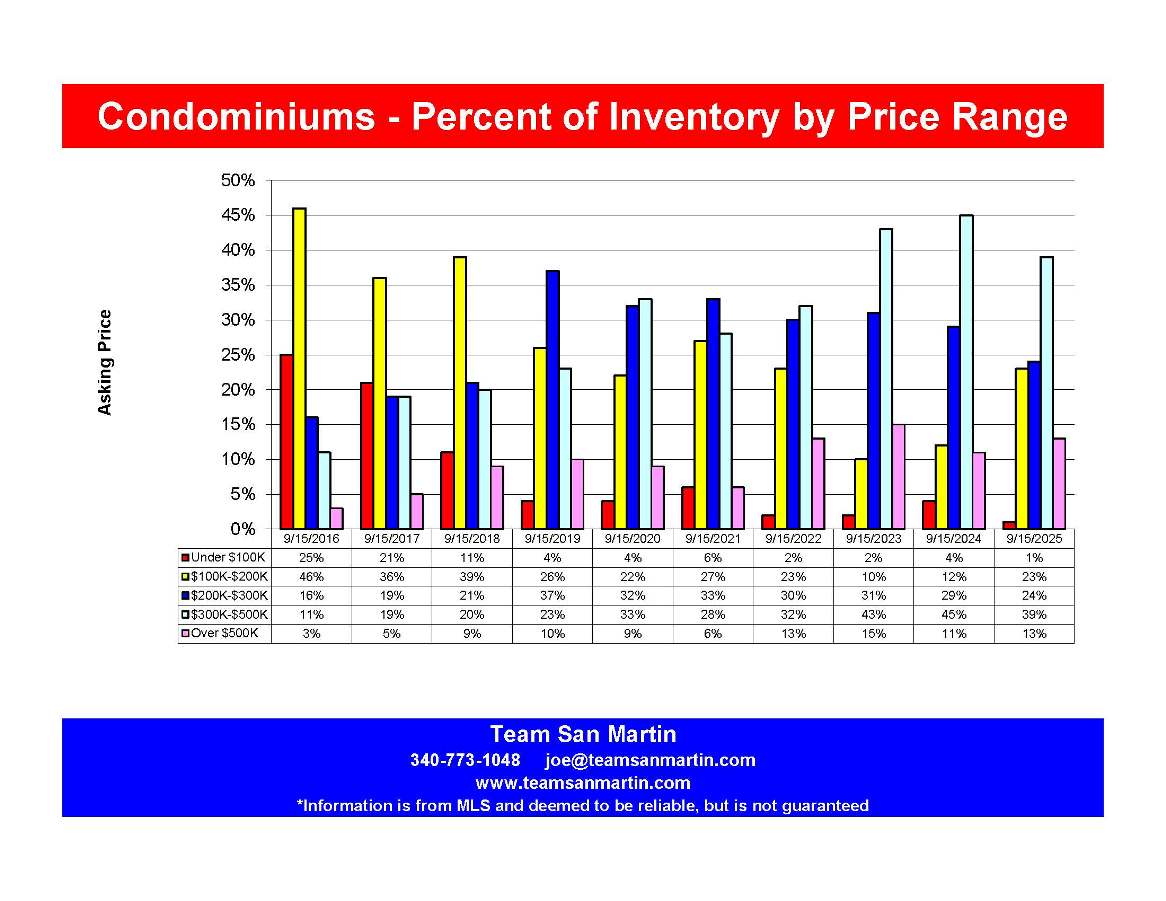

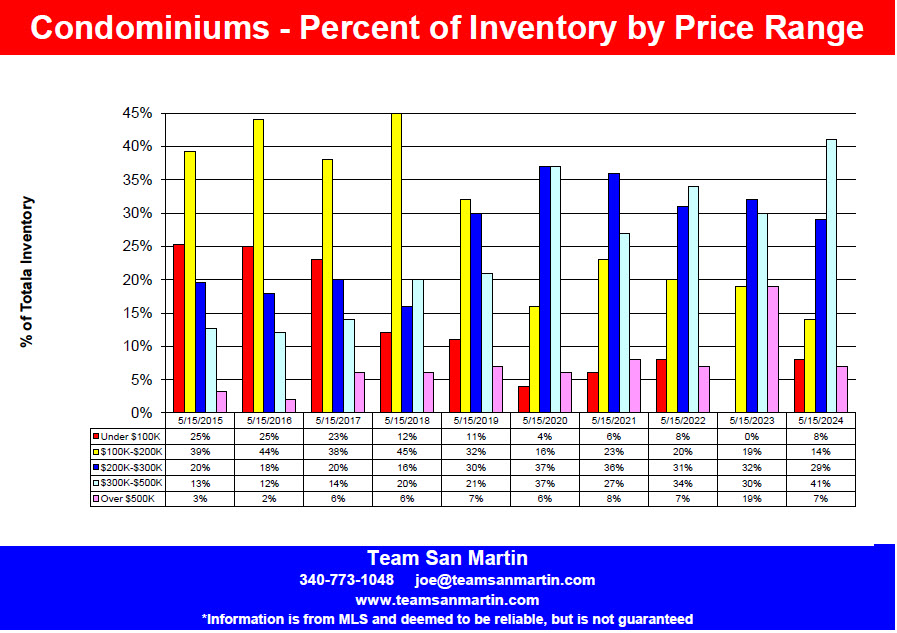

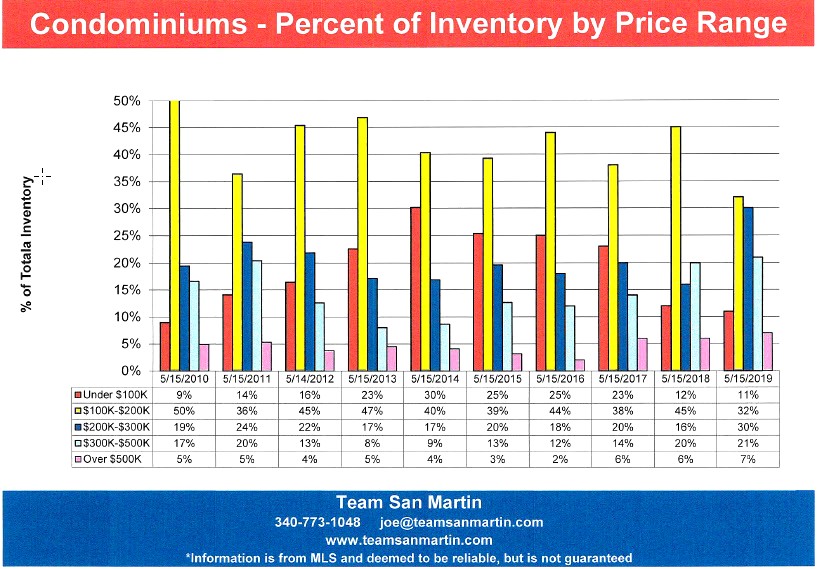

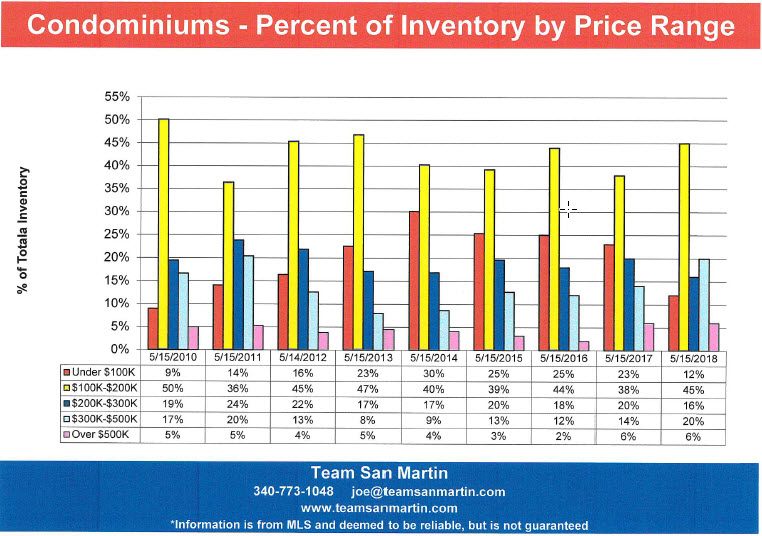

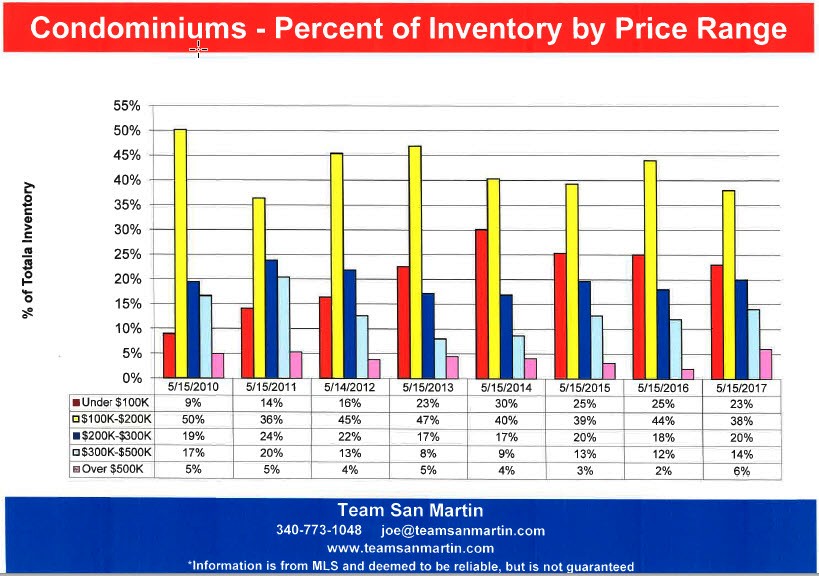

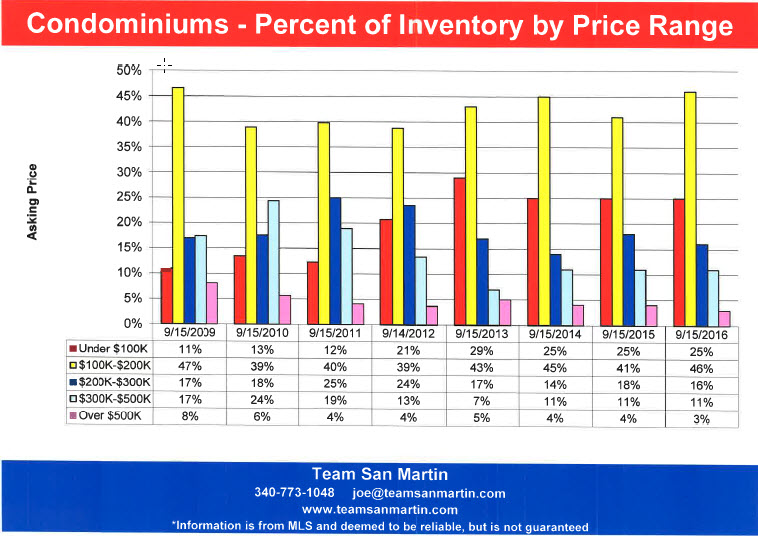

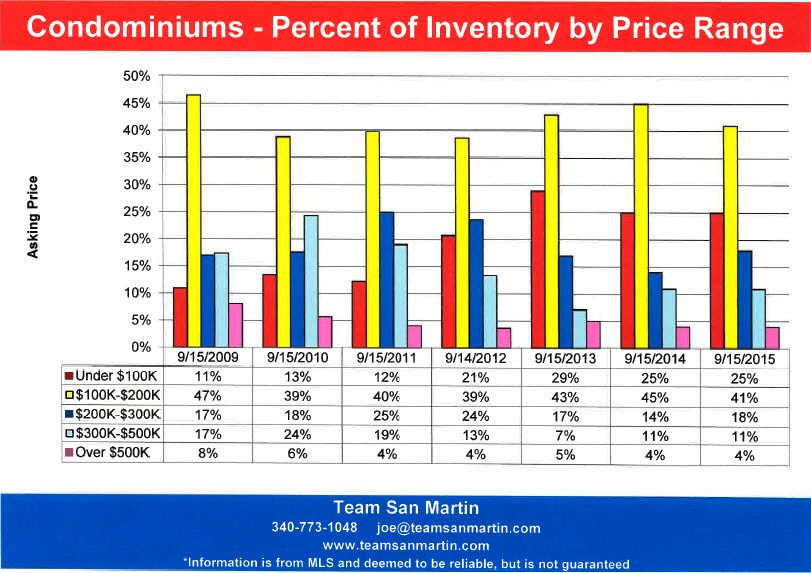

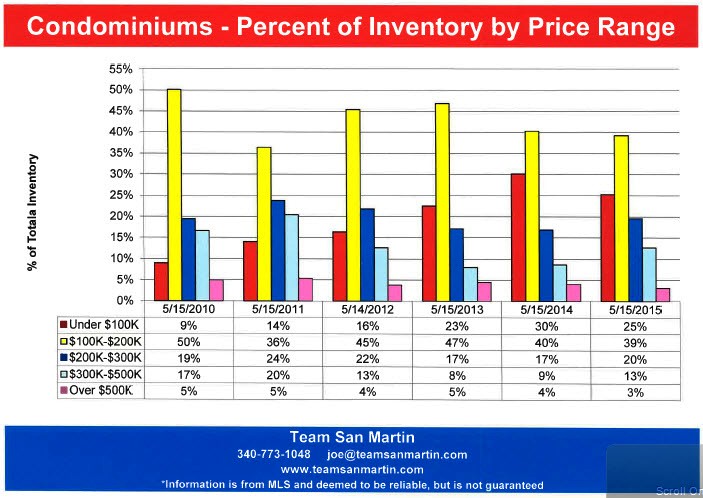

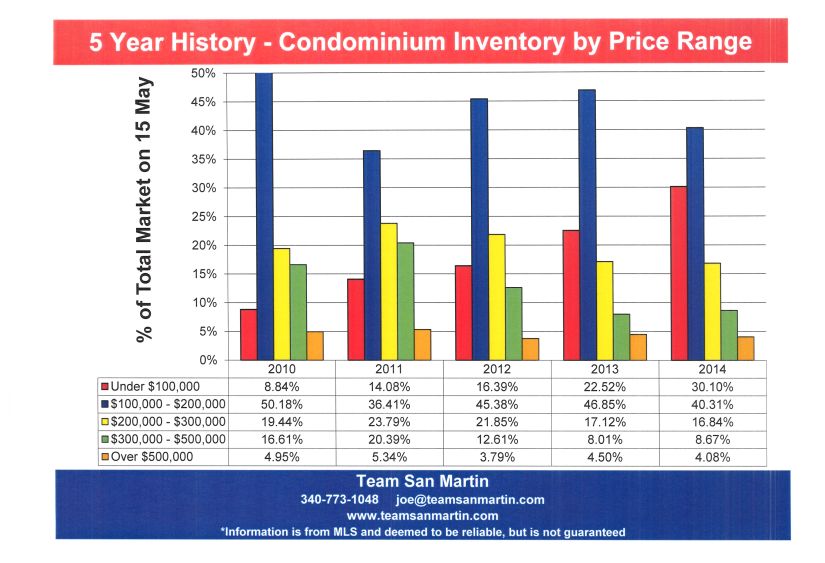

Condominium

Under $100,000 listings are currently only 1% of total condo listings, down from a high of 25% (9/15/16).

$100,000 to $200,000 listings (23%) are half of total inventory when compared to 10 years ago (46%). The lowest was 10% (9/15/23).

$200,000 to $300,000 listings are at 24% of total inventory, 8% higher than 10 years ago (16%).

$300,000 to $500,000 listings, at 39% of total inventory, have increased 29% compared to ten years ago. The lowest level was 11% (9/13/16). The highest 45% (9/15/24).

Listings over $500,000 represent 13% of the total condominium market, an increase of 10% compared to ten years ago.

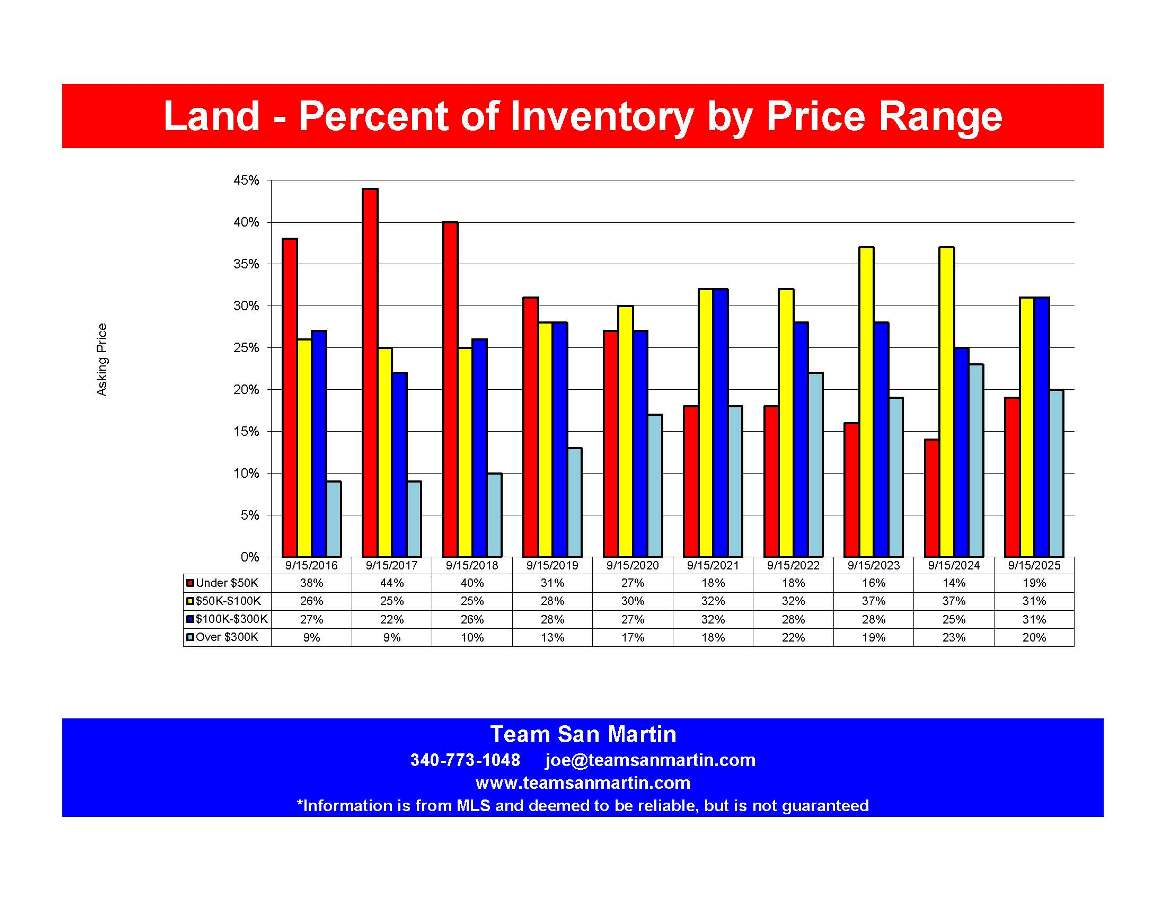

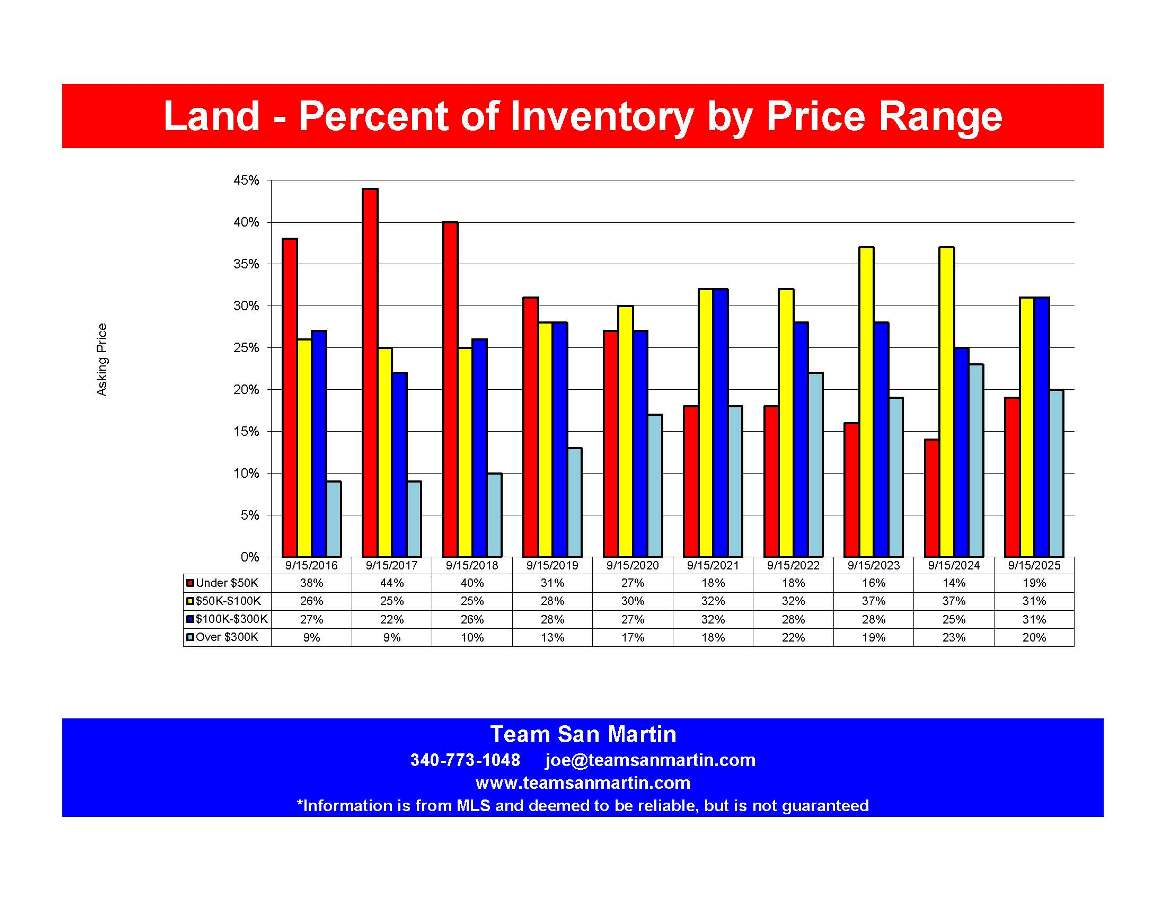

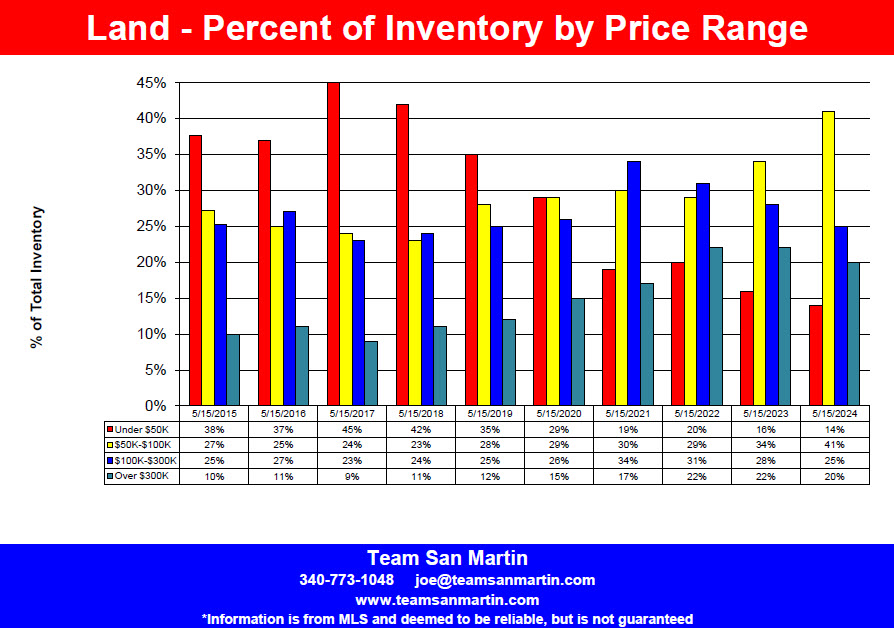

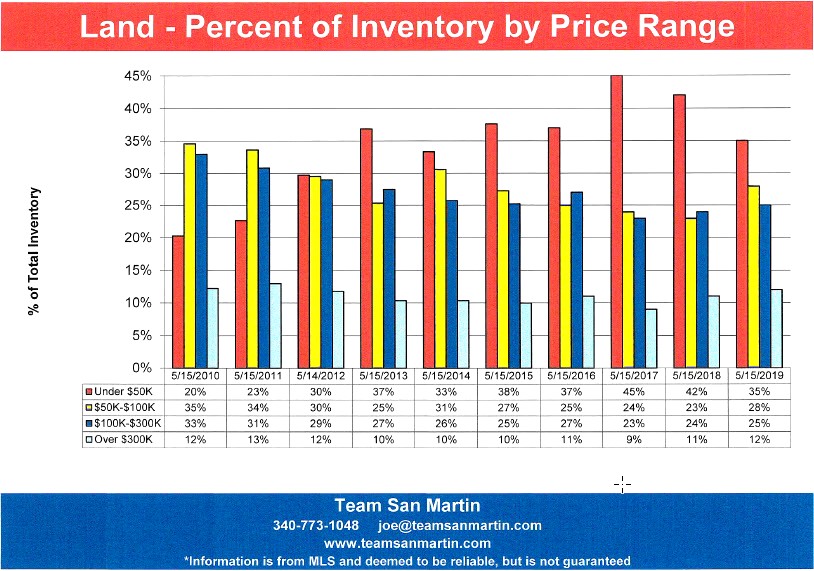

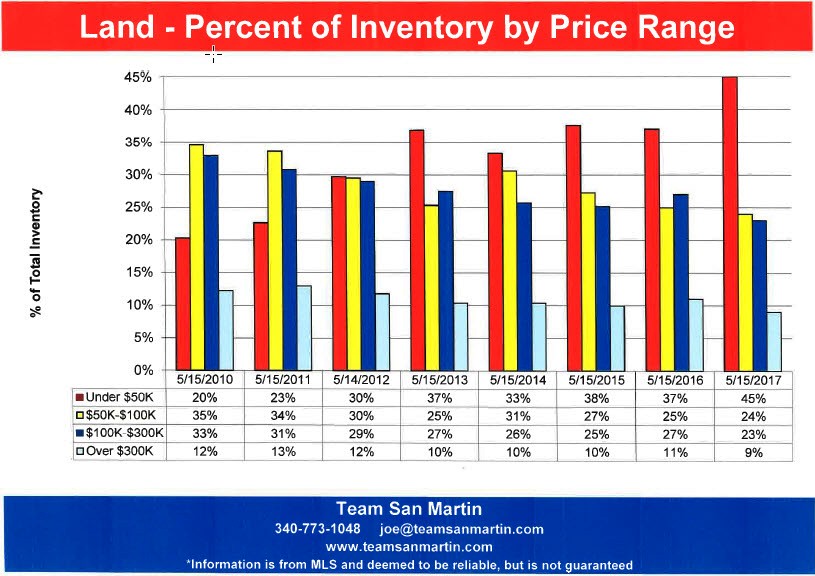

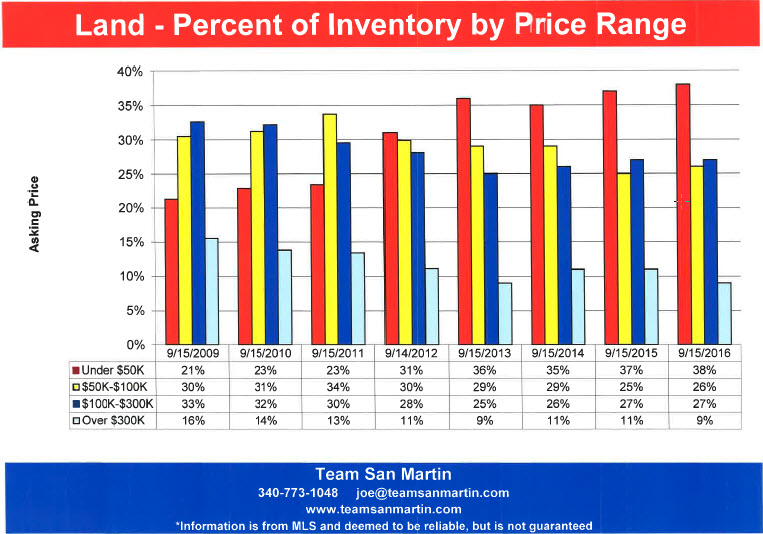

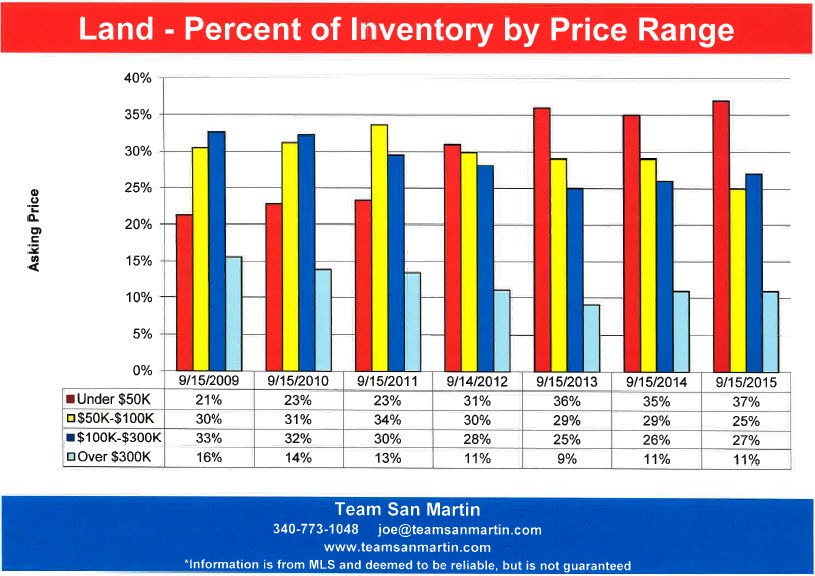

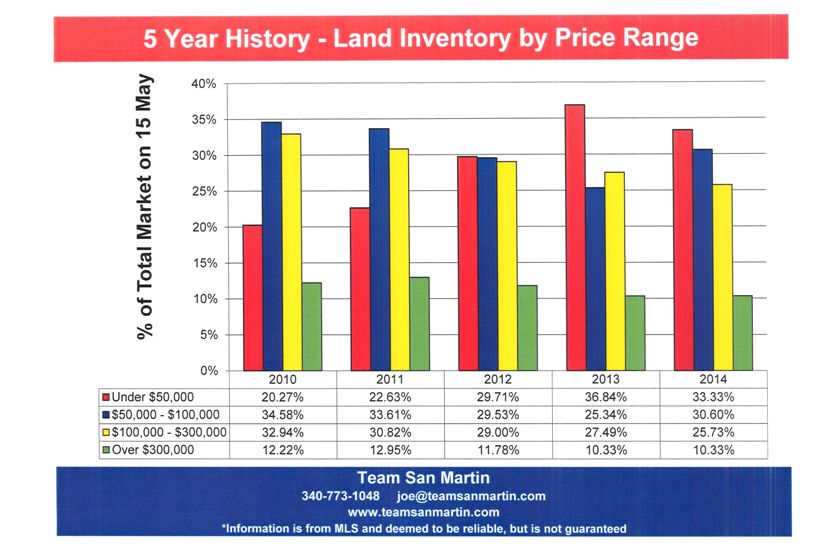

Vacant Land

Under $50,000 listings (19%) are half of 10 years ago (38%). The highest percentage of total inventory (44%) was 9/15/17, the lowest (14%) was 9/15/24.

$50,000 to $100,000 listings (31%) have remained relatively constant over the 10-year period.

$100,000 to $300,000 listings (31%) have also remained constant over the ten years, lowest percentage was 9/15/17, at 22% of total land inventory.

Listings over $300,000 (20%) increased 11% when compared to ten years ago. The lowest levels were 2016 and 2017 when this segment of the market decreased to 9% of total land listings.

Information is from MLS and deemed to be reliable, but is not guaranteed.

Prepared by:

Julie San Martin

Team Manager

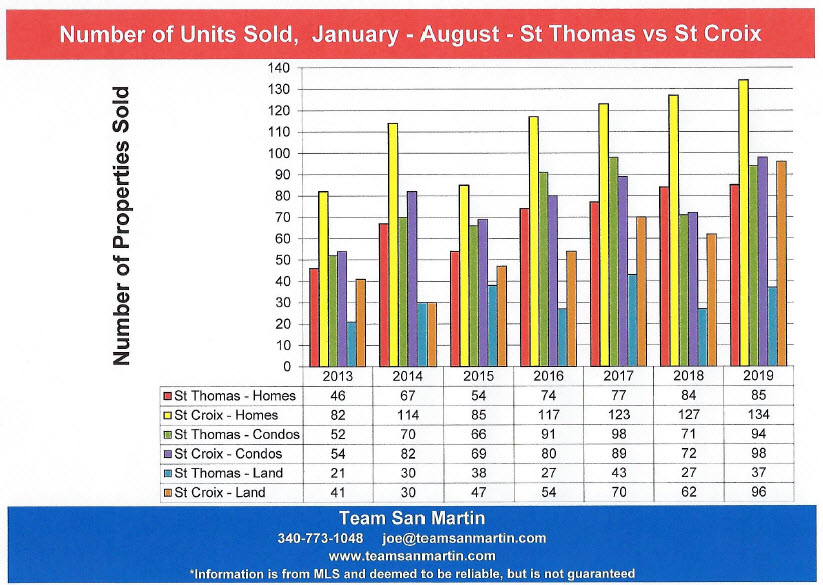

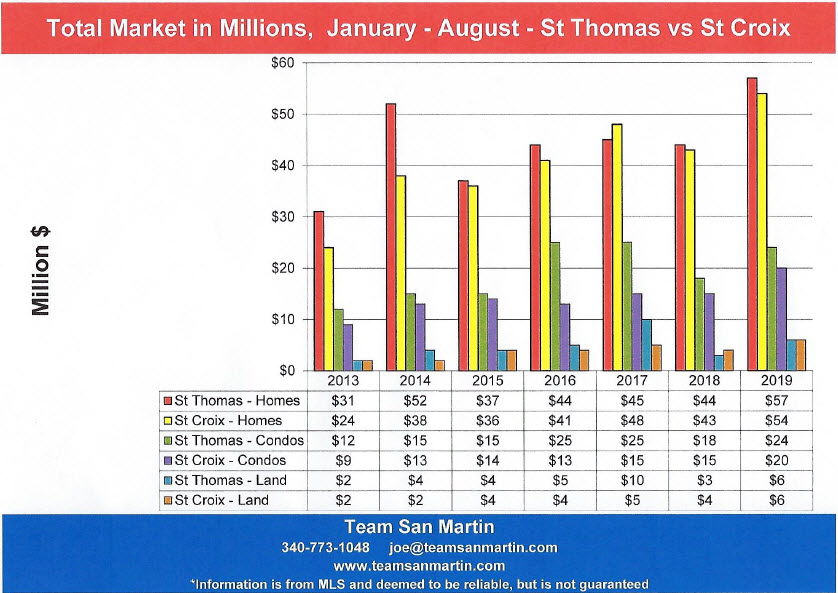

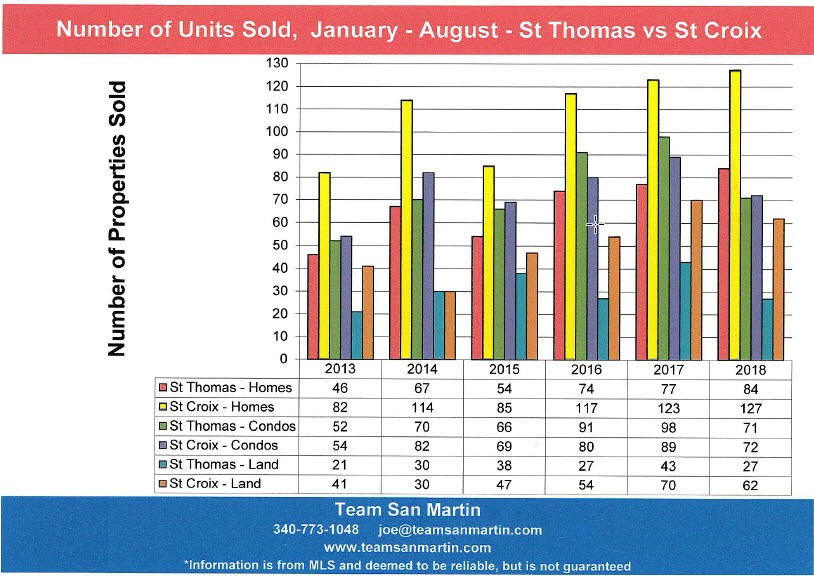

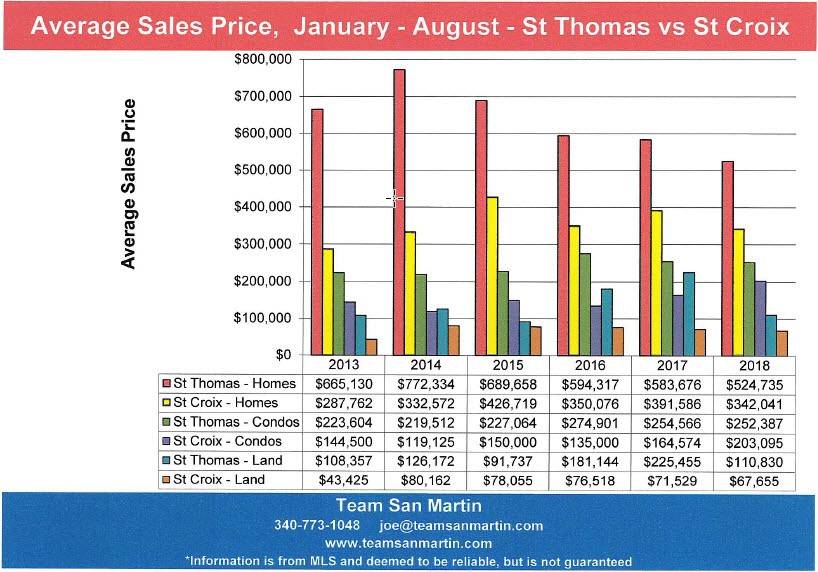

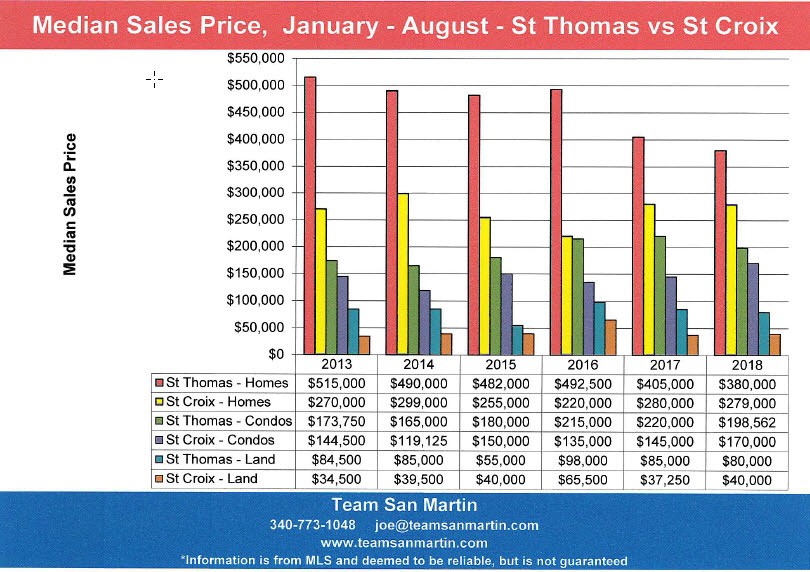

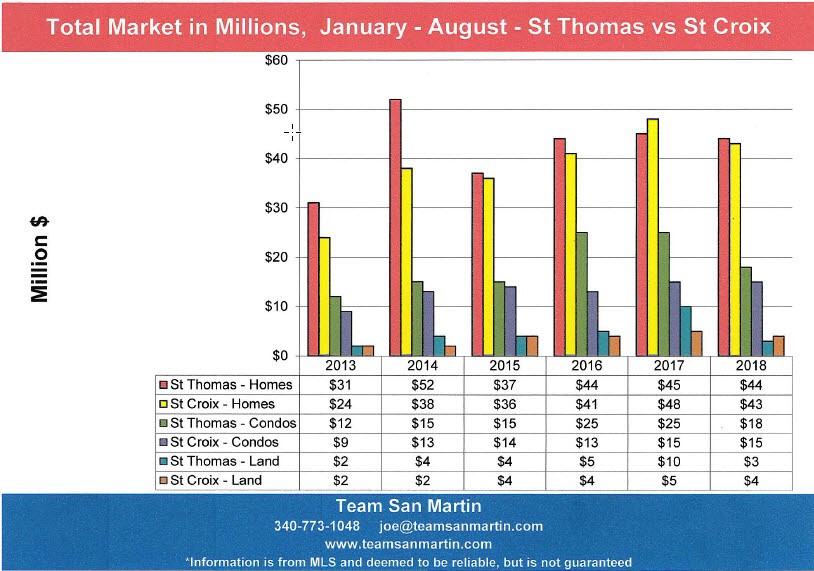

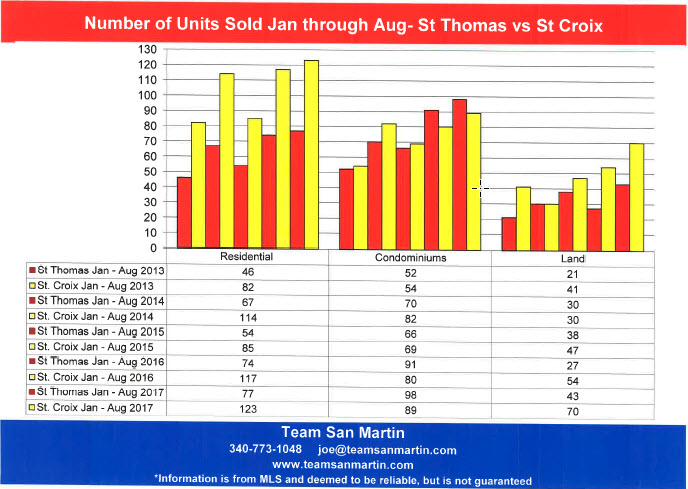

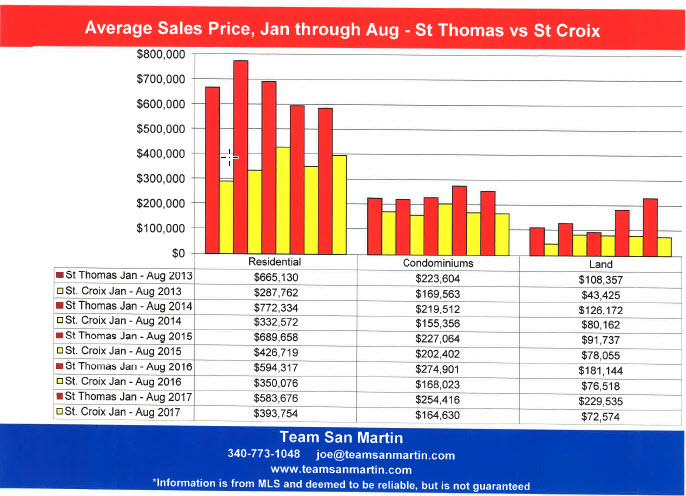

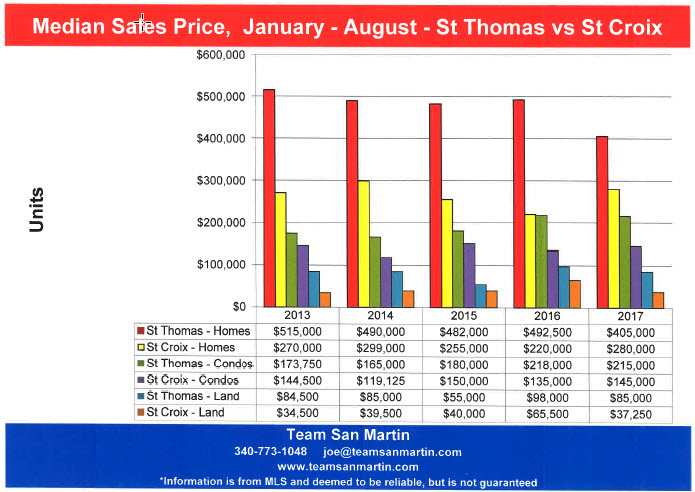

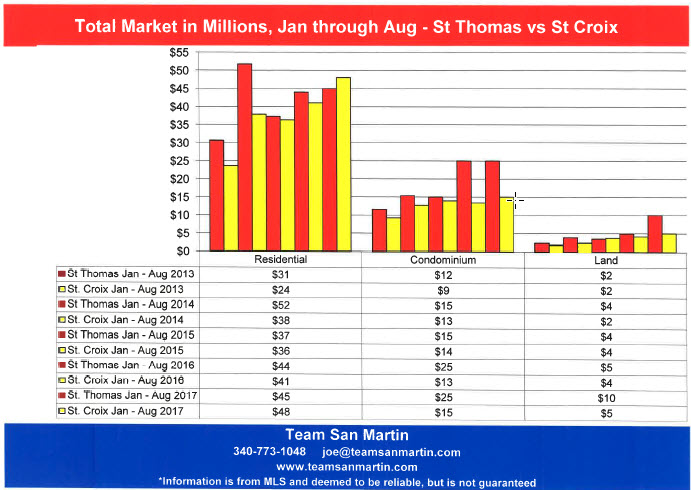

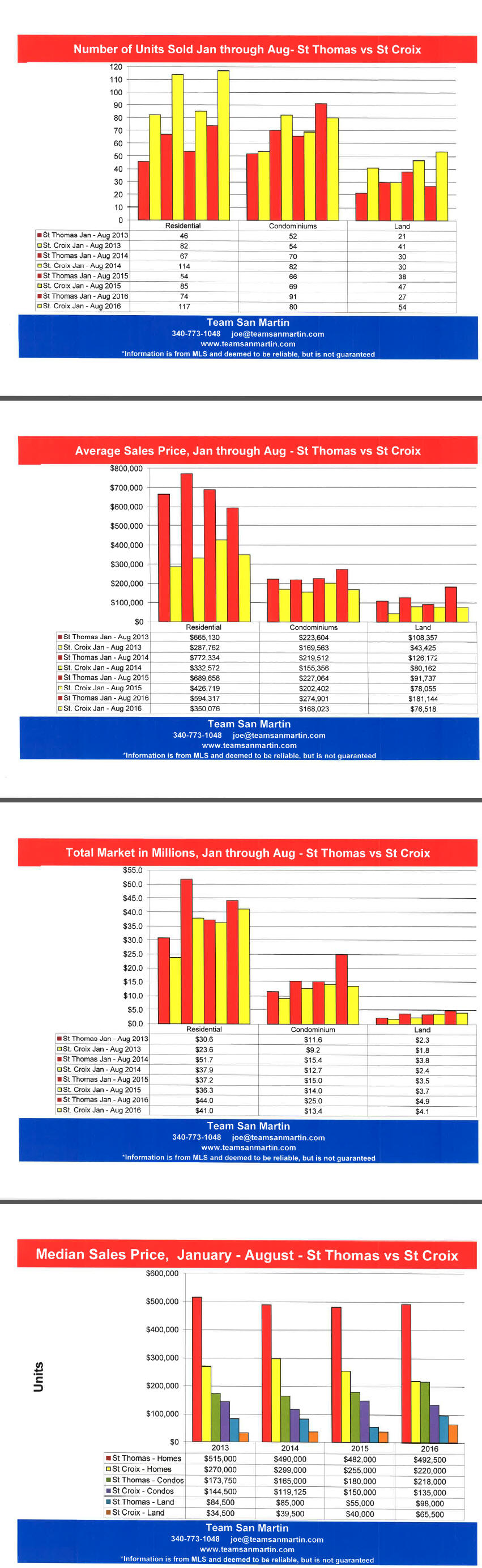

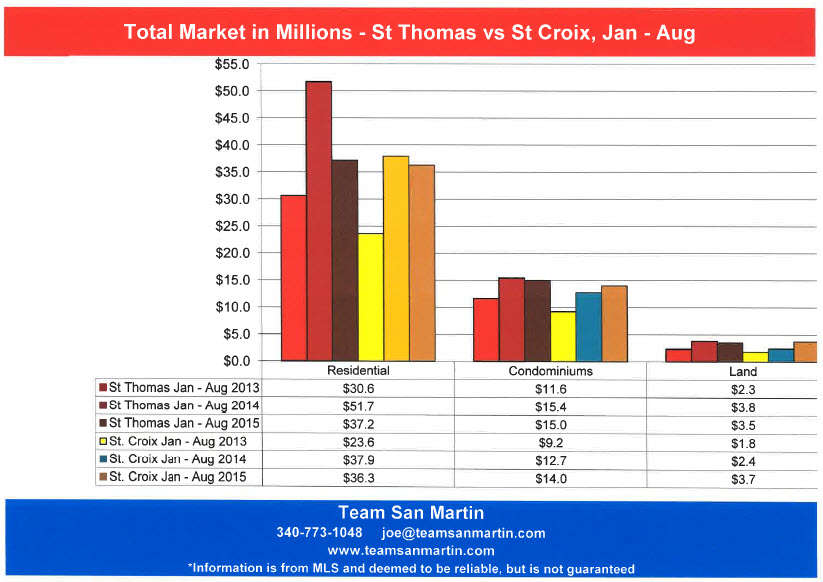

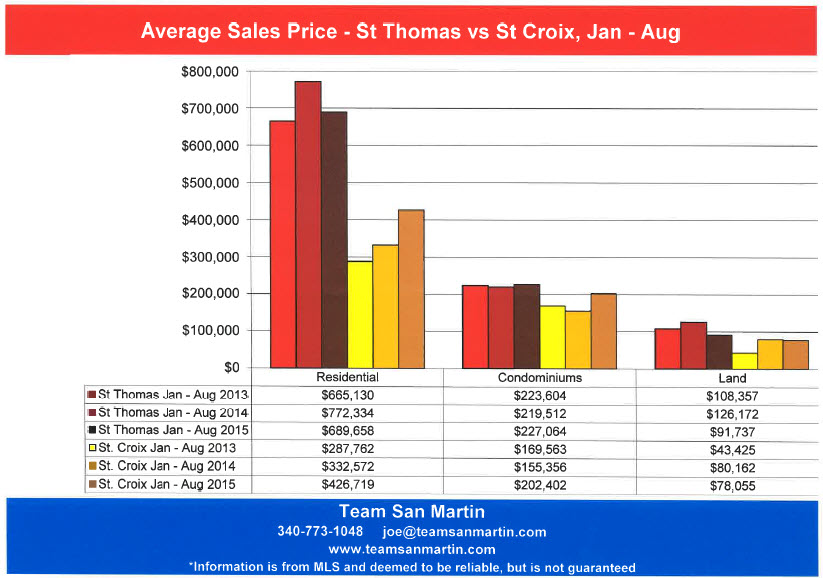

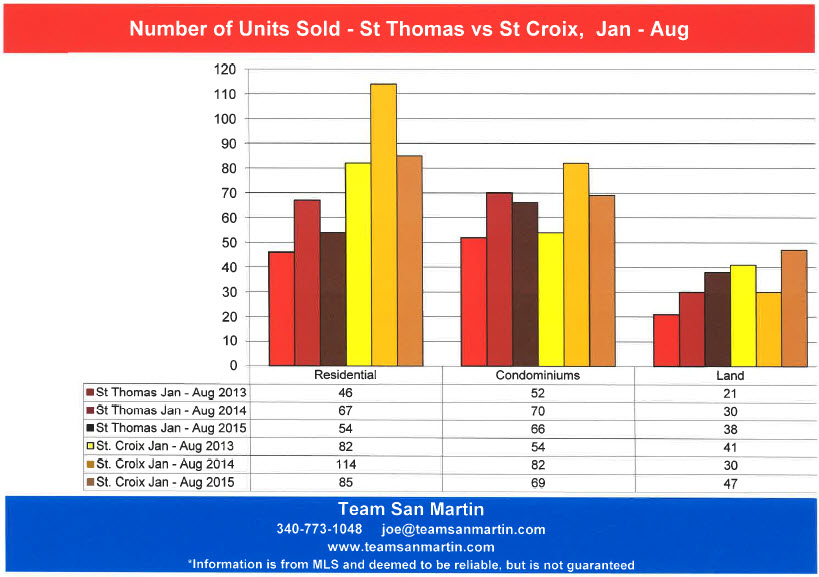

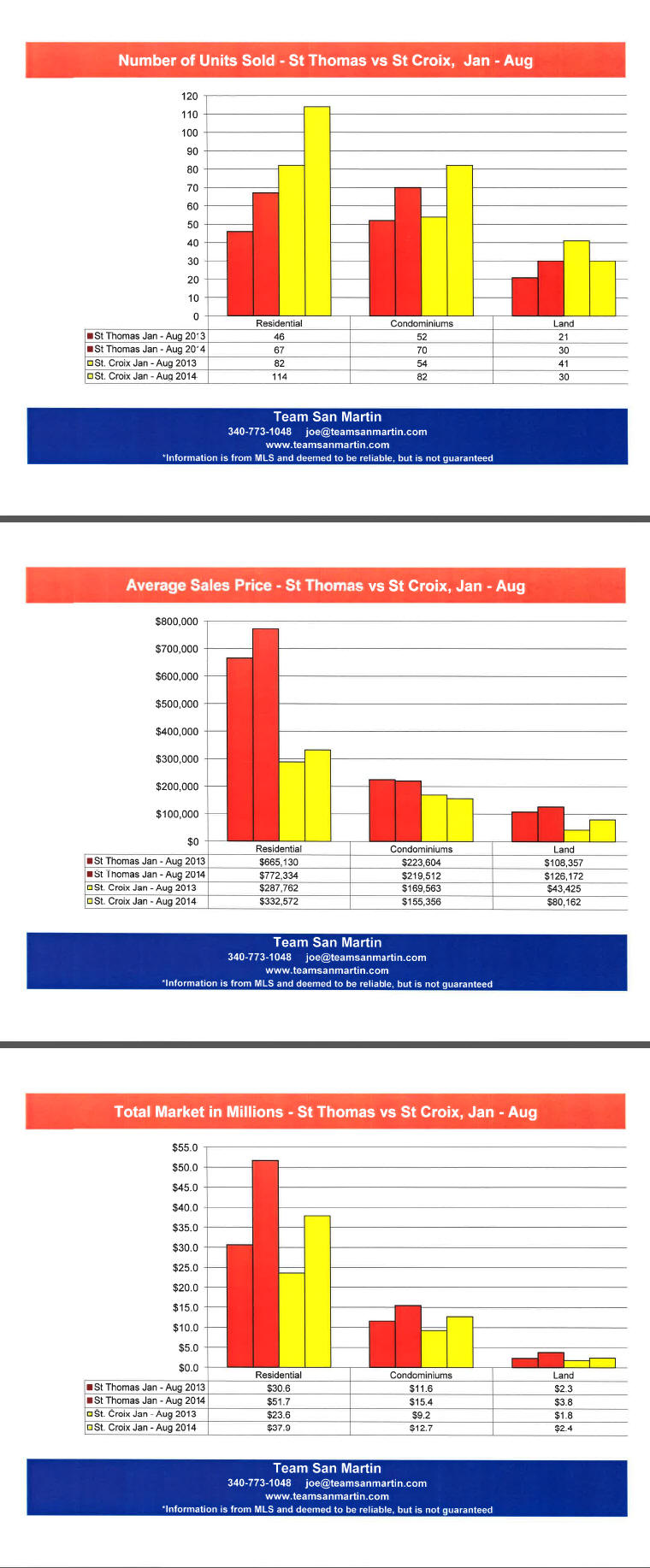

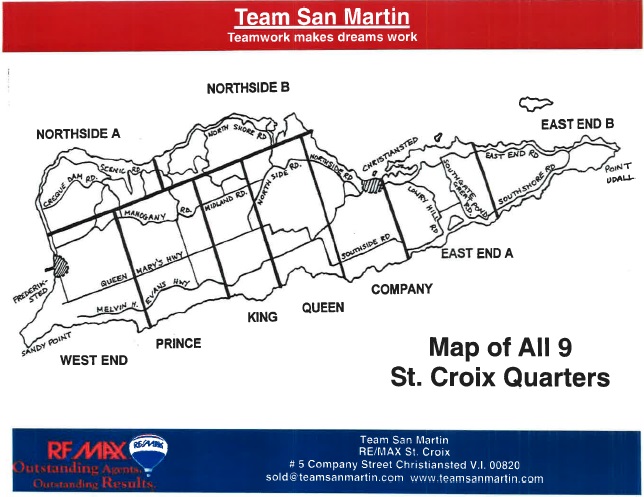

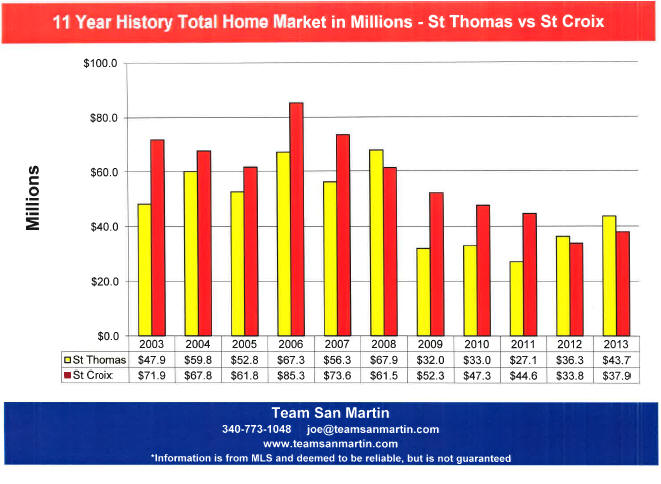

A Tale of Two Islands

St Croix and St Thomas Real Estate Sales

Ten Year Comparison Year to Date

Condominium

Number of condominium sales increased 11% (8 condos) on St Thomas, compared to last year but is 14% lower (13 condos) than this period ten years ago. On St Croix, the number of condos sold increased 20% (14

condos), compared to last year and is 5% higher (4 condos) than this period ten years ago.

Vacant Land

Number of vacant land sales on St Thomas increased 24% (7 lots) compared to last year and increased 33% (9 lots) compared to ten years ago. On St Croix, land sales decreased 18% (18 lots) compared to last year and increased 48% (26 lots) compared to ten years ago.

Sales Price and Marketing Time on St Croix

Annual Supply represents the number of years it will take at the current annual rate of sales to sell all the properties for sale

in a specific area.

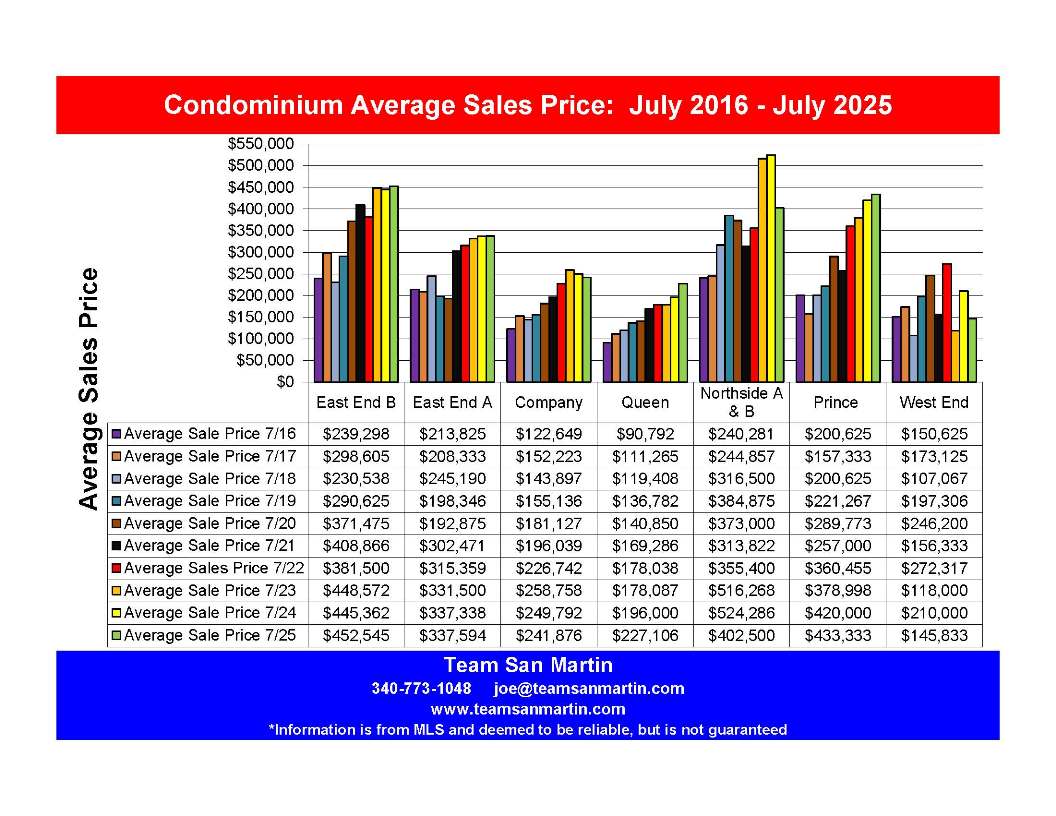

East End B

Far East End

Inventory

Ten years ago (July 2016), there was a 1.2-year supply of homes and a 1.4-year supply of condominiums on the market.

Residential inventory has increased by 6 months, compared to 10 years age.

Condominium inventory has decreased by about 2 months.

There is now a 20-month (1.7 years) supply of homes (an increase of 0.9 years compared to last year) and a 14-month (1.2 year) condominium supply (a 5-month increase compared to last year).

Average Sales Price

Average residential sale price ($982,132) is 16% higher than last year ($850,138) and 76% higher than 10 years ago ($558,212)

Average condominium sales price ($452,545) is 2% higher than last year ($445,362) and 89% higher than 10 years ago ($239,298).

East End A

Christiansted east to Coakley Bay

Inventory

Ten years ago (July 2016), there was a 1.4-year supply of homes and a 1.8-year supply of condominiums on the market.

Inventory decreased by 4 months for homes, to a 1.1-year supply, compared to 10 years ago and a decrease of 4 months compared to last year.

Inventory decreased by 13 months for condominiums, compared to 10 years ago, and by 5 months since last year.

Average Sales Price

Average residential sale price ($909,605) is 28% higher than last year ($709,182) and 132% higher than ten years ago ($392,706).

Condominium average sale price ($337,594) is unchanged from last year and 58% higher than ten years ago ($213,825).

Company

Christiansted west to east side of Judiths Fancy

Inventory

Ten years ago (July 2016), there was a 2.7-year supply of homes and a 1.0-year supply of condominiums on the market.

Residential inventory decreased by 17 months, to a 1.3-year supply of homes, compared to 10 years ago and a decrease of 5 months compared to last year.

Condominium inventory increased by 2 months, to a 1.2-year supply of condominiums for sale, compared to 10 years ago, and a decrease of 5 months compared to last year.

Average Sales Price

Average home sale price increased 12% ($50,376) compared to the previous year, from $407,210 to $457,586.

Compared to 10 years ago, the average home sales price increased 108% ($238,165).

Average condominium sale price increased 97% compared to 10 years ago, from $122,649 to $241,876.

Since last year, average condominium sale price decreased 3% ($7,916).

Queen

Constitution Hill west to La Reine, includes southwest Judiths Fancy

Inventory

Ten years ago (July 2016), there was a 3.6-year supply of homes and a 1.1-year supply of condominiums on the market.

Home inventory decreased by 3 years, to a 10 month supply over the ten-year period. Since last year, home inventory increased by 1.1 years.

Condominium inventory is unchanged over the 10-year period at 1.1 years. Since last year, inventory increased by 6 months.

Average Sales Price

Average residential sale price increased 57% over the ten-year period, from $354,895 in 2016 to $556,589 for the 12 months ending July 2025. Average residential sales price increased $122,589 (28%) since last year.

Average condo sale price increased 150% ($136,314) over the ten-year period, from

$90,792 in 2016 to $227,106 for the 12 months ending July 2025.

Since last year, average condominium sales price increased 16% ($31,106).

Northside A & B

North shore from north Judiths Fancy west to Hamms Bluff

Inventory

Ten years ago (July 2016), there was a 1.8-year supply of homes and a 6 month supply of condominiums on the market.

Residential inventory decreased by 4 months, to a 1.5-year supply of homes compared to 10 years ago.

Compared to last year, residential inventory decreased by 2 months.

Condominium inventory increased by 1 year over the 10-year period.

Last year there were no condominiums on the market in these quarters, there is now a 1.5-year supply of condominiums on the market.

Average Sales Price

Average home sale price ($1,171,929) increased by $418,741 (55%), compared to ten years ago ($753,188). Average home sale price decreased $119,094 (9%) since last year ($1,291,023).

Average condominium sales price increased $162,219 (68%) over the ten-year period, from $240,281 for the 12 months ending July 2016 to $402,500 for the 12 months ending July 2025.

Compared to last year, the average condominium sale price decreased $121,786 (33%).

King

South shore from La Reine west to UVI

Inventory

Ten years ago (July 2016), there was a 2.3-year supply of homes.

There are no condominiums in King Quarter.

Residential inventory decreased 1.7 years, compared to ten years ago, to 7 months of inventory for the 12 months ending July 2025.

Residential inventory is unchanged from last year.

Average Sales Price

Average home sale price increased $128,5009 (66%) over the ten-year period, from $194,875 for the 12 months ending July 2016 to $323,375 for the 12-months

ending July 2025.

Average home sale price increased $43,298 (15%) compared to last year ($280,077).

Prince

South shore from UVI west to Williams Delight

Inventory

Ten years ago (July 2016), there was a 2.3-year supply of homes and a 1-year supply of condominiums on the market.

Residential inventory decreased by 1.1 years, to a 1.2-year supply of homes over the 10 year period and increased by 8-months compared to the previous year.

Condominium inventory is unchanged compared to 10 years ago and is 4 months higher compared to the previous year.

Average Sales Price

Home sale average price increased $170,282 (105%) when compared to ten years ago, from $161,958 for the 12 months ending July 2016 to $332,240

for the 12 months ending July 2025.

Average home sale price increased $29,746 (10%) compared to last year ($302,484).

Condominiums experienced a $232,708 (116%) increase in average sale price over the ten-year period, from $200,625 for the 12 months ending July 2016 to

$433,333 for the 12 months ending July 2025.

Average condo sales price increased $13,333 (3%) since last year

West End

South from Mahogany Road, East to Williams Delight

Inventory

Ten years ago (July 2016), there was a 1.5-year supply of homes and a 1.3-year supply of condominiums on the market.

Over the ten-year period, residential inventory decreased 4 months, to a 1.2-year supply of homes for the 12 months ending July 2025, a decrease of 1 month compared to the previous year.

Condominium inventory decreased by 7 months, compared to 10 years ago. Compared to last year, condominium inventory is unchanged at 8 months.

Average Sales Price

Average home sale price increased $237,075 (114%) over the ten-year period, from $206,925 for the 12 months ending July 2016 to $444,000 for the

12 months ending July 2025 and a $42,368 (10%) increase over last year ($401,632).

Average condominium sale price decreased $4,792 (3%) over the ten-year period, from $150,625 for the 12 months ending July 2016 to $145,833

for the 12 months ending July 2025.

Compared to last year, the average condominium average sale price decreased $64,167 (31%) over the previous year ($210.000).

Conclusion

The average home sale price is more than $1 Million in one quarter:

· Northside A & B

These two quarters have average sale prices in the $900,000 range:

· East End B

· East End A

This quarter has average home sale price in the $500,000 range:

· Quen

These two quarters have average home sale prices in the $400,000 range:

· Company

· West End

These two quarters have average sales prices in the $300,000 range:

· Prince

· King

Condominium sales prices were more consistent, with a $306,712 difference between the highest average price (East End B at $452,545) and the lowest.

(West End at $145,833)

Condominium inventory increased in all quarters except East End A.

Residential inventory increased in these quarters:

· East End B

· Prince

Residential inventory decreased in these quarters:

· East End A

· Company

· Queen

· Northside A & B

· West End

Average home sale price increased in all quarters except:

· Northside A & B

Information is from MLS and deemed to be reliable but is not guaranteed.

Prepared by:

Julie San Martin

Team Manager

July 2025

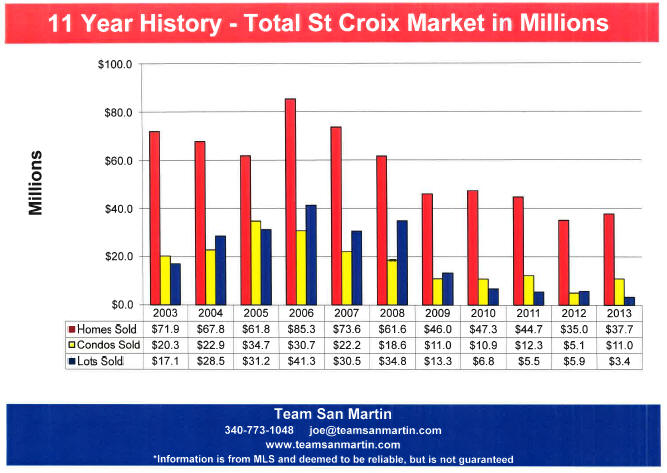

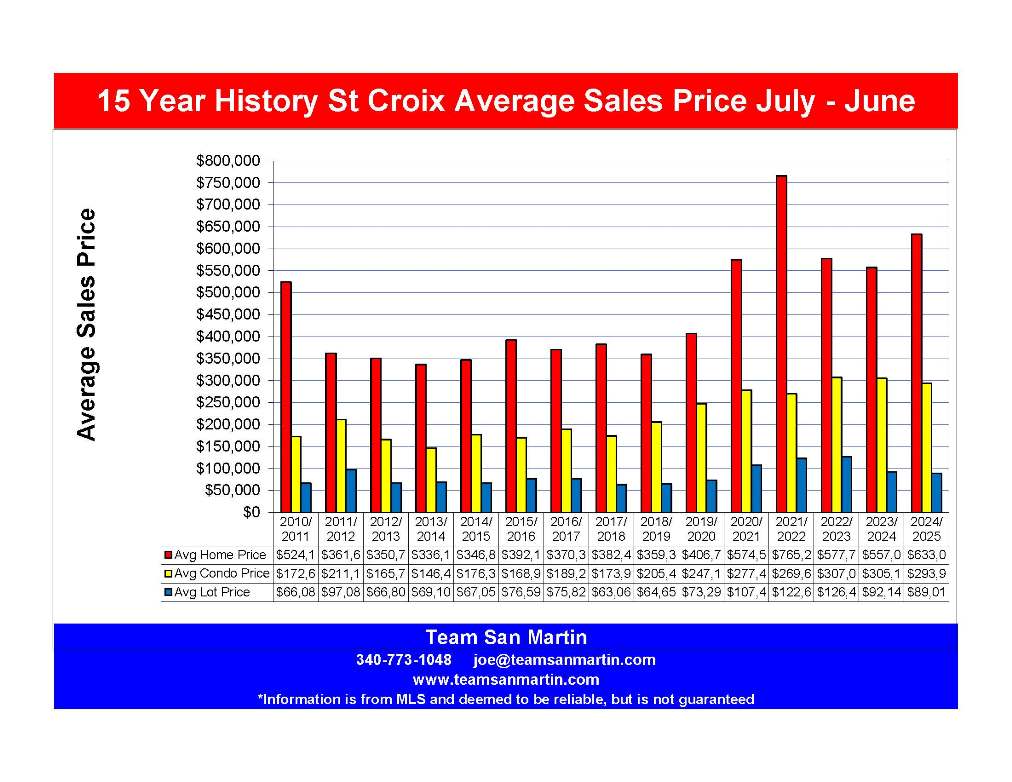

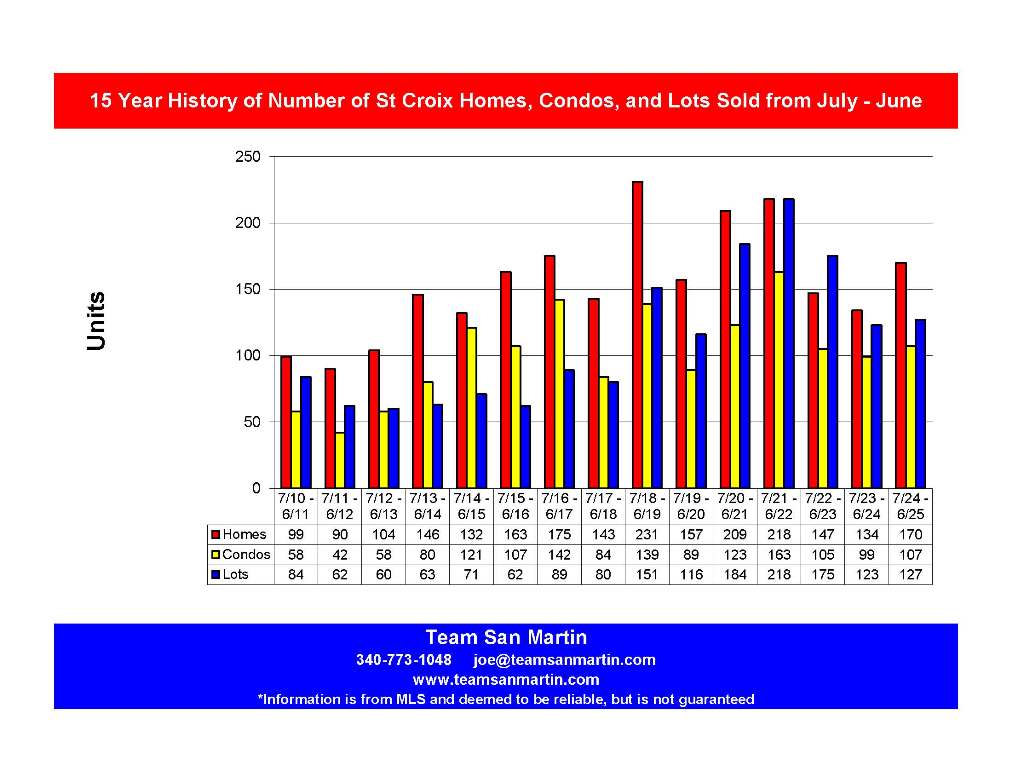

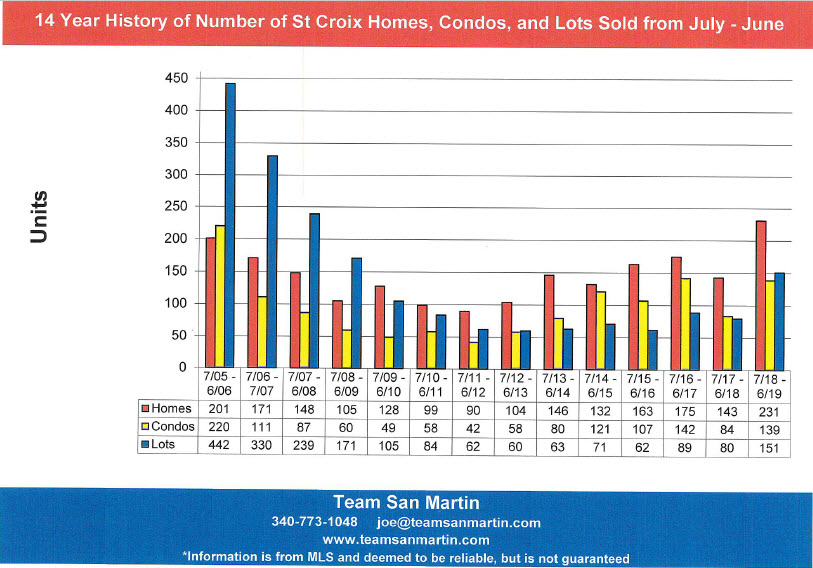

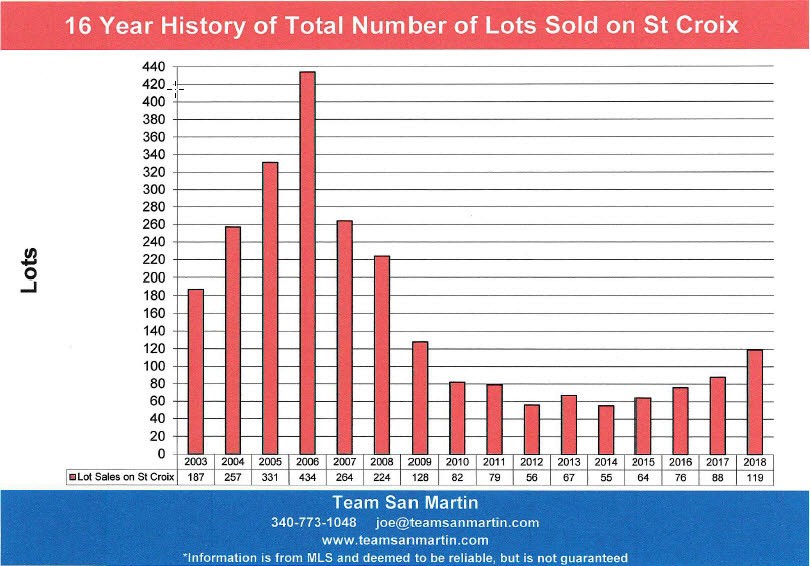

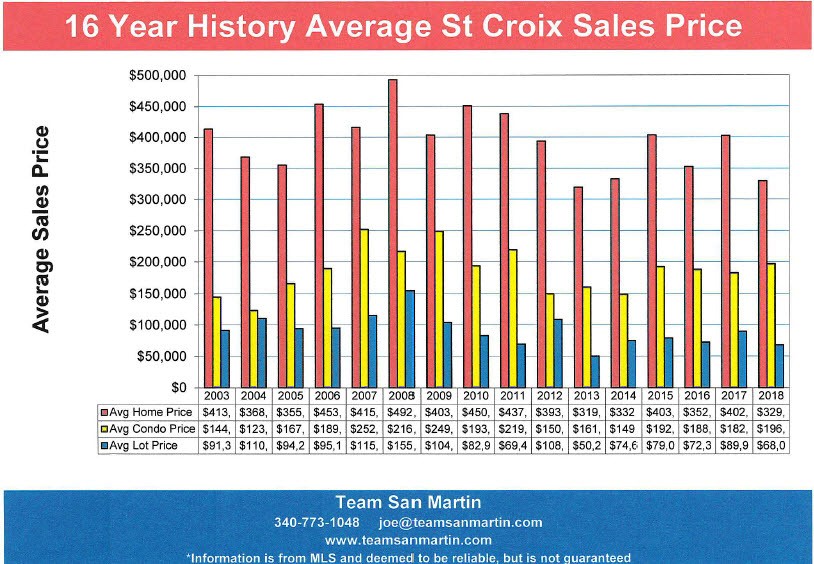

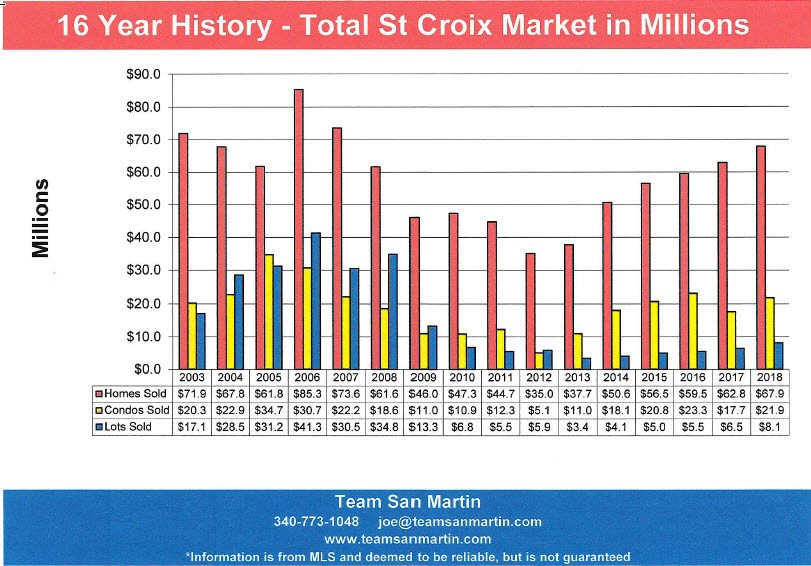

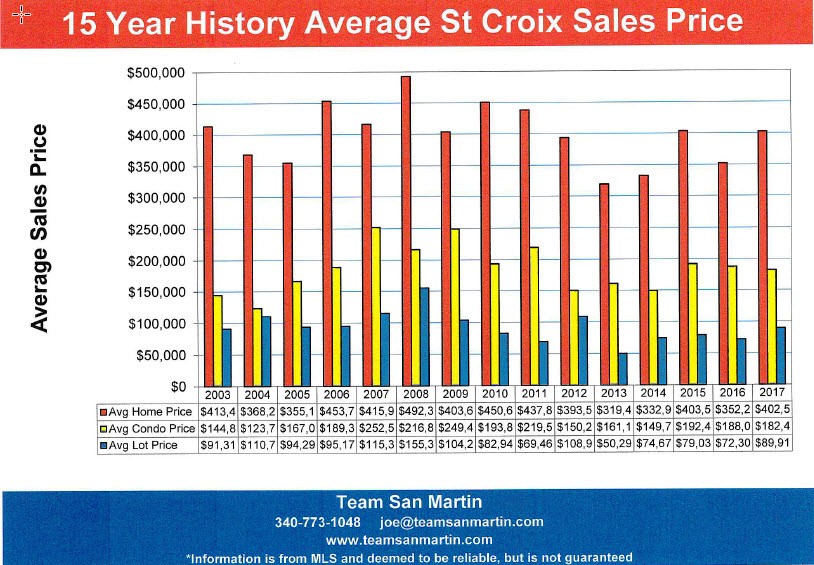

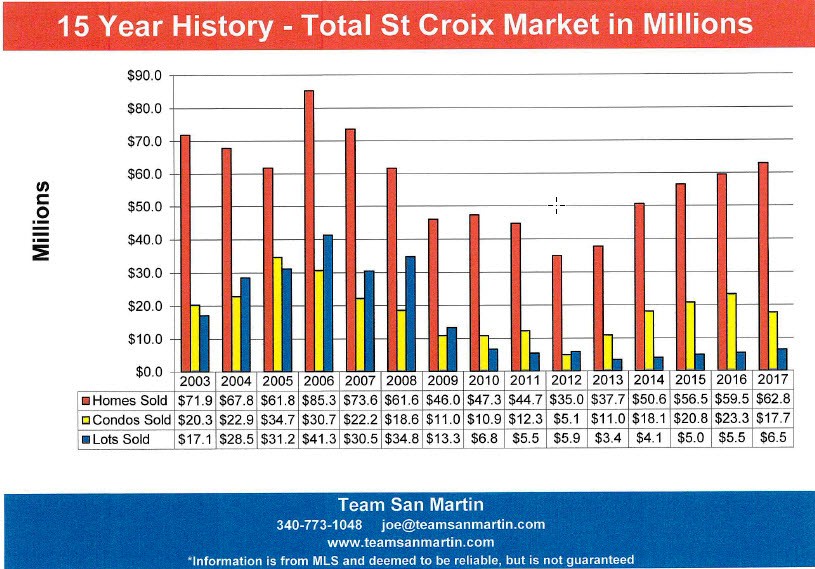

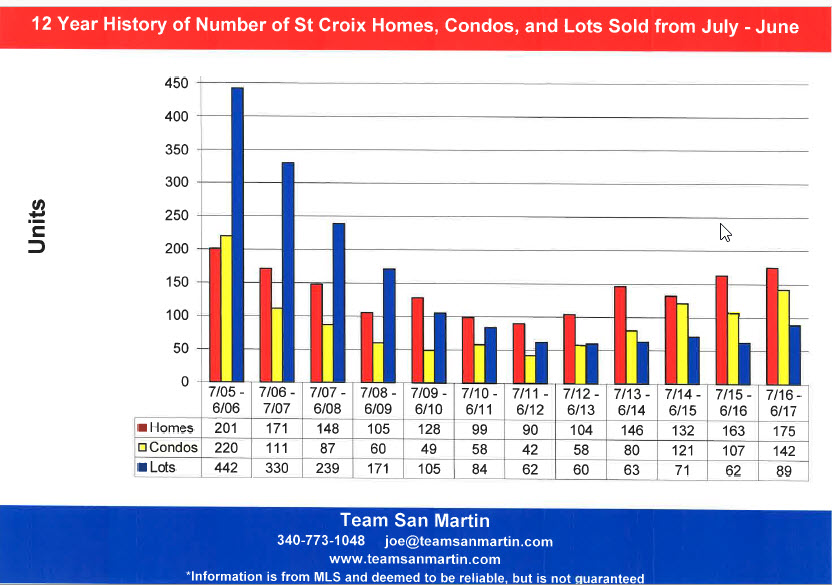

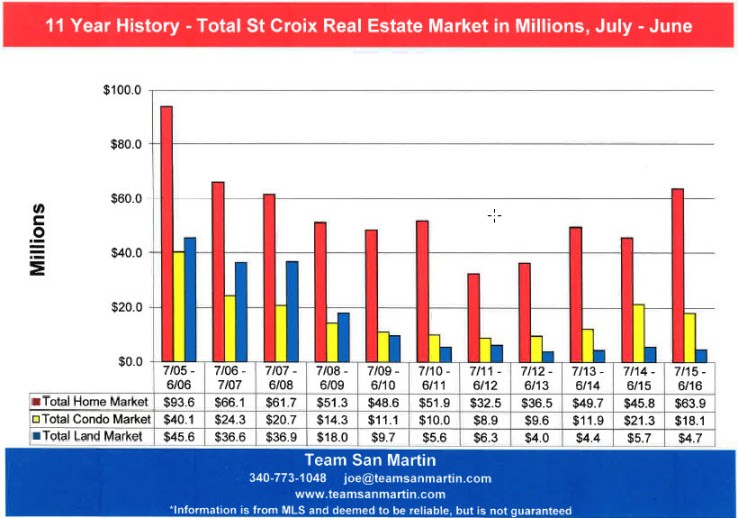

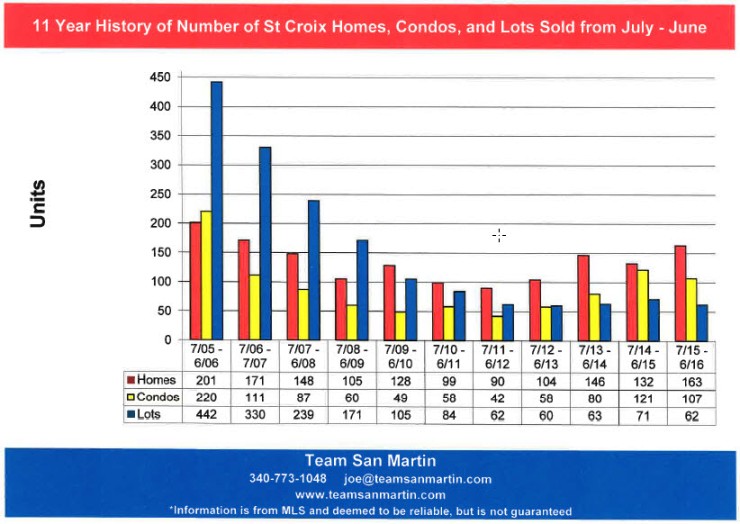

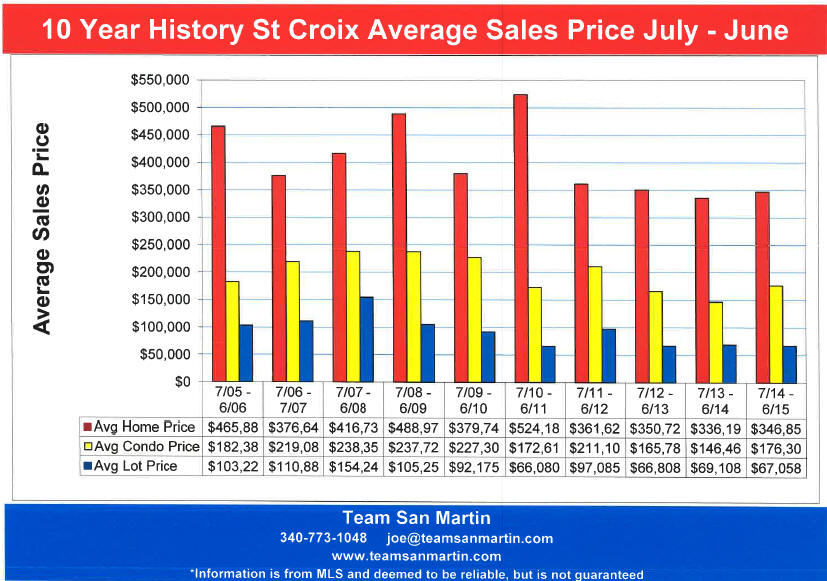

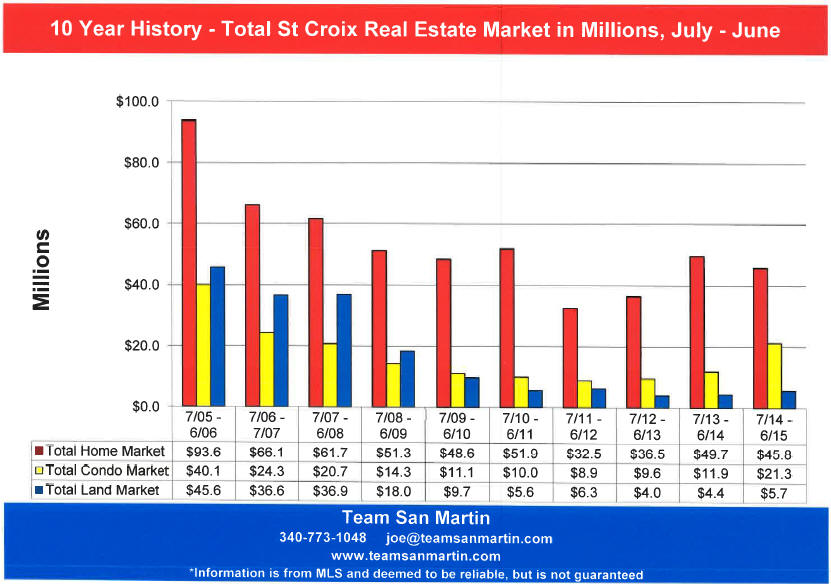

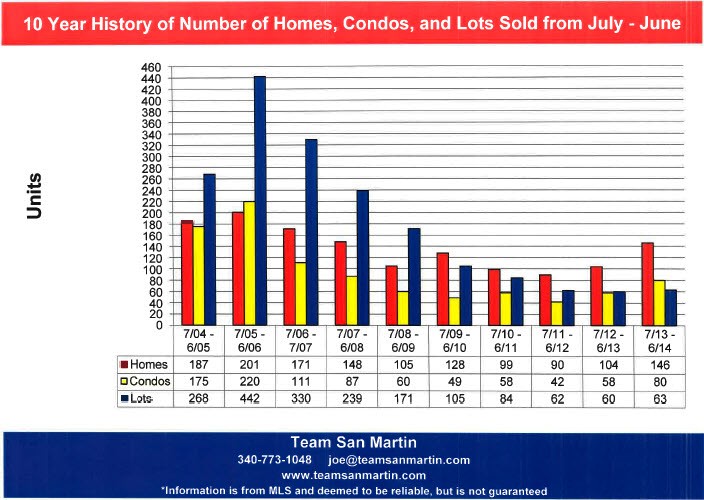

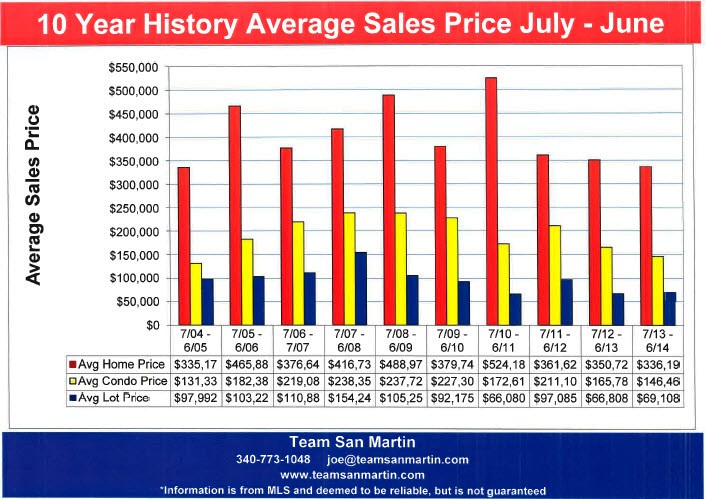

15 year look at the St Croix Real Estate Market for the 12 month period ending 30 June

St Croix real estate market boom cycle is over.

St Croix real estate market peaked July 2021 / June 2022,

Typically, 10 to 15 years between boom cycles

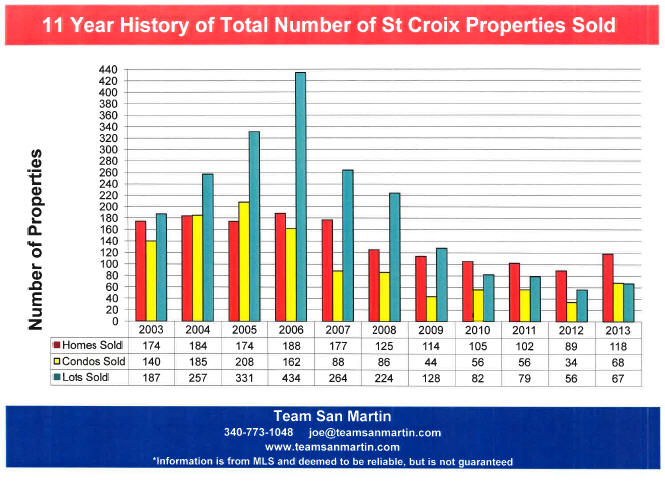

Total number of properties sold

· Residential During the past 12 months, the number of homes sold (170) is 10% above the average number of homes sold per year for the 15-year period (154) and 72% higher than the number of homes sold 15 years ago during this period (99). Currently there are 174 active home listings and 43 pending home sales, a 25% pending rate.

· Condominiums During the past 12 months, the number of condominiums sold (107) was slightly higher than the average number of condos sold per year for this 15-year period (101). This is 84% higher than the number of condominiums sold during this period 15 years ago (58). The current inventory level is 112 active and 15 pending condominiums, a 13% pending rate.

· Land Number of lots sold (127) during the past 12 months is slightly higher than the average number of lots sold per year for the 15-year period (111). Compared to the same 12-month period 15 years ago (84 lot sales), the current period represents a 51% increase. In this category there is plenty of inventory with 353 active lot listings and 41 pending lot sales, a 12% pending rate.

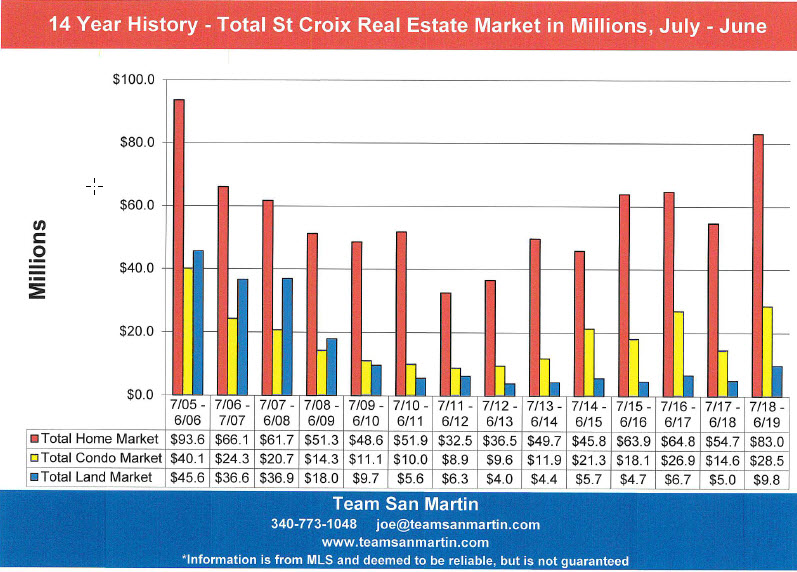

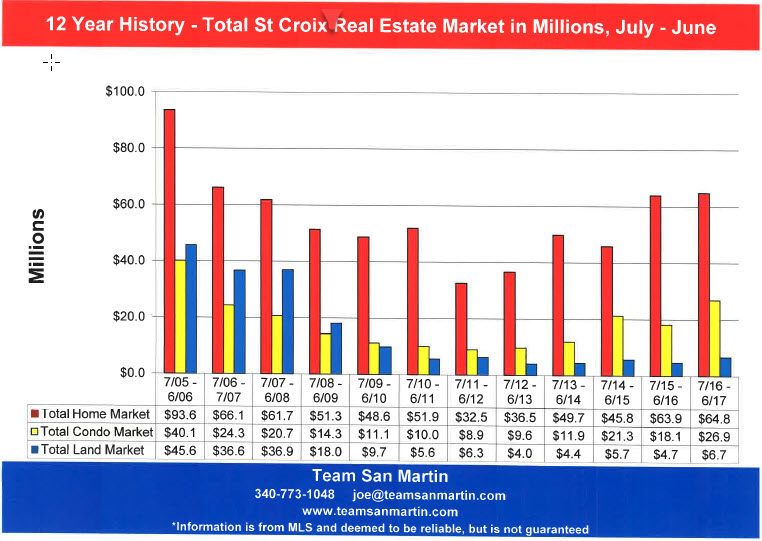

Average sales price

· Residential Average home sales price increased 14% ($76,049) compared to the previous 12-month period, to $633,073 from $557,026. The 2024 / 2025 average is 37% higher than the average sales price for the 15-year period ($462,561)

· Condominiums Average condominium sales price ($293,915) is $11,203 less than the previous year, and 33% higher than the 15-year average of $220,684,

· Land Average lot sales price ($89,016) is 3% lower than the previous 12-month period ($92,149). The current average sales price is 7% higher than the 15-year average sale price ($83,246).

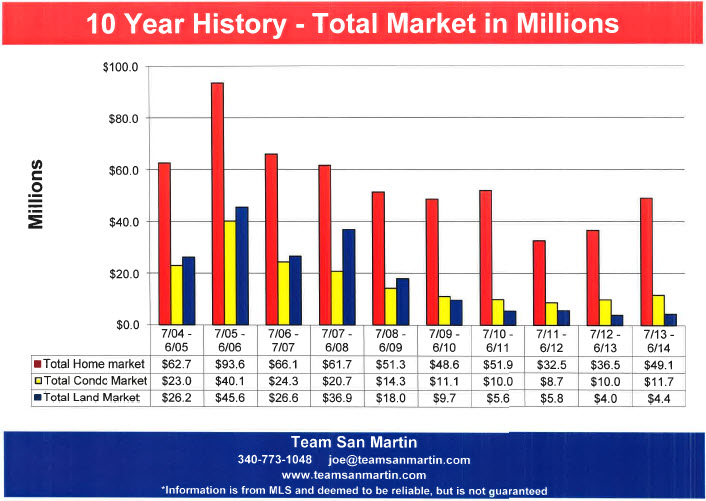

Total Market

Number of properties sold x Average sales price

· Residential This was the best performing segment of the St Croix real estate market during this 12-month period. Total residential market increased by $30 Millon when compared to the previous 12 months, from $74.6 Million to $104.6 Million. The 2024/2025 period exceeded the 15-year average housing market ($73.2 Million) by $34.4 Million (47%).

· Condominiums The past 12 months sales ($31.4 Million) represent a modest $1.2 Million (4%) increase from the 2023/2024 period ($30.2 Million). The 2024/2025 period exceeded the 15-year average condo market ($23.0 Million) by $8.4 Million (37%).

· Land The past 12 months sales ($11.3 Million) represents no change from the 2023/2024 period (also $11.3 Million). The 2024/2025 period exceeded the 15-year average land market ($10.1 Million) by $1.2 Million (12%).

Conclusion

Compared to 15 years ago, the total St Croix real estate market increased 118%, from $67.5 Million

(July 2010 to June 2011) to $147.3 million

(July 2024 to June 2025)

An average of 7.9% growth per year

Compared to the previous 12-month period, total

St Croix real estate sales increased by $31.2 Million (15%) from $116.1 Million to $147.3 Million.

The St Croix real estate market boom is over,

the market is readjusting.

Information is from MLS and deemed to be reliable, but is not guaranteed.

Prepared by:

Julie San Martin

Team Manager

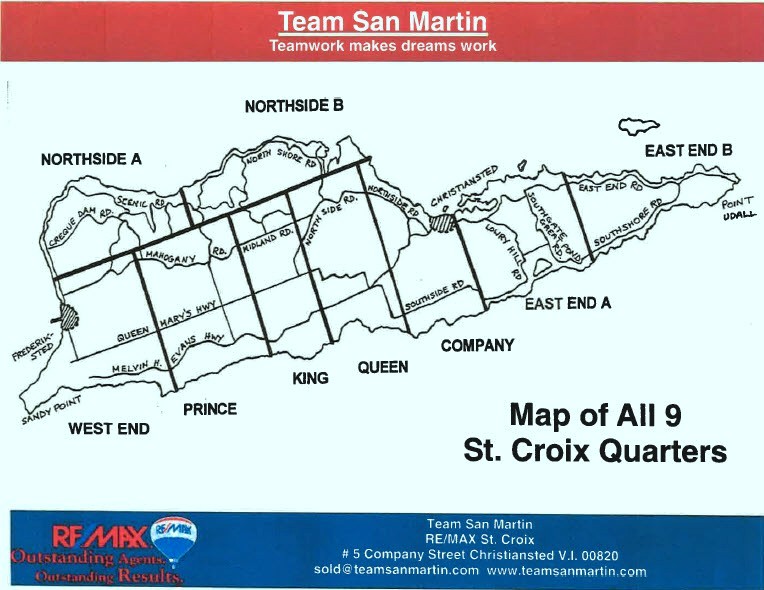

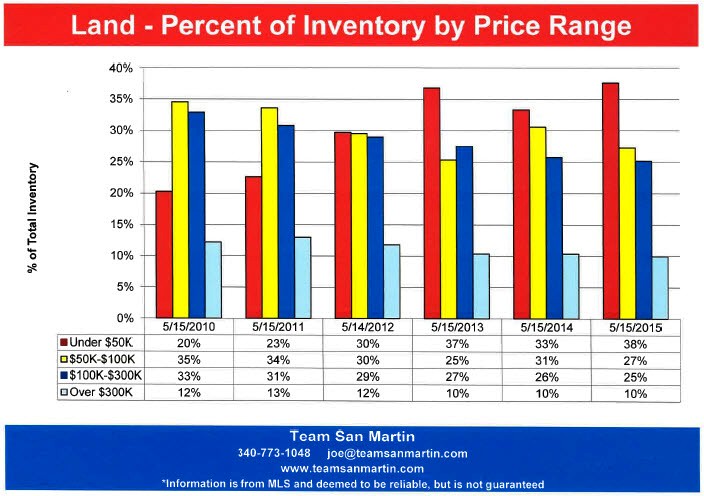

Changes in the St Croix Real Estate Market

Inventory levels by price range reflect the sellers expectations.

The attached graphs compare changes in asking prices over the past decade, using 15 May inventory levels.

BIG changes in sellers expectations!

Residential

Condominium

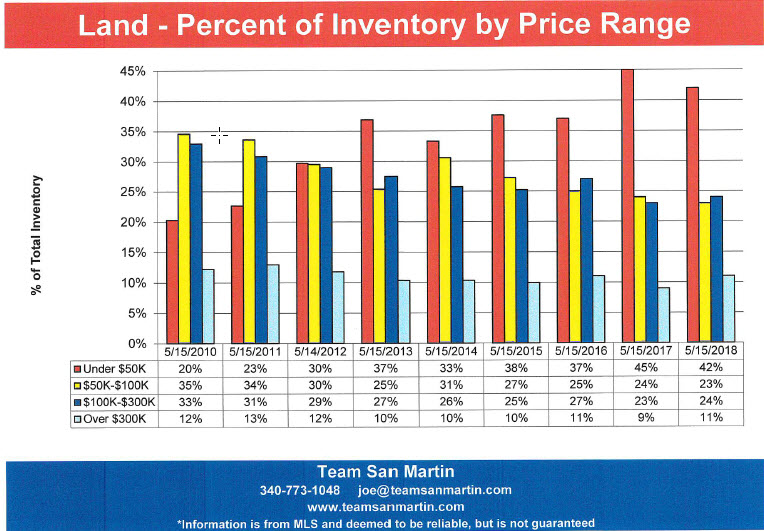

Land

Information is from MLS and deemed to be reliable, but is not guaranteed.

Prepared by:

Julie San Martin

Team Manager

May 2025

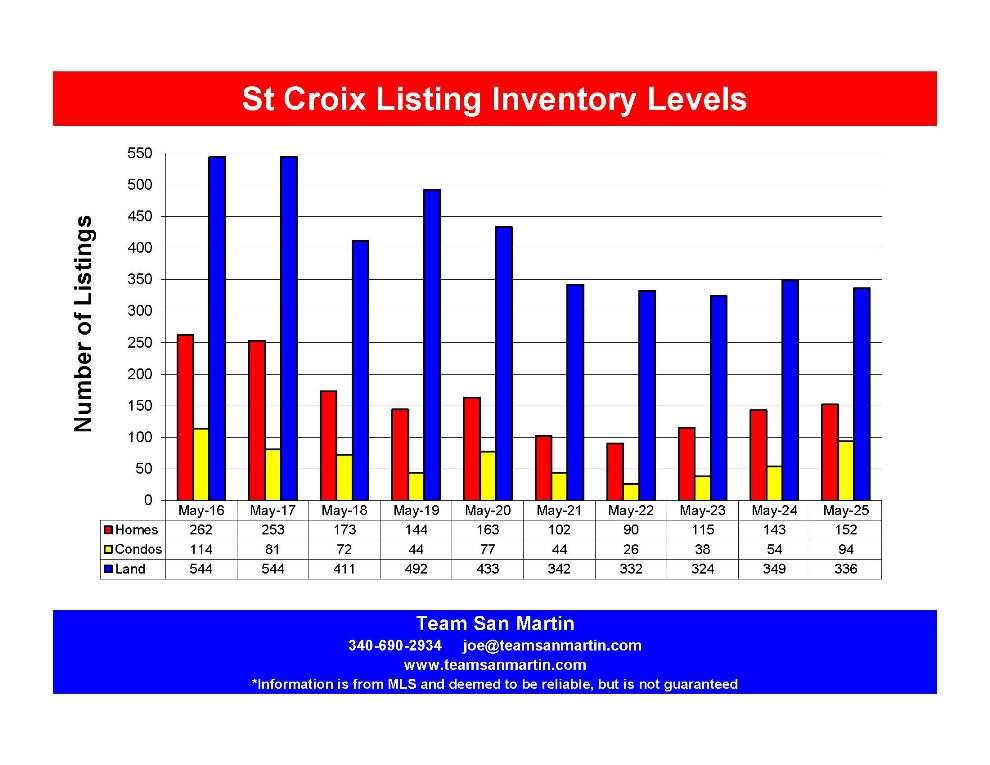

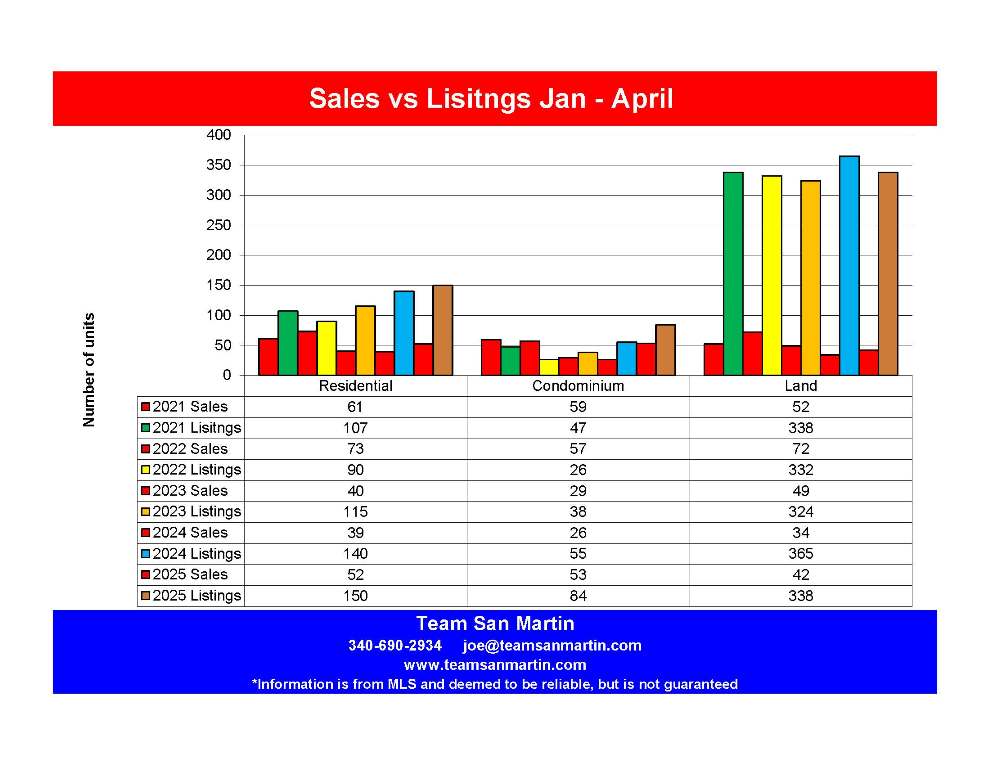

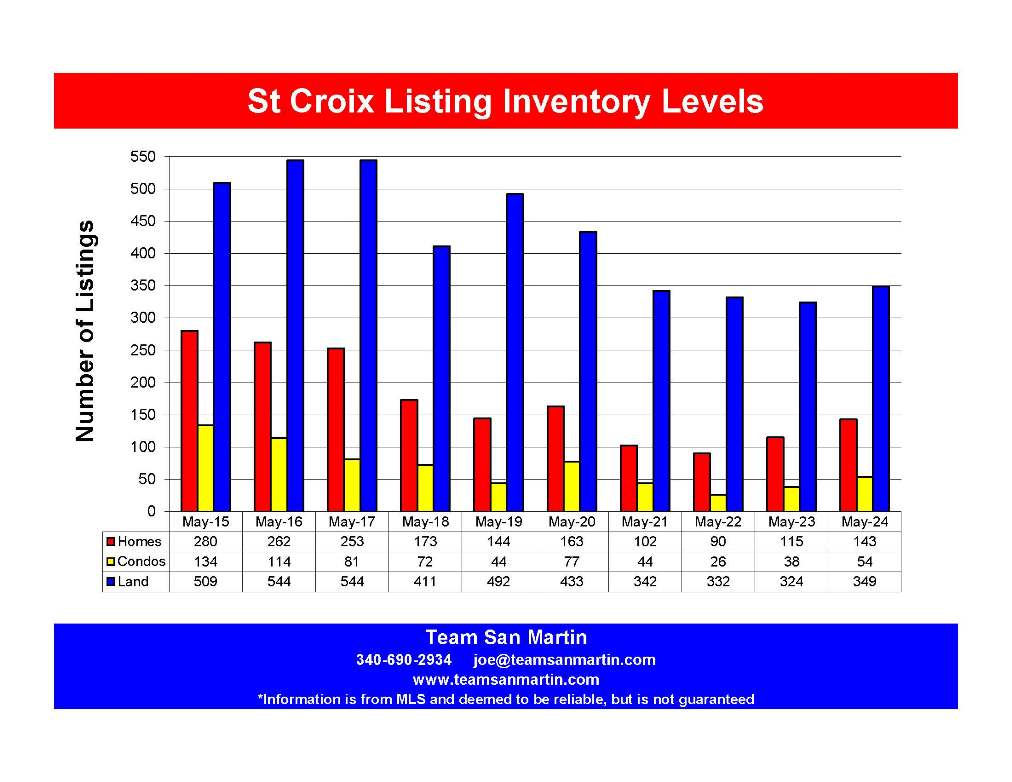

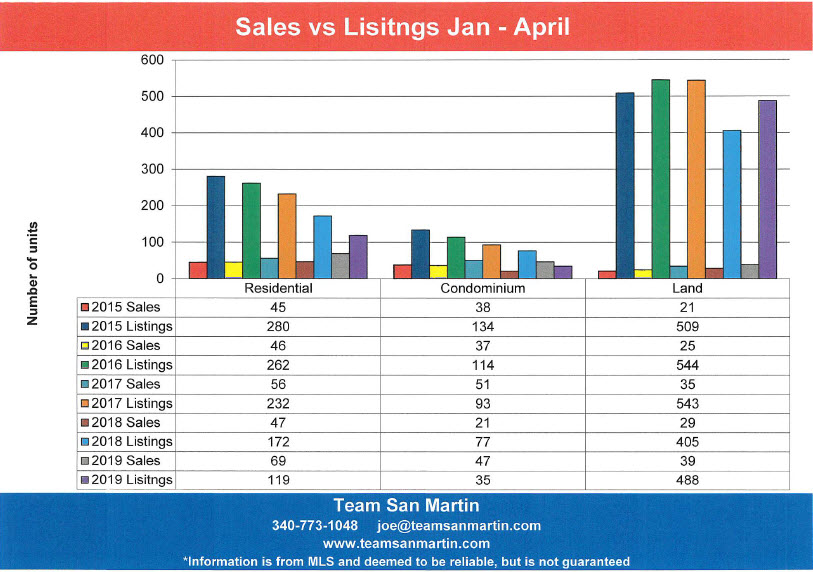

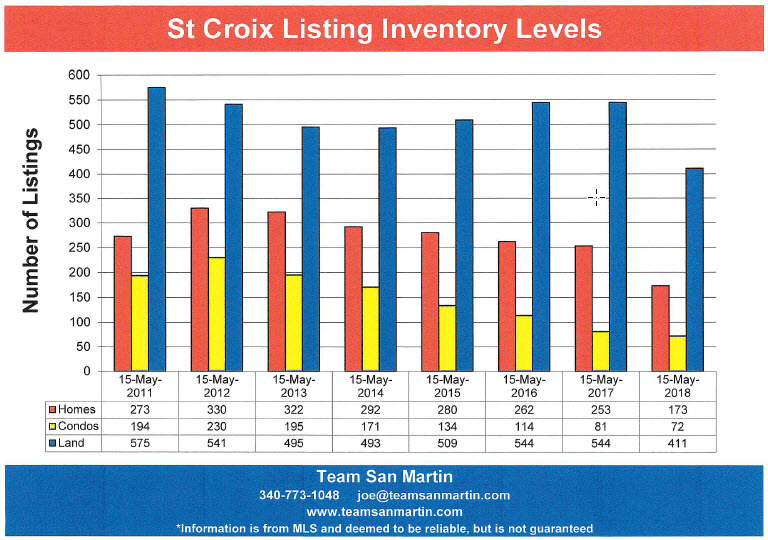

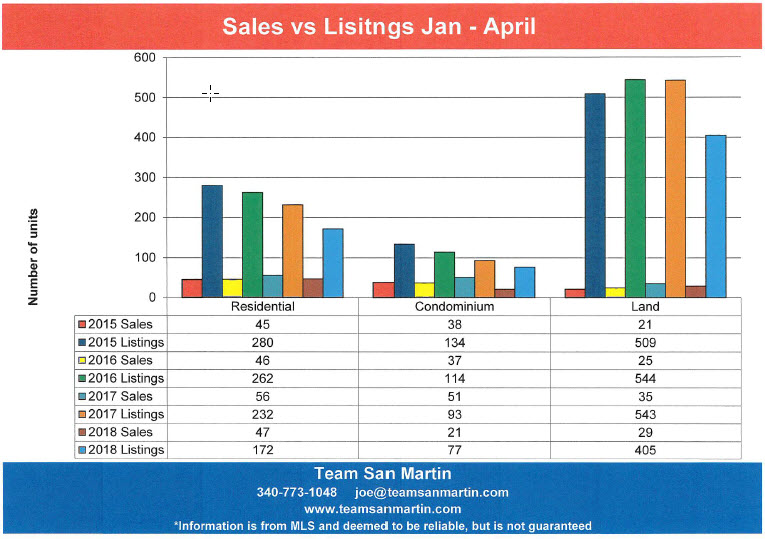

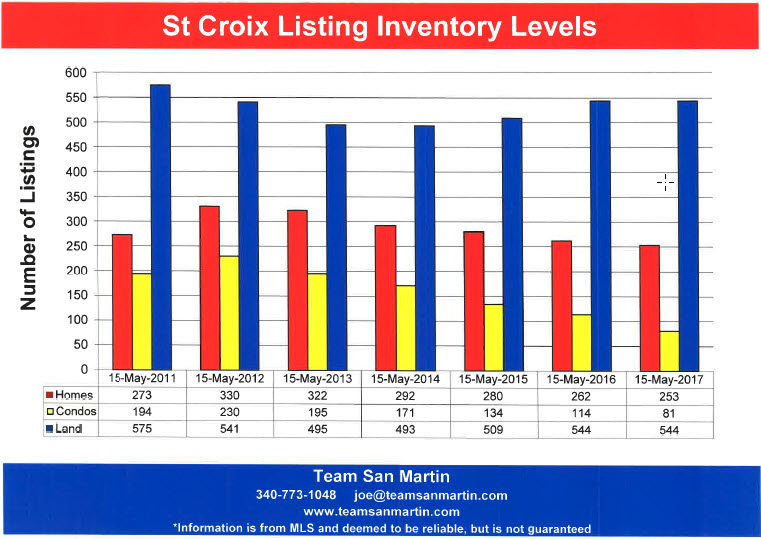

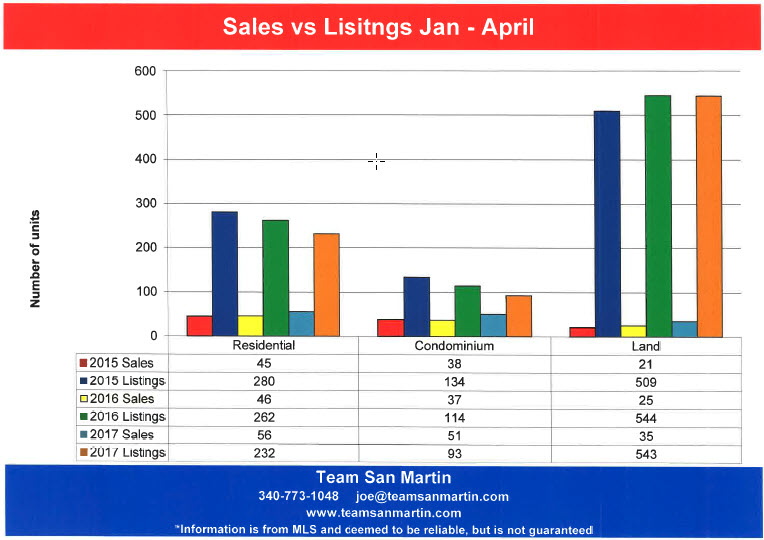

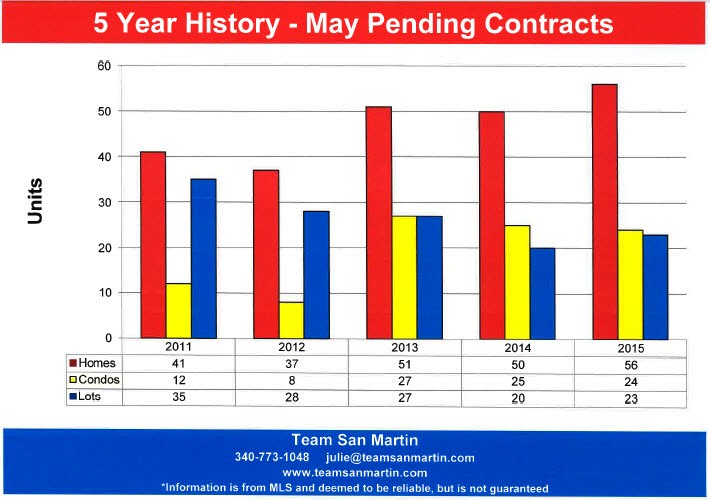

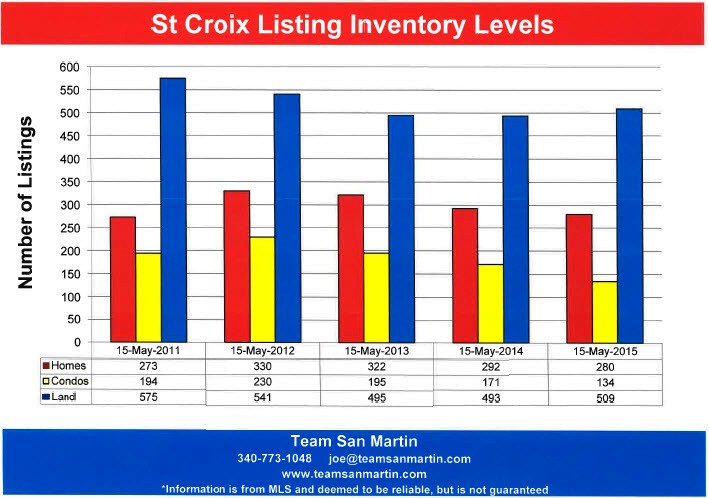

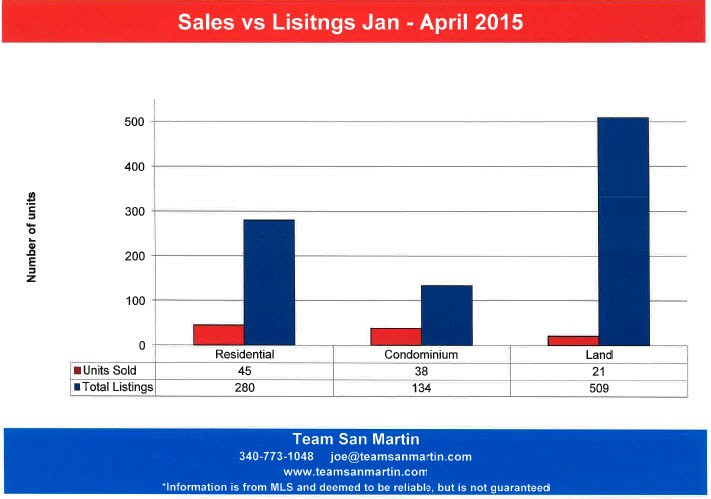

Inventory Levels and Sales Projections

May Inventory Levels

10 Year Review

Residential

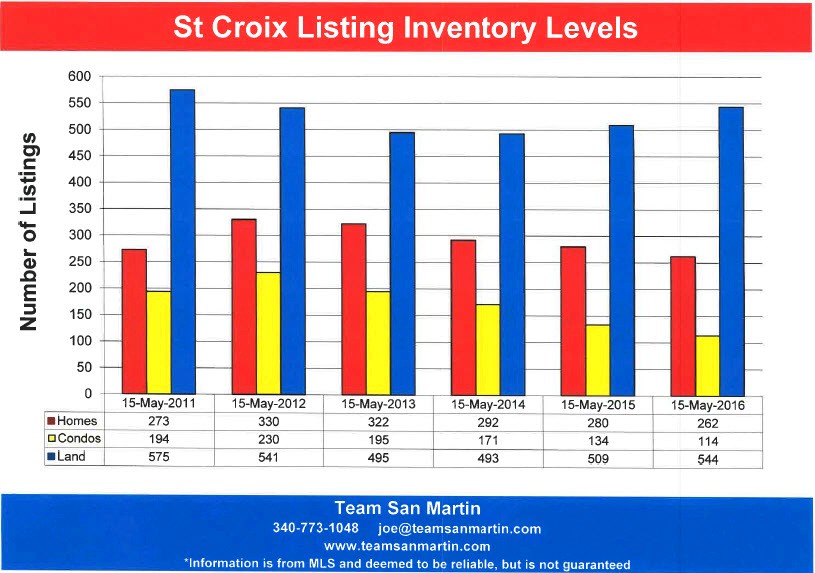

Residential inventory peaked in 2016 with 262 homes for sale and declined through 2022. Current inventory of 152 homes for sale is 58% of the number of homes for sale in 2016.

Condominium

Condominium inventory also peaked in 2016 with 114 condominiums for sale and declined through 2022. Current inventory of 94 condos is 82% of 2016 condominium inventory.

Land

Land inventory peaked in 2016 / 2017 with 544 lots for sale and slowly declining through 2023. Current inventory of 336 lots is 62% of the 2016 / 2017 inventory.

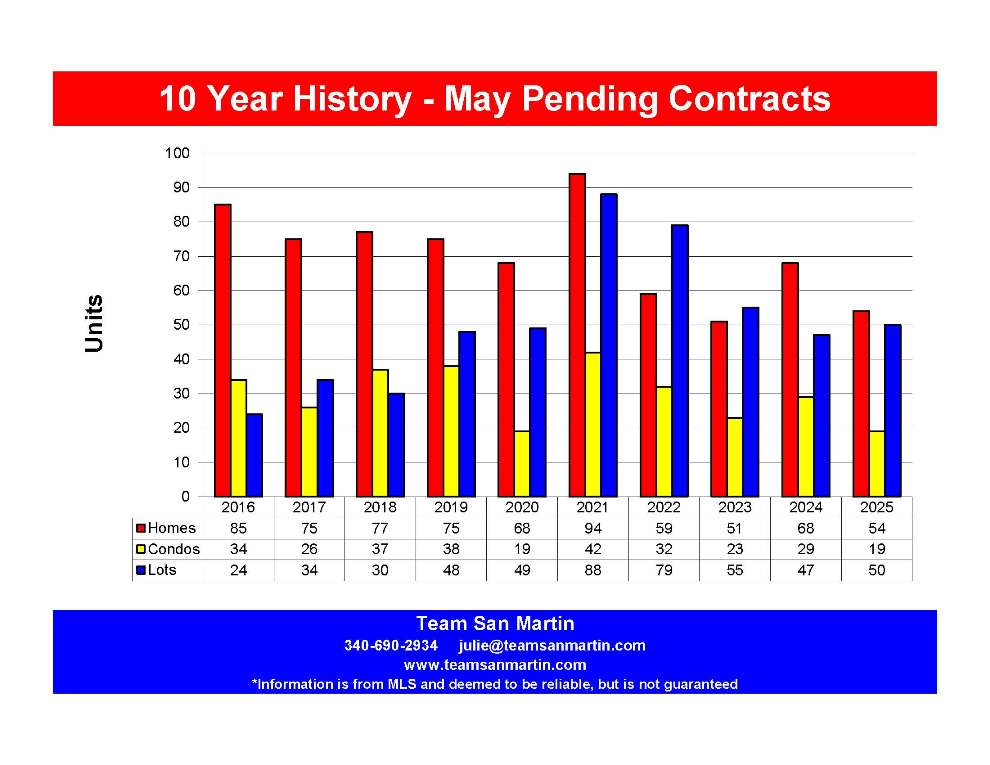

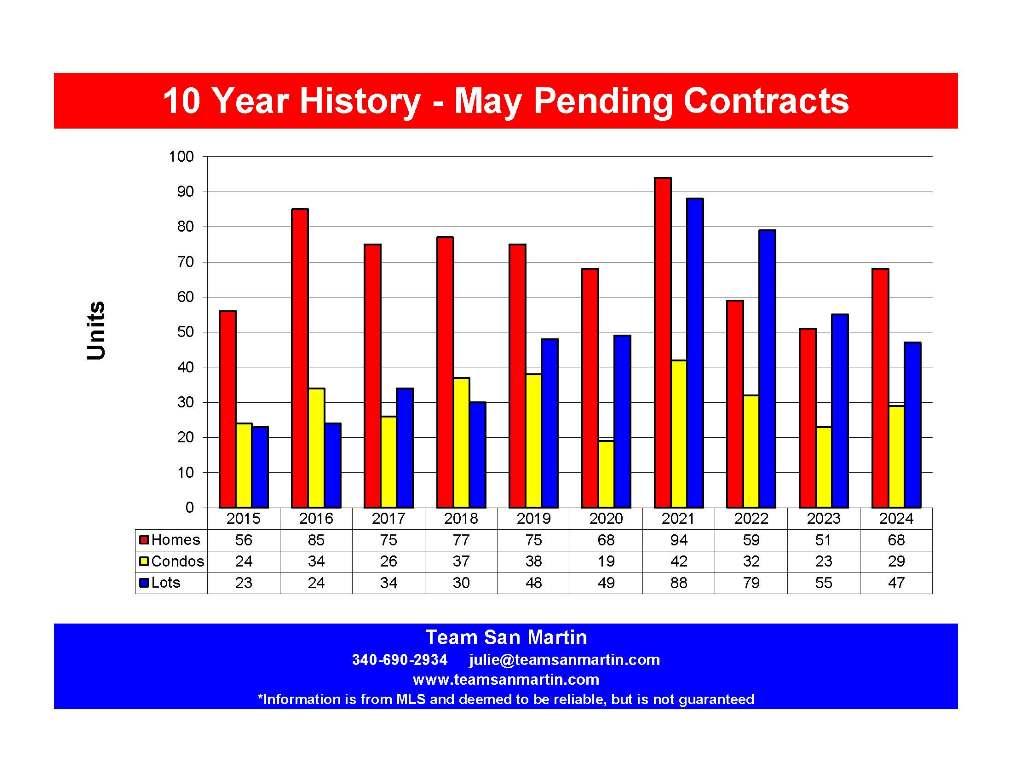

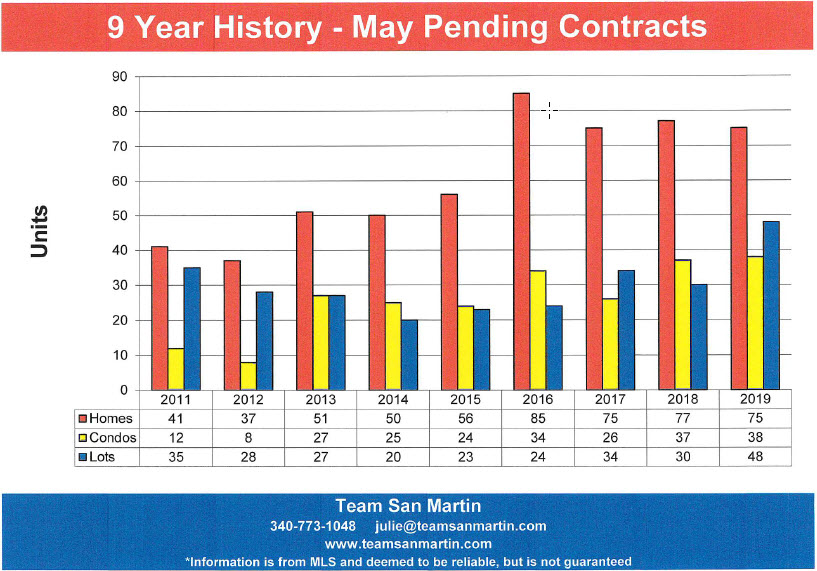

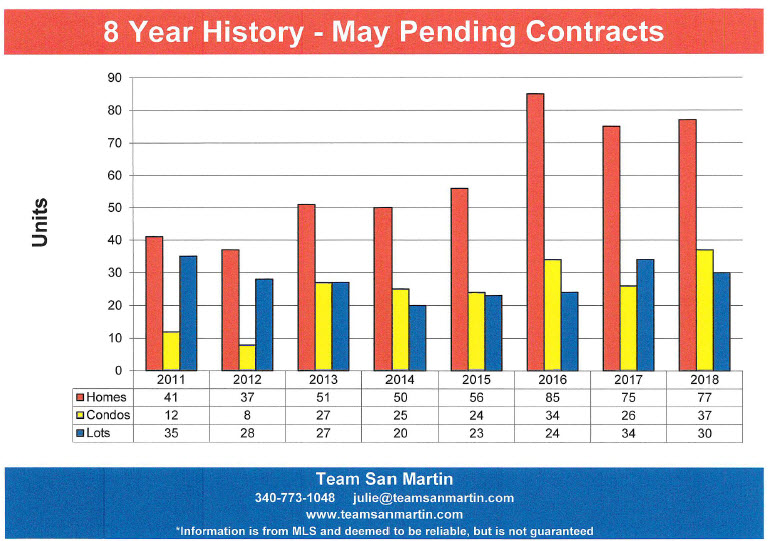

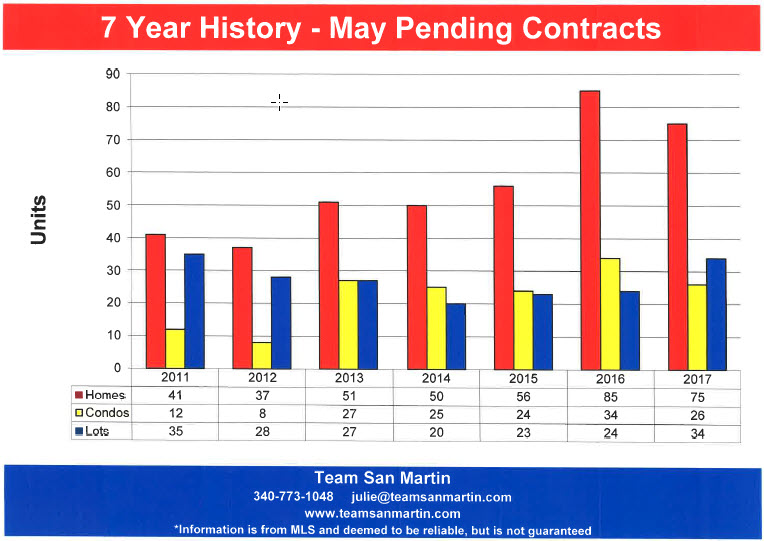

May Pending Sale Levels

10 Year Review

Residential

May 2025 residential pending sales (54) is 64% of the number of pending residential sales 10 years ago (85). The average number of pending residential sales over the 10-year period is 71; the May 2025 number of pending sales (54) is 76% of the 10-year average.

Condominium

May 2025 condominium pending sales (19) is 56% of the number of pending contracts 10 years ago (34). Current pending condominium sales (19) are 63% of the 10-year average of 30 pending condominium sales.

Land

May 2025 pending land sales (50) are more than double pending contracts 10 years ago (24). Current pending land sales ( 50) are 100% of the 10-year average of 50 pending land sales in May.

2024 Sales Predictions

Using the assumption that the first 4 months of 2025 are a valid predictor for the entire year.

Residential

The first four months home sales predict 156 home sales during 2025; pending contracts predict 162 home sales during 2025. Inventory levels of 150 homes on the market suggest the lower number to be more likely.

Condominium

The first four months condominium sales predict 159 condominium sales during 2025; pending contracts predict 57 condominium sales during 2025. Inventory levels of only 94 condominiums on the market suggest a number in the middle, probably 90 to 100 condominium sales.

Land

The first four months land sales predict 126 land sales during 2025; pending contracts predict 150 land sales during 2025. With ample land inventory and dwindling home and condo inventory, it is entirely possible there will be 150 land sales during 2025, an 18% increase from the number of lots sold (127) during 2025.

Information is from MLS and deemed to be reliable, but is not guaranteed.

Prepared by:

Julie San Martin

Team Manager

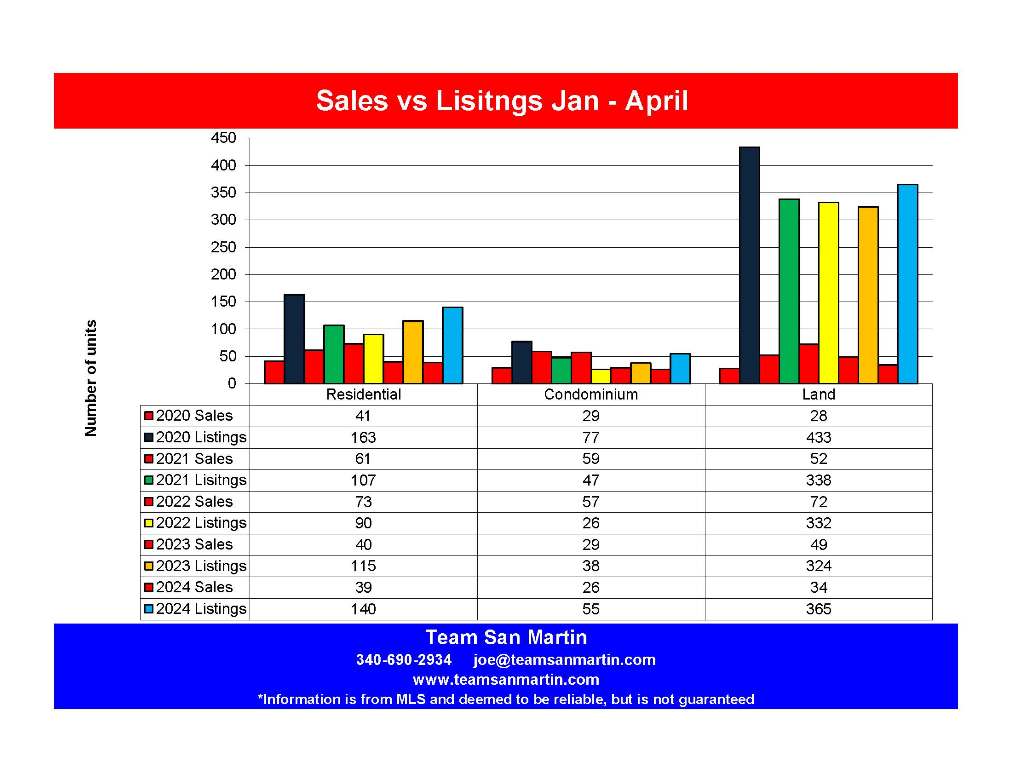

April 2025

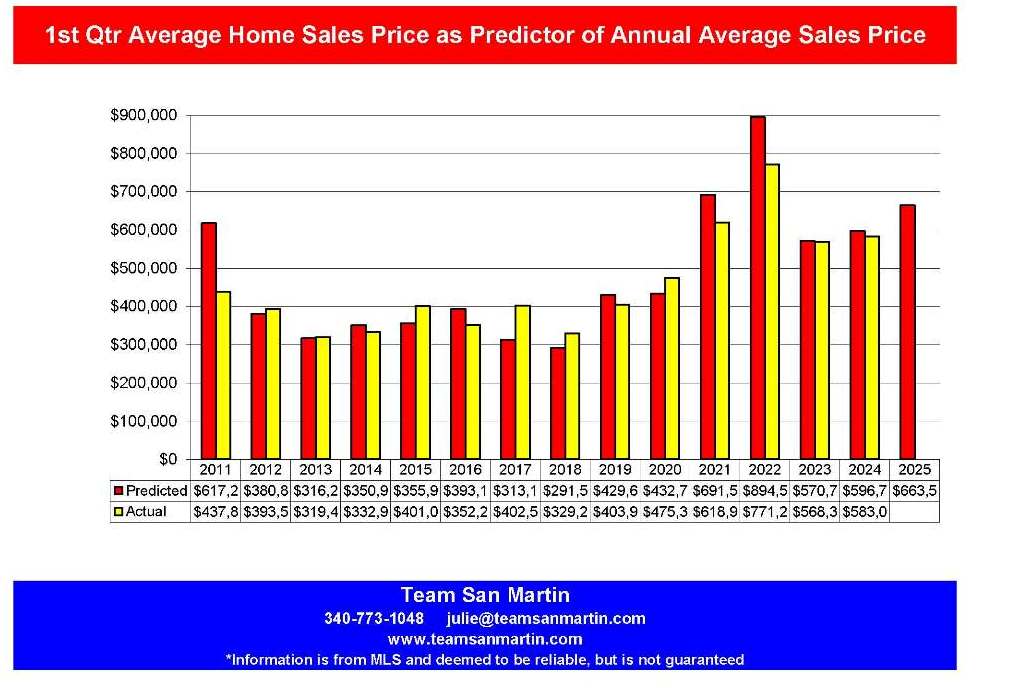

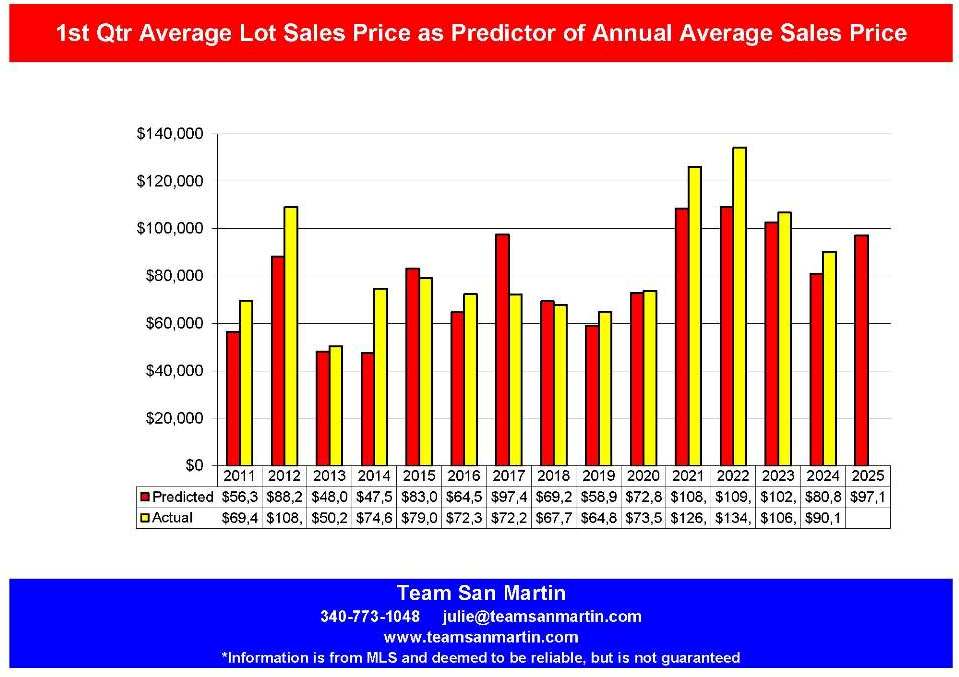

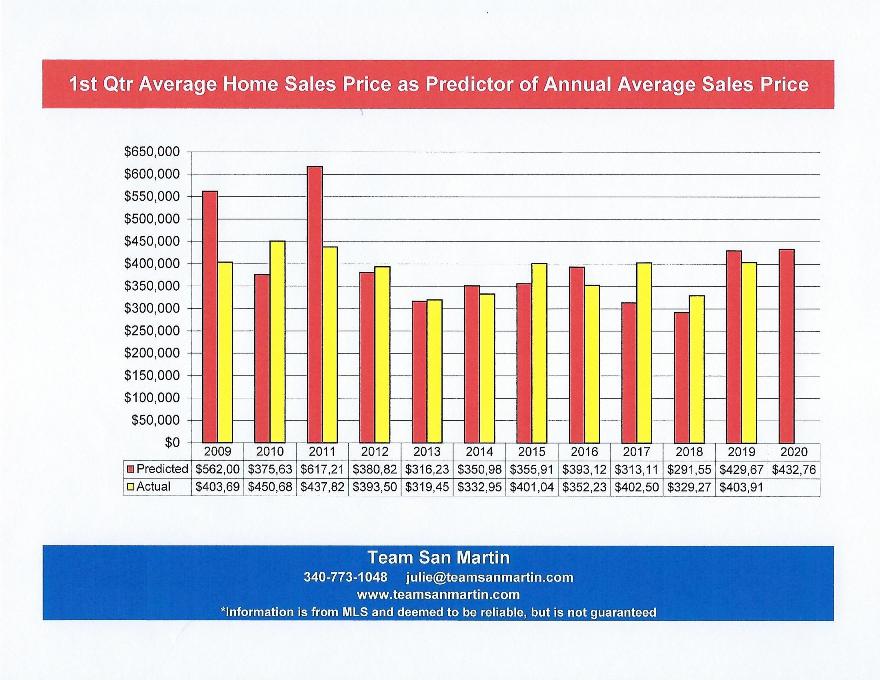

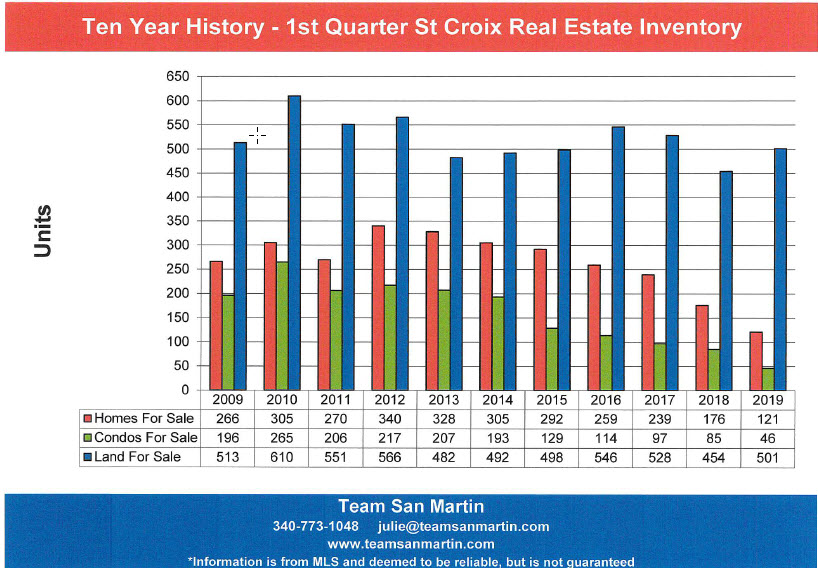

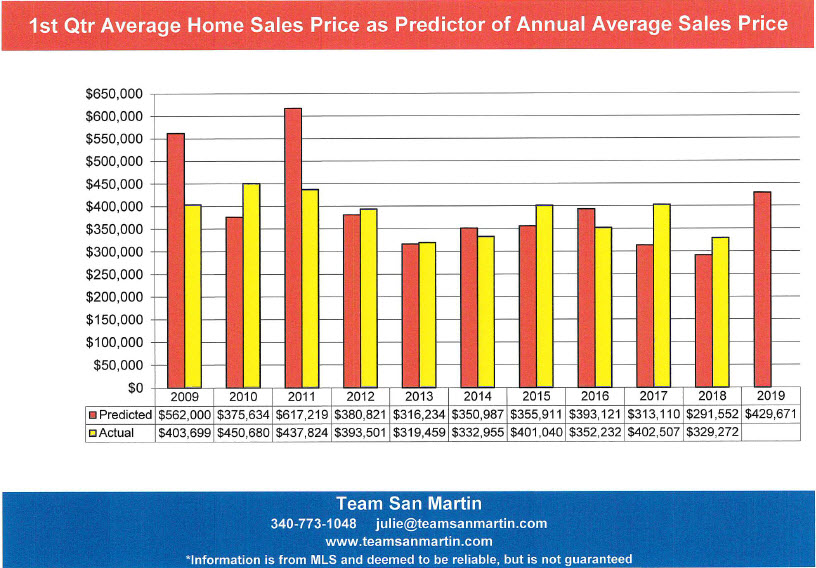

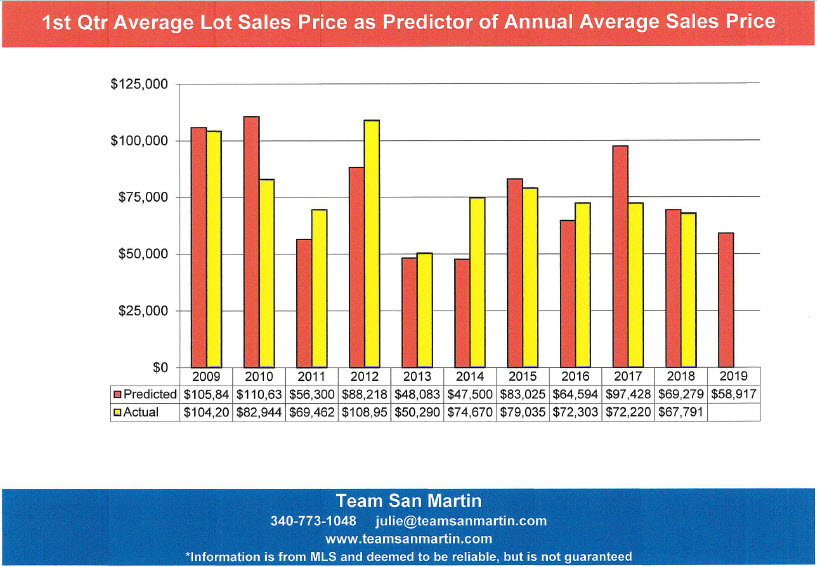

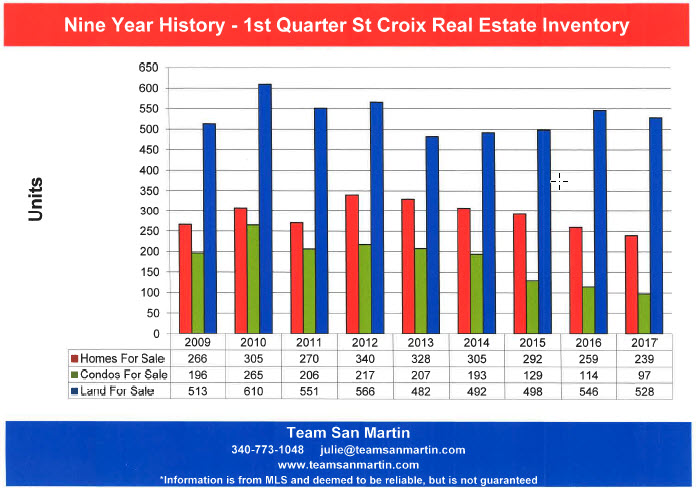

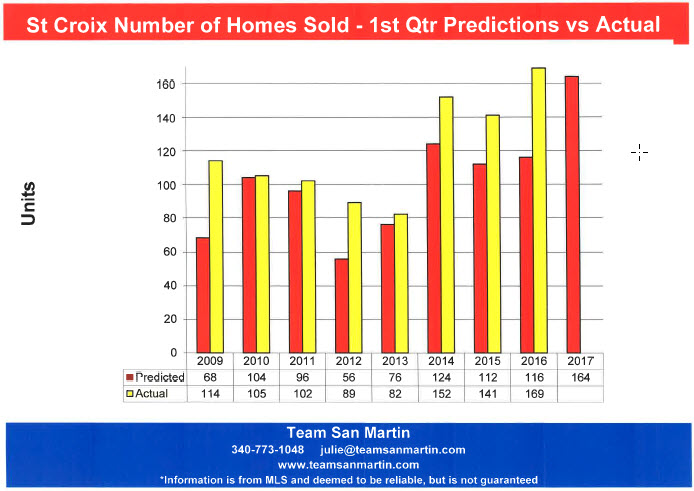

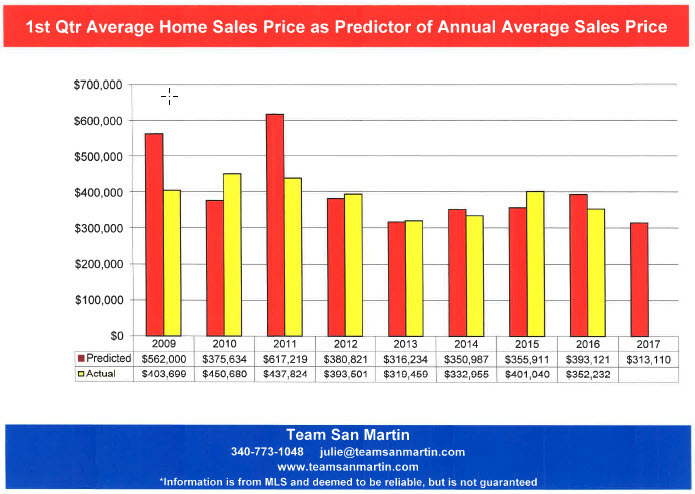

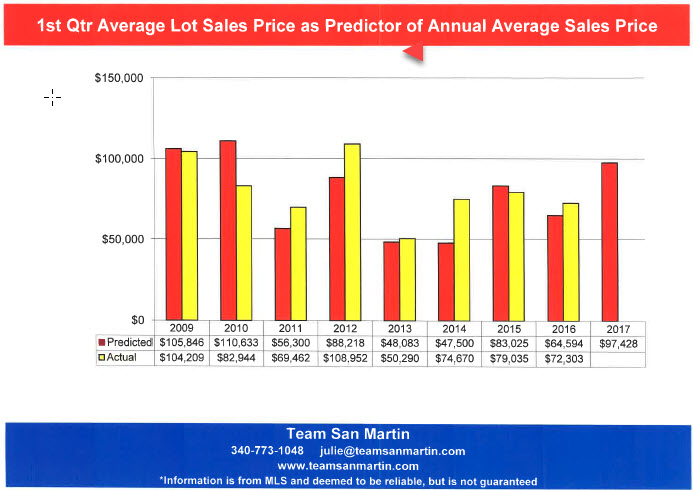

1st Quarter Sales as Predictor for the full year

The St Croix real estate market made a strong recovery through 2022, is now showing signs of contraction.

The question is what do the 1st quarter statistics predict about market prospects for the rest of the year?

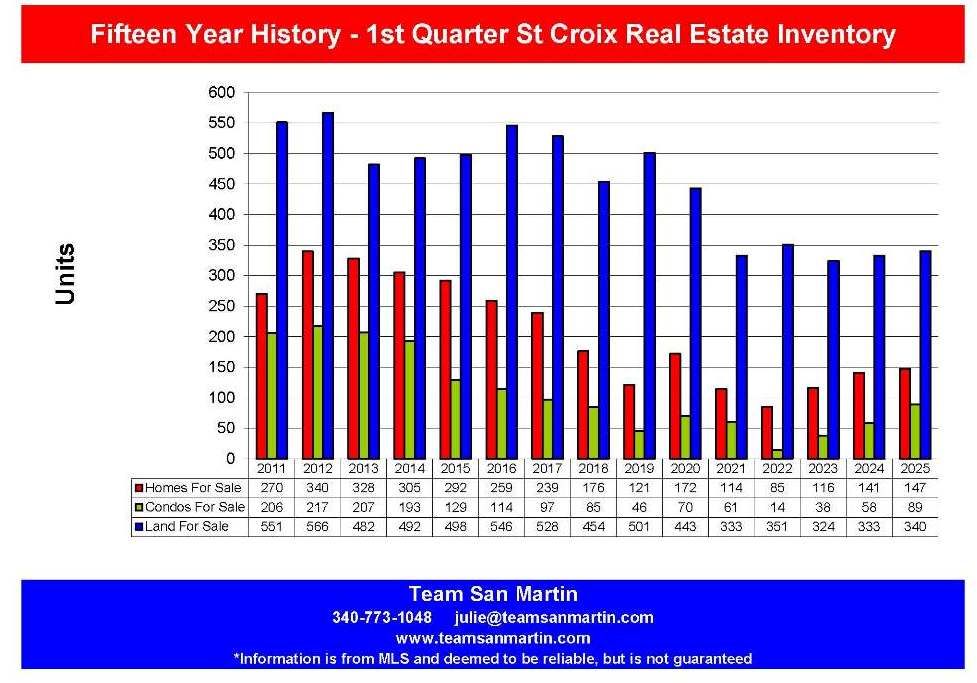

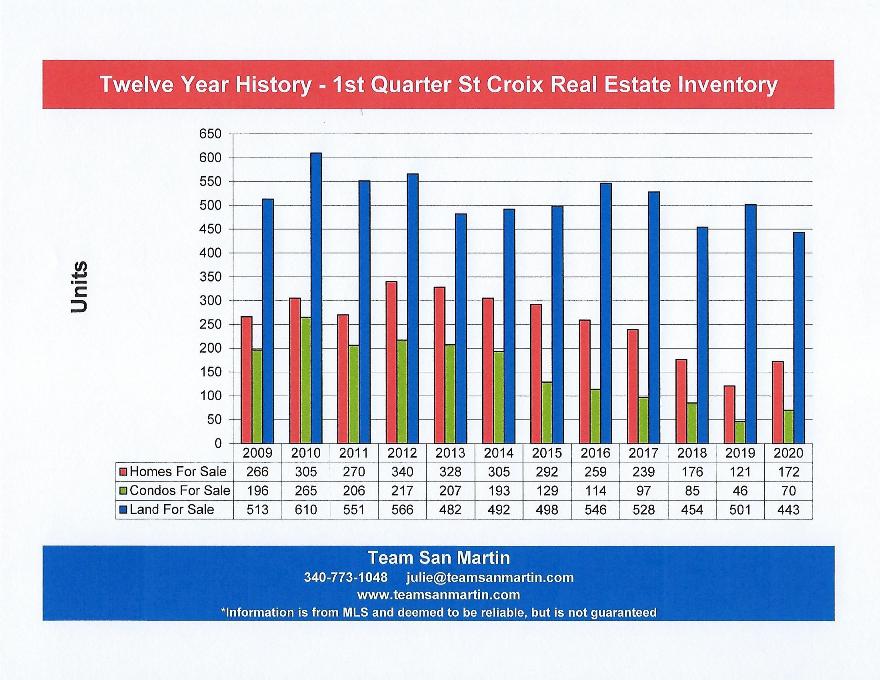

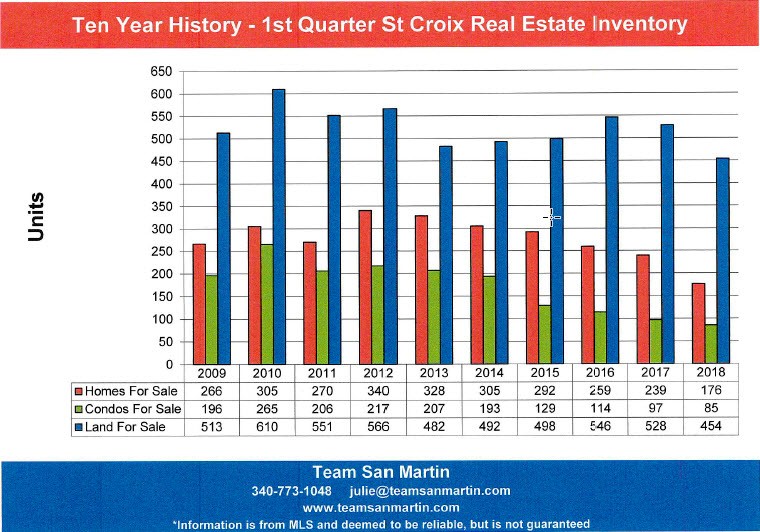

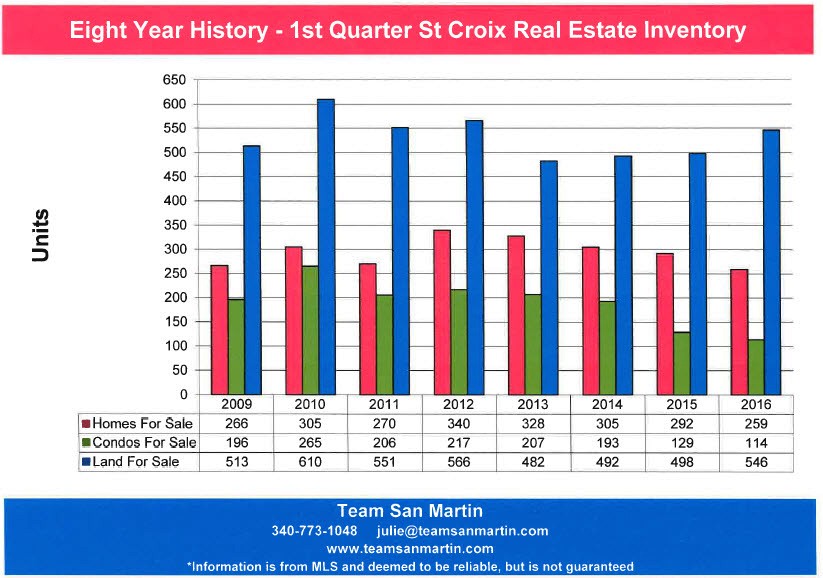

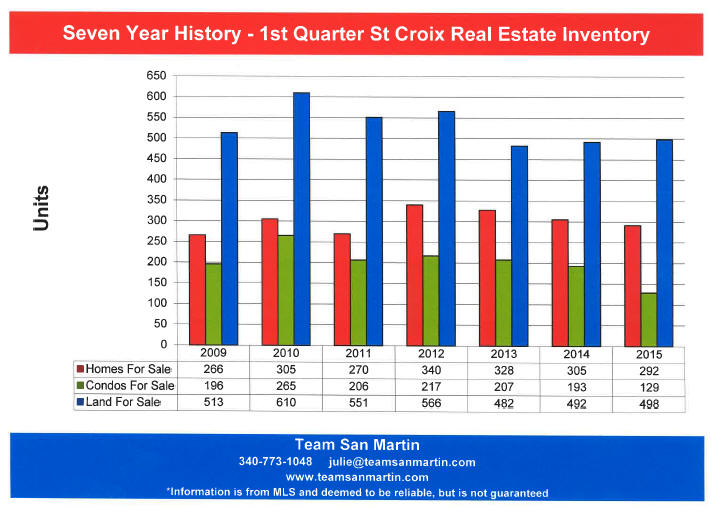

First, a look at inventory trends over the

15 year period:

· Residential inventory peaked in 2012, with 340 homes for sale, then steadily declined each year to the low point of only 85 homes for sale in 2022. Residential inventory is again increasing.

· Condominium inventory also peaked in 2012, with 217 condominiums for sale, then steadily declined each year to the low point of only 14 condos on the market in 2022. The 2025 level of 89 condominiums for sale continues to be low inventory.

· Land inventory also peaked in 2012, at 566 lots for sale. Until 2020, land inventory was between 566 and 443 lots for sale. For the past five years, 1st quarter land inventory has been in the low to mid-300 lot range.

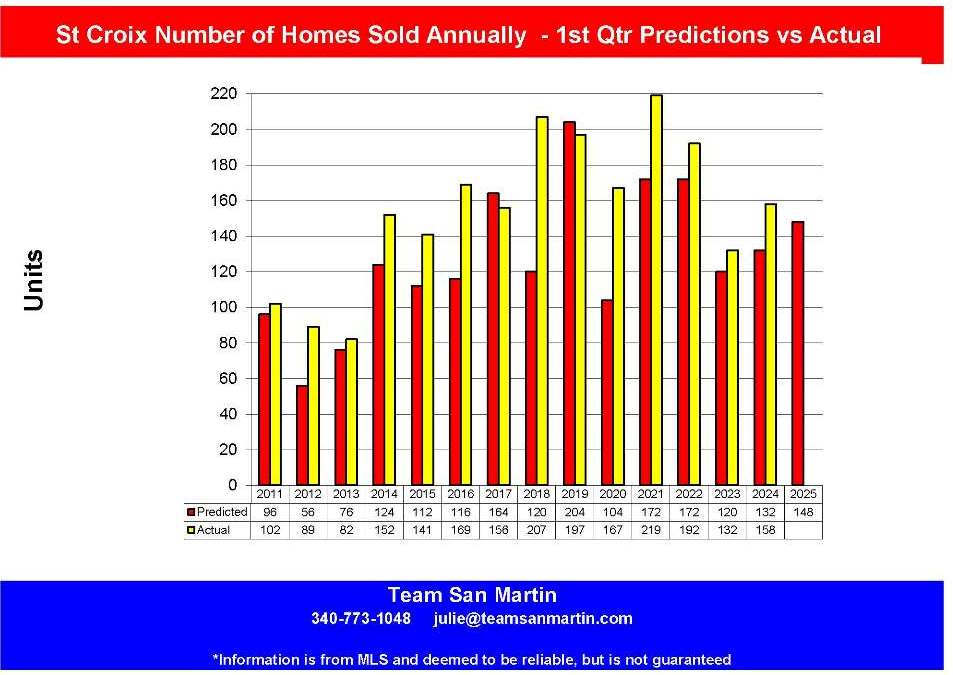

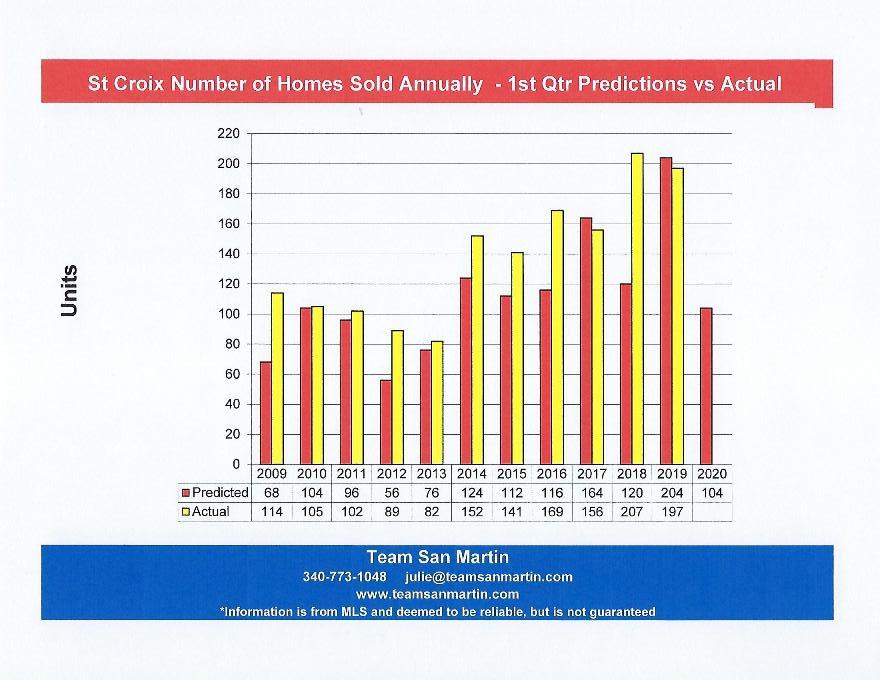

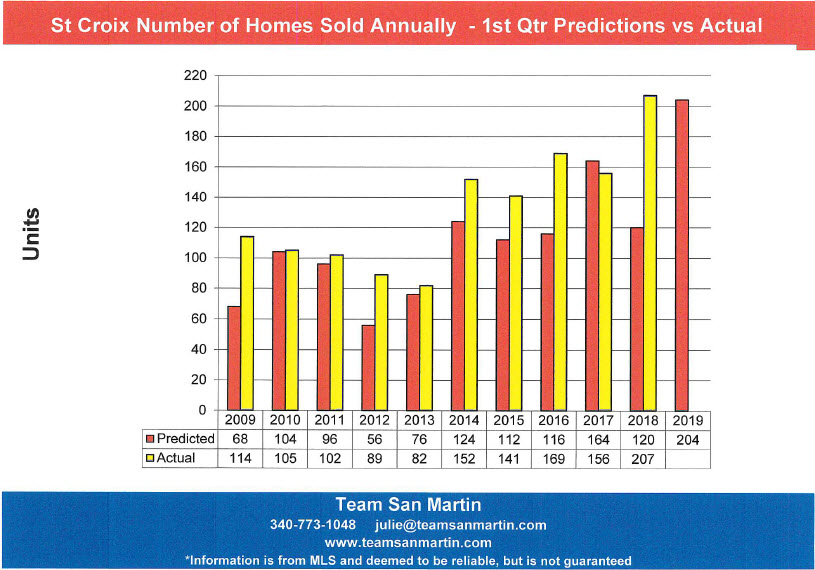

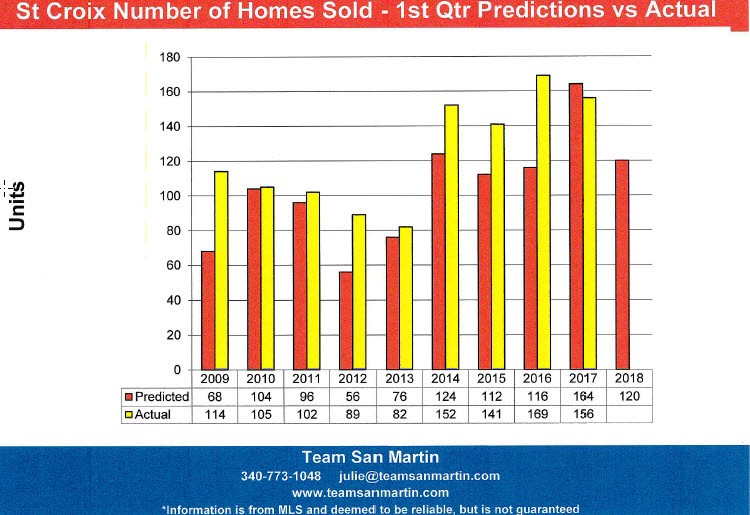

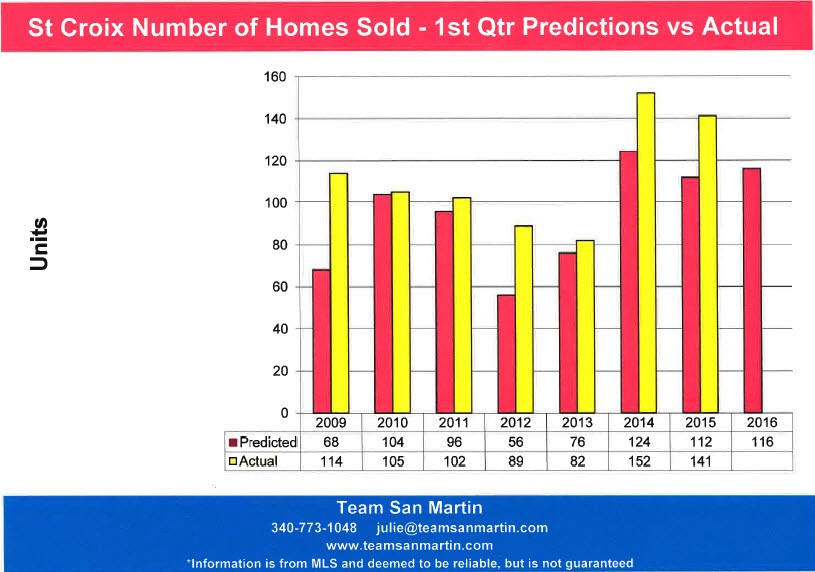

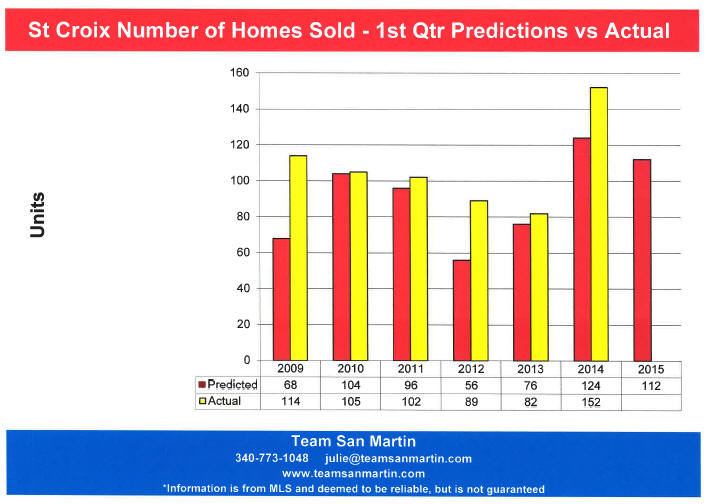

Residential Sales & 2025 Predictions

Over the past 15 years, the number of homes sold during the first quarter has under predicted the annual sales number, with two outliers (2017 and 2019) which slightly overpredicted the annual number of homes sold.

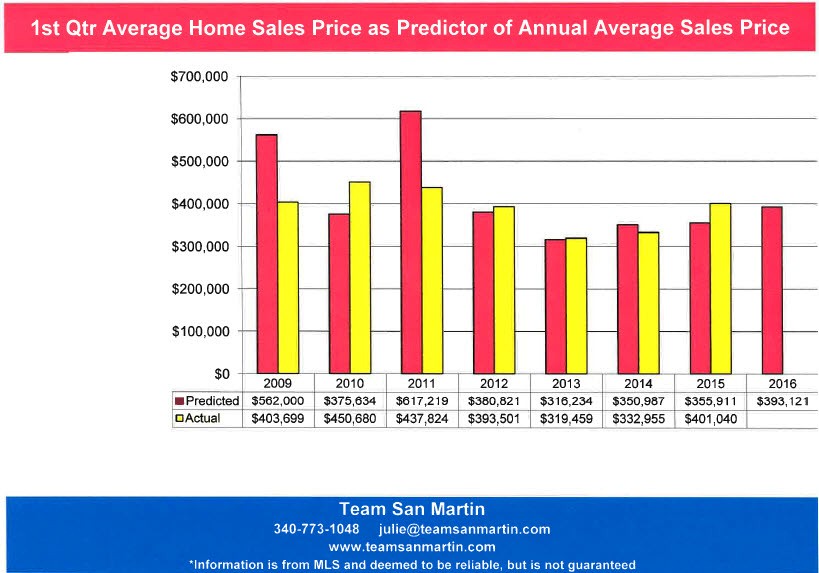

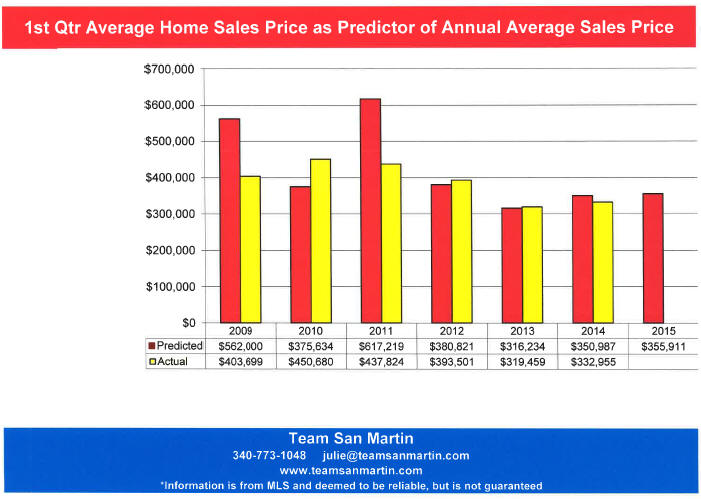

The 1st quarter average sales price has been a fairly accurate predictor of the annual home sales price. Again, there were a few outlier years 2011, 2021, and 2022 when 1st quarter sales price overpredicted the annual average sales price.

2025 annual prediction:

· Total number of homes sold will be as predicted, around 150 homes.

· Average sales price will most likely be in mid $600,000 range.

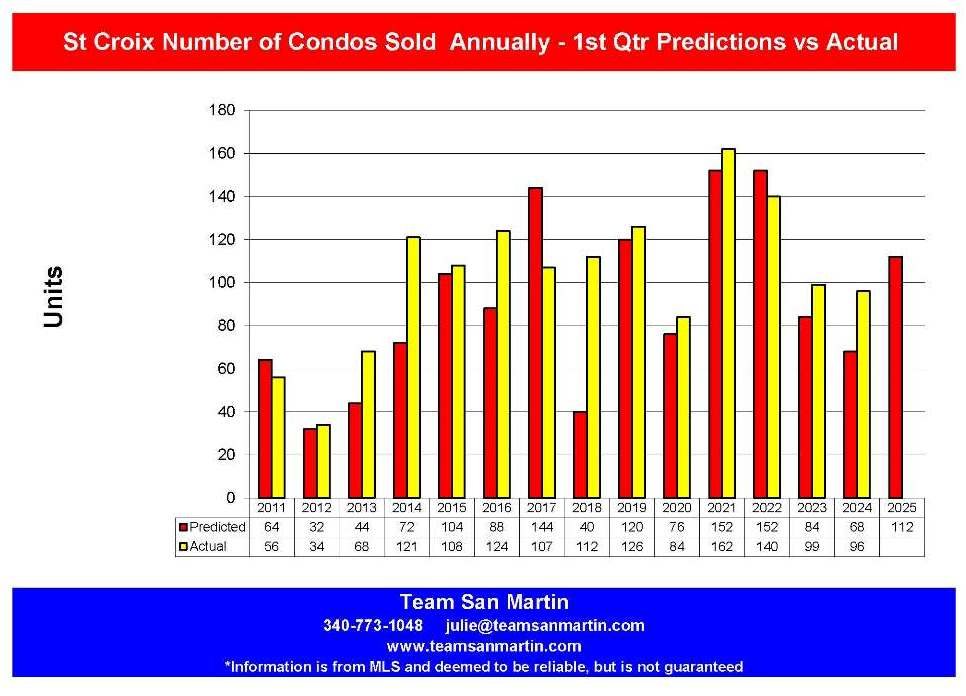

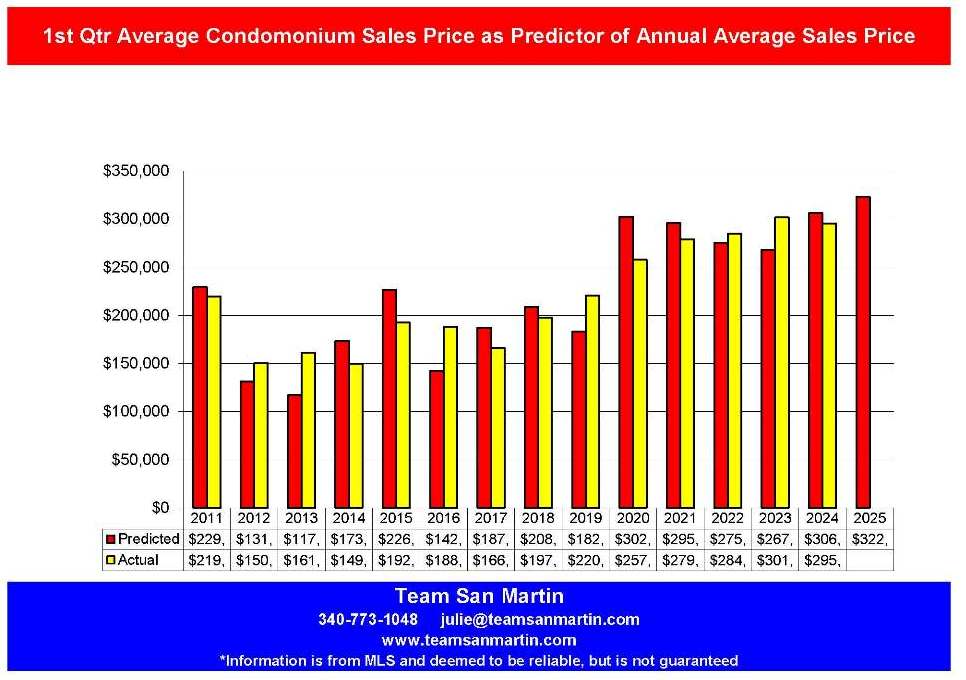

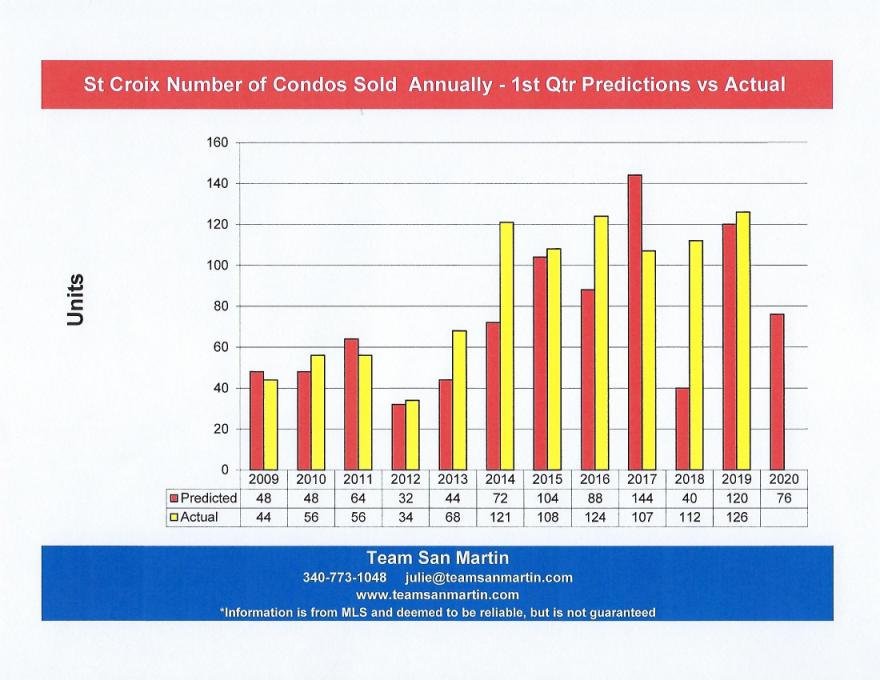

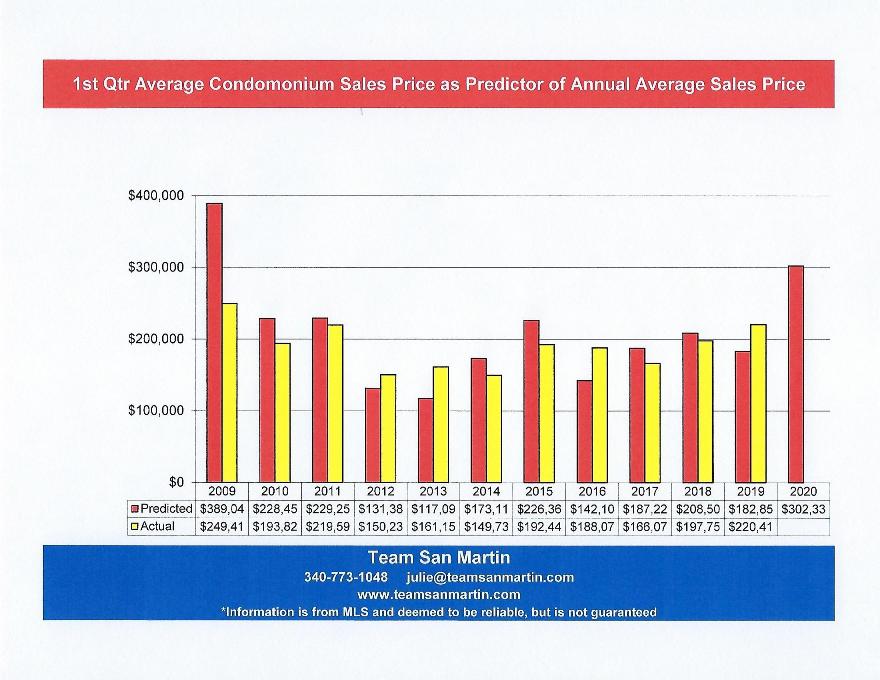

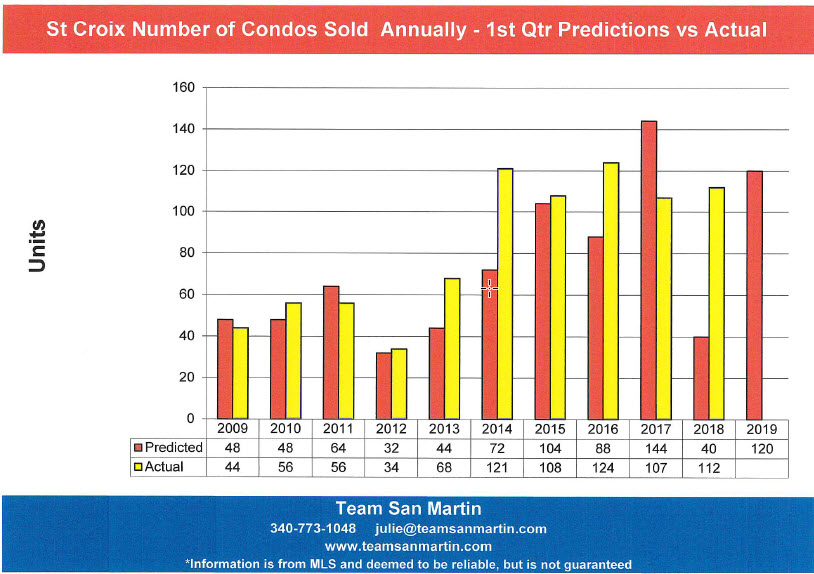

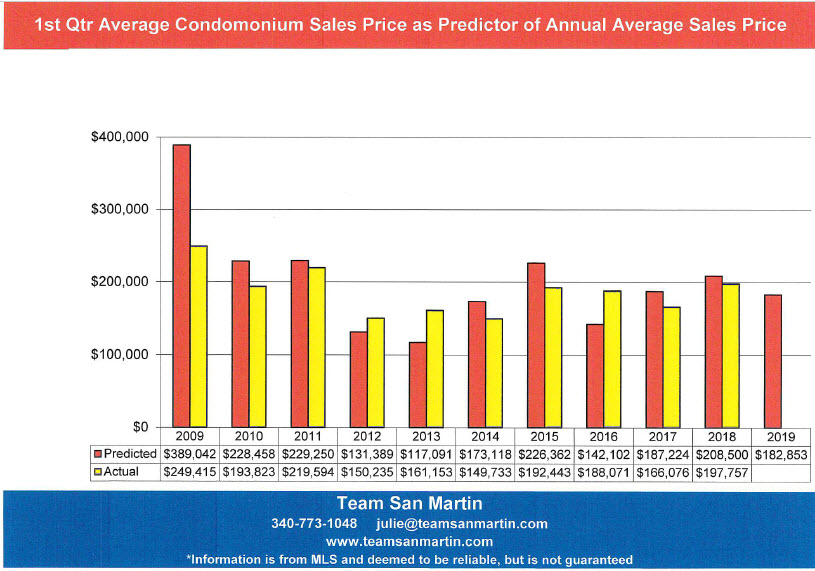

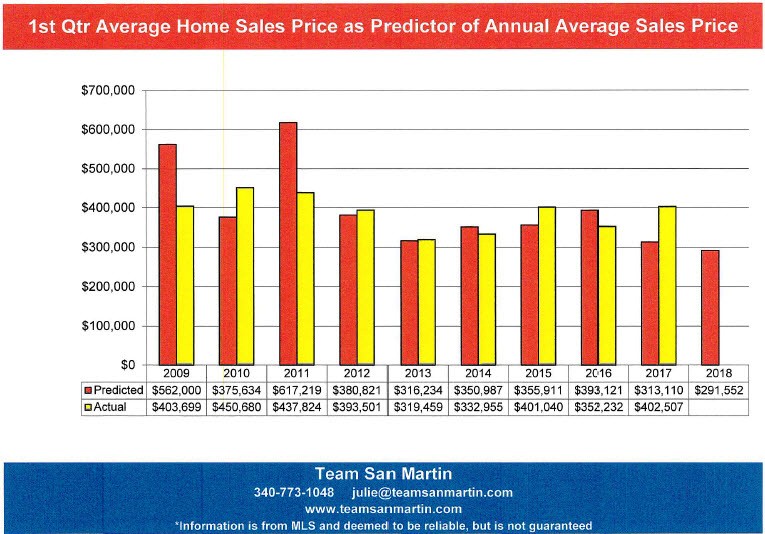

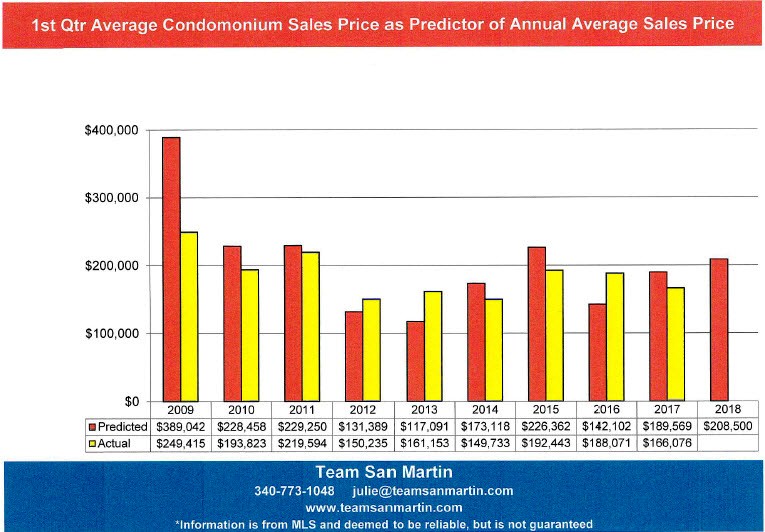

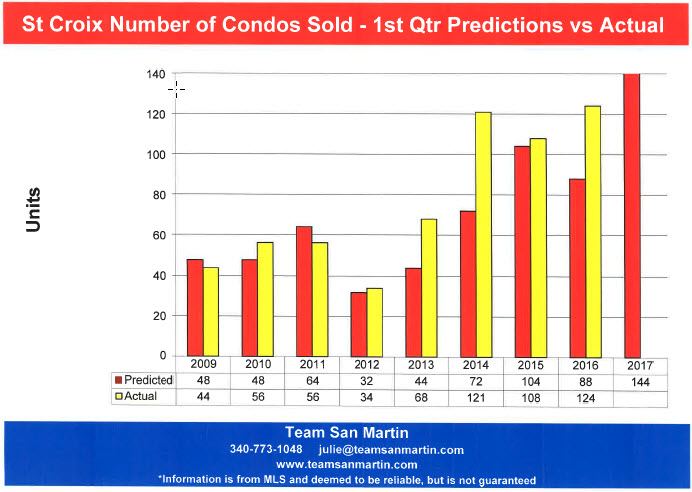

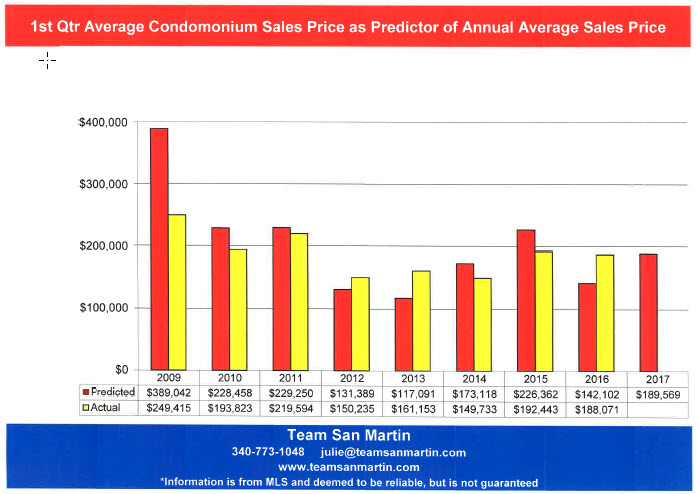

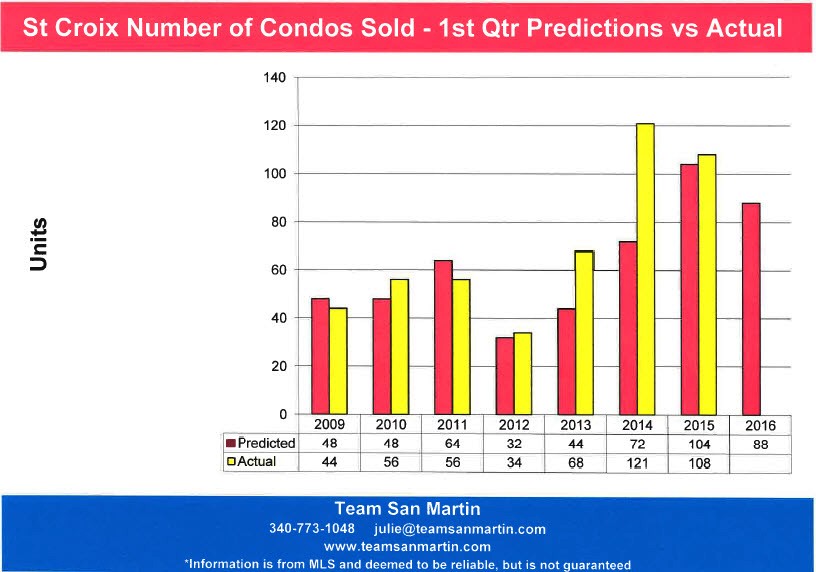

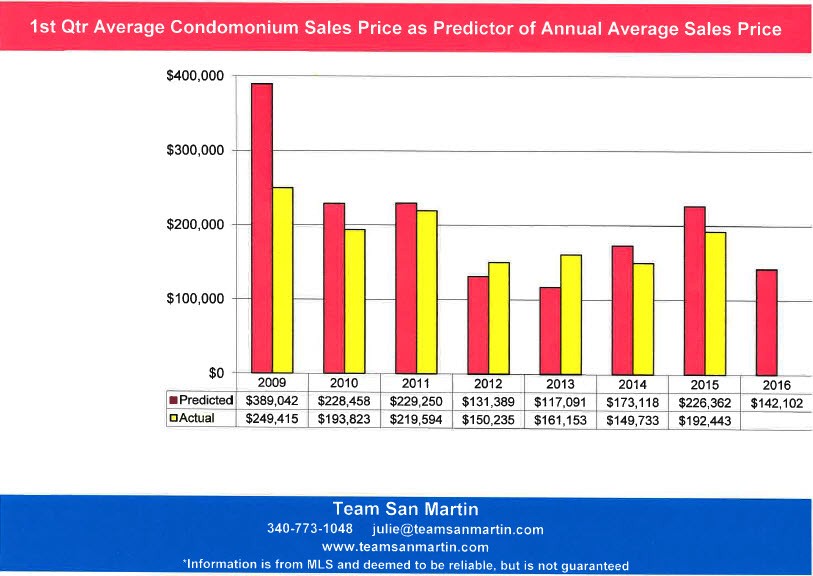

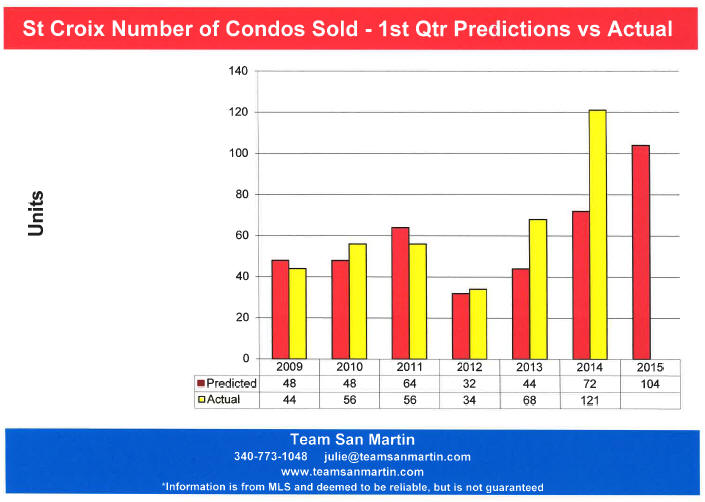

Condominium Sales & 2025 Predictions

Condominiums are a much smaller market, with just a few units built since the 1980s. It is more difficult to identify trends because the sample is significantly smaller.

Since 2015, the number of condominium sales on St Croix has been in the 100 to 150 unit annual range.

1st quarter average sale price has, in most cases, been a fairly close predictor for the year.

2025 annual prediction:

· Total number of condominiums sold will be in the 100 unit range.

· Average sales price will most likely be in the low $300,000 range.

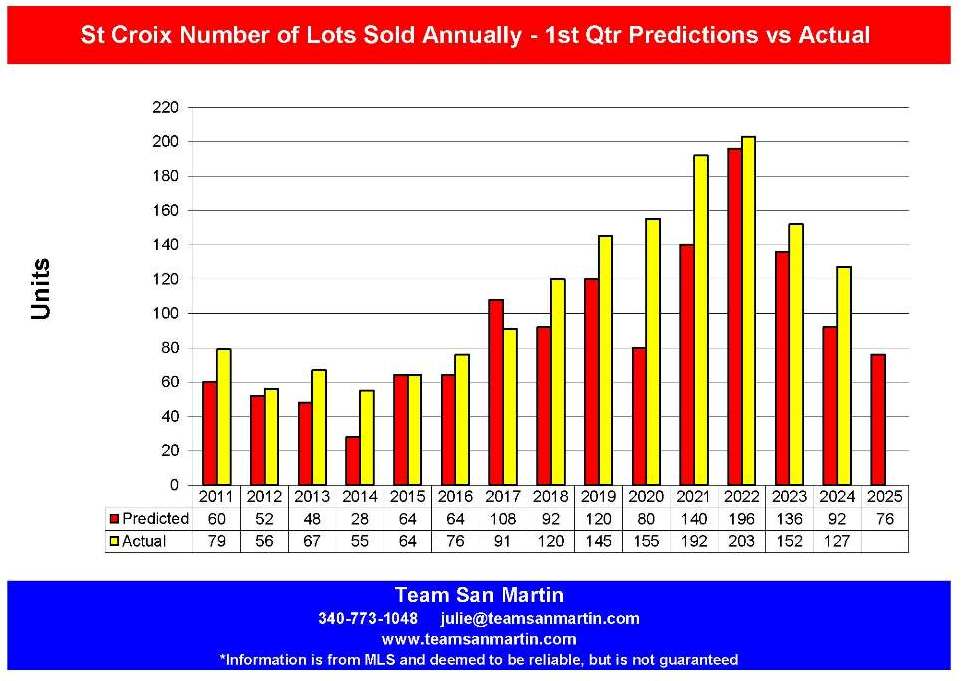

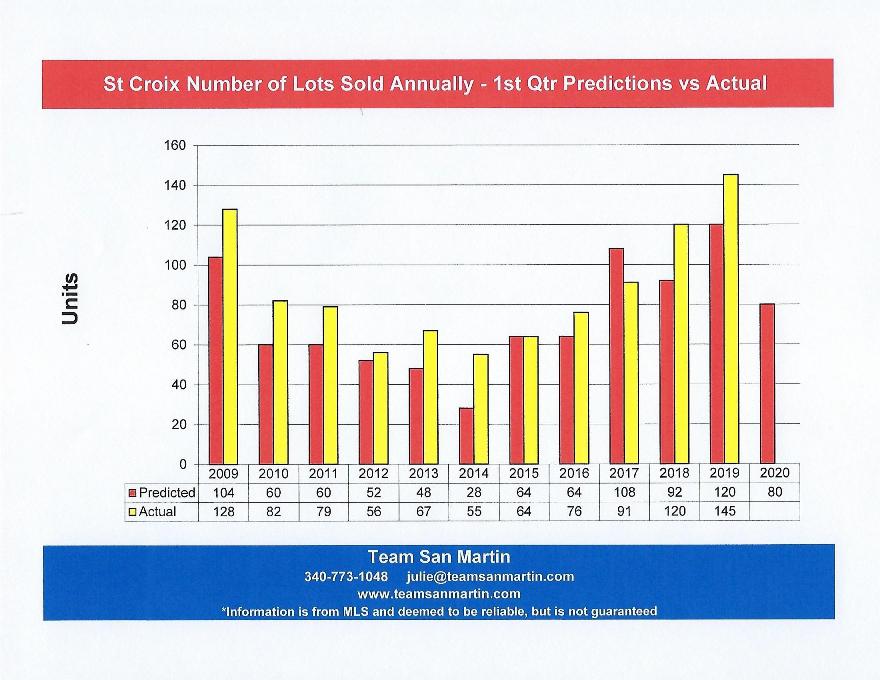

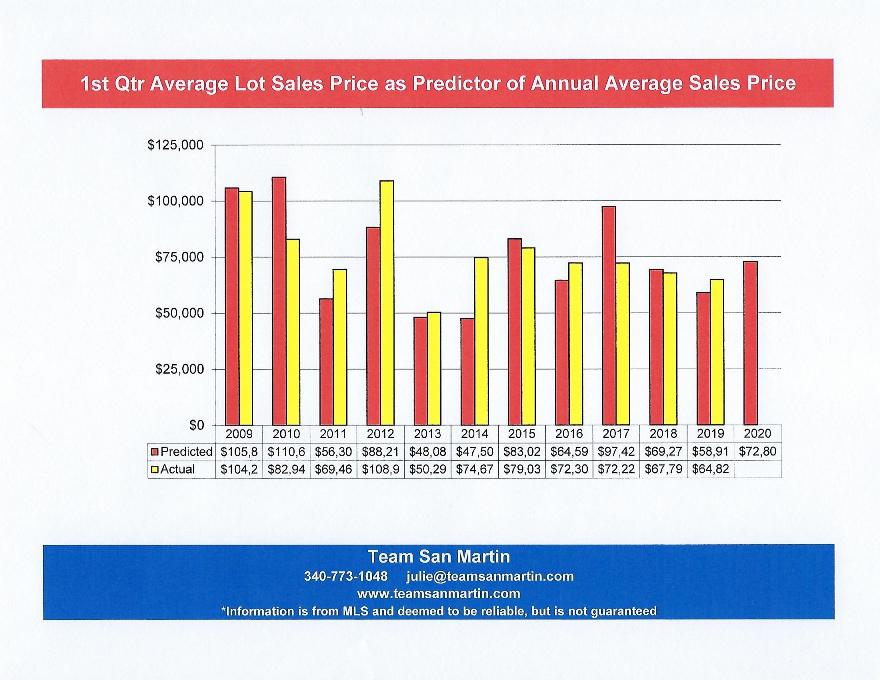

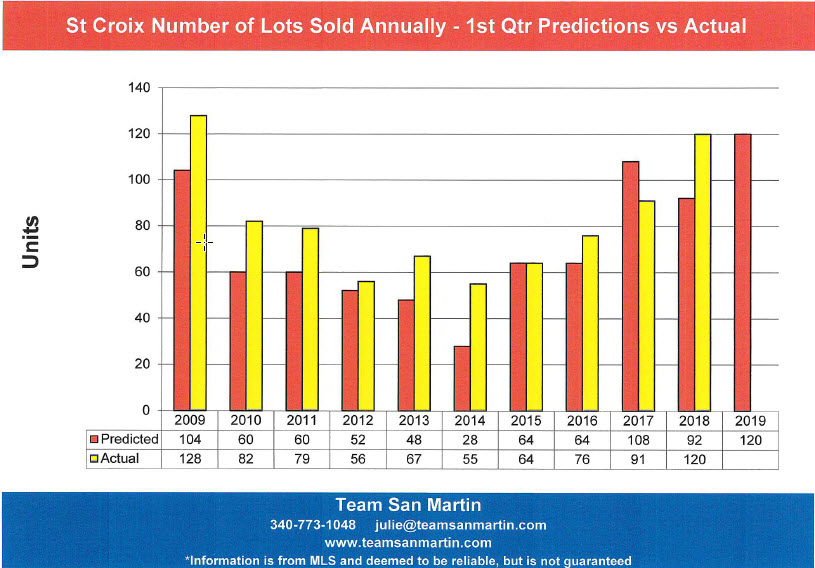

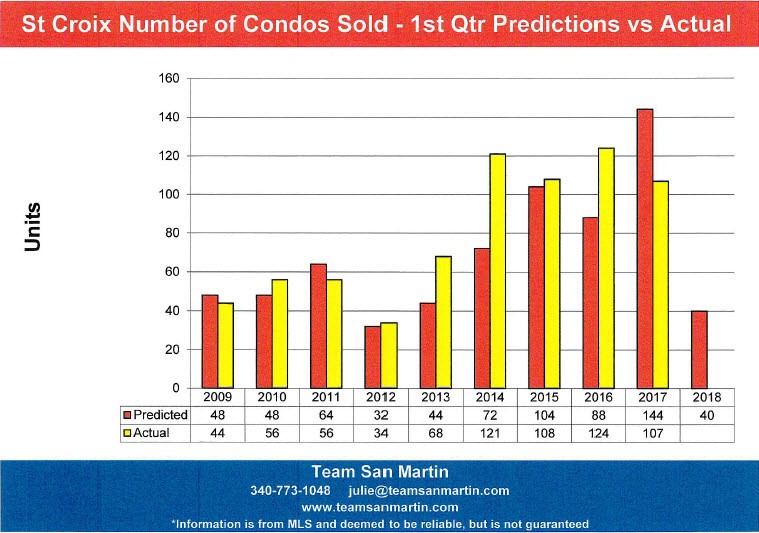

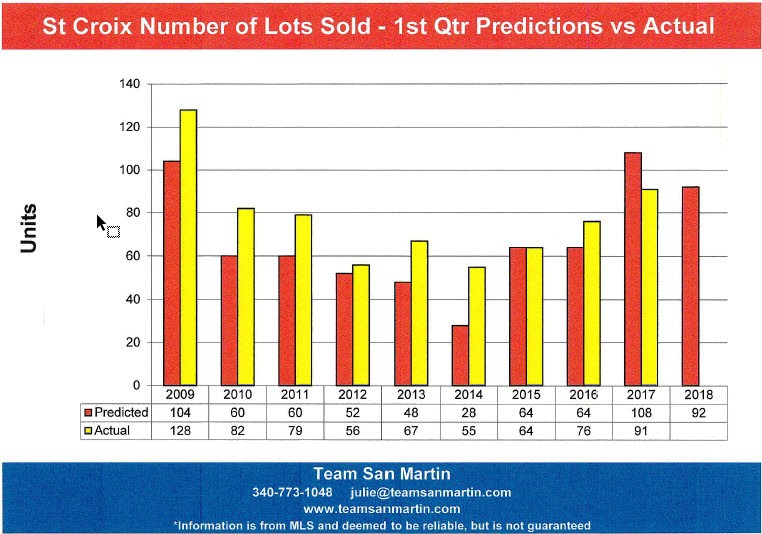

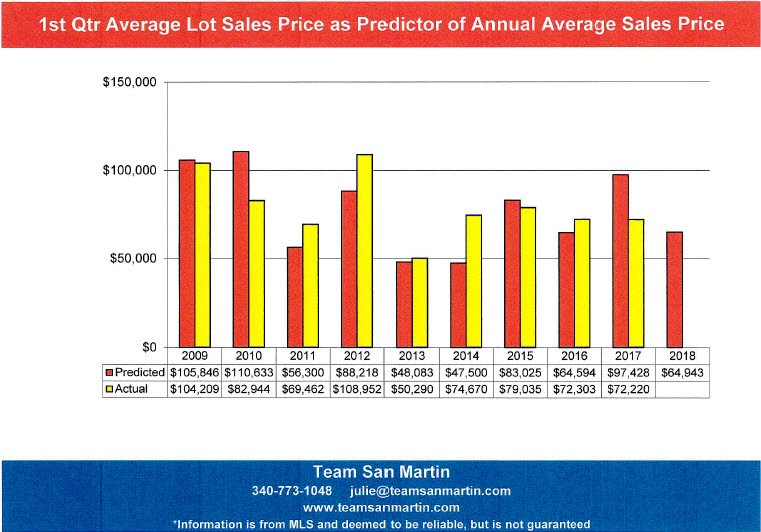

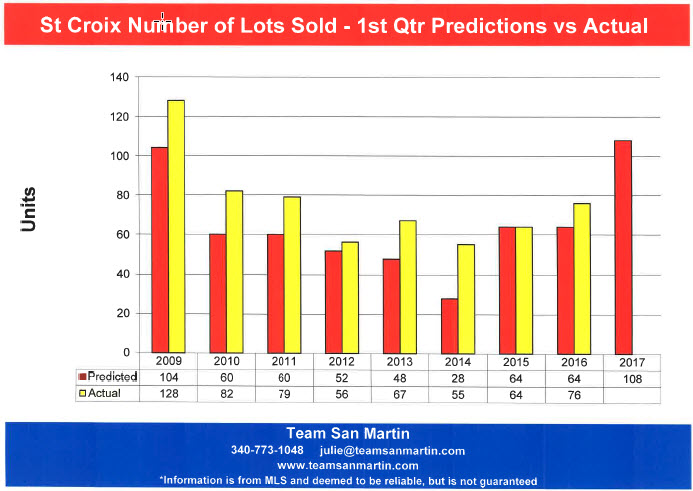

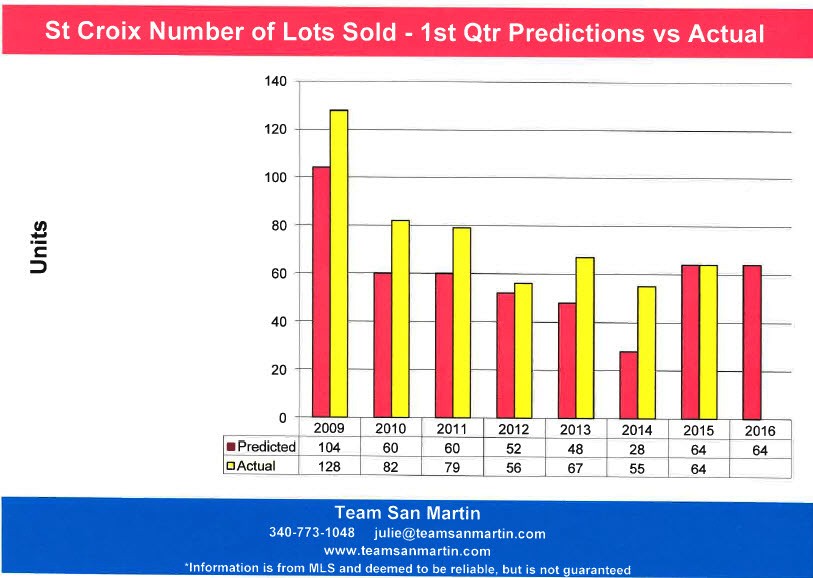

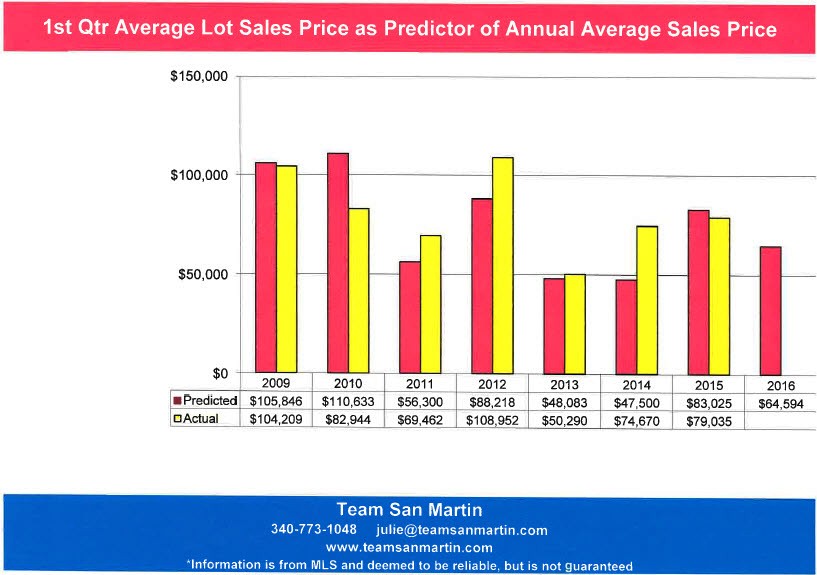

Land Sales & 2025 Predictions

Both predicted and actual number of lots sold were trending up until 2023. The number of lots sold declined 37% from 2022 to 2024. The 2025 1st quarter figure predicts only 76 lot sales during 2025.

For the period of 2021 through 2023, the average lot sales price was in the $100,000 range. The 2025 prediction, based on 1st quarter sales, is a return to an average sales price in the $90,000 range.

2025 annual prediction:

· Total number of lots sold will be under 100.

· The 2025 average lot sales price will be in the $90,000 range.

Information is from MLS and deemed to be reliable, but is not guaranteed.

Prepared by:

Julie San Martin

Team Manager

March 2025

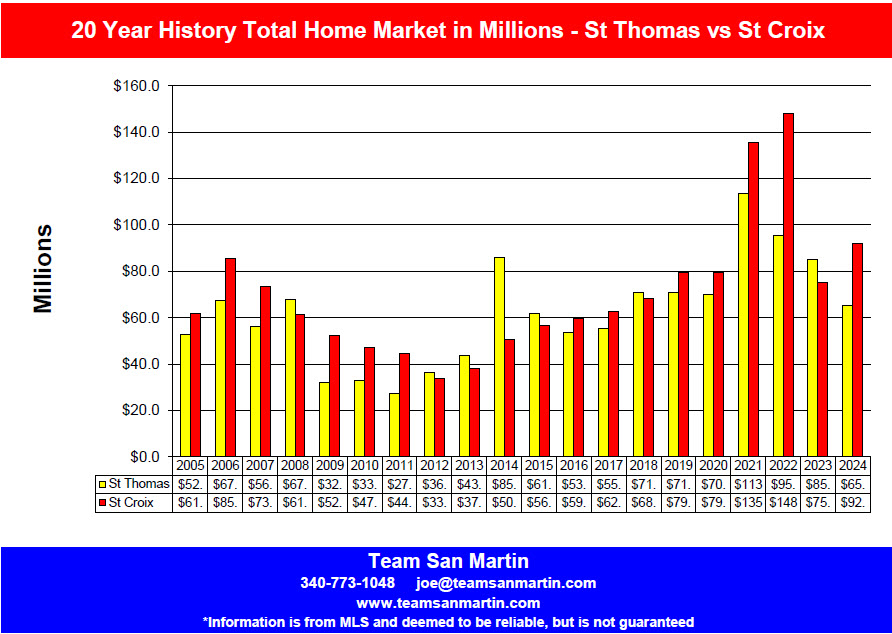

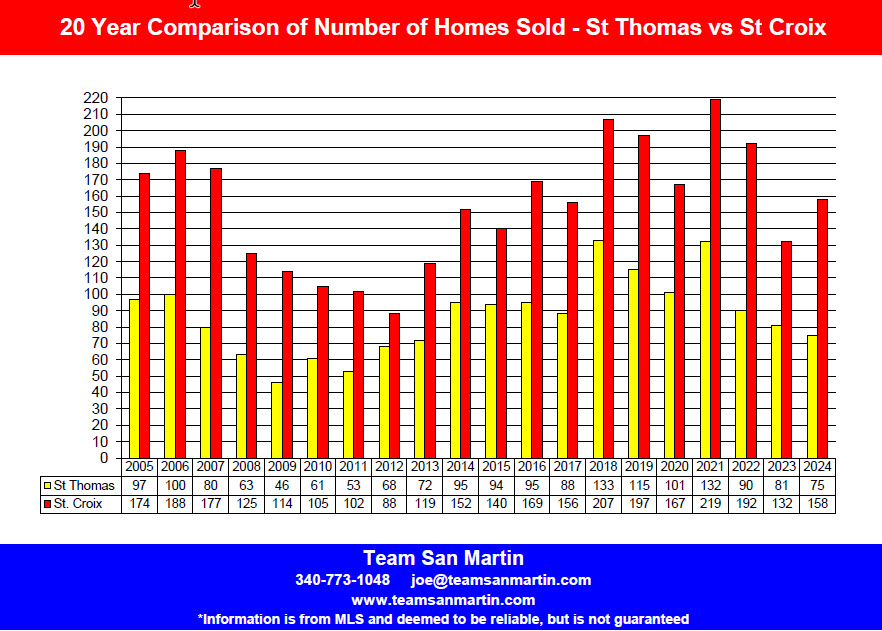

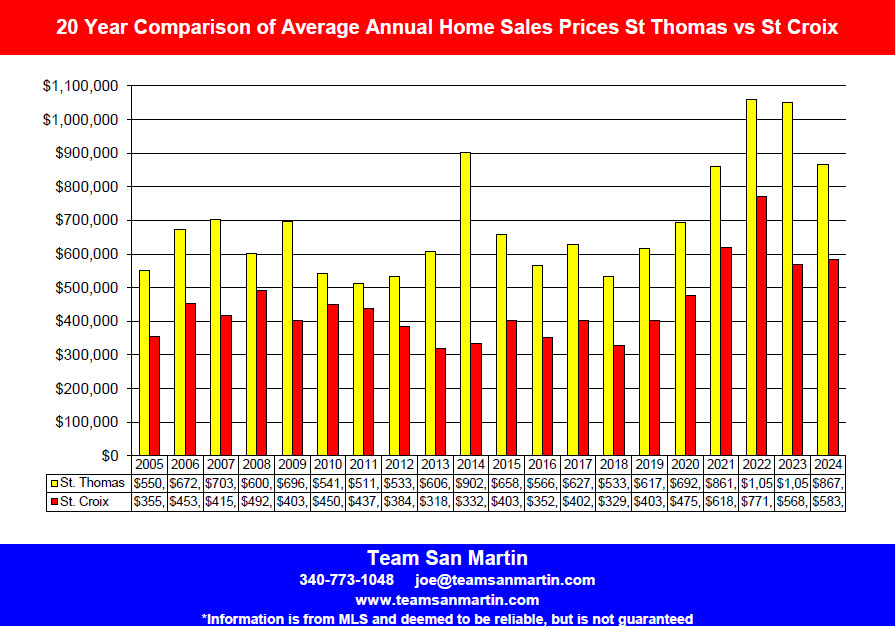

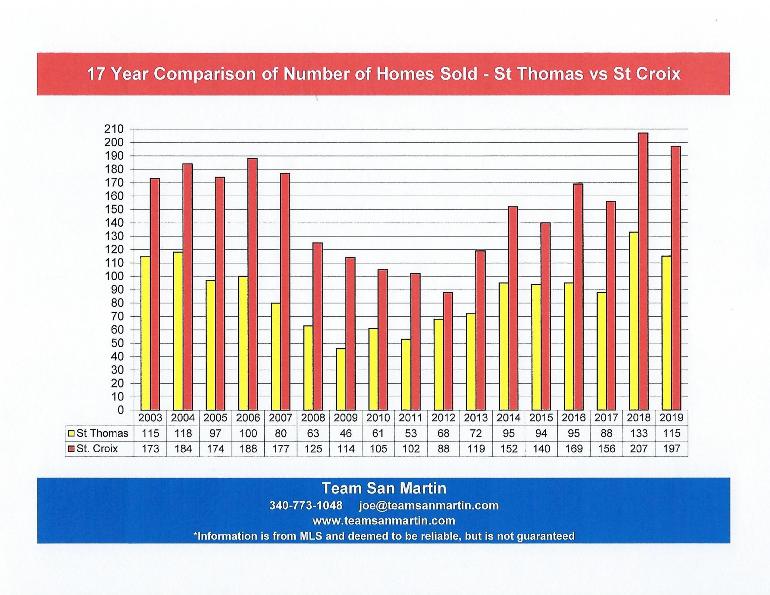

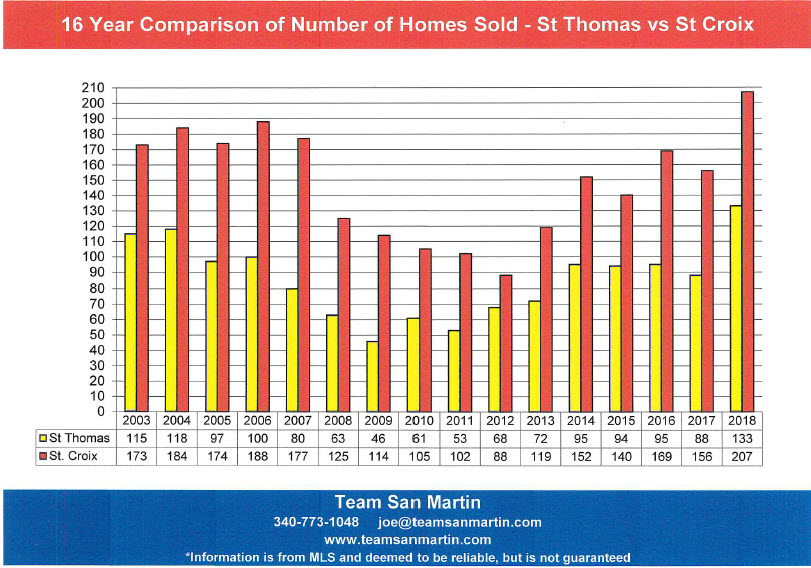

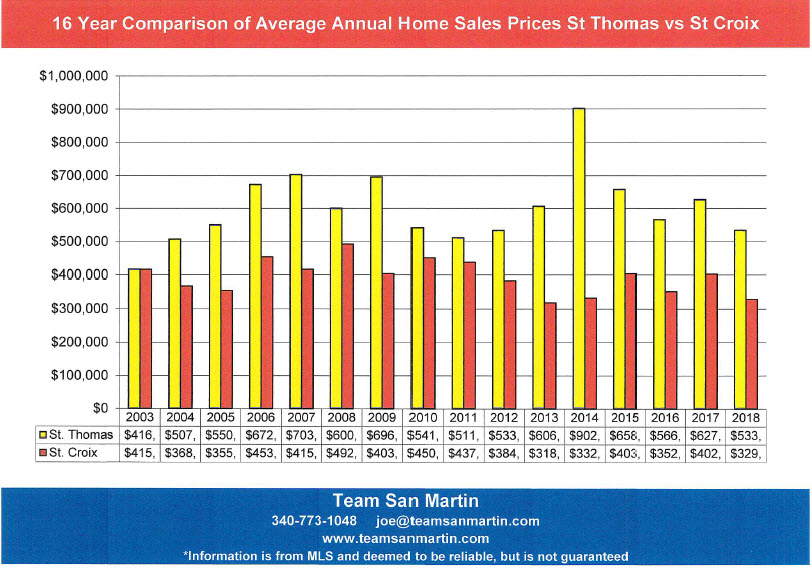

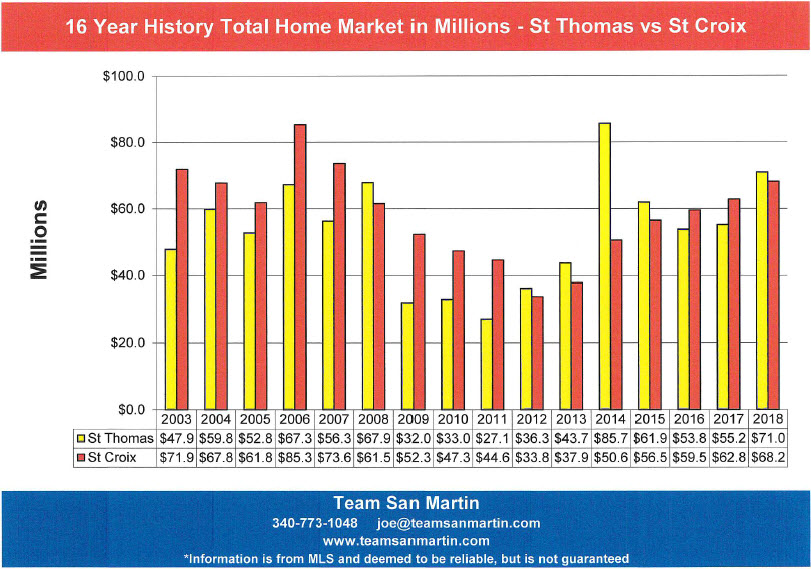

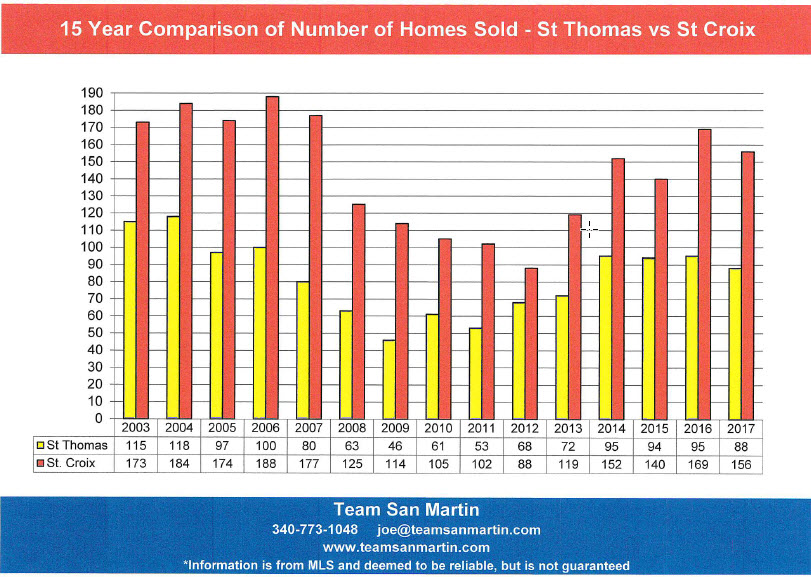

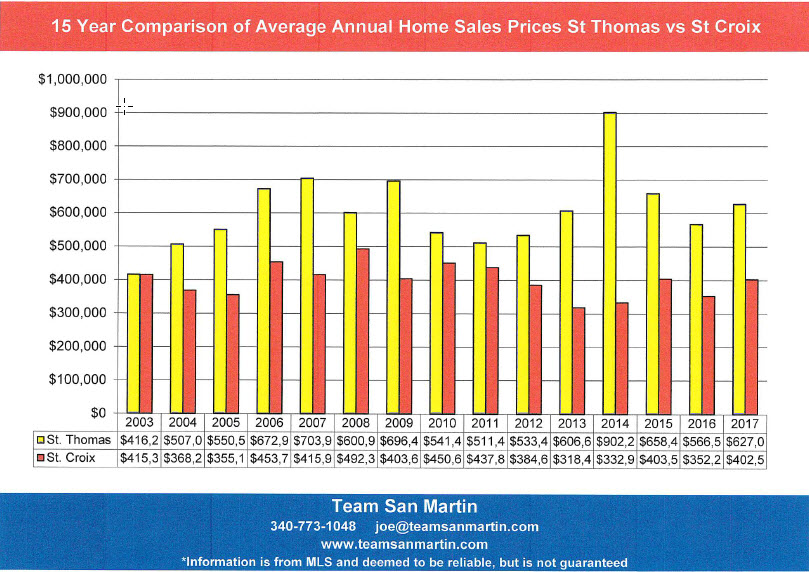

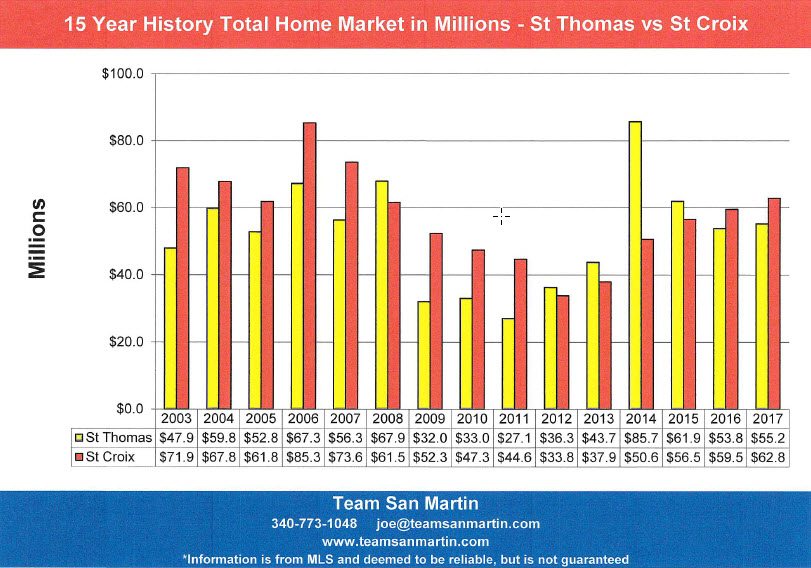

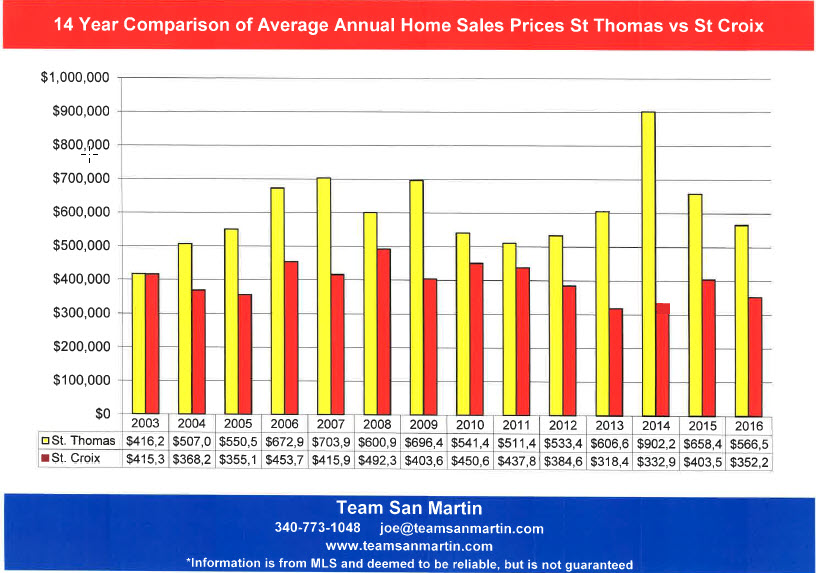

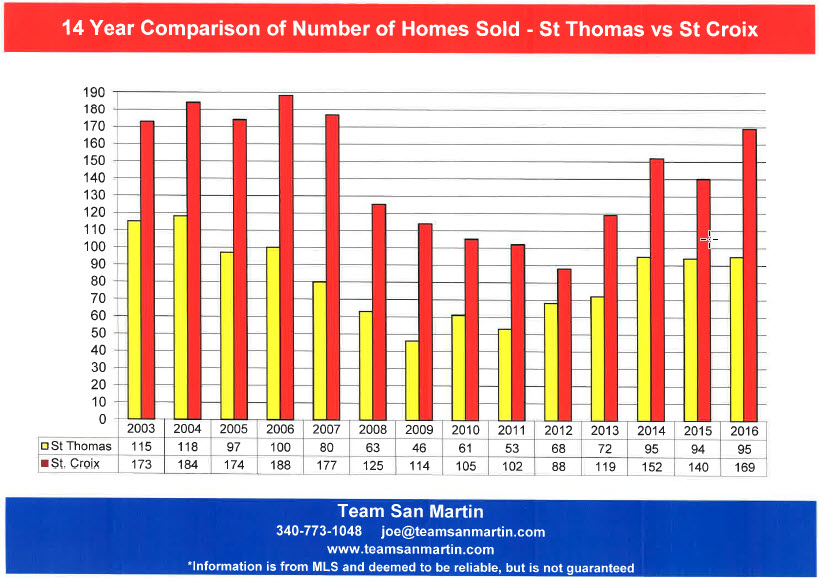

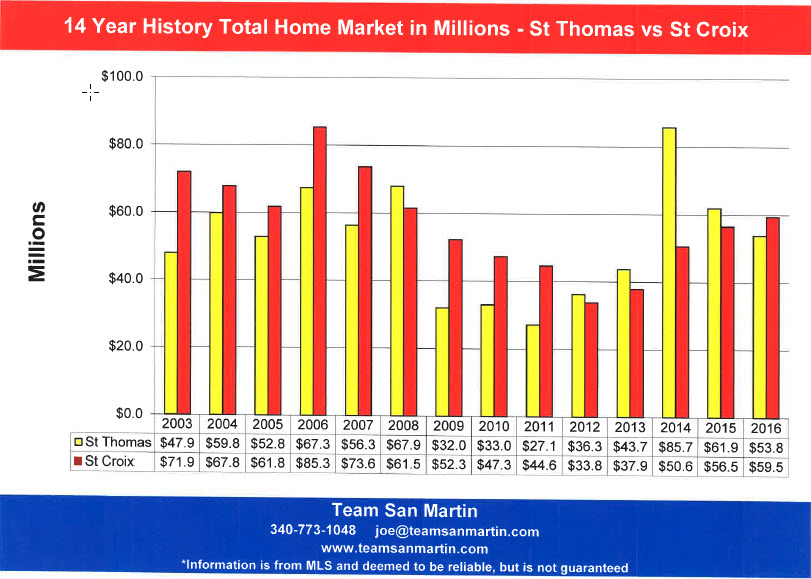

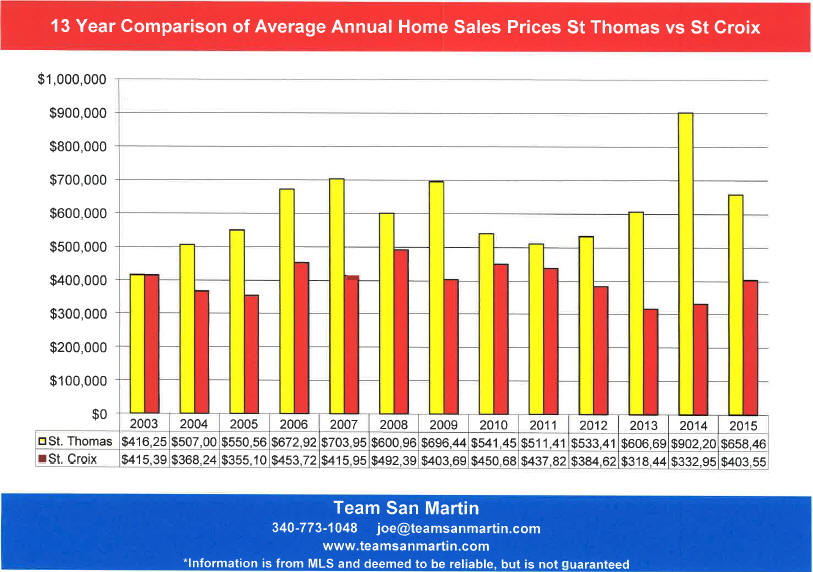

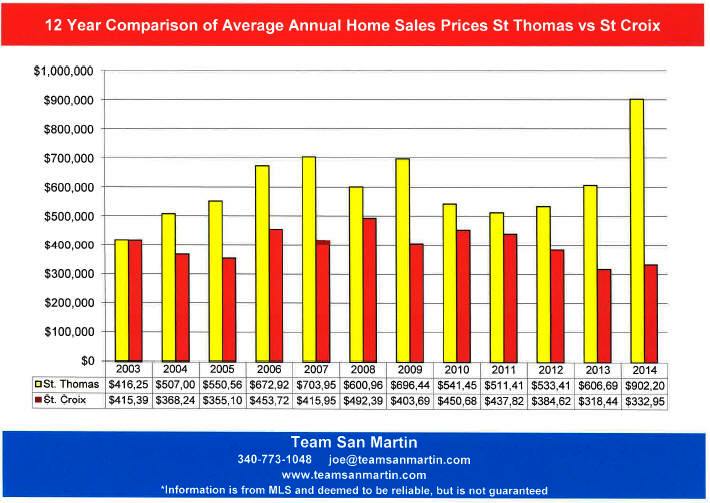

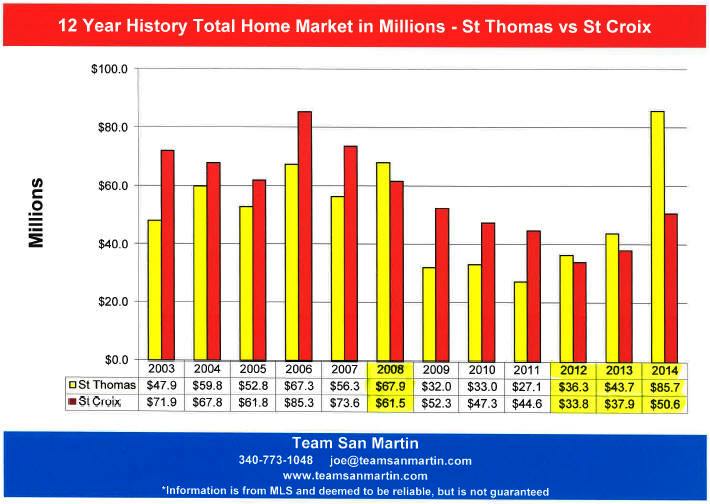

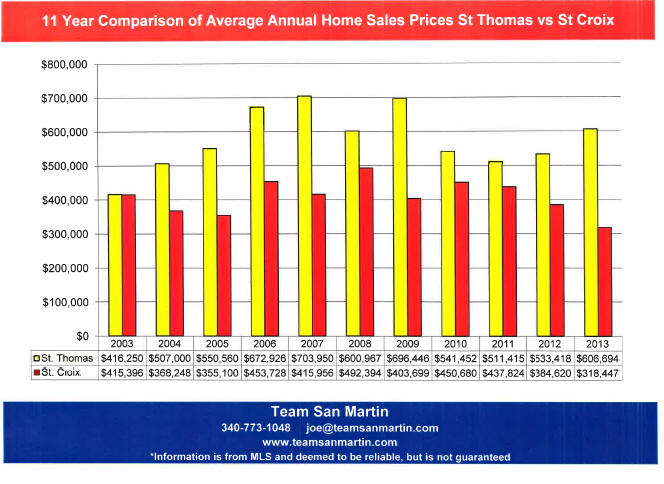

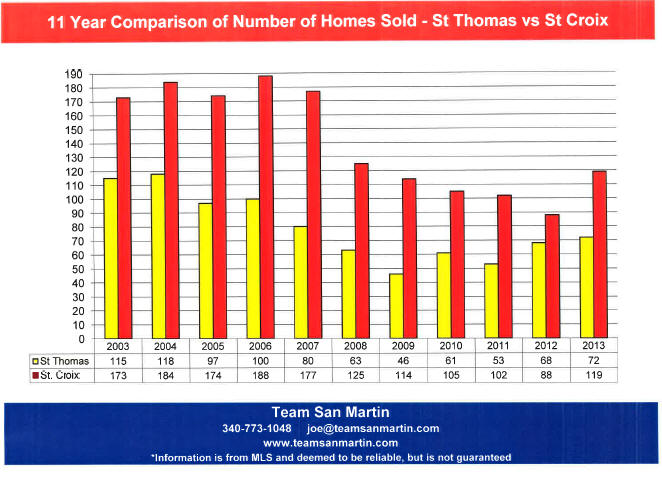

Home Sales

St Thomas vs St Croix

A 20 Year Look

Total Number of Properties Sold

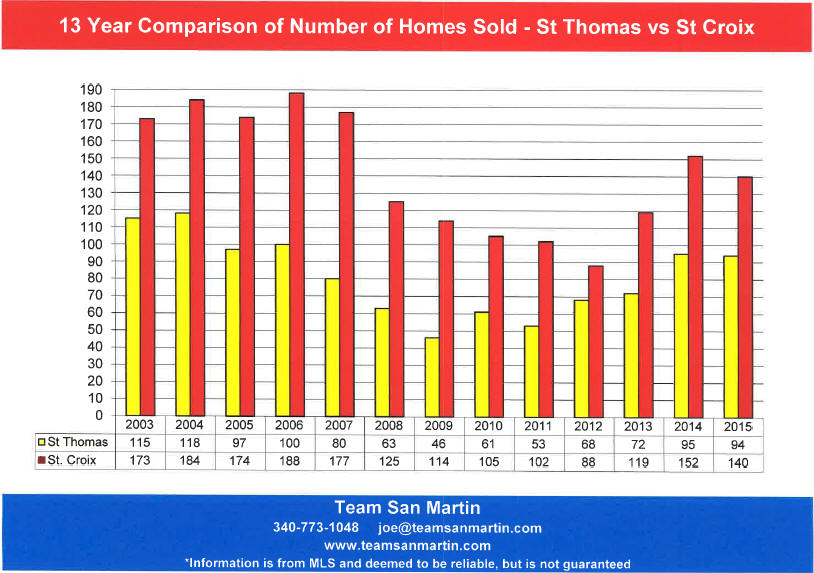

· Over the 20-year period, more homes sold every year on St Croix than on St Thomas.

· Over the 20-year period, the highest number of homes sold was in 2021 for St Croix with 219 home sales and 2018 for St Thomas with 133 home sales; 2021 was nearly the same, with 132 home sales on St Thomas.

· During 2024, 83 more homes were sold on St Croix than on St Thomas.

· Over the 20-year period, the fewest number of homes sold on St Croix (88) was during 2012, the fewest number of homes sold on St Thomas (46) was during 2009.

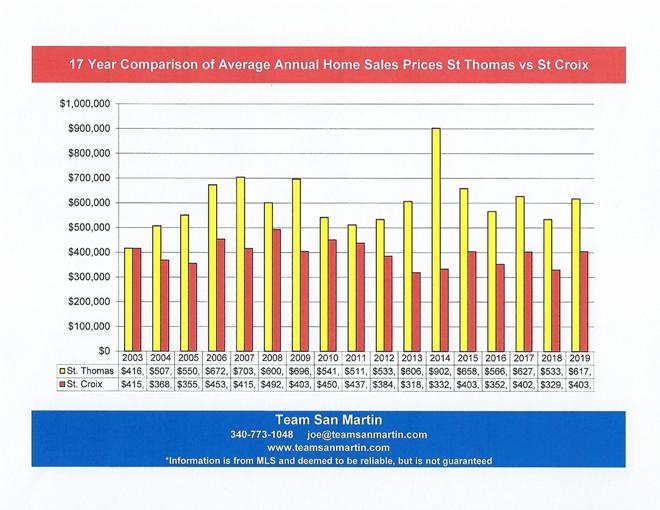

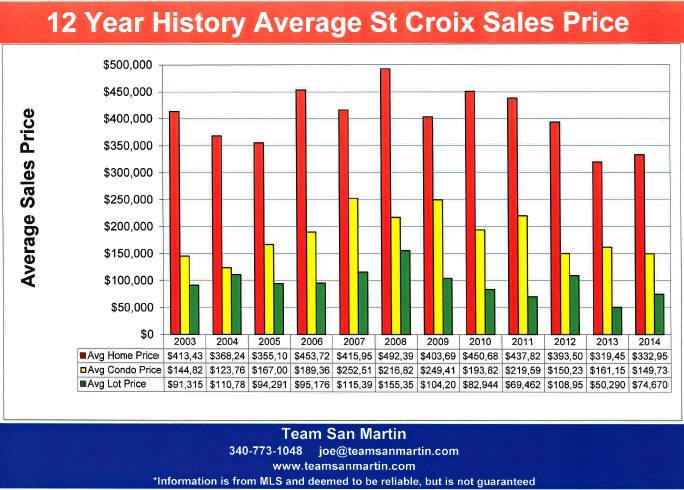

Average Sales Price

· For the past 20 years, the annual average home sale price on St Thomas has exceeded that of St Croix.

· For 2024, the average St Thomas home sale price was 57% higher, at $867,561, than the 2004 average sales price ($550,560).

· The average annual home sale price on St Croix for 2024 was 64% higher, at $583,099, than the 2004 average home sale price ($355,100).

· For 2024, the average sale price of a home on St Croix ($583,099) was 67% of the average sales price of a home on St Thomas ($867,561).

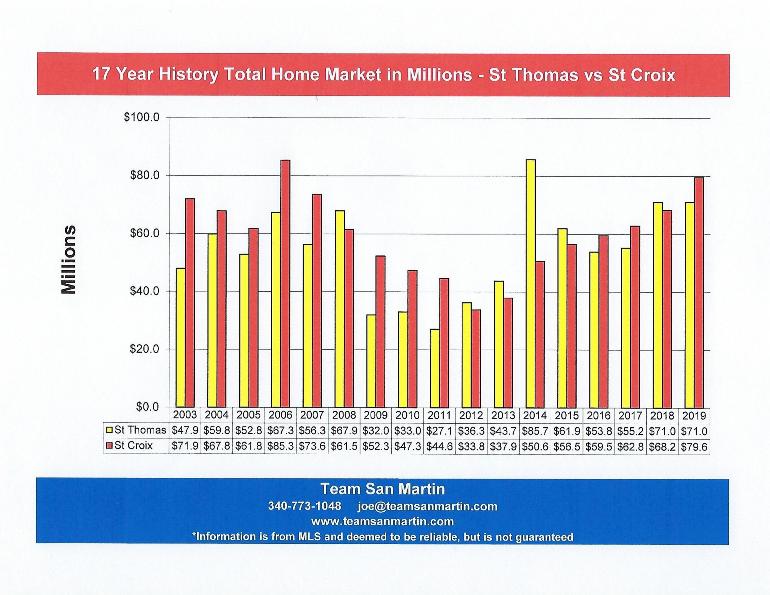

Total Market in Millions of Dollars

· This measurement is a combination of total homes sold multiplied by average sales price; it gives the best overview of annual market performance.

· During this 20-year period, the total St Thomas residential market exceeded the total St Croix market during six years: 2008, 2012, 2013, 2014, 2015, 2018, and 2023.

· During 2024, the total St Croix residential market ($92.1 Million) exceeded the total St Thomas residential market ($65.1 Million) by $27 Million.

Information is from MLS and deemed to be reliable but is not guaranteed.

Prepared by:

Julie San Martin Team Manager

February 2025

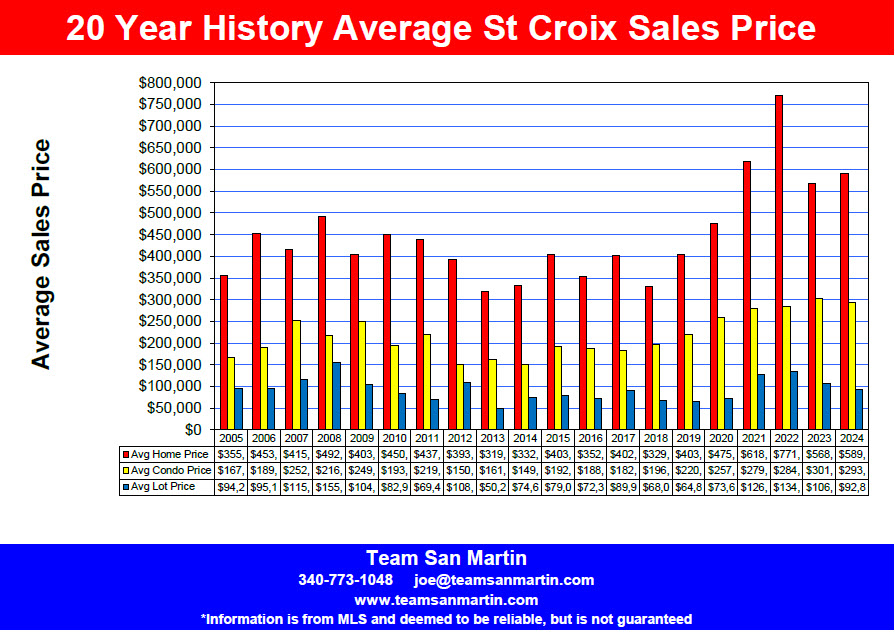

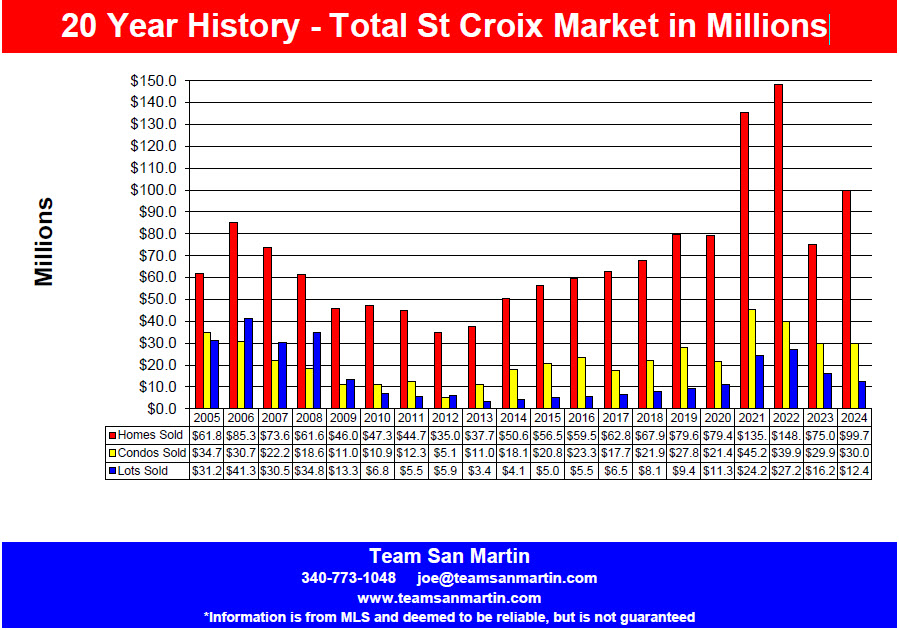

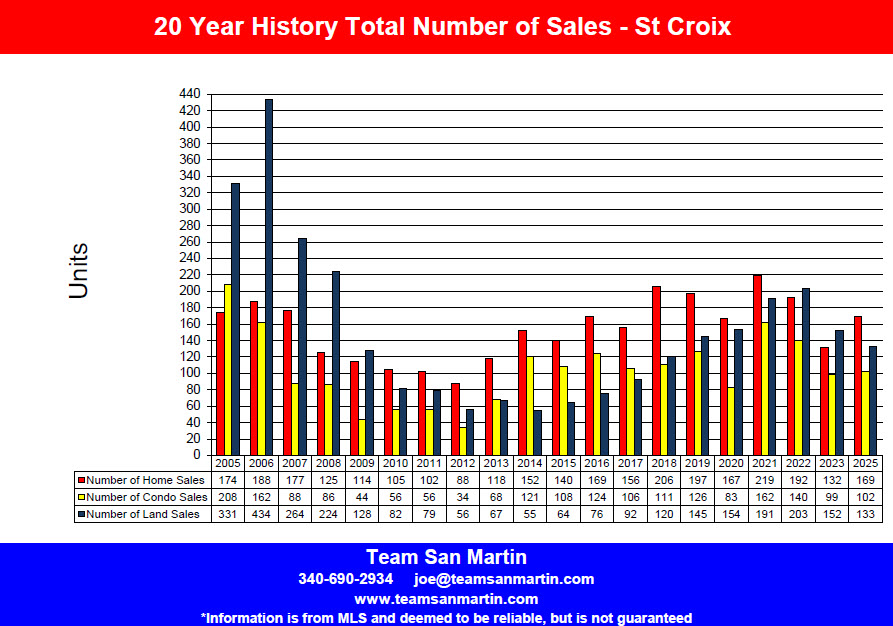

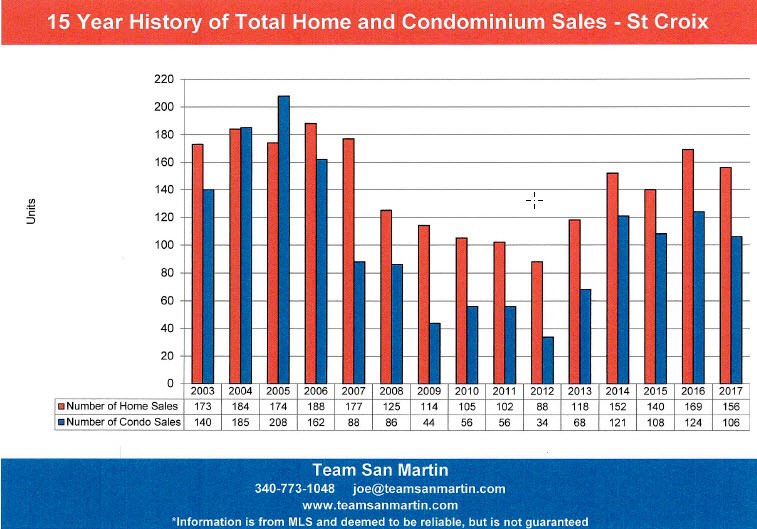

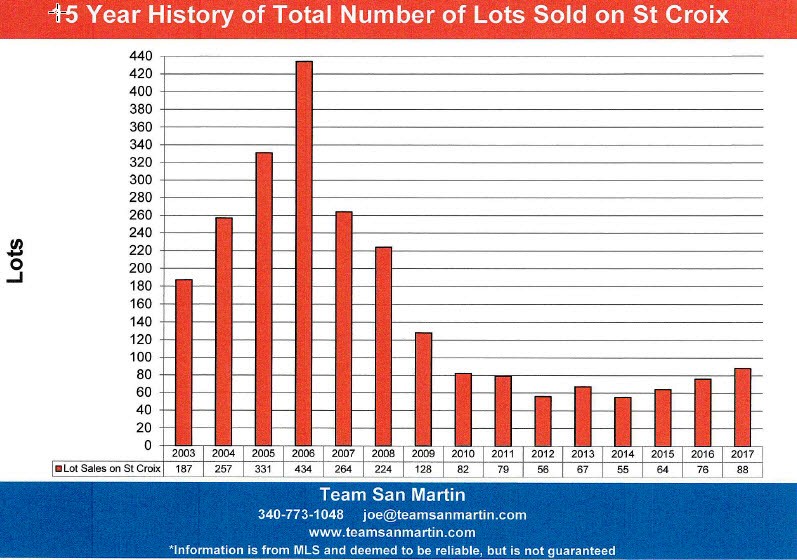

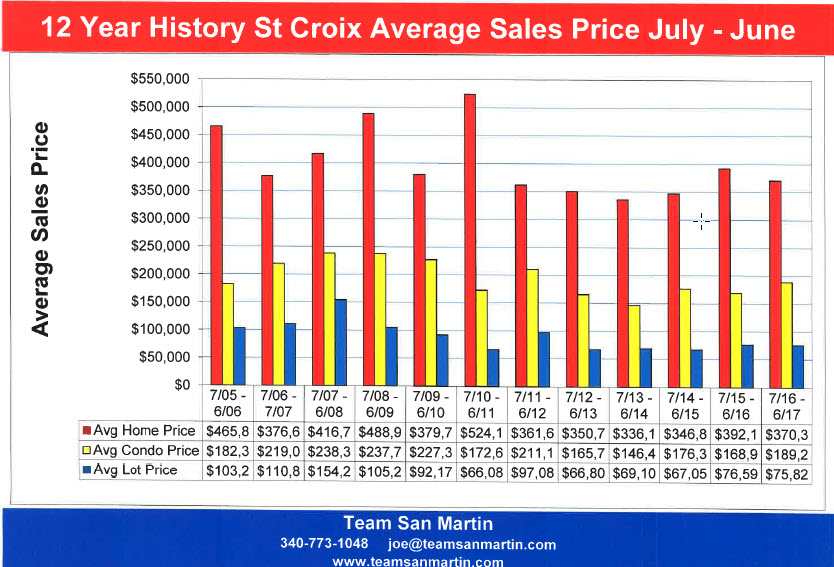

The St Croix Real Estate Cycle

A 20 Year Look

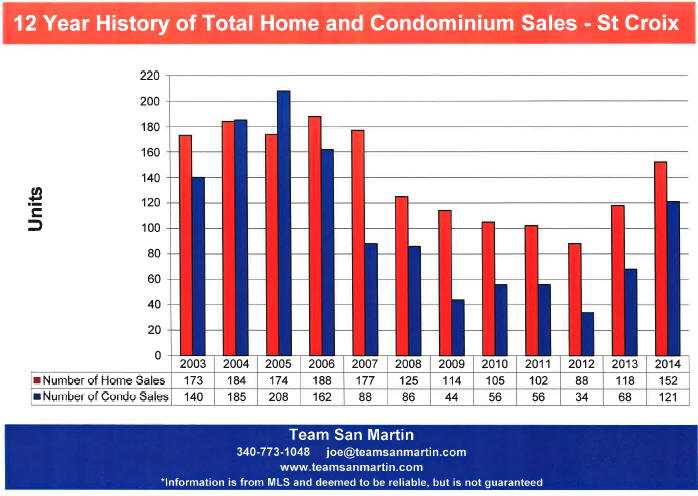

2024 St Croix real estate sales were mixed.

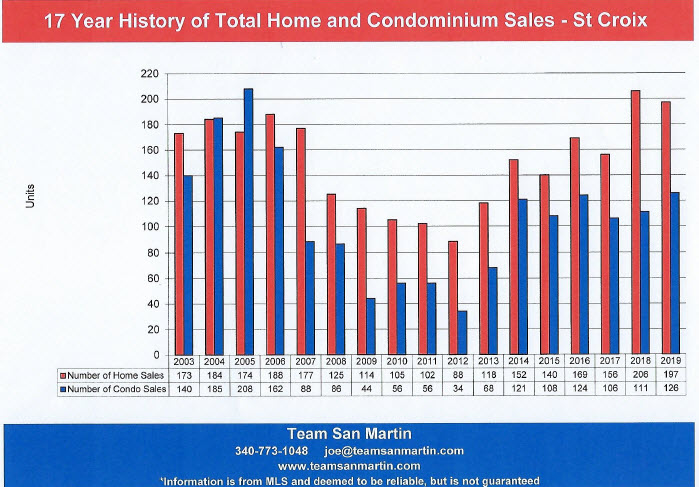

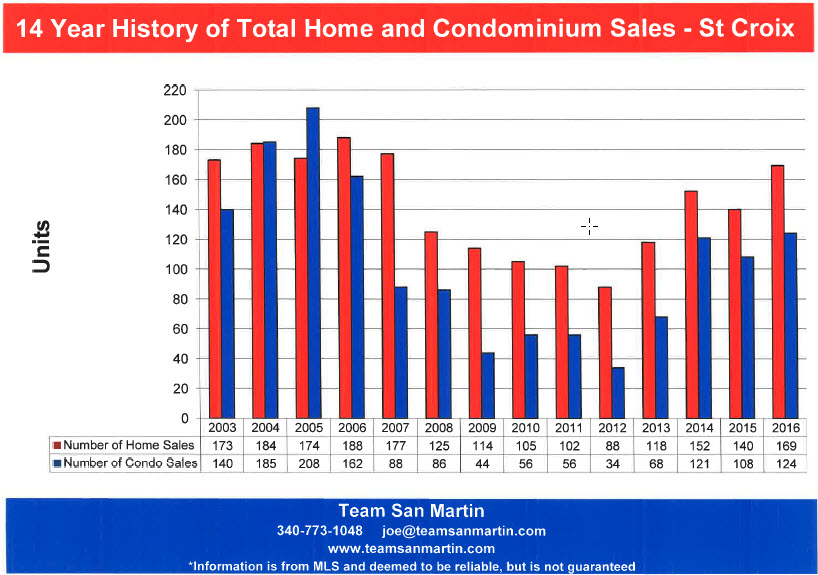

Total Number of Properties Sold

· The number of homes sold on St Croix during 2024 (169) is 37 more homes sold than the previous year (132) and 5 fewer than 20 years ago (1744).

· There were 102 condominium sales on St Croix during 2024, 3 more than the previous year (99) and 106 fewer than twenty years ago (208).

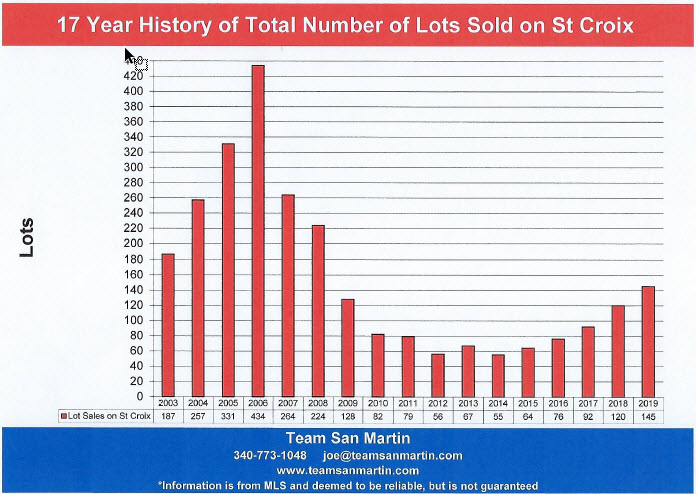

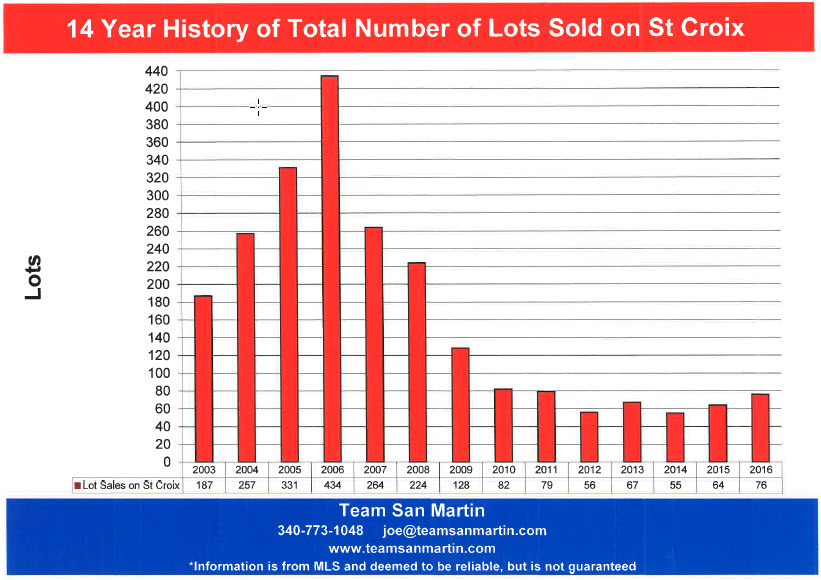

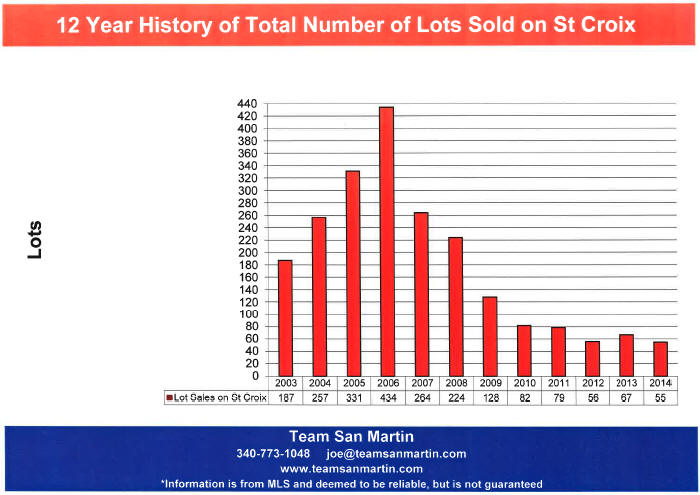

· There were 133 lot sales in 2024. This is 19 fewer than the previous year (152) and 198 fewer than 20 years ago (231).

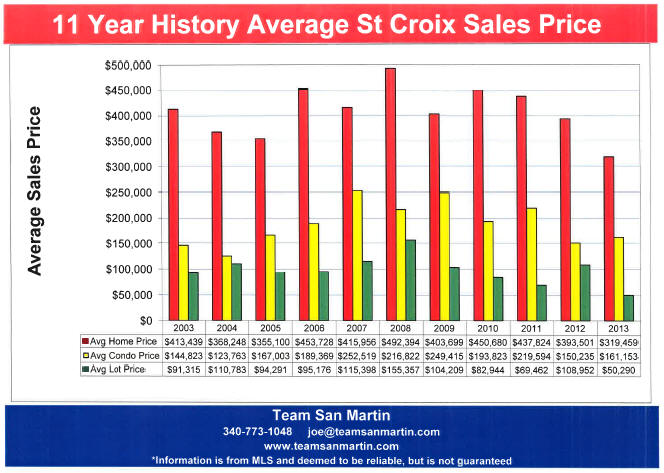

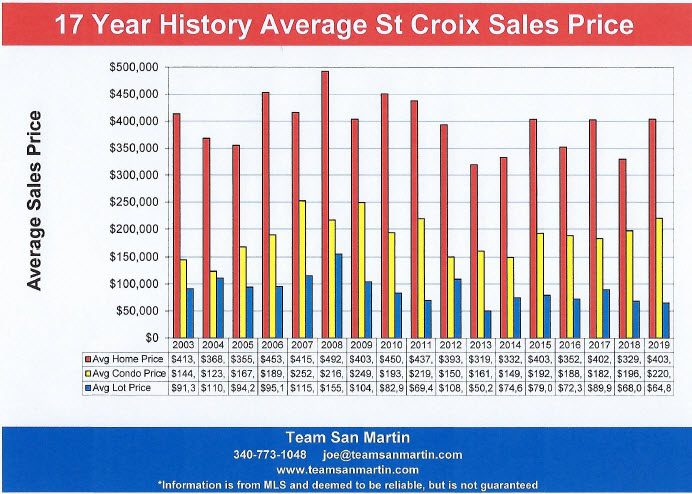

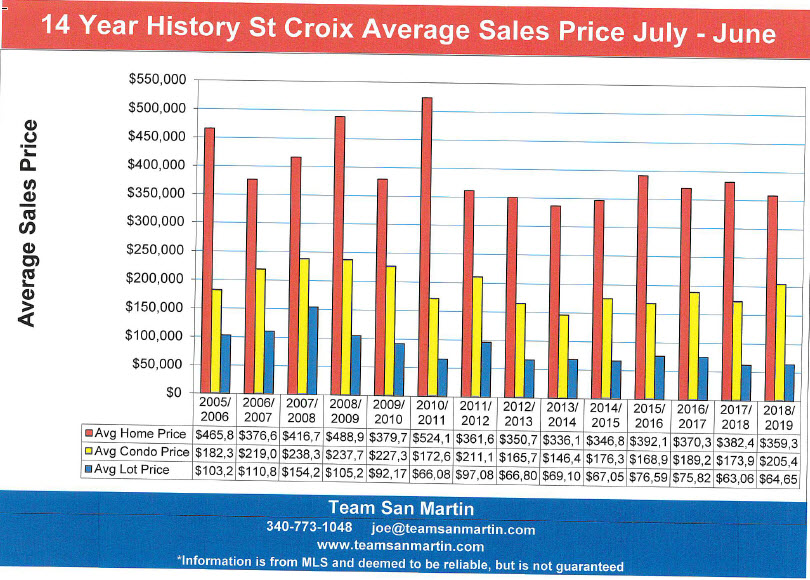

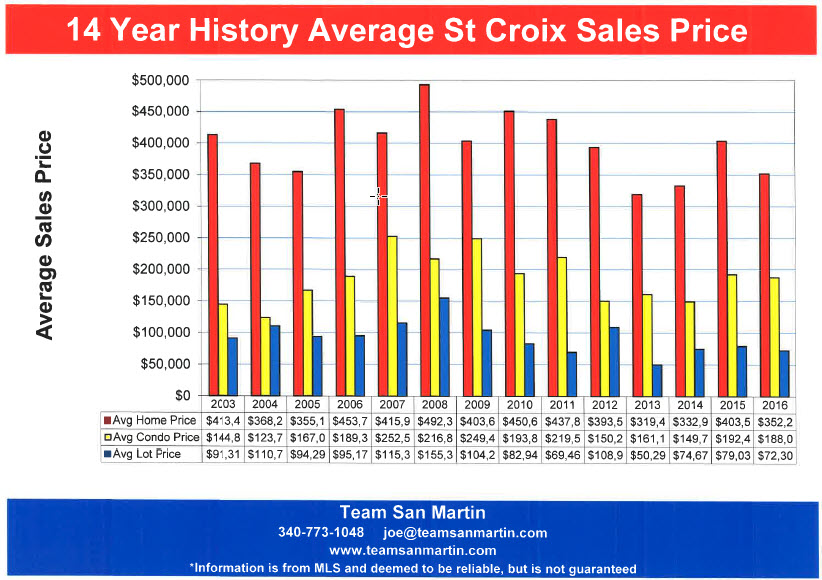

Average Sales Price

· At $589,856, the average 2024 home sales price was exceeded only by the 2021 average home sales price ($618,943) and 2022 average home sales price ($771,242). The average 2024 home sales price is $234,756 higher than 20 years ago ($3555,100).

· The 2024 average condominium sales price ($293,590) is exceeded only by the 2023 average sales price ($301,649), also the highest average sales price of the entire 20-year period. The average 2024 sales price is $126,587 higher than 20 years ago ($167,003).

· The average 2024 lot sales price ($92,858) is $13,877 lower than the previous years average lot sale price ($106,435), a 13% decrease, and $1,433 lower than the 2005 average lot sale price of $94,291.

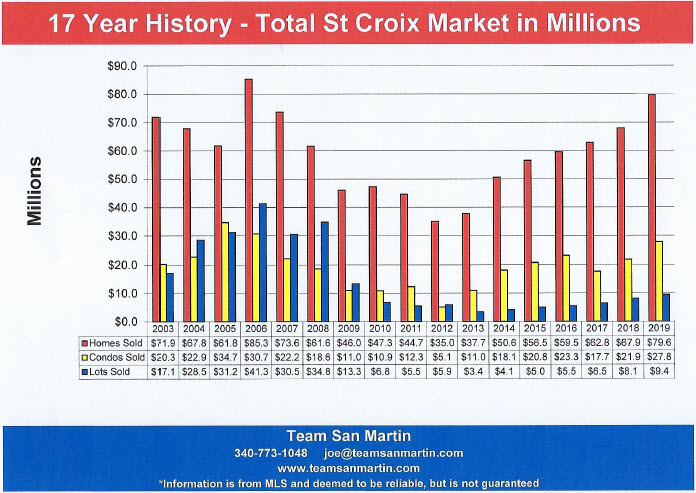

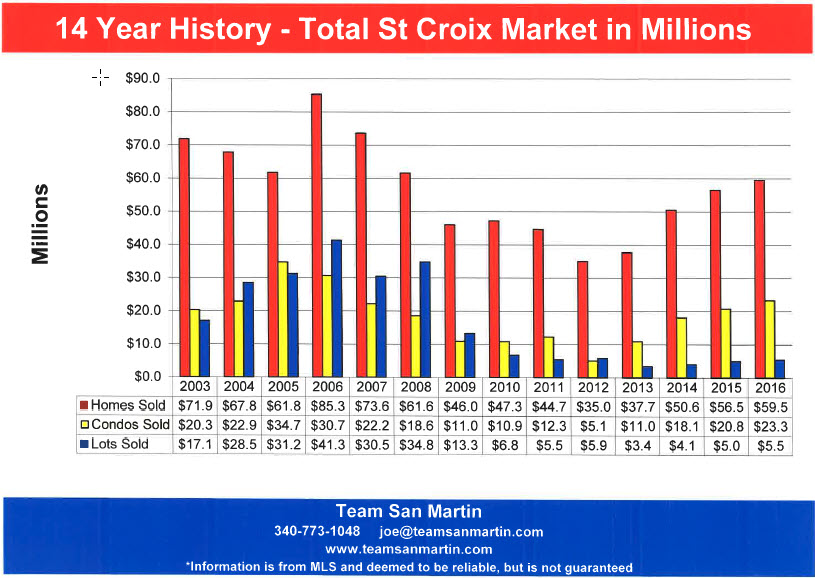

Total Market in Millions of Dollars

· The 2024 total residential market ($99.7 million) is 67% of the 2022 record setting market of $148.1 million. Only 2 years during this 20-year period exceeded the 2024 figure: 2021 ($135.5 million) and 2022.

· The 2024 total condominium market ($30 million) exceeded 2023 by $100,000. Only 3 years during this 20-year period exceed 2024: 2005 ($34.7 million), 2021 ($45.2 million), and 2022 ($39.9 million).

· The 2024 total land market ($12.4 million) is $3.8 million lower than the previous year ($16.2 million) and $18.8 million less than 20 years ago ($31.2 million).

Information is from MLS and deemed to be reliable but is not guaranteed.

Prepared by:

Julie San Martin

Team Manager

January 2025

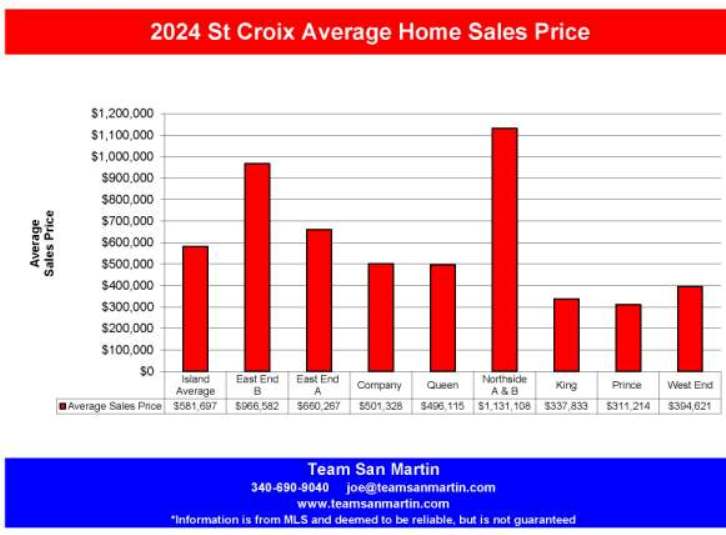

10 Year St Croix Home Sales Price Trends

The average sales price of a home on St Croix increased $178,143 over the

10-year period; this is a 44% increase.

Total number of homes sold annually decreased 12% (17 homes) since 2015.

All areas of the island did not perform the same.

East End B

Far East End

Compared to 9 years ago, the average sales price of a home increased 44% ($297,382 increase).

The number of homes sold in a year decreased by 8 homes, compared to 9 years ago.

25 homes sold in 2015, 17 homes sold in 2024.

East End A

Christiansted East to Coakley Bay

Compared to 9 years ago, the average sales price of a home increased 14%

($81,447 increase).

The number of homes sold in a year increased by 5 homes, compared to 9 years ago;

25 homes sold in 2015, 30 homes sold in 2024

Company

Christiansted West to the East Side of Judiths Fancy

Compared to 9 years ago, the average sales price of a home increased 51% ($168,370 increase).

The number of homes sold in a year increased by 9 homes, compared to 9 years ago,

from 12 home sales in 2015 to 21 home sales in 2024.

Queen

Constitution Hill West to La Reine, includes southwest

Judiths Fancy

Compared to 9 years ago, the average sales price of a home increased 69%

($203,139 increase).

The number of homes sold in a year increased by 6 homes, compared to 9 years ago, from 20 homes sold in 2015 to 26 home sales in 2024.

Northside A & B

North Shore from North Judiths Fancy to Hamms Bluff

Compared to 9 years ago, the average sales price of a home increased 74% ($479,605 increase).

The number of homes sold in a year increased by 2 homes, compared to 9 years ago.

10 home sales closed in 2015, 12 home sales closed in 2024.

King

South Shore from La Reine West to UVI

Compared to 9 years ago, the average sales price of a home increased 140%

($197,271 increase).

The number of homes sold in a year increased by 4 homes, compared to 9 years ago, from 8 homes sold in 2015 to 12 home sales in 2024.

Prince

South Shore from UVI West to Williams Delight

Compared to 9 years ago, the average sales price of a home increased 45%

($96,814 increase).

The number of homes sold in a year increased by 5 homes, compared to 9 years ago, from 9 homes sold in 2015 to 14 home sales in 2024.

West End

South Shore, South from Mahogany Road,

East to Williams Delight

Compared to 9 years ago, the average sales price of a home increased 84%

($180,221 increase).

The number of homes sold in a year is unchanged, compared to 9 years ago, with 23 homes sales in 2015 and 23 homes sales in 2024.

Observations

Average home sales prices in three areas of the island consistently exceed the

island wide average home sales price:

· East End B

· East End A

· Northside A & B

Average home sales prices are consistently much lower than the island wide average home sales price:

· Company

· Queen

· King

· Prince

· West End

More homes sold in all quarters during 2024, when compared to 2015 except for:

· East End B

Compared to 2023, the island wide average home sale price increased 2%.

All quarters experienced increased average sales prices except for:

· East End A

· Northside A & B

Information is from MLS and deemed to be reliable but is not guaranteed.

Prepared by:

Julie San Martin

Team Manager

December 2024

up to November

Ten Year Inventory Level Trends

Current Annual supply represents the number of years it will take at the current rate of sales to sell all the properties listed in a specific area (Quarter) of St Croix.

[Active Listings + Pending Listings] /

Number of Listings Sold During the Previous 12 Months

For example:

In November 2024, there were 15 active and 5 pending home sales in East End B, with 17 home sales in the previous 12 months, for a 1.2-year supply of homes for sale

[15 + 5] / 17 = 1.2 Years

East End B

Far East End

Residential

Compared to 9 years ago, home inventory is unchanged at 1.2 years; average sales price increased 43%; from $637,077 to $910,112.

Compared to last year, average time on the market decreased by 1 year;

average sales price increased 5% (from $867,818 to $910,112)

Condominium

Compared to 9 years ago, condominium inventory increased by 2 months; average sales price increased 59%, from $281,714 to $447,646

Compared to last year, average time on the market increased by 10 months;

average sales price increased 4% (from $431,772 to $447,646)

Vacant Land

Compared to 9 years ago, land inventory decreased by 4 years,

from 7.3 years to 3.3 years; average sales price increased 67% (from $58,575 to $97,861)

Compared to last year, land inventory increased by 2 months;

average sales price increased 10% (from $97,861 to $108,067)

East End A

Christiansted East to Coakley Bay

Residential

Compared to 9 years ago, home inventory decreased 1.6 years,

from 2.9 years to 1.3 years;

average home sale price increased 5%, from $631,295 to $666,000.

Compared to last year, residential inventory increased by about 2 months;

average sales price decreased 30% (from $958,694 to $666,000)

Condominium

Compared to 9 years ago, condominium inventory decreased by 5 months

(from 1.2 years to 0.8 years);

average condominium sales price increased 46% (from $242,965 to $353,800)

Compared to last year, condominium inventory increased by 2 months;

average sales price increased 3% (from $344,917 to $353,800)

Vacant Land

Compared to 9 years ago, land inventory decreased by 9.7 years,

from 12.3 years to 2.6 years;

average lot sales price increased 18%, from $93,571 to $110,914)

Compared to last year, land inventory decreased by 4 months;

average lot sales price increased 5% (from $105,958 to $110,914)

Company

Christiansted West to the East Side of Judiths Fancy

Residential

Compared to 9 years ago, residential inventory decreased by 1.9 years, from 3.7 years to 1.8 years; average home sales price increased 35% (from $342,409 to $463,647)

Compared to last year, residential inventory decreased by 11 months;

average home sales price increased 15% (from $401,789 to $463,647)

Condominium

Compared to 9 years ago, condominium inventory decreased by 10 months (from 1.6 years to 0.8 years);

average sales price increased 89% (from $122,610 to $231,886)

Compared to last year, condominium inventory decreased by 2 months, from 11 months to 9 months; average condo sales price decreased 7%

(from $250,163 to $231,886)

Vacant Land

Compared to 9 years ago, lot inventory decreased by 14 years, from 16.7 years to 2.7 years; average lot sales price increased 232%, from $22,5000 to $74,625.

Compared to last year, land inventory increased by 8 months, from 2 years to 2.7 years; average sales price increased 2%, from $73,286 to $74,625.

Queen

Constitution Hill West to La Reine, includes southwest

Judiths Fancy

Residential

Compared to 9 years ago, residential inventory decreased by 1.4 years

(from 2.9 years to 1.5 years);

average sales priced increased 92% (from $253,171 to $486,760)

Compared to last year, residential inventory increased by 4 months, from 1.2 years to 1.5 years; average sales price increased 20% (from $404,160 to $486,760)

Condominium

Compared to 9 years ago, condominium inventory decreased by

4.7 years (from 5.7 years to 1 year);

average condominium sales price increased 141% (from $88,333 to $213,053)

Compared to last year, condominium inventory increased by 4 months, from 8 months to 1 year; average sales price increased 10% (from $194,5629 to $213,053)

Vacant Land

Compared to 9 years ago, land inventory decreased by 5.2 years,

from 7.8 years to 2.6 years);

average lot sales price increased 40%, from $37,889 to $52,938.

Compared to last year, land inventory increased by 2 months, from 2.4 years to 2.6 years; average lot sales price decreased 36%, from $83,062 to $52,938.

Northside A & B

North Shore from North Judiths Fancy to Hamms Bluff

Residential

Compared to 9 years ago, residential inventory decreased by 1.6 years, from 2.9 years to 1.3 years; average home sales price increased 114%

(from $529,444 to $1,131,108)

Compared to last year, residential inventory decreased by 2 months, from 1.5 years to 1.3 years; average home sales price decreased 12% (from $1,292,500 to $1,131,108)

Condominium

Compared to 9 years ago, condominium inventory decreased by

4 months (from 10 months to 6 months);

average sales price increased 118% (from $239,670 to $523,333)

Compared to last year, condominium inventory decreased by 10 months, from 1.3 years to 6 months; average condo sales price decreased 4%,

from $542,143 to $523,333.

Vacant Land

Compared to 9 years ago, land inventory increased by

2 years, from 3.9 years to 5.9 years;

average lot sales price increased 2%, from $98,671 to $101,136.

Compared to last year, land inventory increased by 2.5 years, from 3.4 years to 5.9 years; average lot sales price decreased 20%, from $125,588 to $101,136.

King

South Shore from La Reine West to UVI

Residential

Compared to 9 years ago, residential inventory decreased by

1.4 years (from 2 years to 0.6 years);

average home sales price increased 156% (from $128,833 to $329,455)

Compared to last year, residential inventory decreased by

2 months (from 0.8 years to 0.6 years);

average residential sales price increased 32% (from $248,717 to $329,455)

Condominium

There are no condominium complexes in King Quarter

Vacant Land

Compared to 9 years ago, land inventory decreased by 5 months,

from 4 years to 3.6 years;

average lot sales price increased 3%, from $76,667 to $78,600)

Compared to last year, land inventory decreased by 1 year,

from 4.6 years to 3.6 years;

average lot sales price increased 29%, from $60,800 to $78,600.

Prince

South Shore from UVI West to Williams Delight

Residential

Compared to 9 years ago, residential inventory decreased by

2.7 years (from 3.3 years to 0.6 year);

average residential sales price increased 79% (from $176,056 to $315,923)

Compared to last year, residential inventory decreased by 5 months, from 1 year to 0.6 years; average residential sales price increased 18% (from $266,460 to $315,923)

Condominium

Compared to 9 years ago, condominium inventory decreased by 4 months, from 1.3 years to 1 year;

Average condominium sales price increased 108% (from $202,000 to $420,000).

Compared to last year, condominium inventory increased by 8 months, from 0.3 years to 1 year; average condominium sale price increased 9%

(from $384,000 to $420,000)

Vacant Land

Compared to 9 years ago, land inventory decreased by

3.1 years, from 4.5 years to 1.4 years;

average lot sales price increased 3%, from $70,985 to $73,286)

Compared to last year, land inventory is unchanged at 1.4 years;

average lot sales price decreased 56%, from $167,381 to $73,286.

West End

South Shore, South from Mahogany Road,

East to Williams Delight

Residential

Compared to 9 years ago, residential inventory decreased by 5 months

(from 2 years to 1.6 years);

average home sale price increased 91%, from $223,800 to $427,541.

Compared to last year, residential inventory increased by 7 months, from 1 year to 1.6 years; average home sale price increased 41% (from $302,275 to $427,541)

Condominium

Compared to 9 years ago, condominium inventory increased by 4 months (from 0.4 years to 0.7 years)

average condominium sales price increased 40% (from $107,714 to $151,333)

Last year, there were no condos for sale in West End quarter on this date; this year there is an 8 month inventory;

average condominium sales price decreased 22%, from $194,500 to $151,333.

Vacant Land

Compared to 9 years ago, land inventory decreased by 12 years,

from 15.6 years to 3.6 years;

average lot sales price increased 8%, from $93,279 to $100,909.

Compared to last year, land inventory increased by 2.2 years, from 1.4 years to 3.6 years; average lot sales price decreased 30%, from $144,391 to $100,909.

Information is from MLS and deemed to be reliable but is not guaranteed.

Prepared by:

Julie San Martin

Team Manage

November 2024

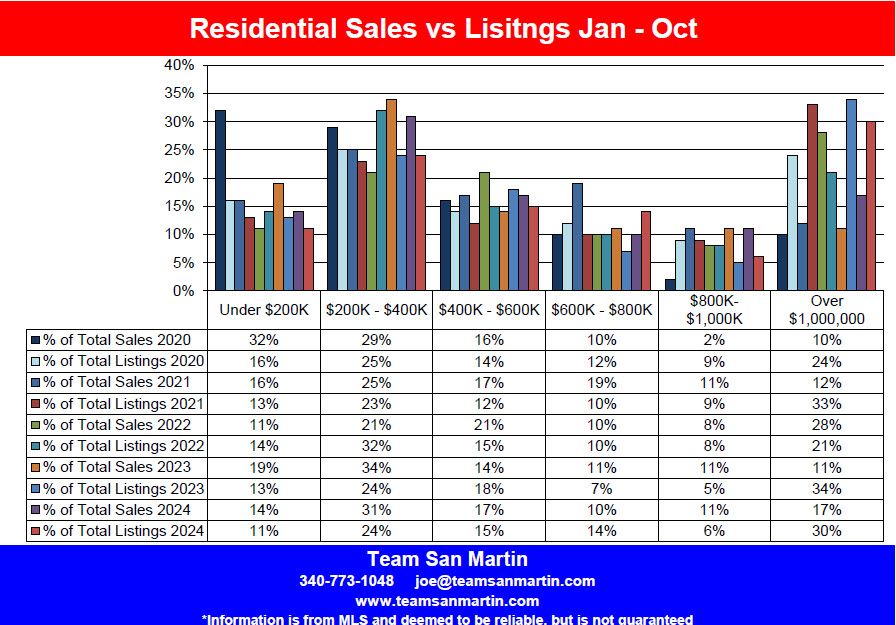

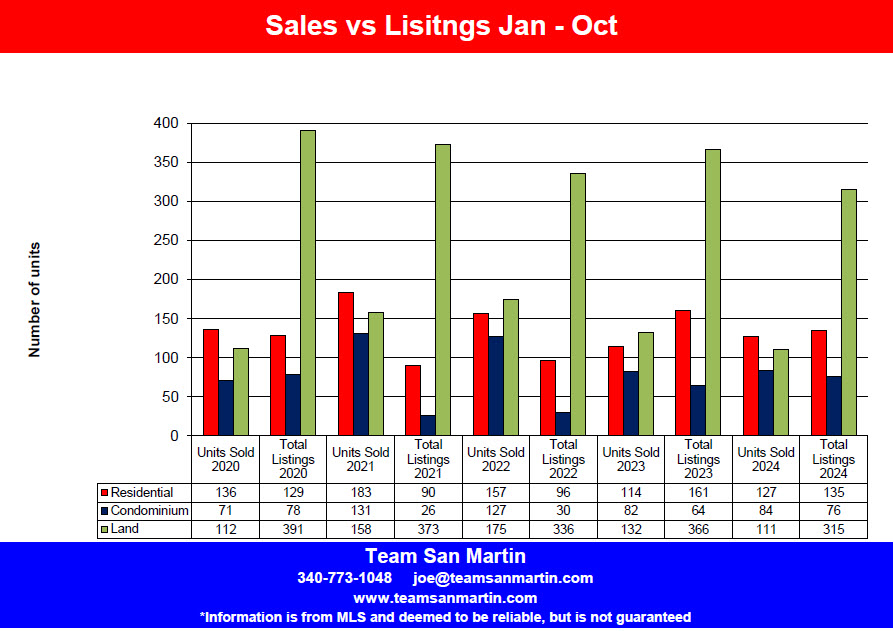

First 10 months of 2020 through 2024

Residential

2020

136 home sales closed January through October; there were 129 homes for sale

1.05 buyers for every seller

2021

183 home sales closed January through October; there were 90 homes for sale

2.03 buyers for every seller

2022

157 home sales closed January through October; there were 96 homes for sale

1.64 buyers for every seller

114 home sales closed January through October; there were 123 homes for sale

0.93 buyers for every seller

2024

127 home sales closed January through October; there were 135 homes for sale

0.94 buyers for every seller

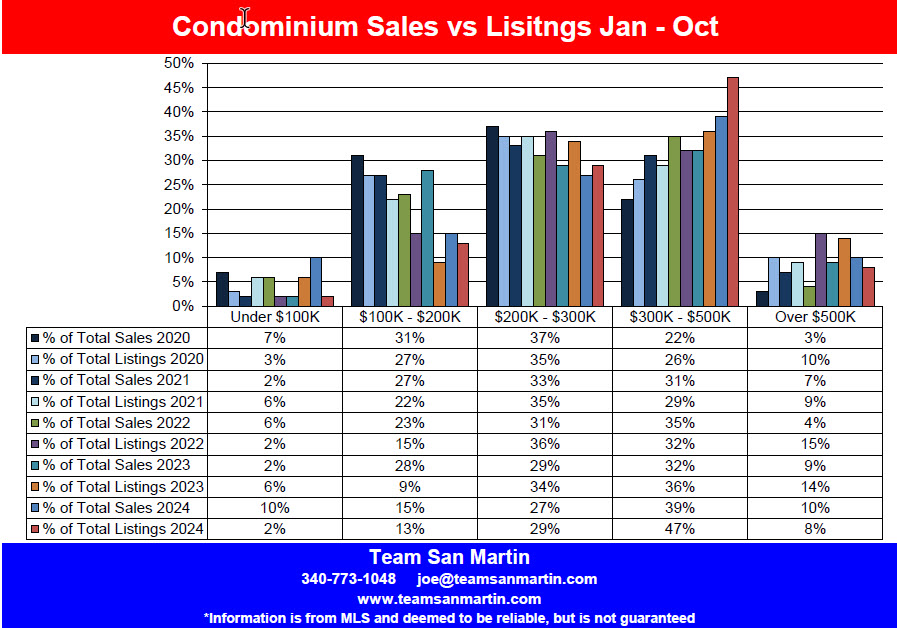

Condominium

2020

71 condominium sales closed January - October; there were 78 condos for sale

0.91 buyers for every seller

2021

131 condominium sales closed January - October; there were 26 condos for sale

5.04 buyers for every seller

2022

127 condominium sales closed January - October; there were 30 condos for sale

4.23 buyers for every seller

2023

82 condominium sales closed January - October; there were 49 condos for sale

1.67 buyers for every seller

2024

84 condominium sales closed January - October; there were 76 condos for sale

1.11 buyers for every seller

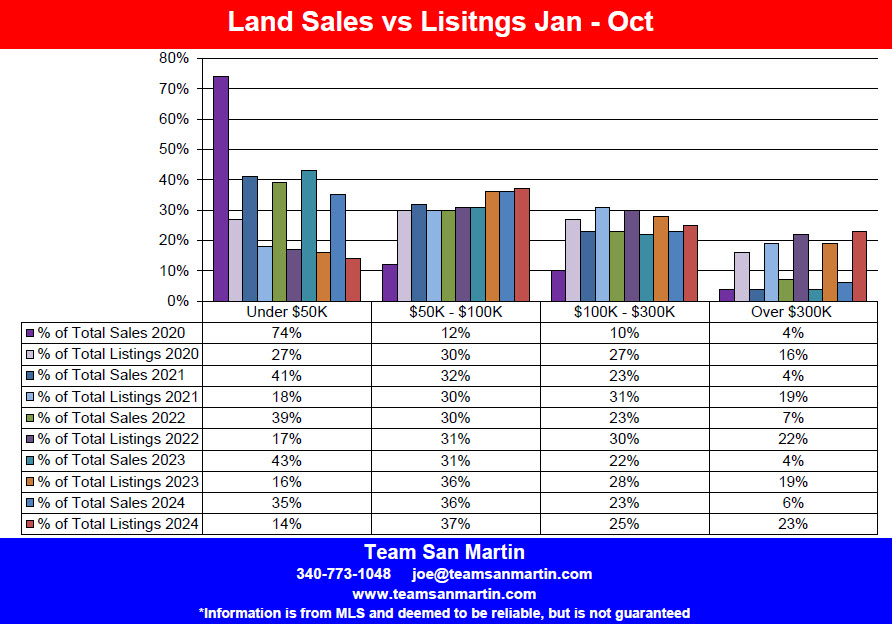

Vacant Land

2020

112 land sales closed January through October; there were 391 lots for sale

0.29 buyers for every seller

2021

158 land sales closed January through October; there were 373 lots for sale

0.42 buyers for every seller

2022

175 land sales closed January through October; there were 336 lots for sale

0.52 buyers for every seller

132 land sales closed January through October; there were 332 lots for sale

0.40 buyers for every seller

2024

111 land sales closed January through October; there were 315 lots for sale

0.35 buyers for every seller

SALES BY PRICE RANGE

Residential

|

2024 % of Sales |

2024 Sales |

2023 % of Sales |

2023 Sales |

2022 % of Sales |

2022 Sales |

2021 % of Sales |

2021 Sales |

2020 % of Sales |

2020 Sales |

Sales Price |

|

%14 |

18 |

%19 |

22 |

%11 |

18 |

%16 |

30 |

32% |

44 |

Under $200K |

|

%31 |

39 |

%34 |

39 |

%25 |

33 |

%25 |

45 |

29% |

39 |

$200K - $400K |

|

%17 |

21 |

%14 |

16 |

%21 |

33 |

%17 |

31 |

16% |

22 |

$400K - $600K |

|

%10 |

13 |

%11 |

13 |

%10 |

16 |

%19 |

34 |

10% |

14 |

$600K - $800K |

|

%11 |

14 |

%11 |

12 |

%8 |

13 |

%11 |

21 |

2% |

3 |

$800K - $1 Million |

|

%17 |

22 |

%11 |

12 |

%28 |

44 |

%12 |

22 |

10% |

14 |

Over $1 Million |

Condominium

|

2024 % of Sales |

2024 Sales |

2023 % of Sales |

2023 Sales |

2022 % of Sales |

2022 Sales |

2021 % of Sales |

2021 Sales |

2020 % of Sales |

2020 Sales |

Sales Price |

|

%10 |

8 |

%2 |

2 |

%6 |

8 |

%2 |

2 |

7% |

5 |

Under $100K |

|

%15 |

13 |

%28 |

23 |

%23 |

29 |

%27 |

36 |

31% |

22 |

$100K - $200K |

|

%27 |

23 |

%29 |

24 |

%31 |

40 |

%33 |

43 |

37% |

26 |

$200K - $300K |

|

%38 |

32 |

%32 |

26 |

%35 |

45 |

%31 |

41 |

22% |

16 |

$300K - $500K |

|

%10 |

8 |

%9 |

7 |

%4 |

5 |

%7 |

9 |

3% |

2 |

Over $500K |

Vacant Land

|

2024 % of Sales |

2024 Sales |

2023 % of Sales |

2023 Sales |

2022 % of Sales |

2022 Sales |

2021 % of Sales |

2021 Sales |

2020 % of Sales |

2020 Sales |

Sales Price |

|

%35 |

39 |

%43 |

57 |

%39 |

68 |

%41 |

65 |

74% |

83 |

Under $50K |

|

%36 |

40 |

%31 |

41 |

%30 |

53 |

%32 |

50 |

12% |

13 |

$50K - $100K |

|

%23 |

25 |

%22 |

29 |

%23 |

41 |

%23 |

36 |

10% |

11 |

$100K - $300K |

|

%6 |

7 |

%4 |

5 |

%7 |

13 |

%4 |

7 |

4% |

5 |

Over $300K |

Information is from MLS and deemed to be reliable but is not guaranteed.

Prepared by:

Julie San Martin

Team Manager

October 2024

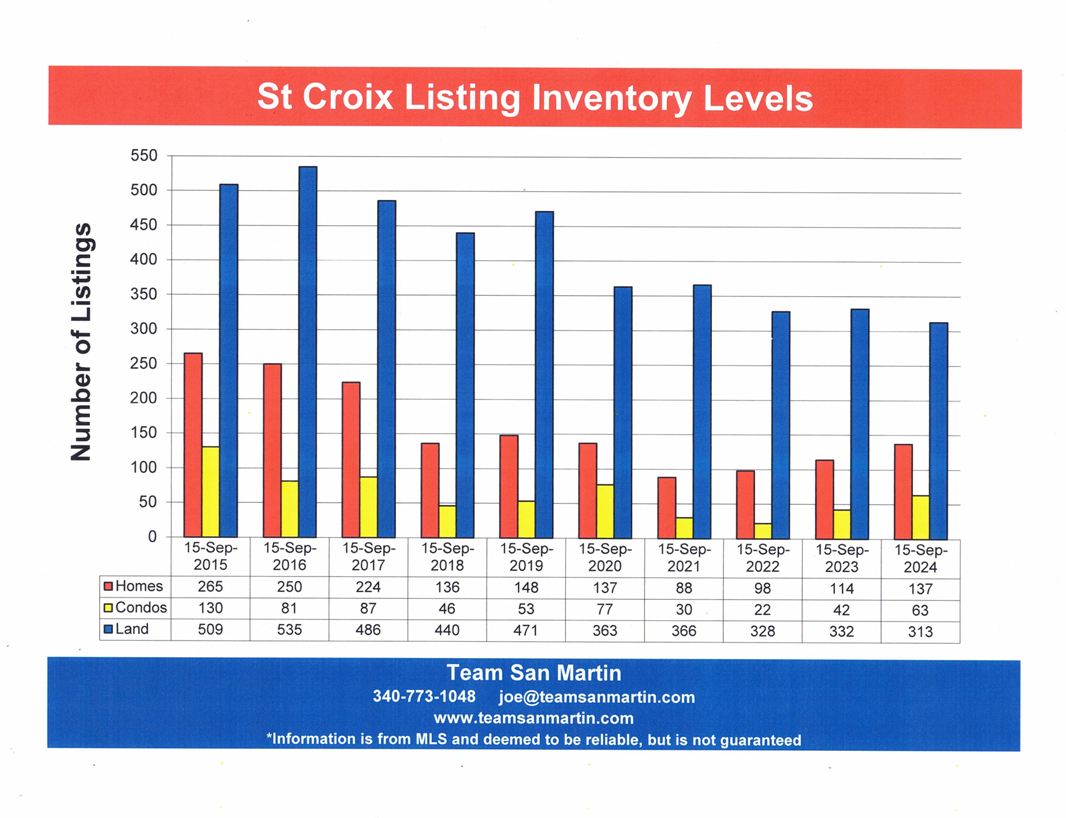

Ten Year Comparison

St Croix Real Estate Inventory Levels

TOTAL INVENTORY

Residential

52% fewer homes (128) than ten years ago.

The highest inventory during this period was 9/15/15 with 265 homes on the market.

Lowest inventory during this period was 9/15/21 with only

88 homes for sale.

Condominium

52% fewer condominiums (67) than ten years ago.

The highest inventory during this period was 9/15/15, with 130 condominiums for sale.

The lowest inventory during this period was 9/15/22 with only 22 condos for sale.

Vacant Land

39% fewer lots (196) than ten years ago.

The highest inventory during this period was 9/15/16 with 535 lots on the market.

9/15/2024 is the lowest inventory of the ten-year period with only.

313 lots for sale.

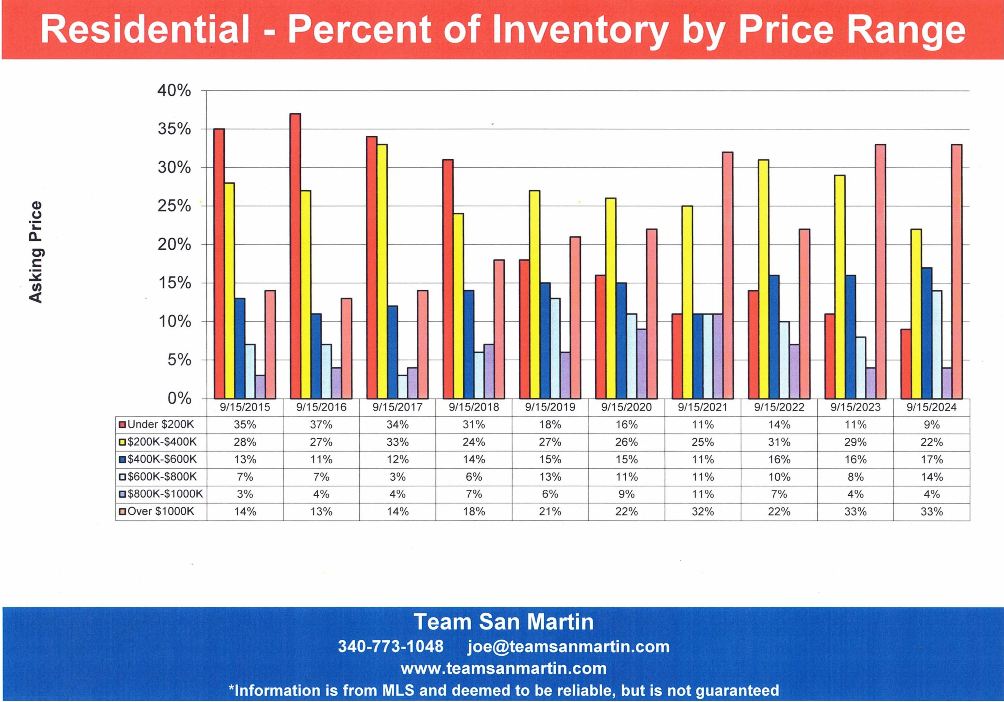

INVENTORY BY PRICE RANGE

Residential

Under $200,000 listings (9%) are 26% lower than ten years ago as percentage of total inventory. Compared to last year, this segment decreased by 2%.

$200,000 to $400,000 listings (22%) have remained relatively constant over the 10-year period, varying from 33% of inventory (9/15/17) to 22% of inventory (9/15/24).

$400,000 to $600 listings (17%) are 4% higher compared to 10 years ago and the highest for this price range. Lowest was 11% (9/15/16 & 9/15/21).

$600,000 to $800,000 listings (14%) are double the percentage of ten years ago (7%).

$800,000 to $1,000,000 listings (4%) are the same as ten years ago. The highest percentage of the 10-year period was 11% (9/15/21).

Listings over $1,000,000 (33%) have more than doubled over the 10-year period. The lowest level was 9/15/16, at just 13% of total inventory, highest was 33% (9/15/23 & 9/15/24).

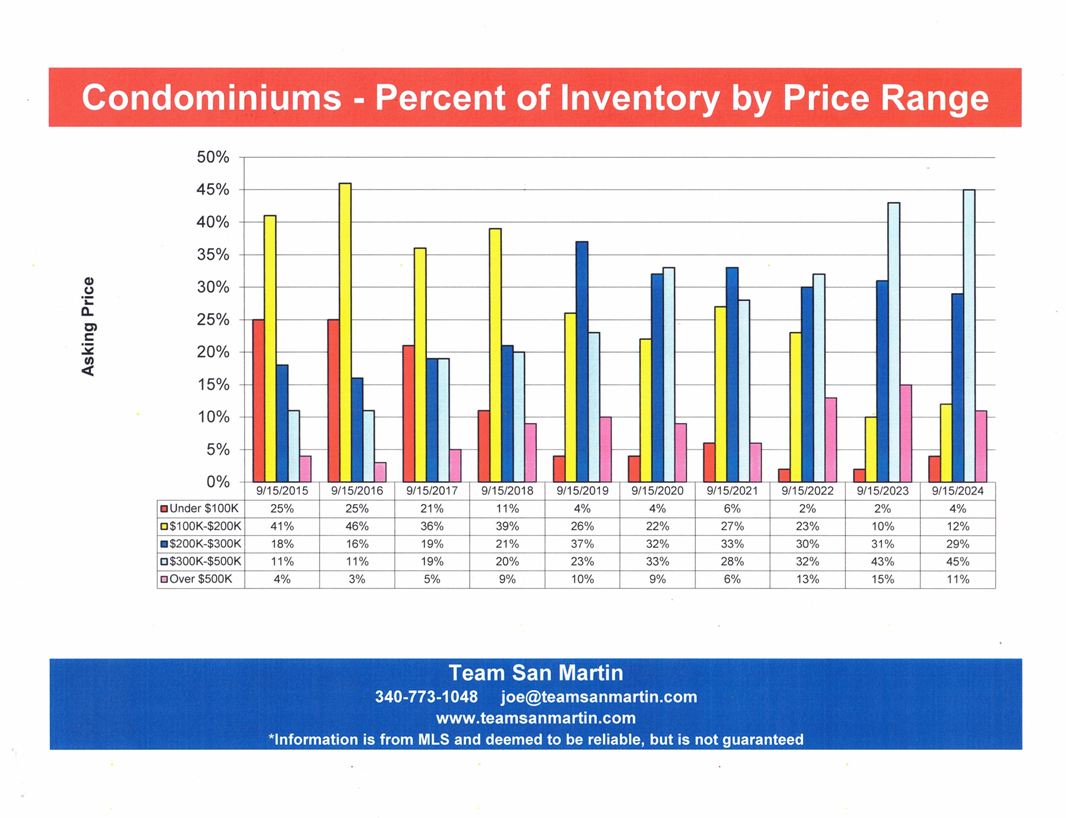

Condominium

Under $100,000 listings are currently only 4% of total condo listings, down from a high of 25% (9/15/15 & 9/15/16).

$100,000 to $200,000 listings (12%) decreased by 29% of total inventory when compared to 10 years ago. On 9/15/16, this price range represented 46% of the total condominium inventory.

$200,000 to $300,000 listings are at 29% of total inventory, 11% higher than 10 years ago (18%).

$300,000 to $500,000 listings, at 45% of total inventory, have increased 34% compared to ten years ago. The lowest level was 11% (9/15/15 & 9/13/16).

Listings over $500,000 represent 11% of the total condominium market, an increase of 7% compared to ten years ago.

Vacant Land

Under $50,000 listings (14%) are less than half of 10 years ago (37%). The highest percentage of total inventory (44%) was 9/15/17.

$50,000 to $100,000 listings (37%) have remained relatively constant over the 10-year period.

$100,000 to $300,000 listings (25%) have also remained relatively constant over the ten years. Lowest percentage was 9/15/17, at 22% of total land inventory.

Listings over $300,000 (23%) increased 12% when compared to ten years ago. The lowest levels were 2016 and 2017 when this segment of the market decreased to 9% of total land listings.

Information is from MLS and deemed to be reliable, but is not guaranteed.

information is from MLS and deemed to be reliable, but is not guaranteed.

Prepared by:

Julie San Martin

Team Manager

September 2024

A Tale of Two Islands

St Croix and St Thomas Real Estate Sales

Ten Year Comparison Year to Date

Number of Sales

Residential

Number of residential sales on St Thomas decreased 15% (8 homes) compared to ten years ago. On St Croix, the number of homes sold increased 19% (16 homes) compared to ten years ago.

|

% increase (decrease) Year over year |

St Croix |

% increase (decrease) Year over year |

St Thomas |

Number of Homes Sold |

|

(-25%) |

85 |

(-19%) |

54 |

Jan Aug 2015 |

|

+38% |

117 |

+37% |

74 |

Jan Aug 2016 |

|

+5% |

123 |

+4% |

77 |

Jan Aug 2017 |

|

+3% |

127 |

+9% |

84 |

Jan Aug 2018 |

|

+6% |

134 |

+1% |

85 |

Jan Aug 2019 |

|

(-23%) |

103 |

(-35%) |

55 |

Jan Aug 2020 |

|

+48% |

152 |

+78% |

98 |

Jan Aug 2021 |

|

(-13%) |

134 |

(-40%) |

70 |

Jan Aug 2022 |

|

(-34%) |

88 |

(-11%) |

62 |

Jan Aug 2023 |

|

+15% |

101 |

(-35%) |

46 |

Jan Aug 2024 |

Condominium

Number of condominium sales increased 6% (4 condos) on St Thomas, compared to ten years ago. On St Croix, the number of condos sold increased 1% (1 condo), compared to ten years ago.

|

% increase (decrease) Year over year |

St Croix |

% increase (decrease) Year over year |

St Thomas |

Number of Condos Sold |

|

(-16%) |

69 |

(-6%) |

66 |

Jan Aug 2015 |

|

+16% |

80 |

+38% |

91 |

Jan Aug 2016 |

|

+11% |

89 |

+7% |

98 |

Jan Aug 2017 |

|

(-19%) |

72 |

(-28%) |

71 |

Jan Aug 2018 |

|

+36% |

98 |

+32% |

94 |

Jan Aug 2019 |

|

(-44%) |

55 |

(-32%) |

64 |

Jan Aug 2020 |

|

+98% |

109 |

+136% |

151 |

Jan Aug 2021 |

|

+2% |

111 |

(-49%) |

77 |

Jan Aug 2022 |

|

(-39%) |

68 |

+14% |

88 |

Jan Aug 2023 |

|

+3% |

70 |

(-26%) |

70 |

Jan Aug 2024 |

Vacant Land

Number of vacant land sales on St Thomas decreased 24% (9 lots), compared to ten years ago. On St Croix, land sales increased 108% (51 lots) compared to ten years ago.

|

% increase (decrease) Year over year |

St Croix |

% increase (decrease) Year over year |

St Thomas |

Number of Lots Sold |

|

+57% |

47 |

+27% |

38 |

Jan Aug 2015 |

|

+15% |

54 |

(-29%) |

27 |

Jan Aug 2016 |

|

+30% |

70 |

+59% |

43 |

Jan Aug 2017 |

|

(-12%) |

62 |

(-33%) |

27 |

Jan Aug 2018 |

|

+55% |

96 |

+37% |

37 |

Jan Aug 2019 |

|

(-17%) |

80 |

+5% |

39 |

Jan Aug 2020 |

|

+58% |

126 |

+77% |

69 |

Jan Aug 2021 |

|

+17% |

147 |

(-17%) |

57 |

Jan Aug 2022 |

|

(-28%) |

106 |

(-21%) |

45 |

Jan Aug 2023 |

|

(-8%) |

98 |

(-36%) |

29 |

Jan Aug 2024 |

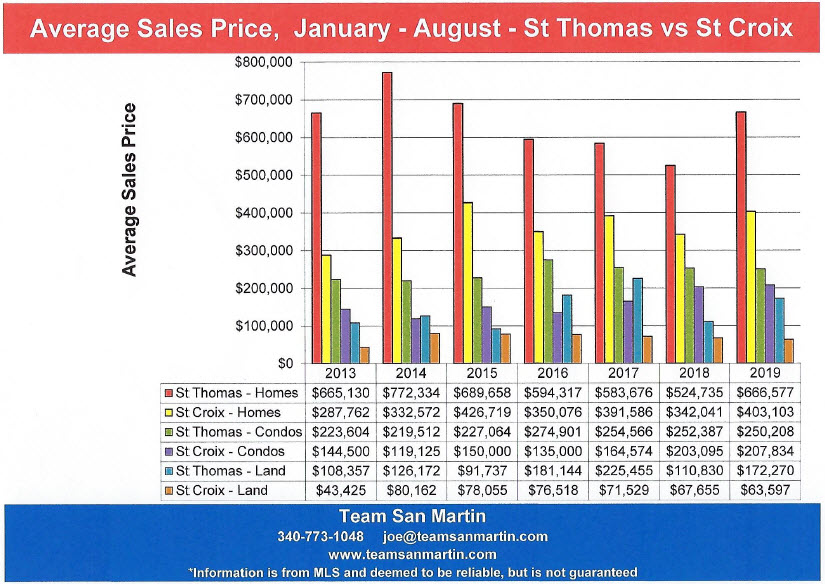

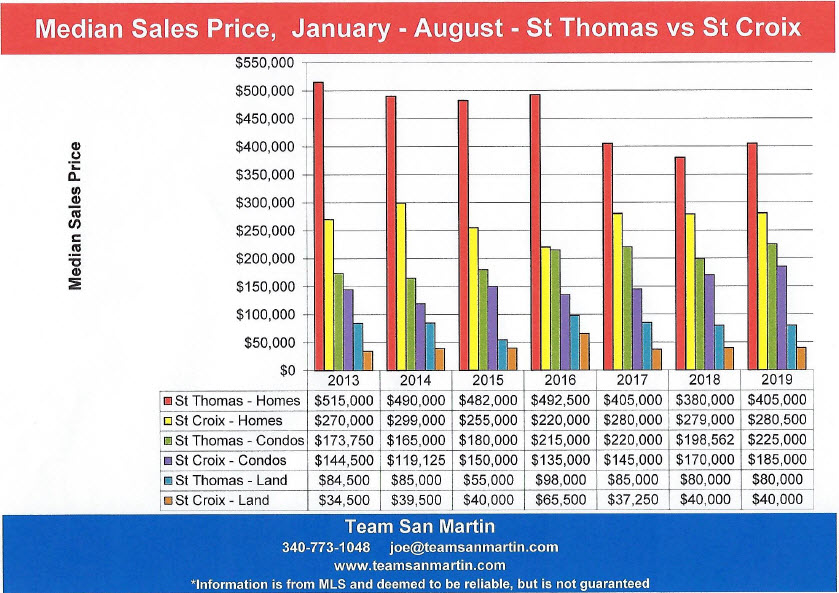

Residential

Average Sales Price

The average St Thomas residential sales price increased 28% ($191,844) compared to ten years ago. On St Croix, the average home sales price increased 30% ($126,949) when compared to ten years ago.

|

% increase (decrease) Year over year |

St Croix |

% increase (decrease) Year over year |

St Thomas |

Average Home Sales Price |

|

+28% |

$426,719 |

(-11%) |

$689,658 |

Jan Aug 2015 |

|

(-18%) |

$350,076 |

(-14%) |

$594,317 |

Jan Aug 2016 |

|

+12% |

$393,754 |

(-2%) |

$583,676 |

Jan Aug 2017 |

|

(-32%) |

$342,041 |

(-10%) |

$524,735 |

Jan Aug 2018 |

|

+18% |

$403,103 |

+27% |

$666,577 |

Jan Aug 2019 |

|

+8% |

$437,163 |

+6% |

$709,626 |

Jan Aug 2020 |

|

+36% |

$594,970 |

+26% |

$896,493 |

Jan Aug 2021 |

|

+47% |

874,628$ |

+20% |

1,078,479$ |

Jan Aug 2022 |

|

(-38%) |

545,642$ |

+8% |

1,167,194$ |

Jan Aug 2023 |

|

+1% |

$553,668 |

(-24%) |

881,502$ |

Jan Aug 2023 |

St Thomas Home Sales Prices

|

|

Lowest |

Highest |

|

Jan Aug 2015 |

$85,000 |

$6,000,000 |

|

Jan Aug 2016 |

$49,000 |

$2,990,000 |

|

Jan Aug 2017 |

$9,000 |

$3,200,000 |

|

Jan Aug 2018 |

$55,000 |

$3,150,000 |

|

Jan Aug 2019 |

$40,000 |

$5,650,000 |

|

Jan Aug 2020 |

$81,000 |

$2,800,000 |

|

Jan Aug 2021 |

$80,000 |

$5,900,000 |

|

Jan Aug 2022 |

$80,000 |

$3,400,000 |

|

Jan Aug 2023 |

$150,000 |

$4,500,000 |

|

Jan Aug 2024 |

$180,000 |

$3,750,000 |

St Croix Home Sales Prices

|

|

Lowest |

Highest |

|

Jan Aug 2015 |

$31,000 |

$6,250,000 |

|

Jan Aug 2016 |

$40,000 |

$2,500,000 |

|

Jan Aug 2017 |

$17,000 |

$2,212,500 |

|

Jan Aug 2018 |

$37,500 |

$1,600,000 |

|

Jan Aug 2019 |

$35,000 |

$2,975,000 |

|

Jan Aug 2020 |

$35,000 |

$1,900,000 |

|

Jan Aug 2021 |

$55,000 |

$2,500,000 |

|

Jan Aug 2022 |

$55,000 |

$9,500,000 |

|

Jan Aug 2023 |

$34,000 |

$3,200,000 |

|

Jan Aug 2024 |

$50,000 |

$2,250,000 |

Median sales price is the midpoint - half of all homes sold for more than this price, half sold for less.

For St Thomas, the median home sales price is 32% higher ($158,000) compared to ten years ago. On St Croix, the median home sales price increased 61% ($155,000) when compared to ten years ago.

Median Home Sales Price

|

% increase (decrease) Year over year |

St Croix |

% increase (decrease) Year over year |

St Thomas |

Median Home Sales Price |

|

(-15%) |

$255,000 |

No change |

$492,000 |

Jan Aug 2015 |

|

(-14%) |

$220,000 |

No change |

$492,500 |

Jan Aug 2016 |

|

+27% |

$280,000 |

(-18%) |

$405,000 |

Jan Aug 2017 |

|

No change |

$279,000 |

(-6%) |

$380,000 |

Jan Aug 2018 |

|

No change |

$280,500 |

+6% |

$405,000 |

Jan Aug 2019 |

|

+16% |

$325,000 |

+14% |

$568,060 |

Jan Aug 2020 |

|

+49% |

$485,000 |

+18% |

$667,500 |

Jan Aug 2021 |

|

+16% |

$562,000 |

+31% |

$875,000 |

Jan Aug 2022 |

|

(-36%) |

$362,500 |

+2% |

$895,000 |

Jan Aug 2023 |

|

+13% |

$410,000 |

(-27%) |

$650,000 |

Jan Aug 2024 |

Condominium

Average Sales Price

The average St Thomas condominium sales price increased 71% ($162,163) compared to ten years ago. On St Croix, average sales price increased 42% ($84,485) when compared to ten years ago.

|

% increase (decrease) Year over year |

St Croix |

% increase (decrease) Year over year |

St Thomas |

Average condo Sales Price |

|

+30% |

$202,402 |

+3% |

$227,064 |

Jan Aug 2015 |

|

(-17%) |

$168,023 |

+21% |

$274,901 |

Jan Aug 2016 |

|

(-2%) |

$164,630 |

(-7%) |

$254,416 |

Jan Aug 2017 |

|

+23% |

$203,095 |

(-1%) |

$252,387 |

Jan Aug 2018 |

|

+2% |

$207,834 |

(-1%) |

$250,208 |

Jan Aug 2019 |

|

+17% |

$243,895 |

+5% |

$263,459 |

Jan Aug 2020 |

|

+18% |

$287,464 |

+29% |

$339,825 |

Jan Aug 2021 |

|

(-1%) |

$283,594 |

+12% |

$380,683 |

Jan Aug 2022 |

|

+3% |

$291,081 |

+14% |

$432,682 |

Jan Aug 2023 |

|

(-1%) |

$286,887 |

(-10%) |

$389,227 |

Jan Aug 2024 |

St Thomas Condominium Sales Prices

|

|

Lowest |

Highest |

|

Jan Aug 2015 |

$55,000 |

$940,000 |

|

Jan Aug 2016 |

$30,000 |

$1,690,000 |

|

Jan Aug 2017 |

$24,000 |

$665,000 |

|

Jan Aug 2018 |

$53,000 |

$780,000 |

|

Jan Aug 2019 |

$72,000 |

$600,000 |

|

Jan Aug 2020 |

$119,000 |

$730,000 |

|

Jan Aug 2021 |

$21,000 |

$1,437,500 |

|

Jan Aug 2022 |

$65,000 |

$1,600,000 |

|

Jan Aug 2023 |

$77,000 |

$1,193,000 |

|

Jan Aug 2024 |

$85,000 |

$850,000 |

St Croix Condominium Sales Prices

|

|

Lowest |

Highest |

|

Jan Aug 2015 |

$22,500 |

$1,150,000 |

|

Jan Aug 2016 |

$22,500 |

$700,000 |

|

Jan Aug 2017 |

$33,000 |

$570,000 |

|

Jan Aug 2018 |

$34,000 |

$570,000 |

|

Jan Aug 2019 |

$41,000 |

$650,000 |

|

Jan Aug 2020 |

$62,000 |

$1,060,000 |

|

Jan Aug 2021 |

$74,900 |

$1,295,000 |

|

Jan Aug 2022 |

$69,000 |

$1,000,000 |

|

Jan Aug 2023 |

$98,000 |

$627,500 |

|

Jan Aug 2024 |

$62,500 |

$870,000 |

Compared to ten years ago, the median condominium sales price increased 108% ($195,000) on St Thomas and 83% ($125,000) on St Croix.

Median Condominium Sales Price

|

% increase (decrease) Year over year |

St Croix |

% increase (decrease) Year over year |

St Thomas |

Median Condo Sales Price |

|

+26% |

$150,000 |

+9% |

$180,000 |

Jan Aug 2015 |

|

(-10%) |

$135,000 |

+19% |

$215,000 |

Jan Aug 2016 |

|

+7% |

$145,000 |

+2% |

$220,000 |

Jan Aug 2017 |

|

+17% |

$170,000 |

(-10%) |

$198,562 |

Jan Aug 2018 |

|

+9% |

$185,000 |

+13% |

$225,000 |

Jan Aug 2019 |

|

+22% |

$225,000 |

(-1%) |

$222,500 |

Jan Aug 2020 |

|

+16% |

$260,000 |

+30% |

$290,000 |

Jan Aug 2021 |

|

(-4%) |

$249,500 |

+12% |

$325,000 |

Jan Aug 2022 |

|

+4% |

$260,000 |

+23% |

$400,000 |

Jan Aug 2023 |

|

+6% |

$275,000 |

(-6%) |

$375,000 |

Jan Aug 2024 |

Vacant Land

Average Sales Price

The average St Thomas land sales price increased 115% ($124,867) compared to ten years ago. On St Croix, average land sales price increased 195% ($84,824) compared to ten years ago.

|

% increase (decrease) Year over year |

St Croix |

% increase (decrease) Year over year |

St Thomas |

Average lot Sales Price |

|

(-3%) |

$78,055 |

(-26%) |

$91,737 |

Jan Aug 2015 |

|

(-2%) |

$76,518 |

+97% |

$181,144 |

Jan Aug 2016 |

|

(-7%) |

$71,529 |

+24% |

$225,455 |

Jan Aug 2017 |

|

(-6%) |

$67,655 |

(-51%) |

$110,830 |

Jan Aug 2018 |

|

(-21%) |

$53,597 |

+55% |

$172,270 |

Jan Aug 2019 |

|

+53% |

$81,949 |

(-38%) |

$107,410 |

Jan Aug 2020 |

|

+55% |

$126,840 |

+71% |

$183,522 |

Jan Aug 2021 |

|

+1% |

$128,249 |

+27% |

$233,224 |

Jan Aug 2022 |

|

(-6%) |

$120,021 |

+39% |

$325,003 |

Jan Aug 2023 |

|

(-20%) |

$96,663 |

(-46%) |

$176,272 |

Jan Aug 2024 |

St Thomas Land Sales Prices

|

|

Lowest |

Highest |

|

Jan Aug 2015 |

$20,000 |

$370,000 |

|

Jan Aug 2016 |

$8,000 |

$900,000 |

|

Jan Aug 2017 |

$20,000 |

$2,100,000 |

|

Jan Aug 2018 |